Join the 4,400+ other investors and traders chatting about this in our Facebook group.

Today, we’ll be doing a post mortem on the market crash that started in mid-February.

We’ll also look at what scenarios will likely happen next.

We also have four stocks that we think will help us hedge the coming volatility, as well as take advantage of a fundamental shift in human behaviour around the world.

Table of Contents

- 1 How we got to this stage

- 2 What is happening now

- 3 What needs to happen next

- 4 What may happen in the next few months

- 5 What may happen in the next few months to years

- 6 What you should do now

- 7 Two ASX stocks to buy during and the coronavirus pandemic

- 8 Two ASX stocks to buy to take advantage of the coronavirus pandemic

- 9 In conclusion

How we got to this stage

In my previous post, I talked about how central bank action should create an opportunity to buy the dip.

However, things went dire since then, turning from a correction into a full-blown crash, with initial central bank intervention having little to no effect.

The move in this market was completely unprecedented, putting us back to January 2013 levels in less than a month.

It was also the fastest crash ever and we just finished Q1 with the worst quarter in history.

The volatility was also unprecedented, with market swings of 7%+ being the market norm.

So what exactly caused all of this?

Why the market crashed so quickly

The world has way too much debt. With fixed interest returns falling lower and lower since 2008, investors have been using cheap debt to move into higher-risk assets such as equities in the search for yield.

This created an environment where the market becomes more sensitive towards corrections. In May 2019, I wrote an article about this phenomenon and what to expect when markets correct too much.

In summary, as the market approaches a 20% drawdown, we will start to see a lot of margin calls and highly leveraged positions unwind.

Once we move past the 20% area, we will start to see assets correlate to one. This where every asset including safe-haven assets are sold.

This is due to a flight for the safety of cash. The two main reasons are for a deflation hedge and needing to unwind non-leveraged positions to pay for margin calls.

We saw this last month where gold, which is a hedge, was sold off.

We even saw US Treasuries, which are as good as cash getting sold off too.

Finally, we saw the US Dollar surge on a massive scale as investors continued to hoard cash.

With all assets selling off and margin calls being triggered, the market went into complete freefall, crashing up to 38% in a matter of days.

Since then, the market has stabilised as central banks around the world used trillion-dollar packages to stem the bleeding.

So what is happening with the market now?

What is happening now

The market is taking a breather and it looks to have formed a base. The reason for this is two-fold.

Firstly, monetary policy. This was the first and most important bazooka the world needed to fire.

The multi-trillion monetary policy bazookas that central banks around the world fired was required to keep the financial system greased.

This is because, in times of great uncertainty, banks don’t know who will or won’t survive the calamity.

This causes the banks to stop lending to each other, thereby effectively shutting down the world financial system.

By putting in place multi-trillion-dollar policies, central banks are guaranteeing the banks that they have access to cheap money.

Central Banks such as in the US, have even gone as far as producing a QE Infinity program. Essentially, unlimited money to support the financial system.

Central Banks are essentially acting as the lender of last resort to banks around the world.

During normal market operations, only monetary policies are required to create a floor and a bounce in the market.

However, the coronavirus has suppressed something that can’t be dealt with using monetary policy – demand.

This leads us to the second set of policies.

Secondly, fiscal policy. This is the second but more complicated bazooka the world needed to fire.

These policies are designed to help companies survive and keep as many people employed as they can.

The policies are also designed to help individuals and families pay for essentials, such as rent and food.

Governments around the world scrambled to put together fiscal these policies as demand around the world crashed.

So why did these policies take a month to get into place?

Quite simply because of logistics. Governments around the world needed to structure it in a way where it was most effective, as well as distribute it through existing government channels.

In the Australian case, for distribution to individuals and families – the Centrelink system.

For companies, through the BAS system.

Since announcing a number of subsidies, including a huge $160 billion worth of support for businesses to keep people employed, markets have stabilised and rallied.

In this case, the government is acting as the lender of last resort for individuals and companies.

What needs to happen next

The two policies should create a base for the markets at this point in time.

For the market to start a real risk-on recovery, we will need a third pillar to be in place. This is for the coronavirus to either stop spreading or we find a cure for the virus.

This is a huge known unknown that will hopefully be answered very soon in the near future.

There is really no forecasting where this might go. We just have trust that the two policies above will last long enough to keep the market stable until this gets solved.

Until then, market volatility will continue to remain extremely high.

What may happen in the next few months

The real estate market could be the next victim of this crisis.

In fact, clearance rates have already dropped off a cliff due to the quarantine, withdrawals and less investor appetite for taking on risk.

This all points to pressure in the Real Estate market which could translate to lower prices.

Additionally, Australia also has one of the highest private debt load in the world at over 200% private debt to GDP.

If real estate prices were to drop just 20%, this would put almost everyone who bought since 2017 into negative equity.

