Today, we will take a look like why we like Codan (ASX CDA).

Codan is a producer of harsh environment technology solutions for groups such as mining companies and governments.

Even though the COVID-19 issue drags on, Codan did not disappoint in its earnings.

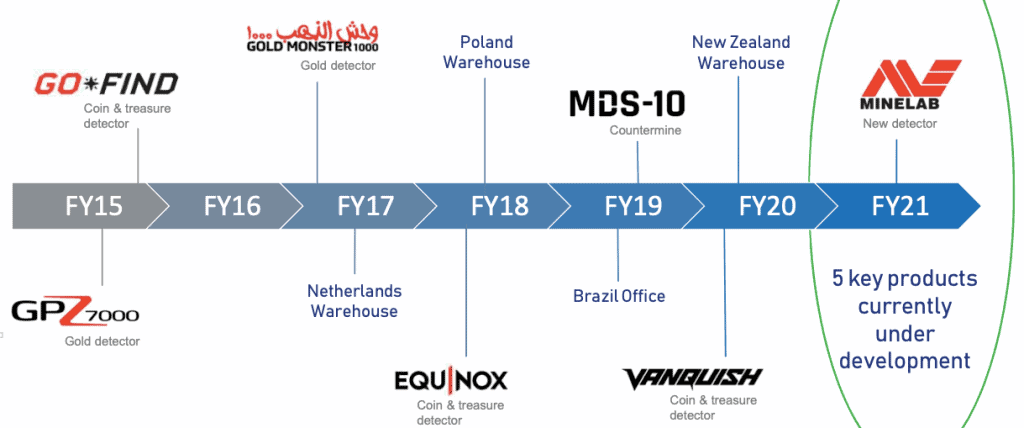

Codan spends considerable resources in research and development, with 5 key products under development in FY21.

As CDA “sells the shovels” rather than digs for the gold, the company is considered to be well fairly insulated from the whims of commodity prices.

Table of Contents

About Codan (ASX CDA)

Codan was founded in 1959 and headquartered in South Australia. It develops technology solutions for metal detection, communications, and tracking in harsh environments.

Codan offices are in Canada, the USA, Ireland, the UAE, and South Africa, with its customers spanning in more than 150 countries.

Its customers include the world’s largest aid and humanitarian organisations, security and military groups, mining companies, and governments.

Codan has presented superior growth momentum in revenue and share price.

The company’s sales revenue increased by 28.5% from AUD$270.8M to AUD$348M FY19-20. On the 23/03, due to the COVID-19 selloff, Codan saw a low of $3.97.

Since then, the share price increased more than 170% to around $11 as of 27 August 2020.

The company’s capitalisation is AUD$1.96B, and its forward dividend yield is 2%.

Codan – Share Price History

Source: S&P Capital IQ

Strategic Position

The core strategy of Codan is to grow the base business in a diversified portfolio of technologies and customer base.

