Today we will look at why Mineral Resources shares (ASX:MIN) have great upside potential in our MIN share price forecast and analysis.

Mineral Resources Ltd. is a large, integrated Australian mining company with a significant market presence in four businesses.

These are mining services, iron ore, lithium, and energy.

The company has also recently progressed its establishment of integrated port and marine infrastructure facilities and taken control of the largest on-shore gas discovery in Australia through the Norwest Energy acquisition.

Despite the recent correction in the stock due to a decline in lithium prices, MIN has handily outperformed the ASX 200 index, gaining nearly 80% over the past 12 months, versus a mere 1.5% upside in the index.

Table of Contents

- 1 About Mineral Resources (ASX:MIN)

- 2 Strength: Integrated Business Model With Nuts and Bolts Competence In Mining Operations

- 3 Strength 2: Energy Assets Hold Massive Promise To Improve Core Business And Make The Company A Potential Energy Producer To Be Reckoned With

- 4 Strength 3: Iron Ore Business Is Very Solid With Plans For 5x Growth Over the Next Five Years With Better Infrastructure, Cheaper Energy, and Higher Quality Ore

- 5 Weakness: With Growth Of Ore Business, The Business Will Be All The More Exposed To Ore Prices And Overall Earnings Could Be Very Cyclical

- 6 Weakness: MIN’s Aggressive Bent Towards Profits Is Concerning As It Employs No Currency or Commodity Price Hedges

- 7 Ownership of Top Tier Lithium Assets With Downstream Processing A Multi-Bagger Opportunity

- 8 Opportunity – MIN Is Chasing Growth Aggressively With Plans To Add Substantial Integrated Hydroxide Processing Capacity Over The Next Few Years To Capture Value Chain Further And Boost Margins

- 9 Wodgina Ramping Up, Substantially Improving Profits While Setting The Foundation For Its Expansions Plans

- 10 Threat: Chinese Economy Is Crucial To The Fortunes Of MIN’s Lithium And Iron Ore Businesses

- 11 Financials – Iron Ore Prices Are On The Rebound, Though Lithium Is On The Back Foot

- 12 Mineral Resources (ASX:MIN) Valuation

- 13 Mineral Resources: All-In-One Exposure To A Mainline Commodity, Battery Metal, And Energy (Don’t Forget The Dividend)

About Mineral Resources (ASX:MIN)

Mineral Resources is an integrated mining service and producer company occupying a unique position in the mining and energy space.

It has four major divisions: CSI Mining Services, where the company is a contract service provider for mines owned by other companies; MINRES Lithium and MINRES Iron, where the company is an owner, producer, and processor of iron ore and lithium products through Joint Ventures and complete ownership; and MINRES Energy, the company’s natural gas division that owns a production site to provide stable and emission-free energy to its client and own production sites.

Mineral Resources is:

- The world’s largest crushing contractor

- A leading pit-to-port mining services provider

- A top five lithium producer – globally

- A top five iron producer – globally

- The largest landholder of gas acreage in Perth and Carnarvon basins

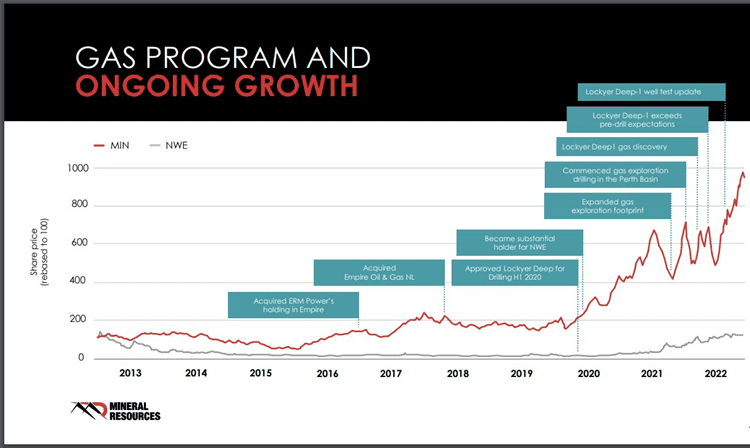

Last week, the company gained majority control of Norwest Energy (ASX:NEW), a Perth Basin gas explorer and diversified resources company.

