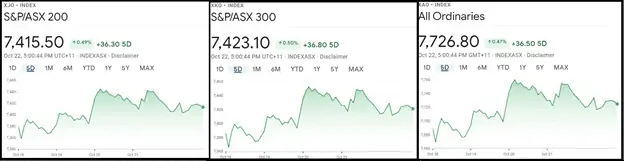

The three ASX indices (200, 300, and Ordinaries) closed last week higher by 0.49%, 0.50%, and 0.47% respectively.

The Australian stock markets managed to end last week in the green despite bearish news of slowing growth in China, a major trading partner to the country, and unrelentingly bullish crude prices following a global crunch in energy supplies.

Moreover, local yields are periodically spiking, seemingly determined to wrong-foot the RBA on its “not-before-2024” stance on rate hikes, and therefore pressuring stocks.

On Friday, the RBA stepped in to buy bonds worth A$1 billion to put a lid on rising yields.

Inflation, due to high prices at the pump and supply-chain-related difficulties in imports, is also rearing its head.

These factors were counterbalanced by general optimism following US quarterly earnings reports.

Deal-making in the wagering, energy, resources, telecom, and transportation sectors also helped bolster sentiment.

All told, the ASX managed to clock a third-week consecutive week of gains.

Table of Contents

Last Week in Stocks

Technology stocks presented a mixed picture. Afterpay (ASX:APT) clocked a net weekly gain of 2.44% after a bearish start to the week and Xero (ASX:XRO) rose 3.28%.

Though Computershare (ASX:CPU) gained 0.44%, Wisetech (ASX:WTC) was down 0.44%, and NextDC (ASX:NXT) lost nearly 5%.

Gambling software vendor Playtech (LON: PTEC) was in play after Aristocrat Leisure (ASX:ALL) bid A$5 billion for the company.

Aristocrat was off 2.28%, however.

Energy stocks put up a very weak show. Santos (ASX:STO), Woodside Petroleum (ASX:WPL), Soul Pattinson (ASX:SOL), and Oil Search (ASX:OSH) were down by 4.74%, 8.24%, 3.20% and 5.66% respectively.

Woodside shares were impacted after the company slashed its gas reserves estimate at its Wheatstone project.

Meanwhile, Senex Energy (ASX:SXY) closed up by over 5% after the company received an A$815 million (twice-improved) takeover offer from POSCO International (KRX: 047050).

Banks were mostly higher. Commonwealth Bank (ASX:CBA) gained over 2% over the week, ANZ Banking (ASX:ANZ) was up 0.86%, and Westpac (ASX:WBC) rose 0.55%.

National Australia Bank (ASX:NAB) closed +0.42%, but Bank of Queensland (ASX:BOQ) lost nearly 3%, continuing its sell-off from the previous week.

Macquarie Group (ASX:MQG) jumped a solid 4.15%, following through with its previously bullish moves.

The stock is up nearly 46% over the past year.

Miners were in correction mode, following a downturn in iron ore prices.

BHP Ltd (ASX:BHP) was down 3.46%, Fortescue (ASX:FMG) lost 1.99%, and South32 (ASX:S32) gave up 2.56% and Rio Tinto (ASX:RIO) was in the red by 4.59%.

However, Newcrest Mining (ASX:NCM) was up 2.09% following an upswing in gold prices.

BHP also reported a fall in ore production following a shortage of train drivers due to COVID-19 border controls.

However, the company raised its offer to buy all of Canadian copper and nickel miner Noront Resources (CVE: NOT) at C$0.75 per share.

In healthcare, Sonic Healthcare (ASX:SHL), Fisher & Paykel (ASX:FPH), and Resmed CDI (ASX:RMD) all closed in the positive zone by 0.46%, 3.00%, and 2.69%, respectively.

Ramsay Health Care (ASX:RHC) was up 3.59%, announcing that elective surgeries in Sydney would resume from Monday.

Though it warned that COVID-related costs may affect its earnings.

However, CSL Limited (ASX:CSL) was down 0.38%.

Though Australia has started to ease virus restrictions, travel-centric stocks such as Webjet (ASX:WEB) and Australian flag carrier Qantas (ASX:QAN) were down 2.62% and 1.38% respectively.

Flight Centre (ASX:FLT) was down a solid 11.86%.

The company last week announced the successful close of the issue of a convertible bond worth A$400 million.

The company also declined to forecast a full-year profit projection because of uncertainties in travel trends.

However, Corporate Travel Management (ASX:CTD) bucked the trend and ended higher by 1.46%.

Crown Resorts (ASX:CWN) managed to close the week higher by 0.21% though shareholders nixed the company’s executive pay plans for a second consecutive year at its annual meeting on Thursday.

However, the company survived a vote that wanted to dismiss the whole board.

Milk and infant formula continued their bullish trend.

Bubs Australia (ASX:BUB) built on the previous week’s rally with another gain of 4.21%, while A2 Milk Company (ASX:A2M) also added 1.62%.

Australia’s largest rail freight operator Aurizon (ASX:AZJ) has acquired One Rail Australia for A$2.35 billion with an eye on the bulk freight markets in South Australia and the Northern Territory, and as a means to grow non-coal revenue.

Aurizon shares plunged 7.36% for the week.

