The Australian markets enjoyed a relief rally after the choppy conditions the previous week. Investors appeared to have discounted fears surrounding a recession and rate hikes, while positive news in the form of Chinese stimulus drew bulls back into action.

This was despite a rate hike of 50 bps by the RBA, the first time it has ever raised the cash rate by that much at back-to-back meetings.

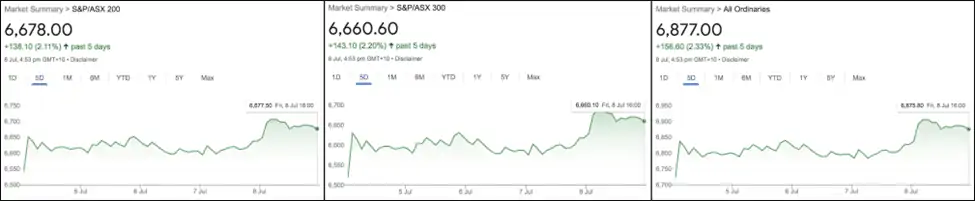

The ASX200, ASX300, and ASX Ordinaries closed the week higher by 2.1%, 2.2%, and 2.33%.

The performance of the three indexes points to an interesting shift in the preference of investors towards small and midcaps rather than blue chips, which predominantly make up the ASX200.

Table of Contents

Last Week In ASX Stocks

ASX Materials Index (ASX:XMJ)

The ASX Materials Index (ASX:XMJ) continued its underperformance, ending the week down 0.83%.

After opening on a high note, the sector tanked on the back of a strengthening dollar that usually hurts demand for commodities, leading to lower prices.

However, the sector rebounded sharply on news of a $200+ billion Chinese stimulus package focused on infrastructure, which is a heavy consumer of commodities including iron, copper, nickel, and aluminum.

Sector heavyweights BHP (ASX:BHP), Rio Tinto (ASX:RIO), Mineral Resources (ASX:MIN), South32 (ASX:S32), and Fortescue Metals (ASX:FMG) all lost ground and closed down 1.68%, 4.49%, 0.38%, 4.98%, and 0.08% down respectively.

New energy metal miners were mixed: Vulcan Energy Resources (ASX:VUL), Pilbara Minerals (ASX:PLS), and Allkem (ASX:AKE) ended higher by 1.41%, 2.84%, and 1.25% while Lynas Rare Earths (ASX:LYC), IGO (ASX:IGO), and Iluka Resources (ASX:ILU) gained 8.18%, 0.89%, and 6.16%.

Gold miners continued their downward spiral with Newcrest Mining (ASX:NCM), Northern Star Resources (ASX:NST), and Evolution Mining (ASX:EVN) giving up 5.36%, 1.2%, and 1.41%, respectively in the face of the sharp fall in the price of the yellow metal since early-June.

ASX Energy Index (ASX:XEJ)

The ASX Energy Index (ASX:XEJ) fell 0.59% for reasons similar to materials.

The middle of the week saw a heavy sell-off in energy commodities due to the strengthening dollar and recession fears; however, share prices in the sector recovered considerably by Friday after oils clawed back to above $100 a barrel.

Sector major Woodside Energy (ASX:WDS) closed up 0.42% while peers Santos (ASX:STO) and Beach Energy (ASX:BPT) ended down 4.01% and 0.87%, respectively.

Coal producers Yan Coal (ASX:YAL), Stanmore Resources (ASX:SMR), and Coronado Global (ASX:CRN) tanked 1.72%, 3.49%, and 7.98% while Whitehaven Coal (ASX:WHC) and New Hope Coal (ASX:NHC) ended up 3.93% and 2.85%.

ASX Financials Index (ASX:XFJ)

The ASX Financials Index (ASX:XFJ) inched 0.68% into the green.

Financials were nervous going into the week ahead of the all-important RBA meeting, and bounced after expectations of a 50 basis point hike prevailed.

Big banks Commonwealth Bank (ASX:CBA), Westpac Bank (ASX:WBC), and Australia New Zealand (ASX:ANZ) ended up 0.26%, 1.29%, and 1.07% while National Australia Bank (ASX:NAB) ended flat.

Smaller banks Bank Of Queensland (ASX:BOQ) and Bendigo Adelaide Bank (ASX:BEN) also ended higher at 1.62% and 0.75%.

Wealth managers AMP (ASX:AMP) and Platinum Asset Management (ASX:PTM) ended up at 3.86% and 0.85%.

Magellan Financial (ASX:MFG) closed lower by 6.15% after reporting a 5% decrease in AUM, and news of a sale of his shares in the company by co-founder Hamish Douglass.

Insurers Insurance Australia Group (ASX:IAG) and Suncorp (ASX:SUN) closed up 0.93% and 0.18% while QBE Insurance (ASX:QBE) closed down 2.81%.

Consumer Discretionary Index (ASX:XDJ)

The Consumer Discretionary Index (ASX:XDJ) had a stellar week gaining 3.02% after the robust retail sales figure of 0.9% growth in May against consensus of 0.4%.

Hospitality companies Star Entertainment (ASX:SGR) and Skycity Entertainment (ASX:SKC) ended up by 3.68% and lower by 11.47% respectively.