As previous JV partners, Mineral Resources and Norwest had discovered Lockyer Deep 1, potentially one of Australia’s largest onshore gas discoveries.

At the current MIN share price, Mineral Resources shares have a market capitalization of A$16.02 billion.

Strength: Integrated Business Model With Nuts and Bolts Competence In Mining Operations

Mineral Resources’ strength is its integrated position in the mining industry.

The company provides turnkey mine operation services to mine owners, thus giving the company a relatively stable stream of revenue compared to pure commodity producers because the revenues of Mineral Resources are tied to production levels and not prices realized for the commodity produced.

The company is thus shielded from commodity price cyclicality to the extent that revenue does not directly move with prices in the short term; however, over longer time frames, depressed prices of commodities can lead to lower production and thus lower revenue.

Mining Services have been the bedrock business of the company with a 25% compounded annual growth rate over the past three years.

While Mineral Resources shares (ASX:MIN) reported a dip in revenues and EBITDA as a result of a decline in ore prices, mining services revenues grew 22%.

That cushioned the pain from ore to some extent while also ensuring cash flows to service crucial debt for expansion.

This resulted in a cheaper cost of debt financing compared to pure-play producers.

The company’s management, which grew the Mining Services business from $10,000 in starting capital to where it is today, recognizes its importance moving forward despite sexier new divisions such as lithium and a rapidly scaling iron ore division.

The company has doubled down on the Mining Services division not just in commitment to scale, but through innovation in technology by developing state-of-art autonomous road trains that reduce project completion time, thrash the economics of rail transportation, and reduce overhead costs (such as drivers) due to autonomy.

These road trains will also reduce emissions substantially by going fully electric.

All this is further supplemented by the company’s proprietary and modular ore processing facilities where it has complete expertise in operation and offers a quicker project setup.

Lastly, the company’s marine division (inside of Mining Services) boasts of one freighter in operation (five more freighters upcoming), a berth at Port Hedland hub (the highest tonnage port in Australia), and a complete port at nearby Onslow directly connected by road-train to its 30-50 Mtpa Onlsow Iron site (which also serves as an ore processing unit).

The port ownership will be a game-changer as it will further lower costs and increase margins compared to any port at which the company currently provides services. Completion of Onslow is expected in 18 months.

The clincher is that the company expects that this “ore-to-customer” logistics infrastructure combined with its track record, proprietary technology, and cheap energy from its gas deposits will help secure long-term (30-40 years) contracts with leading mines in the area.

Strength 2: Energy Assets Hold Massive Promise To Improve Core Business And Make The Company A Potential Energy Producer To Be Reckoned With

Power consumption is one of the biggest operational costs for a mining operation and also the largest source of its emissions.

Both of these became a huge problem for operating mines.

The onset of the Ukraine war caused global energy inflation at an unprecedented rate, increasing the operating cost of the mining industry.

At the same time, climate consciousness is at an all-time high with all major customers demonstrating a clear preference for green mining products, while miners are under pressure to meet Paris-aligned emissions targets.

Natural gas is a comparatively cleaner fossil fuel and this is an advantage for Mineal Resources shares (ASX:MIN).

The acquisition of Norwest is therefore opportune and meshes well with the other business pillars as well as advances the company’s plans for tackling carbon emissions.

Said Chris Ellison, Managing Director on the call relating to the acquisition of Norwest Energy:

- “We see gas as a natural transitional fuel.

- We think that certainly in the MinRes business, I want to eliminate diesel and coal-fired power wherever I can, and as quick as I can.”

- “We want to be able to use the gas that we develop for long-term downstream processing.” (Ellison was referring to urea, ammonia, powering lithium hydroxide plants, pelletized magnetite)

- “It’s the key to decarbonization.

