Today, we will look at why we like McPherson’s.

McPherson’s is a leading beauty and wellness retailer which has recently refocused its strategy on its core brands.

Along with that, the company has managed to stem revenue decline and at the same time, grew profits two years in a row.

We first became interested in this stock and recommended it to our clients around July, when the stock was $1.70.

Since then, the company reported very positive FY19 numbers and the stock has rallied to over $2.20.

We think McPherson’s continues to have potential in the long term and this is why we like MCP.

Table of Contents

About McPherson’s Limited (ASX MCP)

Founded in 1860, McPherson’s Limited (ASX MCP)is a leading supplier of health, wellness, beauty, household, and personal care products in Australasia, with operations in Australia, New Zealand, and Asia. The company also manages some significant brands for overseas agency partners such as Dr. Wolff and Karen Murrell.

The major revenues of the company are from its diversified portfolio of owned market-leading brands, including Manicare, Lady Jayne, Dr. LeWinn’s, A’kin, Glam by Manicare, Swisspers, Moosehead, Maseur&Multix.

McPherson’s mission is to provide superior and comprehensive products that customers need in their everyday lives. Also, the company strives to provide consumers with products that offer exceptional value in terms of both price and quality.

Strategy Overview

McPherson’s plans to grow in health, wellness, and beauty via a revamped three-pronged execution strategy by investing and delivering growth in its six core-owned brands, establishing strategic customer and supplier partnerships, and driving growth across geographies.

With the tailwind from the strong sales growth of the group’s major skincare brand, Dr. LeWinn’s and A’kin (+42% combined), the company arrested the decline in its revenue.

FY19 sales were level with FY18 ($210 million and $211 million respectively). The company delivered a 17% growth in underlying profit before tax.

Industry Analysis

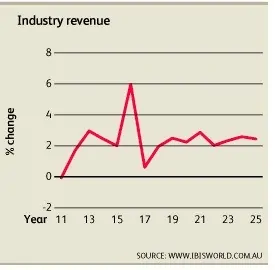

The cosmetics and wholesale toiletry industry in Australia are projected to grow at an annualized rate of 2.4% over the next five years, to $8.6 billion.

Source: IbisWorld

An aging population, the development of new multi-functional products, and increasing awareness of health and wellbeing are all likely to stimulate growth in the industry over the next five years.

Despite being in the mature phase of its life cycle, the Australian beauty and wellness industry is continuing to evolve in step with global trends.

However, competition from international online retailers that offer similar products at large discounts has limited profit margins of luxury cosmetics wholesalers.

The competition is increasing pressure on the supply chain of the domestic industry and could further constrict its profit margins in the future.

Increasing demand for Dr. LeWinn’s China

During FY19, the company achieved 125% year on year growth in sales of its Dr.LeWinn’s brand.

This growth was driven by strong domestic demand and a significant increase in export sales, particularly in China through ABM, the company’s strategic and exclusive partner for that country.

The Dr.LeWinn’s line has gained a reputation in China for superior quality and affordable pricing.

Reviews have been favourable for the Line Smoothing Complex Triple Action Day Defence, an innovative anti-aging day treatment containing powerful anti-oxidants that defends against all known free radicals responsible for premature aging.

Dr. LeWinn’s brand has grown from $1 million in FY17 to $3 million in FY18 and $16 million in FY19 enabled by manufacturing step change investment and partnership with Aware Group.

The strong growth shows that the strategy of growing its China-facing business has paid off in spades for the company.

Successful business strategy

McPherson’s recent business strategy refocuses the business purely on health, wellness, and beauty, and revitalizing its owned brands in these markets.

The company accordingly restructured its core portfolio to fit the target market and improved market presence with above-the-line marketing.

The new strategy led to a 13% growth in sales revenue from the core six brands in FY19, compared to 6% in FY18.

Market competition risk

The beauty industry has changed under the influence of digital trends and social media platforms. When exposed to more information about new products, potential customers become aware of their choices.

On the flip side, this growing trend makes it easier for customers to shop online.

International online retailers that offer similar products at large discounts have increased competition in the industry.