With demand drying up and people unable to pay rent, or deliberately not paying rent in Premier Investments case, this can force people to sell at a loss.

This then creates bad loans for the banks which they need to write off – creating deflation as money is destroyed through defaults.

Furthermore, a drop in prices can create a negative feedback loop where investor sentiment collapses.

This will trigger a sell-off as investors move into the safety of cash and sell assets off indiscriminately.

In that sense, Real Estate is no different to stocks, gold and bonds when it comes to leverage, risk and reward. If investors need cash or need to meet margin calls, they will sell Real Estate as well.

The only real difference is that the Real Estate market is not fungible and data is always very delayed.

This means that a downturn in the Real Estate market might already be happening – it’s just that we don’t have the data to support it yet.

However, there are a few bright spots in terms of the Real Estate market which could keep this market stabilised.

Individuals and families still need a place to live and policies such as mortgage repayment holidays, rental support and so forth will help support this market.

It is highly likely we will get a pullback in Real Estate, but with government support, it will be unlikely we would see a crash in this area.

What may happen in the next few months to years

This will depend on a lot of factors, but there are two main scenarios of which I believe one of them is not avoidable.

Scenario 1 – Recession with a fast rebound with a fast containment of the coronavirus

This is the best and most likely scenario to play out. Containment through herd immunity or a vaccine.

With both fiscal and monetary policies now being finalised and put into place, this is just a matter of outlasting the coronavirus.

As a species, we have managed to get through quite a number of harrowing, life-altering events.

Here are a few man-made ones and some pretty bad epidemics that we have survived:

- World War 2 – 85 million dead

- World War 1 – 24 million dead

- Spanish Flu – 17 – 100 million dead

- Smallpox – 500 million dead

- HIV/AIDs – more than 32 million dead

As a species – we are pretty adaptable. We should get past this just fine.

However, we will likely see very high volatility in the markets until we reach scenario 1.

Furthermore, once we do, everything will bounce back violently as demand rises and things return to normal.

We will take a hit when the world reopens, but the blow will be significantly cushioned thanks to government policy.

No doubt – this is a scenario where you want to be long the market.

There is a caveat however as nothing is free.

As governments around the world become lenders of last resort, this creates or exacerbates two main problems.

Firstly, there is a lot more cheap money in the world

The flood of printed money will create inflation.

The problem we have had since 2008 where asset prices inflation was much higher than income inflation will be worse.

This means that wealth gap issues such as being able to purchase a first home will likely become worse.

Secondly, government debt will balloon

If government debt wasn’t a problem before in Australia like it is in Europe, Asia and the US – it likely will be now.

Since the government is a lender of last resort, the government has nobody else to borrow from.

To solve this issue, governments print money.

Even though governments control their own money supply and can essentially never default, printing too much money can create hyperinflation.

Hyperinflation will essentially destroy the currency and make it worthless.

However, we have seen other countries such as the US, Europe and Japan do this for many years.

Provided this is managed properly, hopefully we won’t run in this issue any time soon.

Scenario 2 – Coronavirus uncontained, long recession with slow rebound

This is the worst-case scenario governments around the world are trying to avoid at all costs.

The coronavirus is not contained fast enough, governments run out of support, companies collapse and consumers lose the ability to create demand due to loss of income.

Even though this scenario is possible, it is unlikely with the support and the lengths the government are going to, to avoid it.

What you should do now

Firstly, please stay home to help flatten the curve. It is in everyone’s best interest to get this over as soon as possible.

Secondly, the same advice as before – don’t panic.

Markets and the world are run on investor and consumer sentiment. By not adding to the panic, we are collectively avoiding the worst-case scenario.

Don’t overthink things. It’s not the end of the world. We are not entering an era of Hunger Games.

We don’t need more guns.

However, we will still need food, transport, oil, gas, electricity, entertainment and numerous other things when this is over.

Companies that supply these goods and services will still be here. However, speculative and poorly run ones might not.

Use common sense. Stick to well-run companies with good prospects and strong balance sheets.

This brings us to four stocks that we think will be solid and grow in the post-coronavirus world.

There are two stocks that will get profit upgrades during this pandemic. Coles (ASX COL) and Woolworths (ASX WOW).

This is a no brainer and confirmed by the fact that both Coles and Woolworths are hiring thousands of more people whilst everyone else is trimming their human resources.

Coles and Woolworths are wonderfully defensive stocks because everyone needs basics such as toilet paper (apparently) and food to get by.

During normal times, they are boring but very predictable and reliable with their dividends.

Both Coles and Woolworths are great stocks that can create a strong base and a hedge for market shocks such as these.

With the markets indiscriminately sold off, both these great stocks are on sale right now.

Seeing the devastation that a coronavirus can cause around the world, we can expect governments, individuals and businesses around the world to take this issue more seriously.

If the world learns from its mistakes, then we can expect demand for certain products to rise exponentially.