- We’ve got a very broad target of reducing our carbon by 50% out to 2035.

- We can achieve that much quicker than that with the use of gas and the elimination of some of the other nasty fuels that we’ve been using.”

- “Lockyer Deep is possibly Australia’s largest onshore discovery, and we’re looking at trying to get that into production over the next two to three years.”

- “Domestic gas demand in WA is going to continue to grow, and they’re predicting it’s going to tighten towards the end of this decade.

- We think that the Perth Basin is part of that solution.”

Furthermore, subsequent to the end of the December quarter, MIN announced that it had acquired a 19.17% strategic shareholding in Warrego Energy Limited (ASX: WGO) as part of its Perth Basin business strategy.

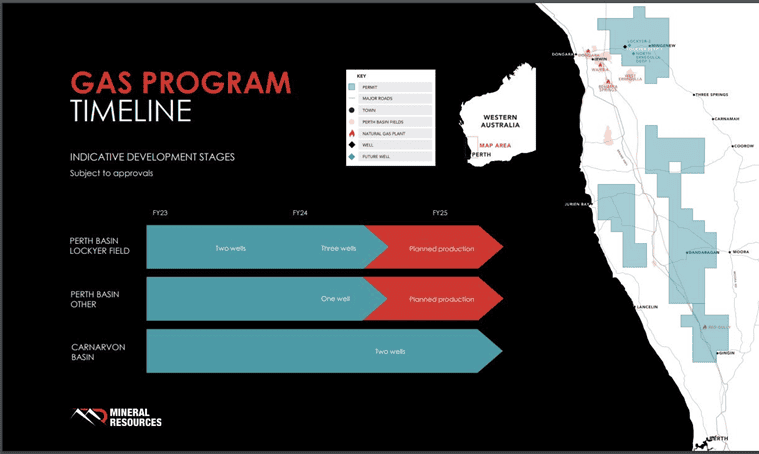

As a JV partner with Norwest, the company had already made sufficient progress on its upcoming natural gas production projects that it acquired in the Perth Basin and Carnavon.

This portfolio of assets (see graphic below) will allow the company to provide its services without the operating cost variability that comes from diesel, which is currently the most commonly used power source for mines.

Mineral Resources shares (ASX:MIN) will now have a large, ultra-low emission energy source under its ownership that can further strengthen its dominant position and boost margins, especially at mines that it both owns and operates.

The extent of the company’s natural gas assets is truly impressive.

MIN is the largest acreage holder in both the Perth and Carnavon basins, both being extremely well endowed with gas reserves.

The Carnavon basin is located adjacent to energy giant Chevron’s processing facilities.

The company will now also have the opportunity to be an energy supplier to customers other than the mining sector and its own businesses, given the scope of its gas assets.

That may be a prudent call given that Russia’s weaponizing of its energy assets has been a wake-up call to energy importers around the world.

These buyers would be looking to diversify supply chains, and Australia qualifies as a solid partner to fulfill that requirement, once it satisfies demand in Western Australia.

Strength 3: Iron Ore Business Is Very Solid With Plans For 5x Growth Over the Next Five Years With Better Infrastructure, Cheaper Energy, and Higher Quality Ore

The company has plans to expand its iron ore capacity by a further 50 Mt by FY24 and 90 Mt by FY 2026 with the development of its Ashburton plant in WA, 20 Mt at Pilbara, and the nameplate 35 Mtpa Onslow Iron Project.

Once these projects reach fruition, prices should be better following the end of China’s recent COVID woes, its real estate problems, and economic recovery.

Mineral Resources shares (ASX:MIN) has three distinct advantages in the segment.

First, its expertise in operating the business is second to none given its services segment, hence we can be reasonably sure that expansions will be completed in time and on budget.

Second, the company has ensured that even in its ore JV’s, which will account for a significant part of the production, it has been retained as the mine operator, hence ensuring steady cash flow to an extent.

Finally, the company is on track to improve its product mix to have higher quality ore make up the majority of production, as compared to the lower 58% ore that dominates production as of now.

