The Australian share market, along with its global peers, received a boost from a US inflation report that pleasantly surprised by turning out softer than expected.

Investors immediately indulged in hoping that inflation may have peaked, or is moderating enough to temper rate hikes by central banks across the world.

The Australian share market therefore ended in positive territory for a fourth week in a row, also bolstered by energy stocks.

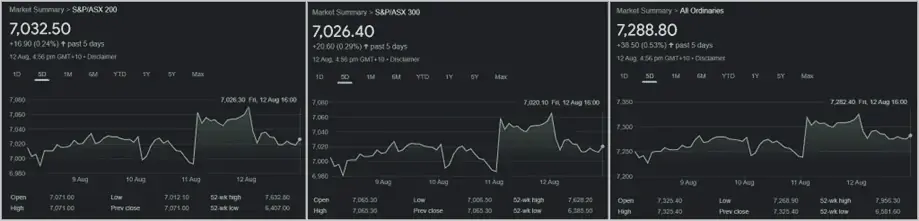

The ASX200, ASX300, and Ordinaries ended the week with gains of 0.24%, 0.29%, and 0.53% respectively.

Table of Contents

Last Week ASX In Stocks

ASX Materials Index (ASX:XMJ)

The ASX Materials Index (ASX:XMJ) gained this week by 0.49% following a more positive outlook for resources amidst rising expectations that softening inflation could also help avoid a global recession.

Sector majors presented a mixed performance. While BHP (ASX:BHP) and Rio Tinto (ASX:RIO) fell 0.40% and 4.30%, South32 (ASX:S32), Fortescue Metals (ASX:FMG) and Mineral Resources (ASX:MIN) shot up 3.47%, 1.88% and 2.87% respectively.

OZ Minerals (ASX:OZL) rejected BHP’s unsolicited A$25-a-share, A$8.4 billion bid saying it “significantly” undervalued the company. OZ shares closed at $25.70, flat for the week.

New energy miners IGO (ASX:IGO), Lynas Rare Earths (ASX:LYC), Allkem (ASX:AKE), and Pilbara Minerals (ASX:PLS) continued their bullish ways and were up 1.18%, 0.73%, 4.54%, and 8.00%, respectively.

These stocks got an added tailwind after the US Senate passed the Inflation Reduction Act, which contains $US370 billion in funding for green energy and to fight climate change.

Amidst gold producers, Northern Star Resources (ASX:NST) gained 1.22% though Newcrest Mining (ASX:NCM) and Evolution Mining (ASX:EVN) fell 1.09% and 0.55%.

ASX Energy Index (ASX:XEJ)

The ASX Energy Index (ASX:XEJ) was a star performer this week shooting up 3.91%.

Heavyweights Woodside Energy (ASX:WDS), Santos (ASX:STO), and Beach Energy (ASX:BPT) shook off last week’s blues and romped higher by 3.62%, 2.87%, and 5.73%, respectively.

Coal majors pressed pedal to the metal last week, all clocking double-digit gains.

New Hope Corporation (ASX:NHC), Whitehaven Coal (ASX:WHC), YanCoal (ASX:YAL), and Coronado Global (ASX:CRN) gained 11.76%, 11.66%, 11.83% and 20.82%.

Coronado announced that surging coal prices had helped it swing to a half-year net income of $561.9 million, from a $96.1 million net loss a year ago.

Coking coal producer Stanmore Resources (ASX:SMR) hit it out of the park with a gain of 30.23% after it announced first-half revenue had increased 15-fold to $1 billion on soaring coal prices and the acquisition of two mines.

ASX Industrials Index (ASX:XNJ)

The ASX Industrials Index (ASX:XNJ) gained marginally by 0.41%.

However, industrial commodities makers Brickworks (ASX:BKW), ADBRI (ASX:ABC), and Boral (ASX:BLD) corrected and lost 0.70%, 0.38%, and 1.01%, respectively.

Industrial majors Reece (ASX:REH) and Reliance Worldwide (ASX:RWC) were up 1.44% and 2.30%, but Amcor CDI (ASX:AMC) ended flat; though Brambles (ASX:BXB) gained 0.35%, infrastructure players Transurban Group (ASX:TCL) and Qube Holdings (ASX:QUB) fell 1.17% and 0.18%.

Airlines were a bright spot with Qantas (ASX:QAN) and Air New Zealand (ASX:AIZ) taking off higher by 2.63% and 9.52% respectively.

ASX Financials Index (ASX:XFJ)

The ASX Financials Index (ASX:XFJ) was up a subdued 0.66%. Amidst banking heavyweights Commonwealth Bank of Australia (ASX:CBA) was down 1.81% in a sea of green; Australia New Zealand Bank (ASX:ANZ), Westpac (ASX:WBC) and National Australia Bank (ASX: NAB) put on 4.89%, 3.28% and 0.03% respectively.