Investors pressed the sell button on Skycity on news of a regulatory review of its Adelaide casino as part of a wider examination of the gaming sector.

Travel stock Webjet (ASX:WEB) closed up 1.1% while Flight Center (ASX:FLT) and Corporate Travel Management (ASX:CTD) ended down 0.05% and 0.20%.

Retailers Harvey Norman (ASX:HVN), Temple and Webster (ASX:TPW), and JB Hi-Fi (ASX:JBH) ended higher by 2.73%, 7.8%, and 3.65% in a relief rally after the sell-off over the past few weeks.

Other discretionaries such as Breville (ASX:BRG) and Dominos (ASX:DMP) also closed up 3.9% and 7.76% while Collins Foods (ASX:CKF) fell 1.08% after rallying heavily last week.

Consumer Staples Index (ASX:XSJ)

The Consumer Staples Index (ASX:XSJ) did well but underperformed the broad market, gaining 1.27% for the week.

Wesfarmers (ASX:WES), Woolworths (ASX:WOW), and Coles Group (ASX:COL) ended higher by 4.11%, 2.22%, and 1.89% respectively.

Food producer Tassal Group (ASX:TGR) ended up 0.21% while GrainCorp (ASX:GNC) and Bega Cheese (ASX:BGA) closed down by 8.95% and 3.65%.

Lastly, processed food makers Bubs Australia (ASX: BUB) and a2M Milk (ASX:A2M) ended down 12.52% and up 1.32% with the former tanking after rallying strongly over the last few weeks on strong US exports.

Trading in BUB was halted ahead of its $63 million capital raise to support growth initiatives and execute long-term strategic goals.

ASX Industrials Index (ASX: XNJ)

The ASX Industrials Index (ASX: XNJ) ended down 1.26% for the week on fears that industrial spending would decline due to higher debt costs after another rate hike.

Industrial commodities makers Boral (ASX: BLD) and ADBRI (ASX: ABC) ended down 0.19% and 1.82% while Brickworks (ASX: BKW) ended up 1.27%.

Industrial majors Reece (ASX: REH), Amcor (ASX: AMC), and Reliance Worldwide (ASX: RWC) closed up 1.6%, 0.27%, and 4.27% while Brambles (ASX: BXB) closed down 1.07%.

Airlines Qantas (ASX: QAN) and Air New Zealand

(ASX: AIZ) closed lower by 2.52% and 0.90% respectively.

Lastly, infrastructure players Transurban Group (ASX: TCL) and Qube Holdings (ASX: QUB) lost 1.41% and 0.70%.

ASX All Technology Index (ASX:XTX)

The ASX All Technology Index (ASX:XTX) performed strongly in line with the Nasdaq and gaining 5.6% for the week as the economic data around the world showed that rate hikes have not harmed demand much yet.

SaaS players Appen (ASX:APX), Nuix (ASX:NXL), and Xero (ASX:XRO) ended up 7.33%, 4.97%, and 10.06%, respectively.

Platform players REA Group (ASX:REA), RedBubble (ASX:RBL), and CarSales.com (ASX:CAR) closed up 7.27%, 9.52%, and 4.66%, respectively.

BNPL players Block (ASX:SQ2), Zip Co (ASX:Z1P), and Sezzle (ASX:SZL) ended up 5.99%, 3.92%, and 36.36%.

Sezzle was probably scooped up by value hunters after the battering the stock received since February 2021 and its plunge to a low of $0.26.

Semiconductor and data center companies NextDC (ASX:NXT) and Altium (ASX:ALU) ended up at 3.70% and 5.49%, respectively.

ASX Healthcare Sector (ASX:XHJ)

The ASX Healthcare Sector (ASX:XHJ) was gained 2.72% for the week.

Healthcare providers Ramsay Healthcare (ASX:RHC) and Healius (ASX:HLS) ended down 3.95% and 1.59% while Fisher & Paykel (ASX:FPH) shot up 6.74%.

Equipment makers Cochlear (ASX:COH) and Sonic Healthcare (ASX:SHL) ended down 0.65% and 1.28% while Resmed CDI (ASX:RMD) and CSL Limited (ASX:CSL) ended up 1.87% and 3.94%.

Biotech firms Imugene (ASX:IMU), Mesoblast (ASX:MSB), and Polynovo (ASX:PNV) rose strongly in line with their tech counterparts gaining 15%, 9.93%, and 15.13%.

Polynovo rose on news of insider buying and the finalization of the sale of its headquarters in Port Melbourne; meanwhile, Imugene gained following positive news flow regarding its immunotherapy for gastric cancer.

ASX Real Estate Index (ASX:XPJ)

The ASX Real Estate Index (ASX:XPJ) inched into the green at 0.80% during the week.

Rising debt costs are making investors vary about the sector as increased borrowing costs are bound to hurt investments/demand along with the knock-on effect of lower valuations of properties.

Sector majors Goodman Group (ASX:GMG), Dexus Group (ASX:DXS), and GPT (ASX:GPT), ended up 0.9%, 0.98%, and 2.83% while Charter Hall Group (ASX:CHC) and Scentre Group (ASX:SCG) ended down 0.61% and flat.