At Yilgarn, one of its premier hubs, the company has a lot of magnetite (67% ore) that is untapped and will entirely transition from hematite (58%) to the former over the next 3-4 years.

Therefore, improving realized costs while operating costs remain the same.

During the December quarter, Yilgarn’s processing plant was successfully converted to process both lump and fines, with lump shipments commencing during the quarter.

Weakness: With Growth Of Ore Business, The Business Will Be All The More Exposed To Ore Prices And Overall Earnings Could Be Very Cyclical

FY22 period exemplified our concerns regarding the company’s overdependence on iron ore.

Even though ore shipments were at record levels and lithium proceeds and mining services were at their highest levels, the company underperformed last year solely due to depressed ore prices.

Factors such as inflation, the Russia-Ukraine war, persistent COVID woes, and a bleeding construction sector in China kept a lid on ore prices.

Overall, Mineral Resources shares (ASX:MIN) reported a negative impact of A$1.4 billion on EBITDA on account of lower ore prices.

While the integrated nature of its operations is a strength, the company is, however, heavily dependent on the cyclical iron ore market.

Because of the company’s reliance on iron ore for revenues both from contract services as well as own production, its fortunes are highly sensitive to volatility in iron ore prices.

However, the outlook is getting better given the recently bullish trend in iron ore prices.

As this is being written, iron ore prices are ruling at eight-month highs on expectations of a sharp revival in demand as China reopens.

Weakness: MIN’s Aggressive Bent Towards Profits Is Concerning As It Employs No Currency or Commodity Price Hedges

The company’s risk management procedures are a matter of concern. It does not employ any hedges on its currency/US$ exposure nor on its product.

While the company has off-take agreements in place in some cases, they are all tied to indices, hence MIN is always exposed to commodities prices.

The company’s rationale is that it is very bullish on the prospects of its commodities, particularly lithium, where a demand-supply imbalance is very probable given the uptake of EVs; hence they do not want to put a lid on profits.

It does not offer an explanation for not hedging its currency exposure.

Nevertheless, the effect of a commodity bear market on the Mineral Resources shares (ASX:MIN) could be worse than on its peers.

Ownership of Top Tier Lithium Assets With Downstream Processing A Multi-Bagger Opportunity

The biggest opportunity for Mineral Resources shares (ASX:MIN) is its lithium resource. Lithium is slated to be one of the hottest commodities in the world over the next decade due to a potentially massive increase in lithium-ion battery production.

Global demand for lithium batteries is expected to surge more than five-fold by 2030, public-private alliance Li-Bridge has said, as more people opt for electric vehicles and energy storage systems.

Demand for EVs has soared over the past few years, as climate-conscious consumers have snapped up cars with electric drive trains amidst soaring fuel prices.

Demand for lithium batteries in the United States is expected to grow more than six times and translate into $55 billion per year by the end of the decade, but still, the country is expected to depend on imports for supply, the report added.

Albemarle Corp, the world’s largest producer of lithium for the electric vehicle industry, posted a better-than-expected quarterly profit last week helped by a fivefold jump in sales of the battery metal – this despite the more-than 300% jump in the price Albemarle charges for its lithium.

Reportedly, it expects to raise its lithium prices this year by at least another 55%.

In order to ensure the security of supply, automakers such as Tesla and GM are acquiring or buying stakes in lithium miners.

For example, Tesla is reportedly considering a bid for battery metals miner Sigma Lithium.

GM acquired a $650-million stake in Lithium Americas to help develop Nevada’s Thacker Pass mine, which may support output of as many as one-million EVs a year.

Glencore CEO Gary Nagle said last week that recent government policies, such as the US’s Inflation Reduction Act and the European Union’s proposed Green Deal Industrial Plan, demonstrate the growing need for critical raw materials through to the end of the decade and beyond, necessitating fresh investment in both primary supply and recycling for the decarbonization of the world’s energy grid.

The uptake of EVs has also received a potentially huge boost due to the surge in traditional energy prices as a result of the Russia-Ukraine war.

