Today we’ll look at why we think Xero Shares (ASX:XRO) have such great upside potential in our XRO share price forecast and analysis.

The last time we looked at Xero was back on March 22, 2023 – almost exactly a year ago when the share price was trading at $89.77.

Since then, the share price has rallied 50% in just a year, and we still see strong upside in the XRO share price with their expansion overseas.

Xero is Australia’s largest technology company and one of the world’s largest fintech SaaS companies.

Even through the rough macro environment since 2022, the company managed to grow reasonably well owing to the product’s non-discretionary nature and the company’s favorable unit economics.

With the double engine of pandemic-induced digitization and technology pervasiveness that AI will drive, Xero is poised to take advantage of a massive global SME opportunity.

The company has gotten its act together with its restructuring efforts which are showing strong operational efficiency just a year in and has concentrated its future strategy on core segments which enjoys a NZ$76B TAM.

Recent developments and future opportunities paint a very strong picture for Xero.

At the current XRO share price, the company has a market capitalisation of A$20.22B and has outperformed the ASX200 by about 19% YTD.

Table of Contents

- 1 About Xero Shares

- 2 Non-Discretionary Product With Solid Unit Economics Are Strengths

- 3 Impressive Growth Will Be Tougher To Sustain And More Expensive Moving Forward

- 4 Big Opportunities In Generative AI

- 5 AI Brings Renewed Competitive Threats and Disintermediation Risk While Macro Threats Remain

- 6 The fruits of Restructuring Are Showing

- 7 Xero Shares (ASX:XRO) Valuation

- 8 Conclusion

Xero (ASX:XRO) is a company that provides cloud-based accounting software for small and medium-sized enterprises (SMEs) to automate and simplify complex accounting procedures.

The platform offered by the company provides businesses with an all-in-one solution for managing various business operations including cash-flow management, multi-currency accounting, banking integration, payroll management, taxation, expenses, inventory, invoicing, and workflow.

Xero’s business model is based on subscriptions, which ensures steady and predictable cash flows for the company while also providing clients with a flexible and cost-effective solution.

Xero operates in a NZ$76B TAM (Total Addressable Market) opportunity sector with revenues spread across ANZ, the UK, the US, and Rest-of-the-World (Asia, Africa, etc.).

Non-Discretionary Product With Solid Unit Economics Are Strengths

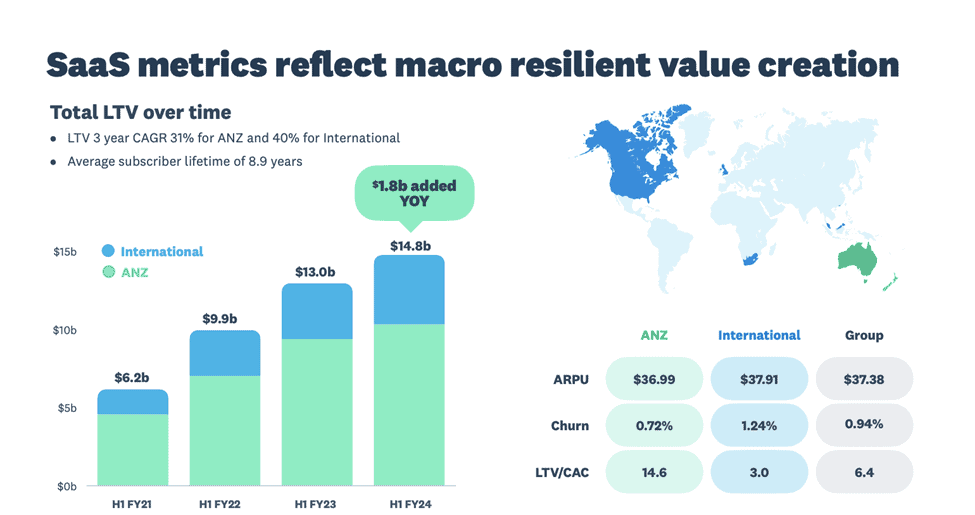

Xero’s non-discretionary product and successful growth strategy are its core strengths, reflected in its best-in-class SaaS metrics with high operating leverage.

Xero (ASX:XRO) stands out from other SaaS peers, as its product is non-discretionary, making it more defensive than most enterprise SaaS products.

The company has raised prices by more than 50% over the past 4 years, depending on the plan tier, and still experienced robust subscriber growth with sub 1% churn, showing customer stickiness.

Source – 1H’24 Presentation

Xero’s core features used by customers are accounting, payroll, and payments.

After some strategy missteps and underwhelming acquisitions, the company has decided that its future strategy will hinge on dominating its product’s core propositions.

It plans to do that through better leveraging AI and feature extension through partnerships and APIs.

The company has recently added bill payments through Xero in the UK market, which is one of its key growth markets.

