Should you buy Allegiance Coal shares (ASX:AHQ)? Our AHQ share price forecast and analysis will look at how the company is one of the most promising metallurgical coal producers in the world with strong upside potential.

Allegiance Coal Limited is an Australian mining company in the metallurgical coal sector.

While COVID was initially harsh on miners for fears of slowing economic growth, lower demand, and mine shutdowns, these companies are back in the reckoning due to potential global spending on infrastructure and expectations of an economic recovery.

As more of its production comes online, Allegiance Coal shares will benefit from rising met coal prices.

Steel is one of the biggest inputs in large-scale and industrial infrastructure projects, and this has turned the tide for miners of metallurgical coal, a key input in steel production.

Although Allegiance Coal is an Australian company, it will not suffer from China’s ban on Australian coal imports as its mines are located in North America, thus positioning it as a beneficiary from China’s large planned infrastructure spends.

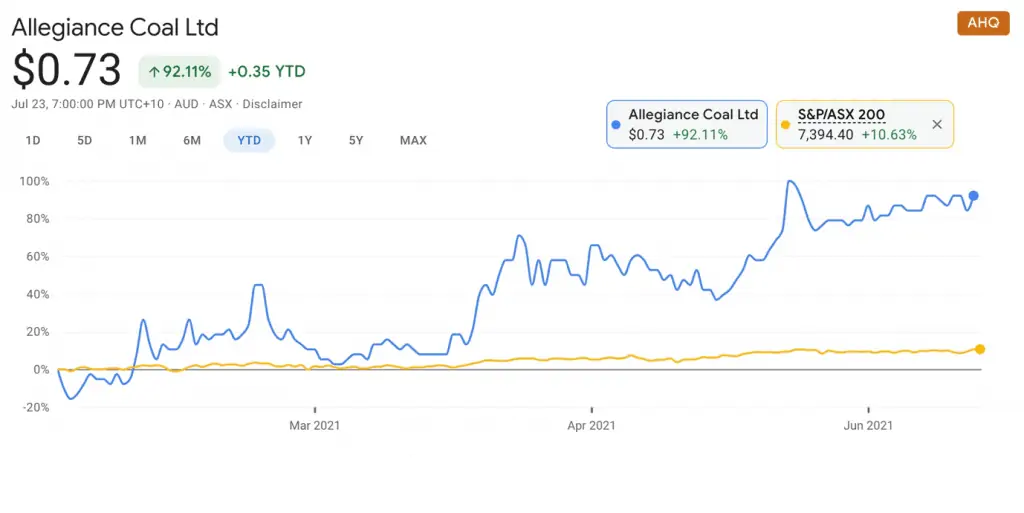

The stock has made a sharp recovery from its COVID low and may soon break out above pre-COVID levels to a five-year high.

At the current AHQ share price, Allegiance Coal shares are up 92% year to date.

Table of Contents

- 1 About Allegiance Coal Shares (ASX:AHQ)

- 2 Low-Cost Business Model With High-Quality Coal and Great Margins

- 3 Allegiance Coal’s (ASX:AHQ) Single Product Portfolio Is Risky But Macro Tailwinds Are Strong

- 4 Projected Financial Performance Very Impressive Even Under Conservative Assumptions

- 5 Peer Valuation Tricky But Allegiance Looks Like a Much Better Deal

- 6 Conclusion – It’s All About Meeting The Projections

Allegiance Coal Limited is a coal mining company headquartered in New South Wales, Australia.

It focuses on steelmaking coal projects in countries with low political risk. The company’s main assets are the New Elk and Telkwa metallurgical coal projects.

New Elk, situated in Colorado, USA, and acquired in October 2020, commenced production in May 2021.

Meanwhile, at the Telkwa asset, in Northern British Columbia, Canada, the Company is developing the Tenas metallurgical coal project in partnership with Itochu Corporation.

Tenas has a completed definitive feasibility study and is now in the permitting process with production targeted for commencement in H2 2022.

Allegiance Coal’s target market is the North-East Asian and US steel sectors.

At the current AHQ share price, Allegiance Coal shares have a market cap of A$207 million.

Low-Cost Business Model With High-Quality Coal and Great Margins

Allegiance Coal (ASX:AHQ) has a very simple business model.

It invests in mines that require low start-up CAPEX or those with low operating expenses thereby cushioning the company from the price volatility of coal.