Moving forward, developed nations that are big oil importers will probably be very aggressive in pushing EVs. Many major countries and some big US states such as California have announced a ban on new fuel-powered car sales in the 2030s.

Mineral Resources owns two quality lithium deposits, Mt. Marion and Wodgina, through joint ventures.

It is also on track to vertically integrate spodumene ore processing into its value chain at Kemerton.

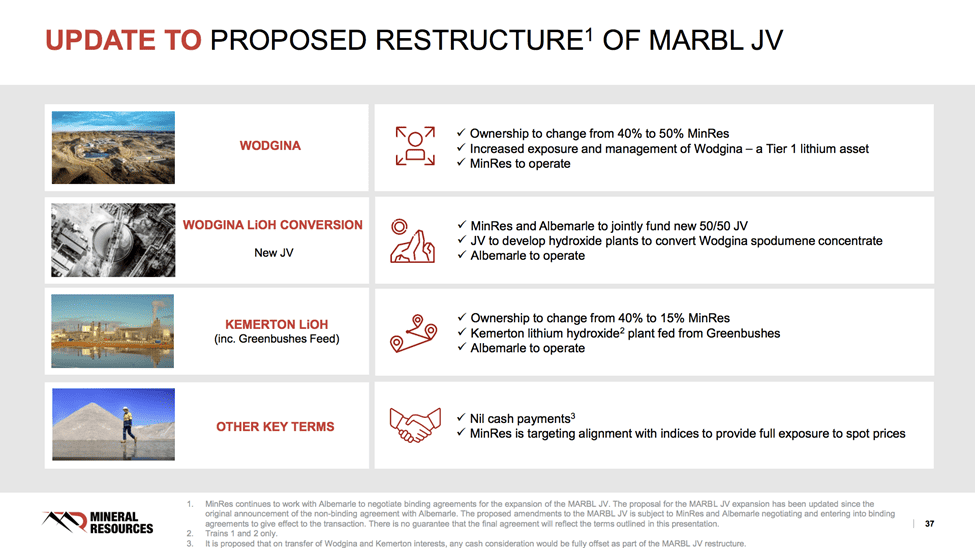

The company’s interest in the Wodgina lithium asset offers great potential as it is one of the biggest high-quality lithium deposits in the world. MIN has upped its holding in Wodgina from 40% to 50%.

Furthermore, compared to other lithium players gearing up for production, Mineral Resources shares (ASX:MIN) has quality assets, top partners, and most importantly, years of hands-on experience of operating mines, and executing mining projects at/below cost and on time.

Opportunity – MIN Is Chasing Growth Aggressively With Plans To Add Substantial Integrated Hydroxide Processing Capacity Over The Next Few Years To Capture Value Chain Further And Boost Margins

Lithium Hydroxide is a potential game-changer for Mineral Resources as it dramatically increases pricing power and enjoys far higher margins than the rather commoditized spodumene ore.

Lithium Hydroxide offers these benefits because it is one step lower in the battery supply chain and goes into batteries directly without any major processing/treatment required.

As part of restructuring its deal with Albermarle, MIN has entered a 50/50 JV in developing multiple hydroxide processing plants at Wodgina, other parts of Australia, and another two offshore.

The company will be acquiring one of the four hydroxide plants of the planned expansion.

Mineral Resources (ASX:MIN) is very keen on hydroxide processing at Wodgina as it would be logistically more efficient, and controlled by experts Albermarle, with MIN having control over marketing/selling rights, allowing the company to decide customers and pricing mechanisms.

The company’s Mt. Marion site, which is a JV with China’s Ganfeng, is currently operating at near nameplate capacity of 485 ktpa (FY’22 production of 442 ktpa), while mining and processing at Wodgina is ramping up.

The company has in place a tolling agreement (which allows the use of another company’s processing operations for its own product) with Jiangxi Ganfeng Lithium Co. Ltd.

This allows MIN to convert its entire share of Mt. Marion production to lithium hydroxide.