Financial Performance and Peer Comparison

McPherson’s performance

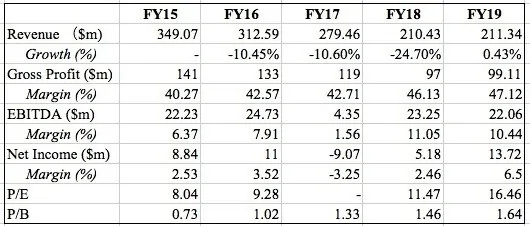

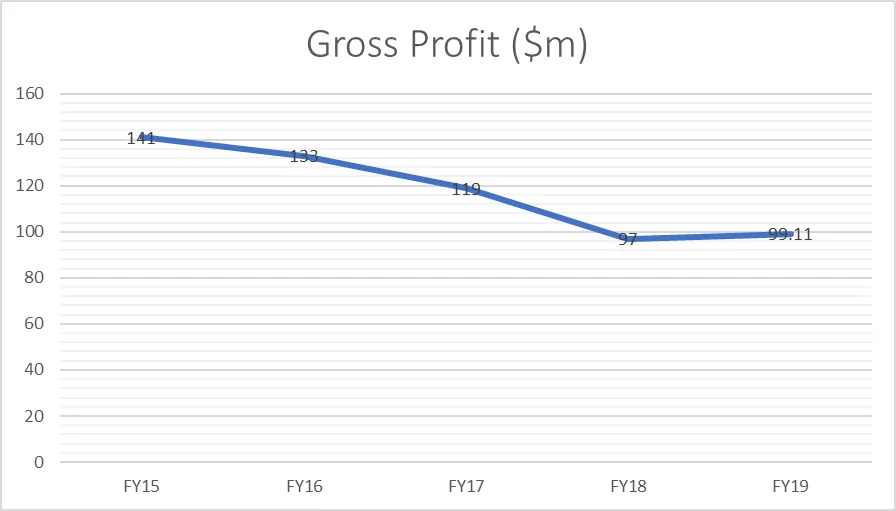

The company is facing declining revenues. Sales revenue in 2019 was $211.34 million, down from $349.01 million in 2015, a decline of an average 11.33% per annum.

However, revenue remained flat between FY2018 and FY2019 primarily due to a pick-up in revenues from the company’s owned brands.

EBITDA and net income have been erratic during the period, falling sharply in 2017.

However, the company is experiencing a strong uptrend in its net profits primarily due to its new strategy.

With the refocus of the company on its core products, revenue should start to tick up and net profits should continue to rise.

Comparison with peers

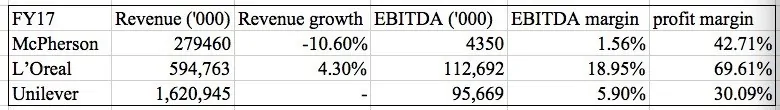

The other major players in this industry are L’Oreal Australian Pty Ltd and Unilever Australia Pty Ltd, both having market shares in the range of 6-8%.

In comparison, McPherson’s has an estimated market share of just 2-3%.

During FY17, L’Oreal had higher revenue growth of 4.3% compared to a revenue decline of 10.60% for McPherson’s, and a higher EBITDA margin of 18.95% versus 1.56%.

During the same period, compared to Unilever’s gross profit margin of 30.09%, McPherson’s had a higher gross profit margin of 42.71%.

Even though McPherson’s numbers in the past are somewhat inferior to those of its competitors, the strong profit margins would help to improve the company’s overall profitability once revenues grow as per the new strategy.

Strong upside potential with strategy refocus

McPherson’s business strategy of refocusing on its core owned brands has gained traction, as shown by the positive results in FY19.

Dr. LeWinn’s, one of the company’s core brands, has shown growth in revenue and market acceptance.

The company has arrested the decline in revenues and is now seeing a strong uptick in profits. This should further grow with its new strategy focusing on its six core-owned brands.

The economic environment indicates that the industry will continue to grow, given demographic factors and digital trends.

Although digital and social media would increase the competition from online in the industry, it would also lead to enhanced opportunities in the global market.

The MCP share price looks to have strong upside potential as the company continues to grow profits with its strategy refocus.