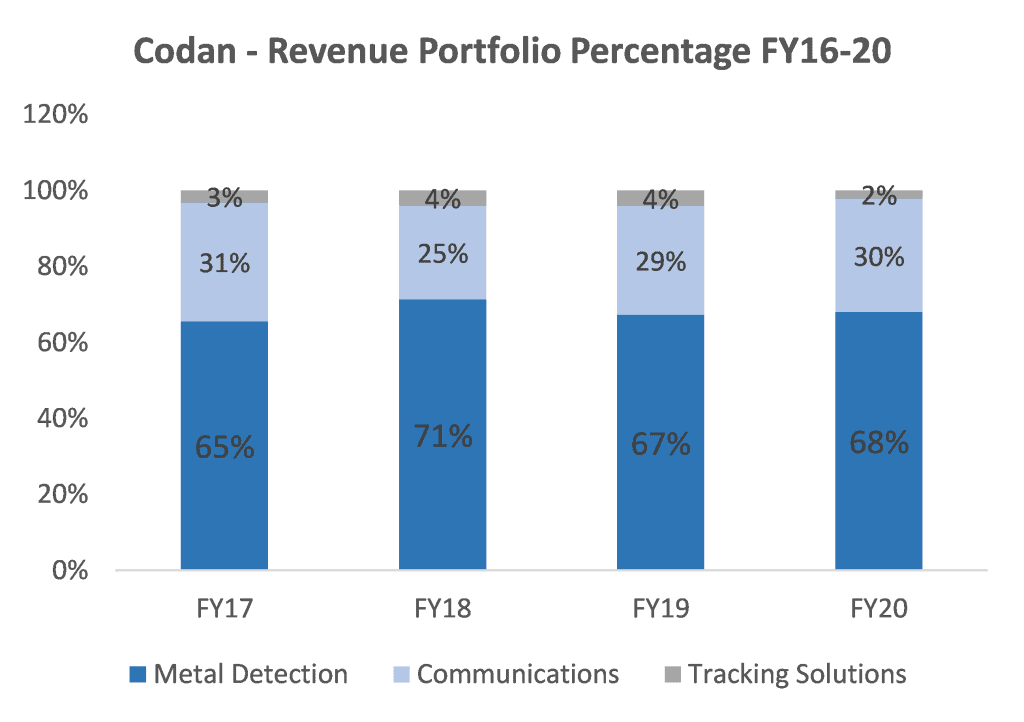

As illustrated below, most of the revenue comes from metal detection (around 68%), followed by communications (30%) and tracking solutions (2%).

The Metal detection segment grew by 29.8% in FY19-20 (24% YoY), from AUD$99.2M to AUD$236.4M.

The Communication segment grew by 33.9% (12.5% YoY) from AUD104M to AUD107.2M.

Codan – Revenue Composition FY16-20

Source: S&P IQ Capital

Codan – Revenue Growth FY16-20

Source: S&P IQ Capital

Source: S&P IQ Capital & MF & Co Asset Management Estimates

Codan’s metal detection achieved high success with a well-executed plan of product development and customer base expansion

Codan is the world leader in providing metal detection technologies for consumers, gold prospecting, and countermine services.

The Metal detection segment, aka the ‘Minelab’, has introduced more innovative and practical technology than any of its competitors over the last thirty years.

Minelab’s product range from coin and treasure, gold detectors for recreation, handheld gold detectors for small-scale artisanal miners to landmine detectors for post-war countries.

As illustrated below, Codan continues to release new and improved technology and products into these markets by investing in product development for recreational markets and expanding its customer base in international markets.

In 2020 the company has successfully established its position as the dominant player in the African gold detecting market

Codan – Metal Detection Product Development Events FY15-21

Source: H1FY20 Investor report

Codan’s Communications is a leading international designer and manufacturer of premium communications solutions for Tactical and Land Mobile Radio (LMR) applications.

Its products in security and public safety markets are delivered in both military and commercial settings.

The strategy is to transition itself to a larger-project systems business and build a compelling services portfolio to sustain long-term growth.

It aims to achieve by its new Cascade™ software-defined networked communications solution.

This network provides an interoperable first-responder with excellent performance.

The Cascade™ solution is scheduled for full release in FY21, and it is expected to deliver higher long-term growth for the company.

Industry Analysis

Mediocre industry growth but high growth headroom

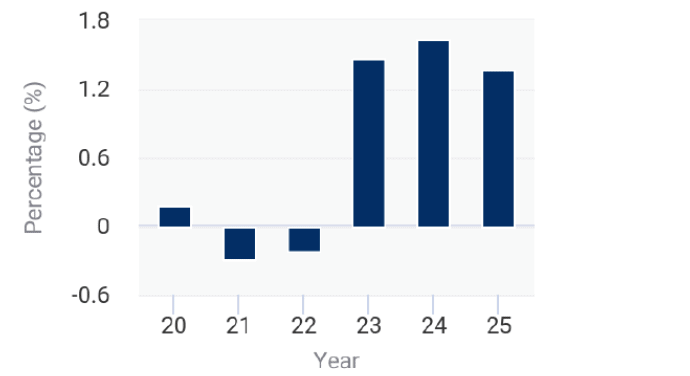

Minelab generates 68% of total revenue, at AUD$236.4M in FY20, and it falls into the Audio Visual Electronic Equipment Manufacturing industry (AEVVM) category.

As illustrated, the industry is projected to grow at an average of 0.8% over the next five years, to AUD$2.9 billion, and it faces near-term negative growth in FY21-22.

However, given the low penetration rate (8.2%), there is still lots of headroom for growth.

Codan – AEVVM Industry Revenue Growth Rate Outlook FY20-25

Source: IBIS World

High barriers to entry benefit a dominant player like Codan

The number of incumbent companies has declined over the past five years (IBIS World) as this industry requires significant capital investments to produce more sophisticated products.