For example, it acquired all the shares in New Elk for US$1 and assumed debt of C$55 million that would be interest-free and repayable over ten years.

The New Elk mine, one unit of which commenced production in May 2021, has already pre-sold four 70,000 metric tonne cargoes of its Blue Seam coal to Asian steel mill customers for delivery in August, October, November, and December 2021, respectively.

It is also receiving strong interest from global steel mills for Blue Seam. Its second unit is expected to commence by the end of this year.

New Elk will further reduce its costs after it completes the reconstruction of a 27-mile rail spur from BNSF’s main rail line to its mine site.

High-quality met coal gives steel mills greater optionality and increases the efficiency of production and lowers the cost of steel, but at a higher cost.

The general threshold for high-quality met coal is <1% sulfur. New Elk produces a very high-quality low-sulfur coal (below 0.5% sulfur).

This will allow the company to blend its own coal with lower-quality coal from Alabama in a 55%-45% ratio and still meet the high-quality threshold of 1%.

This coal can still sell at high-quality prices whilst lowering its already very competitive mining cost per ton to $88/ton, which compares very favourably with current prices of about $200/ton.

The low cost of production places the company in the first half of the global cost curve, meaning that they can sustain at lower prices than the latter half of the curve.

If these prices hold or even deteriorate to $130/ton, which is the price used in company projections, the company still has a wide cushion and excellent margins.

The company’s operational strengths as above are currently being complemented by big sectoral tailwinds.

According to Allegiance Coal (ASX:AHQ), demand for US coking coal is strong and is likely to continue to be so while the Chinese-Australian political conflict continues.

Furthermore, the New Elk acquisition may benefit from big infrastructure spending in the US and China, and the commodities’ rally. The deal, therefore, came at an opportune time.

Meanwhile, it is seen that the metallurgical coal premium hard low-vol (the benchmark) fob Australia-Singapore close price has shot up from marginally above US$100/t in May 2021 to around US$180/t in late June 2021.

This bullish pricing bodes well for Allegiance Coal’s share price.

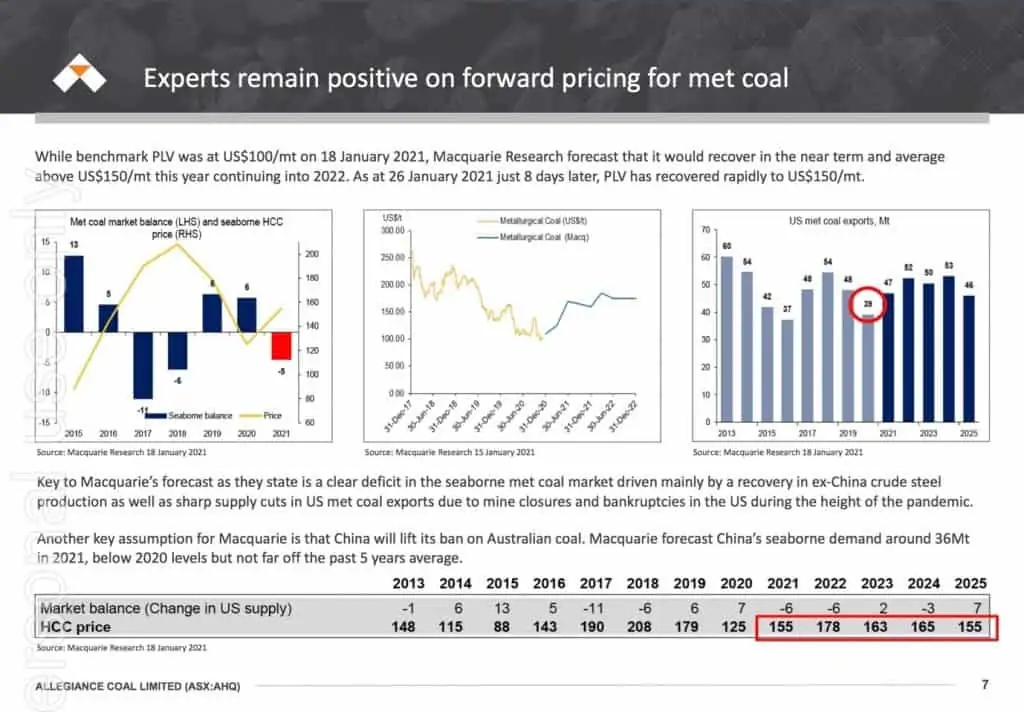

Source: Allegiance January 2021 Investor Presentation

However, a potential long-term weakness facing the company is currency impact.