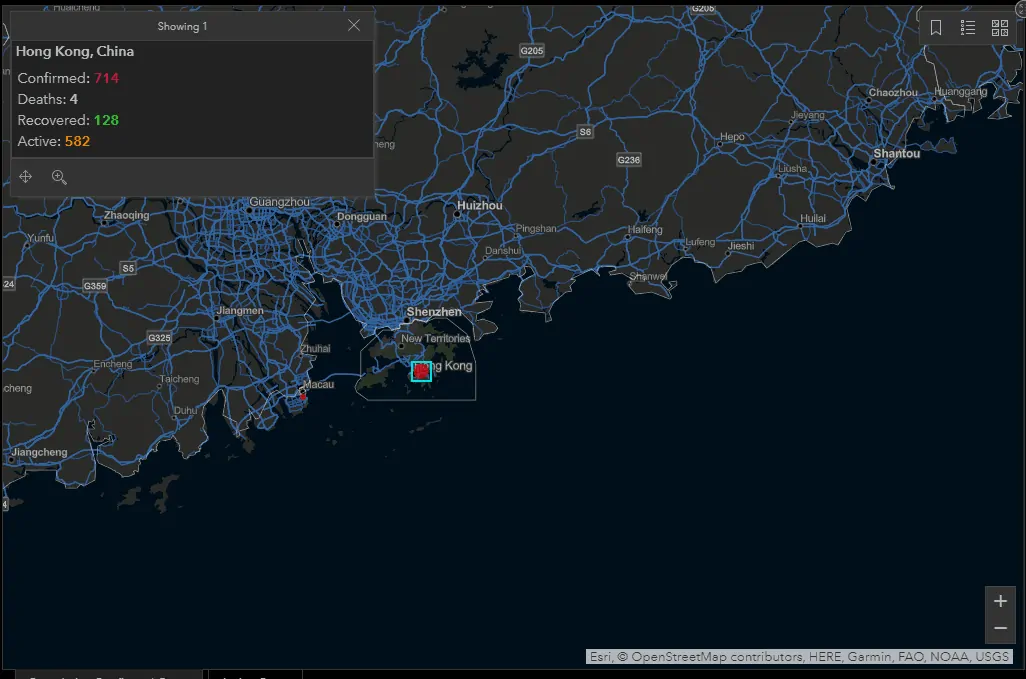

Take Hong Kong for example, which learnt from the SARS epidemic in 2003. Hong Kong has also (so far) kept the new coronavirus under control.

As of the 1st of April, Hong Kong only has 714 cases.

For a city renowned for an extremely high population density as well as having an open border with mainland China, that is a pretty good feat to achieve.

These are just some of the more visible steps that are taken in Hong Kong since the 2003 SARS epidemic.

- lift buttons disinfected every hour

- Escalator rails are disinfected hourly

- MTR (train) handrails are cleaned constantly. Hong Kong probably has some of the cleanest trains in the world.

- Toilet pipes are cleaned with 1:50 bleach solution

- Hand sanitisers are everywhere in Hong Kong

- Emergency Rooms nurses and doctors will always be wearing masks in hospitals with no lack of supply

- Government is constantly teaching people how to wash their hands for at least 2 minutes, from a young age

- Touch-free pedestrian crossing buttons

If the world responds to the coronavirus as Hong Kong did, we can expect stocks which provide equipment such as this to have extremely strong demand.

A company such as Ansell (ASX ANN), who is a manufacturer of medical gloves could see stronger demand for its products.

I would not be surprised if ANN is considering expanding into manufacturing other products to fill a supply gap created by the coronavirus.

Additionally, a company such as Fisher & Paykel Healthcare (ASX FPH) could see strong demand for its respiratory care products.

In fact, we first looked at FPH at the end of May 2019, when the stock was at around $15.

Since the coronavirus pandemic, the stock has rallied to almost $30, or a 100% return in less than a year.

Other companies may start to look to produce more products onshore with Australian companies forced to diversify their supply chains.

One thing that the coronavirus has exposed is how weak Just In Time (JIT) supply chains and reliance on cheap overseas labour and products is.

If Australia is to learn anything from this, critical supply chains will see diversification and more onshore production to hedge risks such as this.

This will be an area that we will look into and our clients will know first when we find new opportunities.

In conclusion

Monetary and fiscal policy will have likely created a strong support base for this market.

Don’t expect a recovery in the markets and a bull market to establish until the coronavirus is under control.

Expect volatility in the markets to be high until then.

Relative to the past month, this base is a good entry point to pick up some strong solid blue-chip stocks that can benefit from the coronavirus.

Other blue-chip stocks which can benefit from the world returning to normal should have extremely strong upside in the near future.

Supply chains will shift to adapt to risks such as a pandemic, expect there to be a lot of opportunities for ASX listed companies to fill the gaps.