Though the tolling agreement with Ganfeng was valid only till November, it has since been extended by one

year to the end of CY23 on similar terms and conditions to the existing agreement.

This agreement may also be extended by the agreement of both parties for a further 12 months to the end of CY24.

The company is on track to increase Mt. Marion lithium production to 900 ktpa of mixed grade ore by April 23 with a budgeted A$120M capex on the expansion.

Like Yilgarn, mixed-grade spodumene out of Mt. Marion will gradually move to high grade 6% spodumene.

Wodgina Ramping Up, Substantially Improving Profits While Setting The Foundation For Its Expansions Plans

Minerals Resources (ASX:MIN) and its partner, Albemarle, decided to shut Wodgina a couple of years ago due to an unfavorable price environment.

However, with lithium prices again reaching all-time-high territory in 2022, the company has been making aggressive moves to restart its 250ktpa of capacity.

The company commenced train train 1 at Wodgina in May while train 2 started in July, and first shipments also commenced in July.

The company now has operating and marketing rights as part of the restructuring and project’s FY23 production of 190 ktpa – 210 ktpa.

The company’s Kemerton lithium hydroxide processing plant (15% stake with the rest belonging to Albemarle) started operating train 1 in July (qualification period of product to last 6 months) while train 2 is expected to start in Q2 FY’23 with a nameplate processing capacity of 50 ktpa, which should be comfortably reached by end of FY23.

While Kemerton is completed, MIN has reduced its stake from 40% to 15%.

Kemerton will now be a pure-play processing facility with feedstock from nearby seller mines and will be operated by Albemarle.

For FY23, the company has given spodumene production guidance of 968ktpa to 1.067M, putting it amongst some of Australia’s largest spodumene producers.

In FY22, the company generated an operating margin of 32% on lithium production and a further 29.7% on hydroxide production from tolling.

Under tolling, the company first books the sale on the spodumene at the prevailing rate, and then the revenues and profits post hydroxide processing are received upon the end product’s sale.

While this significantly added to profit, it also dramatically increased working capital requirements, which jumped 540% YoY, largely on account of hydroxide receivables.

This has serious scope for improvement given the addition of lithium hydroxide to the product mix, which has a far higher margin as mentioned above; further, the company will enjoy economies of scale from more than 2X spodumene ore production planned this year.

Threat: Chinese Economy Is Crucial To The Fortunes Of MIN’s Lithium And Iron Ore Businesses

However, the extent of the Chinese economy’s hold on the lithium market poses a risk to the company should relations sour or if local overcapacity in China hurts prices over the long run as has panned out in other sectors such as solar.

Mineral Resources shares (ASX:MIN) and both the iron ore/lithium industries are highly sensitive to the state of the Chinese economy due to that country’s disproportionate influence over commodities prices.

The risk is even more pronounced in the case of Mineral Resources as China is a crucial piece of the puzzle in both its crucial markets – in the case of ore, China is the largest consumer of steel in the world, while lithium finds application in China’s world-dominating battery production supply chain, alongside other inputs like copper and nickel.

The correction in iron ore prices in 2021 is proof of this risk as China’s blue skies policy, real estate bust, and the revival of COVID single-handedly dampened a burgeoning iron ore market.

However, the freeze in the China-Australia relationship is noticeably thawing, and the first ships carrying Australian coal are nearing Chinese shores.

This improvement in ties is likely to gather further momentum as China reopens and its economy needs resource supplies from Australia.

Moreover, things are also looking up with major economies like the US and India entering substantial trade deals with Australia for key commodities including lithium, copper, nickel, and rare earths.