However, CBA said it would earn a $516 million profit on the sale of its 10% stake in Bank of Hangzhou.

It also announced better-than-expected full-year earnings while warning about the short-term economic outlook due to a reduction in spend across debit and credit cards, and elsewhere in rate sensitive cohorts such as home buying.

NAB warned that its full-year costs could rise by 3 – 4%, primarily due to higher personnel and leave costs.

Regional banks Bank Of Queensland (ASX:BOQ) and Bendigo Adelaide (ASX:BEN) were up 1.20% and 1.70%.

Wealth managers put up a mixed show: While Magellan (ASX:MFG) and Pendal Group (ASX:PDL) ended higher by 1.93% and 1.04% respectively,

AMP (ASX:AMP) and Platinum Asset Management (ASX:PTM) were off by 2.16% and 1.06% respectively.

AMP lost ground owing to a sharp cut in its half-year profit, though the company undertook to return $1.1 billion to shareholders after downsizing and simplifying its business.

Amongst insurers Suncorp (ASX:SUN) lost 1.41% but QBE Insurance (ASX:QBE) and Insurance Australia Group (ASX:IAG) were up 2.34% and 1.86%.

Suncorp said its full-year net profit after tax fell 36.7% to $681 million, missing expectations by a hair.

The insurer said the La Nina weather pattern had contributed to 35 major natural hazard events and about 130,000 claims in Australia and New Zealand.

Meanwhile, IAG revealed that it would be increasing its natural peril allowance after blowing through its 2021/22 allowance by $354 million, while its CEO warned of “increasing severity and frequency of natural perils.”

Diversified financial services majors Macquarie Group (ASX: MQG) was up a marginal 0.91%.

ASX Consumer Discretionary Index (ASX:XDJ)

The ASX Consumer Discretionary Index (ASX:XDJ) was up 0.64% this week – the Australian Bureau of Statistics reported that household spending rose 10.2 percent in June compared to the same time last year.

Amongst hospitality companies Star Entertainment (ASX:SGR) and Skycity Entertainment (ASX:SKC) gained 1.74% and 2.33% respectively.

Travel companies Webjet (ASX:WEB), Corporate Travel Management (ASX:CTD), and Flight Centre (ASX:FLT) went up by 0.79%, 2.51% and 1.31% respectively.

Temple and Webster (ASX:TPW) and Kogan (ASX:KGN) were better off this week and gained 5.87% and 2.18%.

Peers Nick Scali (ASX:NCK), Harvey Norman (ASX:HVN), and JB Hi-Fi (ASX:JBH) kept pace and shot up 5.36%, 4.18% and 3.95% respectively.

While appliance maker Breville (ASX:BRG) had yet another good week and was up 3.63%, food brands continued on their declines with Dominos (ASX:DMP) and Collins Foods (ASX:CKF) falling 2.06% and rose 2.98% respectively.

ASX Consumer Staples Index (ASX:XSJ)

The ASX Consumer Staples Index (ASX:XSJ) trended higher this week with a gain of 1.03%.

Sector heavyweights Coles Group (ASX:COL), Woolworths (ASX:WOW), and Wesfarmers (ASX:WES) closed flat.

Food producers Bega Cheese (ASX:BGA), and Costa Group Holdings (ASX:CGC) ended with gains of 0.53% and 8.56%.

GrainCorp (ASX:GNC) shot up 6.25% and Tassal Group (ASX:TGR) ended unchanged.

Amongst processed food makers Bubs Australia (ASX:BUB) clocked a gain of 5.04% but A2 Milk fell 0.61% due to the delay in approval from the US FDA for exports into the US.

ASX All Technology Index (ASX:XTX)

The ASX All Technology Index (ASX:XTX) ended flat, though mid-week it received a halo effect boost from Wall Street counterparts.

Amongst platform companies REA Group (ASX:REA) and RedBubble (ASX:RBL) powered higher by 7.89% and 11.60%; Carsales (ASX:CAR) and Domain Holdings (ASX:DHG) went up by 1.88% and 10.44% respectively.

REA said its full year global revenue rose 40% compared to a year ago.

Saas players Xero (ASX:XRO) and WiseTech Global (ASX:WTC) clocked gains of 0.61% and 0.59% respectively.

Though Appen (ASX:APX) clawed back a gain of 1.99%, Nuix (ASX:NXL) did better and put on 2.74%.

BNPL gave up a lot of the previous week’s gains with Block (ASX:SQ2), Sezzle (ASX:SZL), Zip Co (ASX:Z1P) and MoneyMe (ASX:MME) losing 2.88%, 12.32%, 1.61% and 5.41% respectively.

