Today, we’ll look at why we like Ansell shares (ASX ANN).

Ansell specialises in manufacturing and distributing personal protective equipment (PPE).

we first recommended Ansell back in April during the COVID crash and we take a deeper dive into the stock today.

If the world is to learn from its COVID mistakes, PPE will become a product that will be in high demand for the foreseeable future.

In addition, a company such as Ansell is a strong pandemic hedge as it is virtually guaranteed COVID will not be the last one that we have.

Having stocks in your portfolio which can be uncorrelated during times of turmoil is a good way to increase return whilst reducing volatility.

Table of Contents

About Ansell (ASX ANN)

Ansell Limited (ANN ASX) develops, manufactures, sources and sells gloves and protective personal equipment in the industrial and medical end markets.

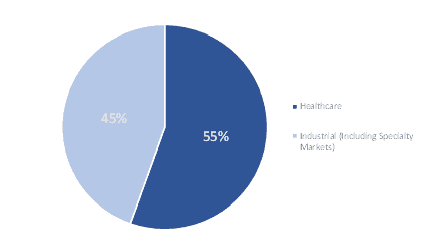

Ansell operates in two main business segments, Industrial and Healthcare.

Industrial Global Business Unit (45%): The Industrial GBU manufactures and markets hand and body protection solutions for a range of industrial applications.

Ansell protects workers in almost every industry, including automotive, chemical, metal fabrication, machinery and equipment, food, construction, mining, oil & gas and first responders.

Healthcare Global Business Unit (55%): The Healthcare GBU manufactures and markets innovative solutions for a range of customers, including hospitals, surgical centres, dental offices, veterinary clinics etc.

The portfolio includes surgical gloves, single-use and examination gloves, clean and sterile gloves and garments, and consumables used by healthcare, life sciences and industrial workers.

We first recommended Ansell as a share to buy in the COVID crash in early April based on our early forecast on the surging demand of Personal Protective Equipment (PPE).

The ANN stock price has risen 37.97% since our first publication on 1st of April, with an annual return of 46.60% against ASX200’s annual return of -6.64% (see below).

ANN – 1Y – Share Price History

Source: S&P Capital IQ

ANN – FY21E – Revenue Composition

Source: MF & Co Asset Management Research, S&P Capital IQ

Industry Analysis and COVID-19 Impact

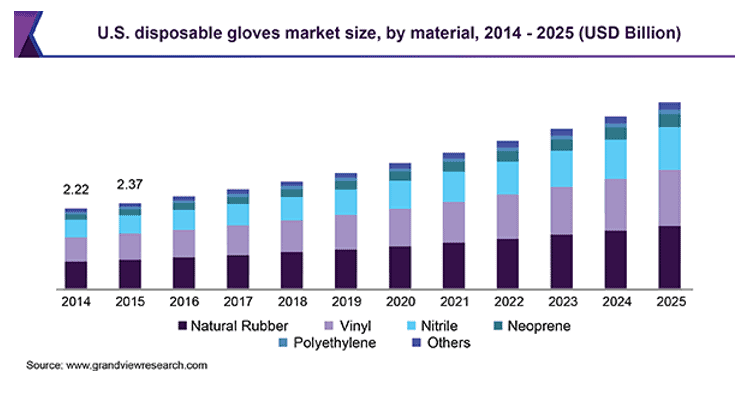

PPE market saw increasing demand before COVID-19 due to growing health awareness and technological advancement.

The global disposable gloves market is estimated to grow at 11.2% FY20-27 and the global PPE market is expected to grow at 7.7% CAGR during the next decade.

Rising demand for disposable gloves in the medical and healthcare, pharmaceutical, automotive, chemical, and oil and gas industries has been a major driving force in recent years for the industry.

Specifically, growing awareness of the health and safety of workers, coupled with rising concern about skin diseases in the industrial sector, is expected to support the demand.

Additionally, technological progress is expected to have a positive impact on production, backed by the development of tailored designs to meet different market demands.

In summary, the PPE market was seeing high growth well before the COVID-19 outbreak.

Moreover, the outbreak of COVID-19 has positively impacted the PPE market as the demand for masks, respirators, protective clothing, and gloves have increased significantly.

Disposable PPEs act as a shield providing protection to the healthcare workers against contagious infections, and occupational safety regulations in both developed and developing countries play a major role in driving the PPE market.

As a result, the demand for PPE is expected to witness sustained high growth in the short term.

Specifically, the short-term growth of the PPE market is expected to be dominated by the spread and containment of COVID-19.

Emerging markets like India saw acute shortage in PPE equipment in June, corresponding to the spike in its daily new confirmed cases, as illustrated below.

Although China was the origin of the COVID-19 outbreak, estimated daily new confirmed case count has decreased dramatically and China now sees an average of 10 cases per day, constituting less than 0.005% of daily new cases globally.

ANN – COVID-19 Global Confirmed Cases Using Linear Model of Seroprevalence

ANN – FY20 – Revenue by Geographic Locations

Source: ANN FY20 Annual Report

Strategic Position

Ansell is a market leader in PPE

Ansell is a market leader in the manufacturing of several safety products for the healthcare industry.