Financials – Iron Ore Prices Are On The Rebound, Though Lithium Is On The Back Foot

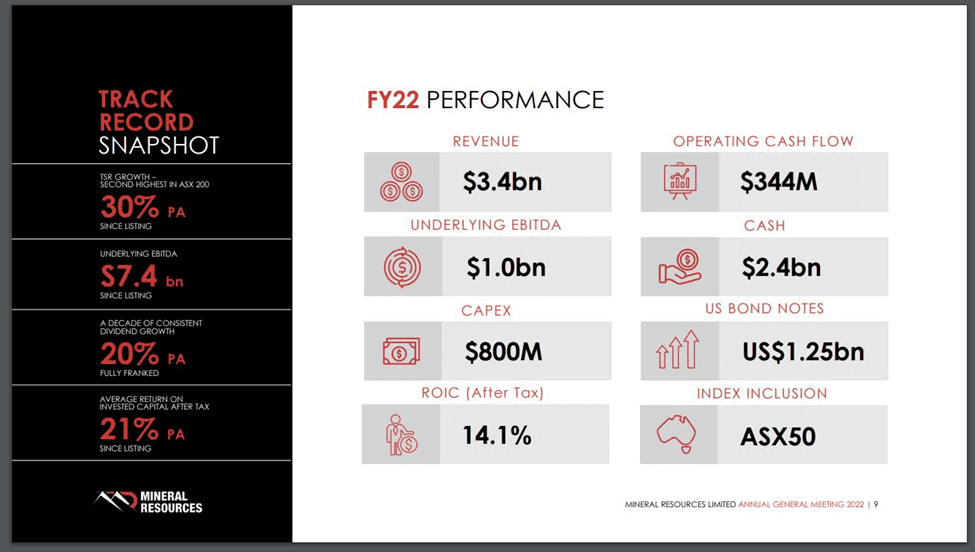

Source: 2022 AGM Presentation

FY22

In FY22, the company ended its streak of regularly improving on its financial performance.

The company reported revenue of A$3.418 billion (down 8% YoY).

Most of the company’s revenue came from its commodities production (A$2.787 billion, 81.5% of the total, which was down 12.6% YoY) followed by the mining services division (A$2.137 billion, 62.5% of the total, up 22% YoY).

The EBITDA for the period was A$1.24 billion, down 46% YoY.

The commodities division reported an EBITDA of A$649 million (down 57% YoY), due to depressed iron prices despite record iron production (up 11.6% YoY).

The iron ore division delivered just A$54 million in EBITDA, down a staggering 95.9% YoY.

The star performer was the lithium division which clocked EBITDA of A$585 million (up from a loss of A$11 million in FY21).

Mining services clocked EBITDA of A$533 million (up 25% YoY).

Lithium contributed A$791 million to revenue (up 508% YoY), while iron ore contributed A$1.996 billion (down 34.8% YoY).

In FY22, the company spent A$431 million on growth CAPEX and A$322 million on sustenance.

The company has planned extensive CAPEX of A$2.06 million for FY23, comprising A$1.537 billion for growth and A$315 million for sustenance.

Mineral Resources shares (ASX:MIN) generated an underwhelming negative A$456 million in operating cash flow (down 150% YoY) and a net profit of A$400 million (down 63.8% YoY) for FY22.

Quarterly report (October – Dec 22)

Mining services production volume was steady at 70Mt, as expected.

Iron ore shipments were down 9% QoQ at 4.1M wmt, but in line with FY23 guidance of 17.2-18.8M wmt.

Average realized iron ore price was US$97 per dry metric tonne (dmt), 33% higher qoq and representing a 98% realization to the Platts 62% IODEX.

It may be noted that on February 21, iron ore prices surged to their highest in eight months and upwards of $131 per tonne based on renewed optimism around China’s reopening.

A total of 97k dmt (attributable) of spodumene concentrate was shipped during the quarter, 18% higher QoQ.

A total of 7,418 tonnes (attributable) of lithium hydroxide and lithium carbonate was converted with 6,612 tonnes (attributable) sold during the quarter, up 75% QoQ.

The average realised lithium hydroxide and lithium carbonate revenue was US$65,996/t (exclusive of China VAT).

Lithium carbonate prices peaked in November 2022 at around US$68,114/t, and are currently off nearly 30% from those highs.

Though there is some industry soul-searching around this decline, Chinese demand for EVs is likely to regain momentum as China reopens.

