Latest Stock Research & Market Analysis

Stock Research

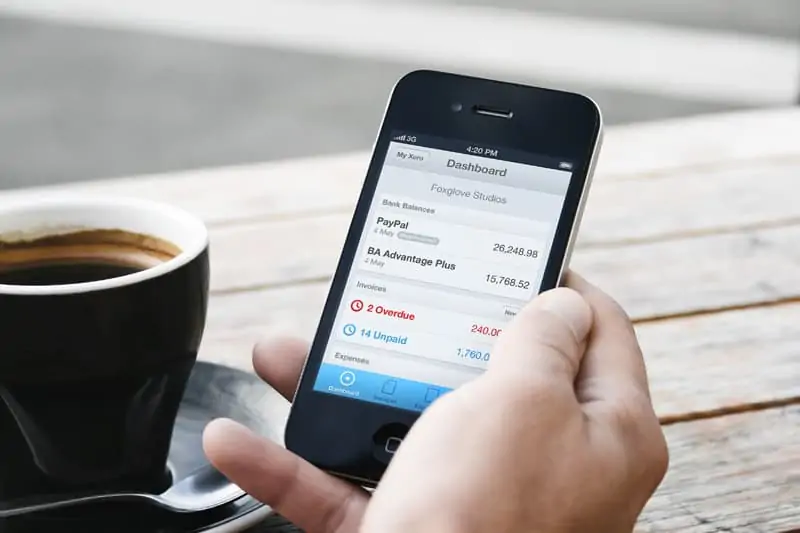

Xero Ltd (ASX:XRO): Strong Growth from a Non-Discretionary Product

Today we'll look at why we think Xero Shares (ASX:XRO) have such great upside potential in our XRO share price forecast and analysis. The last time we looked at Xero was back on March 22, 2023 - almost exactly a year ago when the share price was trading at $89.77....

Alumina (ASX:AWC) – Quality At An Oversold Price

Today, we'll look at why we think Alumina Limited stock (ASX:AWC) has good potential upside in our AWC share price forecast and analysis. Alumina Limited (ASX:AWC) is an Australian company that owns the largest pure-play alumina manufacturer in the world. The company...

Pro Medicus (ASX:PME): A Secular SaaS Growth Story

Today we will look at why we think Pro Medicus shares (ASX:PME) have good upside potential in our PME share price forecast and analysis. Pro Medicus is a health tech software company that provides imaging tools/services to an array of clients such as...

Subscribe

Want more Free Research?

Subscribe today for free and get an alert when we have new research and webinars.

Top Stock Reports

5 Best ASX Tech Stocks To Buy [Australian tech ASX]

Today, we'll look at what we think are the best ASX tech stocks to buy. Some of these ASX technology stocks tend to be in there infancy and there is a lot of upside built into the share price. The technology space is where the growth is - this is because there can be...

5 Best Australian Shares To Buy [Best Growth Stocks ASX]

Today, we'll look at the best Australian shares to buy on the ASX that we think are the best growth stocks. Some of these best growth stocks have already made strong gains and have a lot more upside potential to go. With inflation evening out in the past few months,...

5 Best Shares To Buy Right Now [Undervalued Stocks ASX]

Today, we'll look at the best shares to buy right now that we think are undervalued stocks on the ASX. Undervaluation can come from a few factors - these include competition strength, higher risk future valuations, and most commonly, intrinsic value missed by...

5 Best Small Cap Stocks ASX 2023 [Best Penny Stocks]

Today, we'll look at some of the best penny stocks to buy on the ASX for 2023. Even though these stocks are not "penny stocks" per se (this is more of an American term), I consider any stock under $1b in market cap to be a small cap or penny stock. Small cap stocks...

5 Best Lithium Stocks ASX 2023 [Australian Lithium Stocks]

Today, we will look at some of the best lithium stocks on the ASX 200 to buy for 2023. These Australian lithium stocks have great leverage to one of the fastest growing sectors in Australia. Lithium is a massively growing industry with the advent of clean energy and...

5 Best Dividend Stocks to Buy [ASX Blue Chip Stocks 2023]

Today, we'll look at some blue chip stocks which are some of the best dividend stocks to buy on the ASX for 2023. Most of these shares are already mature stocks with stable revenue and paying good dividends. As defensive stocks, value stocks are considered a safe...

Opinions & Guides

Is the RBA done with rate hikes?

They say, “hope for the best, and be prepared for the worst”. This is the message that Lowe appeared to be sending last week to mortgage holders, telling the world that interest rates “may well” rise again. Given the balance of risks and the outrage resulting from...

Why the RBA Should Press Pause on Rate Hikes… Soon

The Reserve Bank (RBA) has been in a tough spot lately. Yes, it misread the economy in the aftermath of the pandemic. But the RBA wasn’t the only central bank that went all out in providing stimulus. It wasn’t just the RBA that was late in recognising inflation risks....

Finding Value in Breville (ASX:BRG) – Shares for Beginners Podcast

On the weekend I was invited by Phil Muscatello, a good friends of ours, to the Shares for Beginners podcast to have a chat about Breville (ASX:BRG). During the podcast, we also spoke about the methods that we use to find and pick stocks such as this. The full...

Testimonials

What People are Saying...

See what people are saying about our research, products and services.

MF & Co. Asset Management

MF & Co. Asset Management is a boutique investment firm offering Equity Capital Markets and derivative general advice & trade execution services.

We are specialists in advising and trading in Australian and US Equities, Index & Equity Options and Options on Futures.

Contact

Get In Touch

Australia

1300 889 603

International

+61 2 8378 7199

M-F: 8am-5pm

Suite 803, Level 8

70 Pitt St, Sydney, NSW 2000

![5 Best ASX Tech Stocks To Buy [Australian tech ASX]](https://mfam.com.au/wp-content/uploads/2021/08/tech-stocks-to-buy-400x250.png)

![5 Best Australian Shares To Buy [Best Growth Stocks ASX]](https://mfam.com.au/wp-content/uploads/2021/08/growth-stocks-to-buy-2-400x250.png)

![5 Best Shares To Buy Right Now [Undervalued Stocks ASX]](https://mfam.com.au/wp-content/uploads/2021/08/undervalued-stocks-to-buy-2-400x250.png)

![5 Best Small Cap Stocks ASX 2023 [Best Penny Stocks]](https://mfam.com.au/wp-content/uploads/2021/08/small-cap-stocks-to-watch-400x250.png)

![5 Best Lithium Stocks ASX 2023 [Australian Lithium Stocks]](https://mfam.com.au/wp-content/uploads/2021/09/best-lithium-stocks-to-buy-400x250.webp)

![5 Best Dividend Stocks to Buy [ASX Blue Chip Stocks 2023]](https://mfam.com.au/wp-content/uploads/2021/08/dividend-stocks-to-buy-2-400x250.png)