Some of these products include the examination and surgical gloves and heavy-duty protective gloves for chemical handling.

Their competitive position is further strengthened by the fact that most products are patented, certified and comply with stringent standards.

Ansell is optimising its portfolio

Ansell has made over $ USD 1.1bn in acquisitions in the last 10 years including expansion into new areas, for example, Chemical Protective Clothing, Life Science and Industrial Exam.

This has given a broad diversification and expansion advantage to Ansell.

Ansell outperformed despite Covid-19

The FY20 results were higher than expected, with a dividend of 50 cents per share, up 7%, making it the 17th year of increasing its dividend.

Both Ansell’s core businesses the Healthcare and Industrial segment were key drivers of demand for greater cleanliness and protection adding to the sales growth.

Together they contributed to 117% cash flow conversion to ensure the business remains well-capitalized.

Ansell is using the pandemic to solidify its position by spending $65 million to expand the number of production facilities and prepare for a higher raw material cost in 2021 and beyond.

Financial Analysis

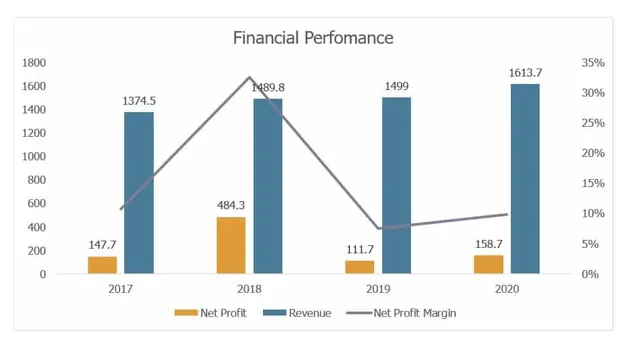

Outstanding Sales Momentum with Margin Growth

Ansell operates across 2 key segments- the healthcare global business unit (HGBU) and the Industrial Global business unit (IGBU).

Healthcare, which comprises surgical and examination gloves and healthcare safety equipment, recorded sales of USD 894.6 million, up by 13.8% on the previous year, contributing 23% growth in EBIT.

Margins were higher due to lower raw material costs and higher volumes due to the pandemic.

The industrial GBU comprises multi-use hand and body production solutions for industrial work environment and speciality uses.

Sales were up 4.2%. The company reported a 42.1% jump in statutory net profit for fiscal 2020 to $US158.7 million.

Total revenue for the period rose 7.7 per cent to $US1.61 billion ($A2.25 billion), ahead of $US1.56 billion market consensus.

Net profit increased significantly to USD 158.7 million, while net profit margin was slightly up, rising to 10%.

ANN – FY20 – Financial Performance

Source: FY20 Ansell Annual Report

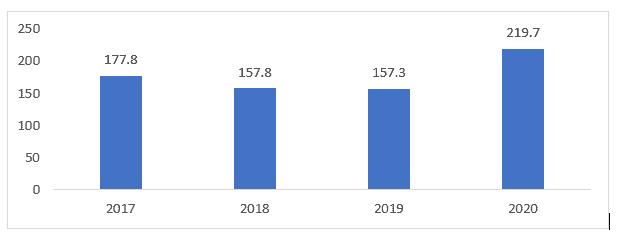

Ansell reported an EBIT of $219.7m, up 39.7% on a statutory basis.

This was driven by sales growth, transformation benefits and net favourable raw material costs.

ANN – FY17-20 – EBIT

Source: FY20 Ansell Annual Report

With the current share price and FY20 earnings, Ansell has a P/E ratio of about 21.5x, which is on par with industry average of 22.0x for Medical Equipment industry average.

Ansell’s balance sheet also looks very strong with the liquidity of US $600 million nearly in the form of cash.

Additionally, Ansell’s net debt to EBITDA is 0.44x, which means the company is in a good position in terms of liquidity and solvency.

Peer Analysis

Ansell is a world leader in providing superior health and safety protection solutions.

However, the global personal protective equipment market is fragmented with the presence of a large number of regional players.

The major competitors in the global personal protective equipment market include:

- 3M Company

- Honeywell

- Alpha Pro Tech Limited

- Ansell Ltd.

- Avon Rubber PLC

- JAL Group Italia SRL

- COFRA SRL

- Uvex Safety Group

- Rock Fall Limited

Moderate valuation in TEV to profitability, and Price to earnings ratios.

As seen above, Ansell’s trading multiples are all below the group’s median.

Conclusion

With the geopolitical conflict between the U.S. and China, negative real economic growth and historic low-interest rate, the stock market has seen diversion from the underlying economy in recent months, especially in the US tech sector.

We believe that value matters more than ever nowadays and Ansell Limited is one of the few large-cap companies on ASX that is relatively cheap, and that has solid fundamentals and a growth story to tell.

Many investors are underweighting industrial due to recent underperformance in this sector.

Ansell may be a good addition to the portfolio for diversification and it is expected to see a genuinely sustainable increase in demand in the PPE market for both shorts and long-term.

Ansell has rallied from a dip in September and is trading close to its all-time highs, it may be prudent to wait for another pullback before considering taking a position.