It is possible that the current decline is a correction to be followed by renewed upward pressure on lithium prices.

A report by Goldman Sachs in October estimated that Mineral Resources shares (ASX:MIN) EBITDA could double to over A$2.4 billion in FY23, and at that MIN share price, dividend yield could be as much as 3%.

A more recent analysis from Morgans places dividend yields at 4.55% for FY23 and 7% for FY24 based on China’s reopening, and the resulting tailwinds for Mineral Resources’ lithium and iron ore businesses.

The company is scheduled to report on its FY23 half-yearly results on Friday, February 24.

Mineral Resources (ASX:MIN) Valuation

Due to Mineral Resources’ integrated nature, a like-for-like comparison is not available.

Hence, we compare MRL to NRW Holdings (ASX: NWH), one of Australia’s largest mining contractors, and BHP (ASX: BHP), one of the world’s biggest iron ore producers with an intense focus on furthering its position in clean energy metals such as nickel.

Lastly, we compare Mineral Resources to Pilbara Minerals (ASX: PLS), one of Australia’s largest spodumene producers with FY22 production of 377k tonnes and capacity of about 588k tonnes.

Pilbara has been a big winner in the recent rally in lithium stocks.

| Metric | Basis | Mineral Resources | BHP | Pilbera Minerals | NRW Holdings |

|---|---|---|---|---|---|

| P/E Ratio | TTM | 46.24 | 9.27 | 23.69 | 13.88 |

| Asset Turnover | TTM | 0.51 | 0.63 | 0.81 | 1.98 |

| Dividend Yield | ANN | 5.79% | 12.41% | – | 6.37% |

| P/Book | MRQ | 5.00 | 3.97 | 10.3 | 2.03 |

| Operating Margin | TTM | 18.5% | 46.8% | 64.52% | – |

| ROE | 5YA | 28.63% | 22.46% | -4.39% | 14.72% |

MIN Vs Mining Peers

As can be seen, at the current MIN share price, Mineral Resources shares are valued higher than its mining peers (BHP and Pilbara) in terms of P/E and in the middle in terms of P/B.

The company also has the lowest asset turnover, which is unfortunate as it is a very important efficiency ratio in the capital-intensive mining space, among its mining peers.

Operating margins have also underperformed MIN’s mining peers.

However, at the current MIN share price, Mineral Resources shares still boasts the highest medium-term average ROE.

MIN Vs. NRW (Mining services)

It is currently substantially more expensive than mining contractor NRW in terms of all metrics other than ROE and margins, but that can be justified as it has a far more sophisticated and larger mining services offering compared to NRW, as well as being a top-five miner.

Mineral Resources: All-In-One Exposure To A Mainline Commodity, Battery Metal, And Energy (Don’t Forget The Dividend)

As can be seen, Mineral Resources shares (ASX:MIN) appears to be very expensive compared to mining peers such as BHP or Pilbara.

However, these numbers do not do justice to the company’s scale of operations and market presence in each of its four business verticals.

In Energy, the company has taken control of Norwest Energy in an all-stock deal, and therefore control of a massive gas asset in Lockyer Deep 1.

This is a crucial piece in the company’s master plan for gas resources in the Perth Basin, giving it wide-ranging optionality – from in-house consumption to outside sales.

Further, iron ore is slowly coming out of its slump over the past couple of months, and given the company’s operational leverage to the price of iron ore, big improvements in earnings are on the table should the trend continue or even if prices stabilize at levels higher than what we saw in the first six months of this year.

Its mining services business is steady as a rock and on track to rapidly scale its infrastructure, ports, and marine assets.

The company, therefore, has many irons in the fire including a massive 5x expansion of its ore business and scaling up of its production of spodumene in FY23.

Despite the current slump in lithium prices, the long-term potential and supply deficit are writ large.

Not for nothing are automotive manufacturers taking unprecedented steps such as acquiring lithium mines or investing in stakes in them.

Lastly, at the current MIN share price, investors may also consider Mineral Resources shares (ASX:MIN) for a potentially attractive dividend yield.