ASX Utilities Sector (ASX:XUJ)

The ASX Utilities Sector (ASX:XUJ) ended lower 2.14% for the week.

Sector majors APA Group (ASX:APA), Origin Energy (ASX:ORG), and AGL Energy (ASX:AGL) closed down 1.6%, 2.57%, and 2.47%, respectively.

ASX Telecommunications Index (ASX:XTJ)

The ASX Telecommunications Index (ASX:XTJ) ended the week up 0.55% and underperformed.

Sector majors Telstra (ASX:TLS) and TPG Telecom (ASX:TPG) closed down 1.53% and 1.16% while Uniti Group (ASX:UWL) and Chorus (ASX:CNU) closed up 0.1% and 0.61%.

Next Week In ASX Stocks

There are no major earnings reports due next week.

New Listings

Botala Energy (ASX:BTE) is a coal bed methane exploration and development company with assets in Zambia.

The company will debut in markets on Thursday to raise A$7 million from shares priced at A$0.20/share.

Market and Economic Outlook

In big news this week, Australia outperformed retail sales expectation for May at 0.9% MoM sales growth while the RBA opted for a double hike of 50 basis point, taking its cash rate to 1.35%.

On the other hand, China irked investors when it announced a second round of virus testing in many areas; however, it also declared a monster $200+ billion stimulus package which involved increasing the credit capacities of various states for the purpose of infrastructure.

In the US, FOMC minutes set the stage for a 75 basis point hike at the next Fed MPC meeting.

This was followed by a strengthening of the dollar index to 14 year highs, which sent commodities prices southwards because their contracts are mostly priced in dollars, thus hurting demand.

At the end of the week, the market was greeted with the bitter-sweet news of strong Non-Farm Payroll growth of 372,000 jobs.

That number, though lower on a MoM basis, was far better than consensus of 268,000.

The unemployment rate stood steady at 3.6%.

However, the market received the news as evidence that the economy was resilient, thus paving the way for further hikes.

But US markets tiptoed into the green at the close on Friday.

In the UK, PM Boris Johnson announced his resignation with close deputy and finance minister Rishi Sunak promptly announcing his candidacy for PM.

Over the week, the UK reported Services, Composite, and Construction PMI numbers.

Though the first two slightly outperformed expectations, the last result disappointed.

Next week, starting Wednesday, we have a press address by BoE Governor Bailey followed by Q2 GDP figures from the UK.

Also scheduled the same day is the Reserve Bank of New Zealand’s Interest Rate Decision and the crucial US MoM CPI for June.

On Thursday, significant reports are the RBNZ Interest Statement and Australian employment change for June.

Later in the day, the US declares Crude Oil Inventories, Initial Jobless Claims, and the MoM Producers Price Index (PPI) for June.

Lastly, on Friday we receive Chinese Q2 YoY GDP and YoY Industrial Production for June.

Later in the day, the US sheds light on MoM Retail Sales and MoM Core Retail Sales for June.

Forex Outlook

AUD/USD

AUD/USD closed at 0.68538, above the previous weekly close of 0.68156, after slumping to a low in the vicinity of 0.67600, where it appears to have met with a strong support line made up of multiple bottoms.

Last Tuesday, AUD/USD closed lower despite the RBA’s solid 50 bps rate hike amidst strong retail numbers.

On Friday, data showed U.S. nonfarm payrolls increased by 372,000 jobs last month.

However, the Dollar Index closed about flat at 106.895 after a choppy session, but still at elevated levels reflecting the market’s acceptance of another 75-bps rate hike later this month.

It appears that the AUD/USD pair is marking time until more clarity is visible on the Chinese economy as it lurches out of lockdowns and into a stimulus-fired environment.

Meanwhile, soft resource prices, particularly iron ore, are still eyeing potential demand destruction from an increasingly likelier global economic slowdown.

Technically, one has to take note of the apparent bottom-fishing in AUD/USD represented by the quadruple line of bottoms around 0.67600.

But do note that the nascent upmove stalled on Friday at the 0.68540 line of resistance (earlier, a zone of support).

In sum, AUD/USD is still not out of the woods, and a meaningful change in trend has yet to emerge.

The prognosis is still a pair seeking lower levels.

AUD/NZD

AUD/NZD ended the week at 1.10650, well above the previous week’s close of 1.09756, with a shooting star pattern emerging at a resistance zone marked by the two dashed red lines at 1.10819 and 1.10972 respectively.

Last Tuesday, AUD/NZD reacted negatively to the RBA’s 50 bps rate hike, however bulls reaserted themselves later in the week taking into account the market-beating report on the Australian Trade Balance.

On Wednesday next, the RBNZ is expected to announce a similar 50 bps hike to address rampant inflation, while the Australian job numbers are likely to be an as-expected +25K.

Meanwhile the Dollar Index may remain elevated and pressure both the resource-laden Aussie and Kiwi currencies.

More clarity will emerge on the direction of AUD/NZD after the RBNZ rate decision, but on appearances, the pair is unlikely to take out 1.1100, and may be headed back to the 1.09500 line.