Link Administration (ASX:LNK) was down 2.28%.

In semiconductor and data center companies Altium (ASX:ALU) and NextDC (ASX:NXT) gave up nearly 5% each.

ASX Healthcare Index (ASX:XHJ)

The ASX Healthcare Index (ASX:XHJ) underperformed the market and lost 1.49% for the week.

Healthcare providers Ramsay Healthcare (ASX:RHC) and Healius (ASX:HLS) gave up 0.71% and 6.97% respectively while Fisher and Paykel (ASX:FPH) gained a minor 0.69%.

Healthcare equipment makers all ended in the red for the week – Sonic Healthcare (ASX:SHL), CSL Ltd. (ASX:CSL), Resmed CDI (ASX:RMD), and Cochlear (ASX:COH) lost 4.17%, 1.16%, 3.97%, and 1.22% respectively.

However, Biotech firms Imugene (ASX:IMU) and Mesoblast (ASX:MSB) gained this week too and were up 5.45% and 3.49% respectively.

Imugene announced US researchers had dosed another breast cancer patient with Imugene’s experimental cancer treatment, a genetically modified poxvirus.

ASX Real Estate (A-REIT) Index (ASX:XPJ)

The ASX Real Estate (A-REIT) Index (ASX:XPJ) spent another week doing essentially nothing and ended flat.

Among sector majors, Mirvac Group (ASX:MGR) and Scentre (ASX:SCG) ended in the green by 2.64% and 0.53%.

Stockland Group (ASX:SGP) was up 0.52% while Vicinity Centres (ASX:VCX) put on nearly 1%.

Meanwhile, Goodman Group (ASX:GMG) was up just 0.05%.

ASX Telecom Index (ASX: XTJ)

The ASX Telecom Index (ASX: XTJ) gained 1.19% for the week.

Sector companies were a mixed lot; while Telstra (ASX:TLS) and Chorus (ASX:CNU) lost 0.87% and 2.82%, TPG Telecom (ASX:TPG) rose 2.16% respectively; however, Megaport (ASX:MP1) closed unchanged after announcing its full-year global revenue had risen 40% to $109.7 million, compared to a year ago.

Telstra raised its total dividend for the first time since 2015, returning $1.9 billion to shareholders despite lower profits.

ASX Utilities Index (ASX:XUJ)

Lastly, the ASX Utilities Index (ASX:XUJ) ended flat.

Among sector majors AGL Energy (ASX:AGL) and Origin Energy (ASX:ORE) shot up 1.91% and 0.17%; however, APA Group (ASX: APA) fell 0.34%.

Next Week ASX In Stocks

| AUGUST 2022 | 15 | 16 | 17 | 18 | 19 |

|---|---|---|---|---|---|

| ANNUAL REPORT | BPT, CAR, DXB, FID, IMD, JBH, JTL, LLC, PPS, SDF, SWM | ARB, BTC, BWF, BXB, CAM, DHG, DXC, DXS, EML, EPD, EXR, GCI, HPI, LRL, MCY, MFG, MNY, SGF, VVA | ABP, AHN, ARU, AXI, COO, CTD, CUE, DMP, DRR, DXI, EBO, EHL, EVS, FBU, LIC, NUH, NWL, PAA, PAI, PME, QVE, RDC, RMD, SPK, SUL, TAH, TOT, VCD, VCX, WGB | AIA, ARC, ASX, BLX, CDP, DCG, DTL, EGN, EOF, EQT, FSG, HDN, HUM, IPH, IRI, MBH, MLM, NAC, NCC, NGI, NSC, ORA, OSL, PMC, PPT, PWH, SEQ, SVS, TRS, TWE, UCM, VG8, WAM, WQG, AIA | ADH, ANO, ARG, BIR, BSA, COH, CTO, MAM, OBL, PEC, PFG, PIC, SGP, SW |

| INTERIM REPORT | GPT, GXY, NGE, GPT | EXL, IBX, MMM, OSP, STO | BFL, DOC, ESK, MAF, OZL, TNK, WDS, STO | DRA, IRE, NGS, TLX, YAL | BFL, ESK, HTA, MSI, RAN, RCT, SIQ, SYD, TPG, VLS, VTI, TPG |