Such high barriers consolidate the industry and small players are either merged or forced out.

High import penetration rate impedes profitability

Around 75% of Codan’s revenue is generated in Australia and the value of imports in this industry is expected to rise at an annualised 6.7% over the five years.

Codan will still see uncertainty from the intensified domestic competition in the short term before it is fully transitioned to a more internationally diversified customer base.

Codan – Gold(^GC) (Comex)/$USD per oz

Source: S&P IQ Capital

A higher gold price is expected to boost Codan’s sales

Codan generates around 25% of revenue from gold detectors and the gold spot price has increased by 41% from USD$1300 to around USD$1900 from January.

This was mostly due to the uncertainty in the economic outlook, the resultant market volatility, higher government debts and lower interest rate.

The topic of the bullish gold price was covered extensively in our previous articles and this has translated into strong growth for Codan’s bottom lines in FY20.

CDA’s revenue from metal detecting business increased by 30% to $236.4million. In the medium-to-long term, the gold price is expected to offer good support for the CDA share price.

Financial Analysis

Codan has strong EBITDA margin and Revenue growth rate

Codan’s average EBITDA margin over the last five years is 25.8%, 21% more than the industry average.

Codan’s average revenue growth rate FY16-20 is 19.8%, compared with 4.7% of the industry.

Codan – Profitability Measures FY16 – FY22E

Source: S&P IQ Capital & MF & Co Asset Management Estimates

Codan – Profitability Margin Analysis FY16 – FY20

Peer Analysis

Codan outperformed in profitability and asset returns.

Codan has the highest LTM return on asset, LTM gross margin, and LTM EBITDA margin.

Its net income margin is ranked 2nd, after KVH industries.

Codan – Peer Analysis – Return & Profitability FY20

Source: S&P IQ Capital

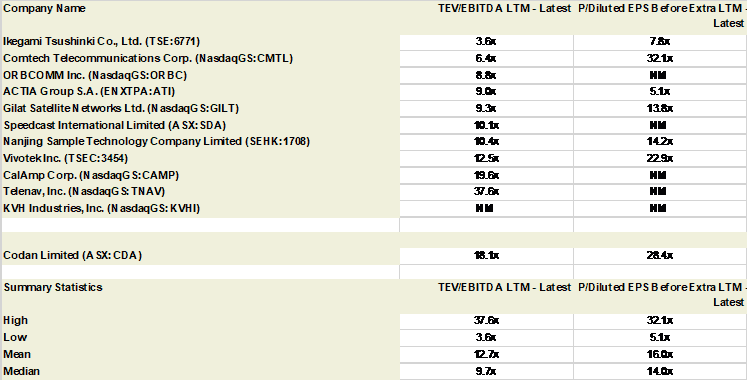

Codan is more expensive than the industry average

Codan has TEV/EBITDA LTM (total enterprise value/EBITDA last twelve months) of 18.1, higher than the median of 12.7.

It also has a P/Diluted EPS Before extraordinary items Last twelve months ratio of 28.4x, higher than the mean of 16x.

It is not surprising though, given its much higher revenue growth and profit margin than the industry.

Codan – Peer Analysis – Trading Multiples FY20

Source: S&P IQ Capital

Codan is trading at almost two times the median multiple of the industry.

Even though Codan is a great company, the stock is fairly expensive to buy at this point in time.

Conclusion

Codan is a global leader in providing communication and metal detector devices.

Its share price has grown more than 134% in the last twelve months, mostly due to its well-executed product development plan and the support of gold price.

However, the majority of Codan’s revenue comes from metal detection and this industry is projected to grow slowly, with a high import penetration, posing a threat to Codan’s growth.

On the other hand, the industry has a high barrier to entry, benefiting incumbent players like Codan.

Financially, Codan has high revenue growth and leading profitability margins among its peers, justifying its higher-than-average trading multiples.

Gold price will likely remain elevated given various factors. This will provide a strong tailwind for CDA.

Such a high gold price would allow artisanal gold mine that used to be unprofitable to operate, bringing in extra profit for Codan.

Even though the PE ratio that CDA is currently trading at is quite high, it is not prohibitively high compared to the growth they are experiencing.

However, it would be prudent to wait for a correction in the stock before taking a position for a less aggressive position.