This week in ASX Stocks

Upcoming Listings between 25-29 Oct

Tuesday, October 26, 2021

C29 Metals Limited (ASX:C29), a mining exploration company focused on copper assets situated within Tier 1 mining regions with significant discoveries, plans to list shares of A$0.20 from its offer of A$5 million.

GQG Partners Inc. (ASX:GQG), a global boutique asset management firm, will sell CDIs of A$2.20 each in its A$1.31 billion IPO.

The Fort Lauderdale, Florida-based money manager had about $89 billion in assets under management at the end of August and is led by Rajiv Jain, who was previously a star fund manager at Swiss wealth and asset manager Vontobel Holding AG.

According to Bloomberg, GQG is looking at an enterprise value of A$6.5 billion, and its Australian float is likely to be one of the largest new listings this quarter.

RemSense Technologies Limited (ASX:REM), a provider of technology and engineering services including virtualization of plant assets infrastructure, plans to list shares of $0.20 each from its $5 million issue.

Wednesday, October 27, 2021

Star Minerals Limited (ASX:SMS), a Western Australia-focused gold explorer, with an advanced development-ready project and extensive land holdings in the world’s most attractive mining jurisdiction, will list shares of A$0.20 each from its A$5 million issue.

Thursday, October 28, 2021

Green Technology Minerals (ASX:GT1) is focused on North American lithium projects aimed at the rapidly growing demand for rechargeable batteries driven primarily by the electric vehicle and energy storage system industries.

It will list shares of A$0.25 each from its $24 million issue.

Friday, October 29, 2021

Cooper Metals Limited (ASX:CPM) is a new Australian-based mineral exploration company focussed on the discovery of copper and gold with three highly prospective projects and a modest capital structure.

It is issuing shares of A$0.20 each in a A$4.8 million offer.

Economic News And Market Outlook

China’s growth during the third quarter was 4.9% compared to the same period a year ago and much less than 7.9% in the second quarter.

A massive energy crunch, shipping disruptions, pandemic restrictions, and a growing property crisis all weighed on growth.

The Consumer Price Index for New Zealand surged 2.2% during the quarter ending September.

That was up from 1.3% in the second quarter, the rise being the highest in a decade for the third quarter.

Annual inflation jumped 4.9% versus 3.3% in the June quarter.

Both readings outstripped consensus estimates of 1.4% and 4.1% by a significant margin.

“We had already expected the RBNZ to continue hiking rates despite the Auckland lockdown.

But the strength in consumer prices in Q3 will surely nudge the Bank towards an even more aggressive hiking cycle,” said Ben Udy of Sydney-based Capital Economics.

The RBA’s minutes of its October 5 meeting showed the central bank in a very dovish light.

Members discussed further stimulation such as cutting the cash rate to zero and purchasing longer-term government bonds.

There was concern regarding the comparatively lower yields in other developed nations, the strength in the Aussie currency, and the need to support the Australian economy as it reopens after pandemic restrictions.

In the US, building permits plunged by 7.7% in September against a rise of 5.6% in August.

in the same vein, housing starts declined by 1.6% after rising by 1.2% in August.

Shortages of materials amid supply chain bottlenecks and a tight labour market were cited as causes.

US crude oil inventories showed an unexpected draw, data showed last week, falling 430,000 barrels in the week ended Oct. 15 to 426.54 million barrels.

The statistics had a bullish impact on crude oil prices.

Philadelphia Federal Reserve said its manufacturing business index fell a reading of 23.8 in October, down from its September reading of 30.7.

The data missed expectations as consensus forecasts were for 25.1, showing weaker than expected manufacturing activity.

On Friday came the news that Evergrande had averted default by making an $83.5 million interest payment to bondholders.

However, another deadline looms on October 29.

In the US, on Tuesday, data will release on new home sales (Sep) and consumer confidence (Oct).

On Wednesday, Australia releases CPI data for the third quarter.

The same day, the US reports on durable goods orders during September and crude oil inventories.

In the US, data on third-quarter GDP, initial jobless claims, and pending home sales for September will be available on Thursday.

Friday is notable for Australian data on September retail sales.

Forex Outlook

AUD/USD ended the week at 0.74658, higher than the previous weekly close of 0.74159, but positioned at the trend line supporting the pair’s ascent from the beginning of October.

Losses on the last two days trimmed some of the week’s earlier gains.

A sequence of lower highs raises the prospect that the line may be challenged, given that the RBA is still positioned easy, and appears set to swat strengthening yields and a harder Aussie.

On the other hand, the US Fed is increasingly looking to commence tapering by mid-November.

If energy and metals prices take a break, this could also weigh on the AUD/USD. All said caution is called for.

The AUD/NZD pair seemingly bottomed out during last week around the 1.04000 level, followed by a sprint towards the 1.05000 level on the last trading day of the week.

That, however, was quickly sold into, and the move speaks to the market’s discomfort with the record inflation figures emanating from New Zealand and the potential for a faster trajectory by the RBNZ on rate hikes.

AUD/NZD closed the week at 1.0435, well below last week, with eyes fixed on whether the pair will violate 1.04250 to the downside.

The AUD/CNY closed the week at 4.7613, off its last weekly close, and looking bearish.

It failed to take out the 4.81000 level and reversed course.

Moreover, it convincingly violated the upslanting trend line from this month, and it now appears that a significant correction may be in the offing.

A likely target for the coming month could be 4.6300, the lower line on the rectangle playing out on the daily chart below.