While the company’s revenue and operational costs are denominated in US$ or C$ as the functional currency, the company’s reporting/presentation currency is the AUD.

Any weakness in the US$ or C$ can potentially hurt the company’s reported earnings even though operational performance may be strong.

Allegiance Coal’s (ASX:AHQ) Single Product Portfolio Is Risky But Macro Tailwinds Are Strong

Politically, the company will benefit strongly from China’s coal import ban on Australia as its mines are located in North America.

Even if/when the coal ban is reversed, Australia is becoming increasingly climate-conscious over time and this is apparent from the far lower number of new mining approvals being granted to companies.

At the moment, the metallurgical coal market is dominated by Australia, with a 58% market share.

If this number goes down over the following years due to the Chinese ban and climate concerns, it will open up opportunities for mines outside Australia, such as Allegiance Coal (ASX:AHQ), to service the Asian markets.

Between New Elk and Telkwa, the company is positioned well to supply the metallurgical coal markets both in Asia and the US.

However, Allegiance’s reliance on a single-product portfolio is a matter of concern. As metallurgical coal is the only product the company produces, its prospects are solely dependent on its prices.

In the event of a downturn, the company’s profitability could be impacted.

That being said, Macquarie projects the average price of met coal over the next 5 years to be about $160/ton, after assuming China lifts its ban.

The company should deliver stellar performance as costs $88/ton at New Elk and is projected to be $114/ton at Telkwa.

Source: Allegiance January 2021 Investor Presentation

Projected Financial Performance Very Impressive Even Under Conservative Assumptions

Allegiance Coal (ASX:AHQ) just commenced operations at New Elk, so we will have to wait for operational results in the Annual Report.

Before New Elk, the company was in the approvals process of Telkwa and hence had no operational revenues.

However, the company’s projections look very promising. At $88/ton, the New Elk mine is a very low-cost producer of met coal.

Assuming average prices of only $131/ton, which is lower than projections of average prices of $163/ton for the next 5 years, the company should generate A$131 million of EBITDA from just New Elk.

Telkwa’s expected EBITDA is $64 million assuming the cost of $45/ton and an average life-of-mine product price of $114/ton.

According to the company’s 2020 annual report, which cited the Definitive Feasibility Study of the deposit, the Tenas project in Canada is likely to be one of, if not, the lowest cost producers of metallurgical coal on the global seaborne market.

The company recently raised $40 million from institutional investors and $3 million from shareholders to ramp up New Elk operations and advance the Telkwa approvals process.

Peer Valuation Tricky But Allegiance Looks Like a Much Better Deal

We will compare Allegiance Coal shares to Cokal (ASX:CKA) and Colonial Coal (CVE:CAD), both of which are companies focused on metallurgical coal.

Cokal owns mines in Indonesia while Colonial Coal owns projects in Canada.

It should be noted however that companies in the micro and small-cap space in mining have widely differing mine characteristics with projects in varying stages of development.

Hence, only a comparison of the Price/Book ratios is viable.

| Metric | Allegiance Coal | Cokal | Colonial Coal |

| Price/Book | 5.47 | 9.52 | 7.48 |

Clearly, at the current AHQ share price, both of Allegiance’s peers are more expensive than Alliengance Coal shares in terms of book value.

Furthermore, Allegiance Coal is the only one with an operating mine (New Elk).

Conclusion – It’s All About Meeting The Projections

Allegiance Coal (ASX:AHQ) is well placed having acquired promising coal assets at competitive prices and will also potentially benefit from both sector and political tailwinds.

The company has a very attractive cost of production in the context of the metallurgical market outlook over the next five years.

As long as coal prices stay in the $120/ton-$160/ton range, the company should perform extremely well.

However, adverse movements in coal prices could hurt the company’s prospects given that the previous two owners of the New Elk mine had to cease operations due to unfavourable coal prices.

That being said, in the current global economic scenario, the likelihood of such an event appears to be remote.

With such high margins, quality assets and growing revenues, the AHQ share price has a lot of upside potential in the next few years.