| PRELIMINARY REPORT | ARG, BEN, BPT, BSL, CAR, CEN, CGA, DXB, FID, GPT, GWA, IMD, JBH, LLC, MIL, PPS, SDF, SWM, VMX, BEN, BPT, BSL, CAR, CEN, CQE, GUD, JBH | ARB, AUI, BHP, BRG, BTC, BTI, BWF, BXB, CAM, CIN, CQR, DHG, DXS, EML, EPD, GCI, HPI, MCY, MFG, MIL, MMM, MNY, SCP, SGF, SGM, TGR, VVA, ABP, BHP, CGF, GMG, GOZ, MCY, SCP, SEK, SWM | ABP, AGI, AMC, AMS, AVN, AXI, BAP, CCR, COL, COO, CSL, CTD, CUE, DMP, DRR, DUI, EBO, EGG, EHL, EPY, EVS, FBU, GLB, INA, LIC, MCP, MWY, MYE, NEA, NUH, NWL, PAA, PAI, PGH, PME, PSQ, QVE, RDC, SFC, SLR, SPK, SUL, SXL, TAH, TOT, VCD, VCX, WGB, WZR, ZNO, BAP, BXB, CSL, CTD, DHG, DXS, FBU, MFG, SDF, SUL, VCX | APZ, ARC, ART, ASX, AVJ, BLX, CDA, CDP, DCG, DTL, DUI, EGN, EQT, EVN, EYE, FFI, FSG, HDN, HUM, IPH, IRI, MBH, NAC, NCC, NCM, NGI, NSC, NWH, ORA, ORG, OSL, OTW, OZG, PMC, PNV, PPT, PWH, RBL, S32, SEQ, SGR, SPA, SVS, SXY, TRS, TWE, UCM, VG8, WAM, WIC, WQG, ASX, BKL, DRR, HPI, MPL, ORG, PME, TCL, TWE | ACF, ADH, AMX, ANO, BCI, BIR, BSA, COH, CWY, ING, IRI, MAM, MXI, MYS, NOU, OBL, PFG, PIC, PPG, PWH, RBL, SDI, SEQ, SGP, SOV, SWF, VTG, AGL, COH, CWY, GNE, ING, KGN, MYS, NCM, SG |

| QUARTERLY REPORT | – | – | – | – | NHC |

New ASX Listings

No new listings next week.

Economic and Market Outlook

Last week’s data prints

The Australia Westpac Consumer Confidence Index fell -3% to 81.2 in August, on par with the lows of the Covid and Global Financial Crisis.

“A strong message from the collapse in the Index over the last nine months has been the negative attitude to major household purchases, where confidence has fallen almost as fast as the 12 month economic outlook,” Westpac’s chief economist Bill Evans said.

“It seems likely that inflation, which we still see as the major negative for confidence over this period has been weighing particularly heavily on the attractiveness of consumer durables.”

In the US, the Consumer Price Index increased 8.5% in July from a year earlier, cooling from the 9.1% June advance that was the largest in four decades.

Reflecting lower energy prices, the deceleration raised hopes that the US Fed may want to ease off on rate hikes.

Furthermore, the July Producer Price Index (PPI), an index of wholesale prices showed a decline of 0.5% compared to an expected increase of 0.2%, bringing the headline PPI figure to 9.8% YoY, versus an expected 10.4%.

The above readings sparked a stock market rally.

Next week

Monday, August 15: China Industrial Production YoY July

Tuesday, August 16: RBA Meeting Minutes / US Building Permits July

Wednesday, August 17: New Zealand RBNZ Rate Decision / US Retail Sales + Core Retail Sales MoM July

Thursday, August 18: Australia Employment Change July / US Philadelphia Fed Mfg Index (Aug) / FOMC Meeting minutes / Crude Oil Inventories

Friday, August 19: US Existing Home Sales July

Forex Outlook

AUD/USD

AUD/USD closed at 0.71213, sharply above the previous weekly close of 0.69109.

The pair was boosted by the softer-than-expected CPI and PPI readings out of the U.S. which raised the possibility of inflation tapering, and the US Fed therefore slowing its aggressive rate hikes.

The market dialled back expectations of a 0.75% Fed hike in September to 0.50%.

That led to a weakness in the Dollar Index which fell to a low of 104.66.

AUD/USD was propelled higher and embarked on a fresh breakout from a flag pattern, resuming an uptrend that commenced from the mid-July low of 0.66830.

The pair has now set up a sequence of higher lows and higher highs.

The environment is now skewed towards ‘risk-on’ and if the momentum continues to support, there is not much in the way of the AUD/USD pair before 0.72500.

AUD/NZD

AUD/NZD ended the week at 1.10299 and below the previous week’s close of 1.10683.

The pair has hammered a multiple top in the range of 1.11750, which is also the upper line of a sideways rectangle pattern playing out since May 2022.

Key data out next week is the RBNZ rate decision on Wednesday and the Australian employment change (July) on Thursday.

The RBNZ on Wednesday is expected to hike its Official Cash Rate (OCR) by 50 basis points (bps) consecutively for the fourth time, taking it to 3%.

Technically, as it moves sideways in a broad rectangle pattern, AUD/NZD is likely to break through the channel line and head towards the rectangle’s lower support line of 1.09500.