Its feature extension efforts include better reconciliation using AI, automation of tax tasks through local partnerships such as Avalara in the US, and launching features such as e-invoicing/direct vendor payment high growth markets such as the US, UK, and RoW.

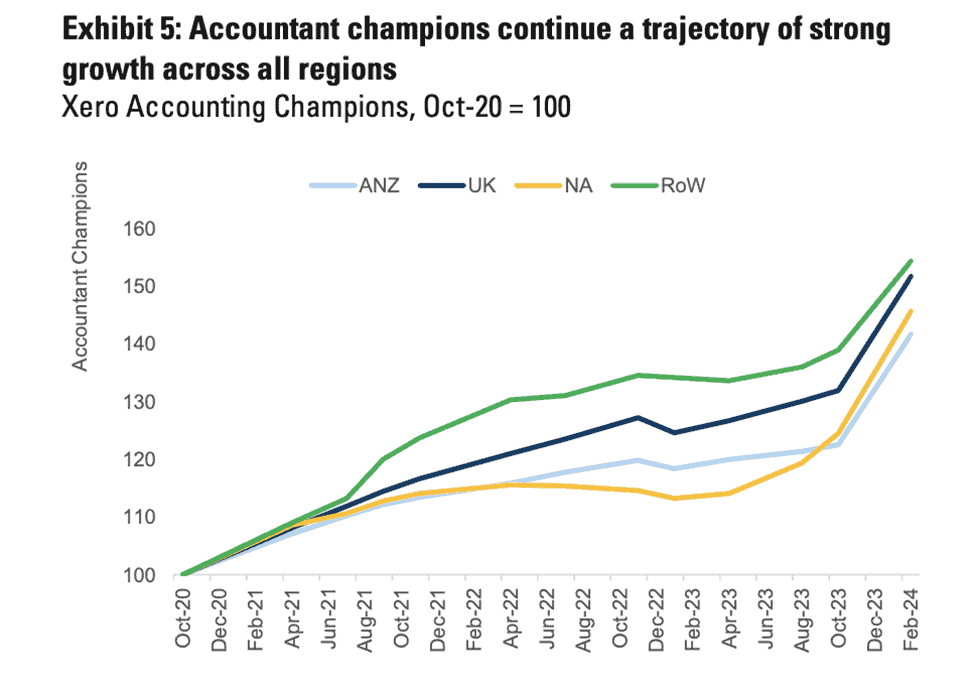

Xero’s GTM (Go To Market) strategy is very efficient as it depends on accounting practices to drive business, a model that has a very powerful flywheel effect.

Under this model, the majority of Xero’s revenue (70%) is generated from accounting firms using Xero’s platform at a firm-wide level for multiple downstream clients.

Firms get base subscriptions at low rates to which their individual clients’ subscriptions are added based on account size and feature usage.

This model is very cost-efficient as direct marketing to small and medium businesses is very expensive and Xero gets to ride on the accounting firm’s cost of client acquisition.

The strategy has performed very well as Xero Accounting Champions (High Revenue Accountancy Practices) have grown on a sustained basis over the past few years.

This is best reflected by Xero’s SaaS industry-leading LTV/CAC ratio of 6.4, which signifies massive revenue potential per client at a very low acquisition cost.

Source – GS Research

There are two more reasons this is a good time for Xero.

First, the firm has put to rest all market fears of a messy leadership transition as new CEO Sukhinder Singh Cassidy has hit the ground running with strong performance in FY24.

Further, the fruits of required impairments and restructuring are now showing as financials are markedly improving.

Lastly, Xero just completed a revamp of its software stack which will allow for more financial efficiency in further product development and quicker feature addition, which is key to its growth strategy for the next few years.

Impressive Growth Will Be Tougher To Sustain And More Expensive Moving Forward

Xero (ASX:XRO) faces challenges when it comes to expanding its user base and revenue outside of the ANZ region, where most of its revenue is generated. Currently, 68% of revenues are generated in the ANZ region while the remainder comes from international jurisdictions.

International markets are proving to be a very expensive avenue of growth as the LTV/CAC ratio in ex-ANZ markets is nearly 80% lower, signifying much lower revenue potential in comparison to the cost of onboarding.

Recently, the company’s growth in overseas jurisdictions such as the UK, US, and Canada has been underwhelming.

The UK is Xero’s biggest international growth avenue and has seen sluggish growth over the past 2 years compared to the already tapped ANZ region, a trend expected to continue as the country has slipped into recession.

The US and Canada on the other hand are proving equally difficult as they are very competitive markets with well-funded and aggressive players. The rest of the World such as Africa though is growing well, but offers a low TAM.

With such headwinds, we should expect a bit of pressure on Xero to deliver which would be reflected in the XRO share price.

Big Opportunities In Generative AI

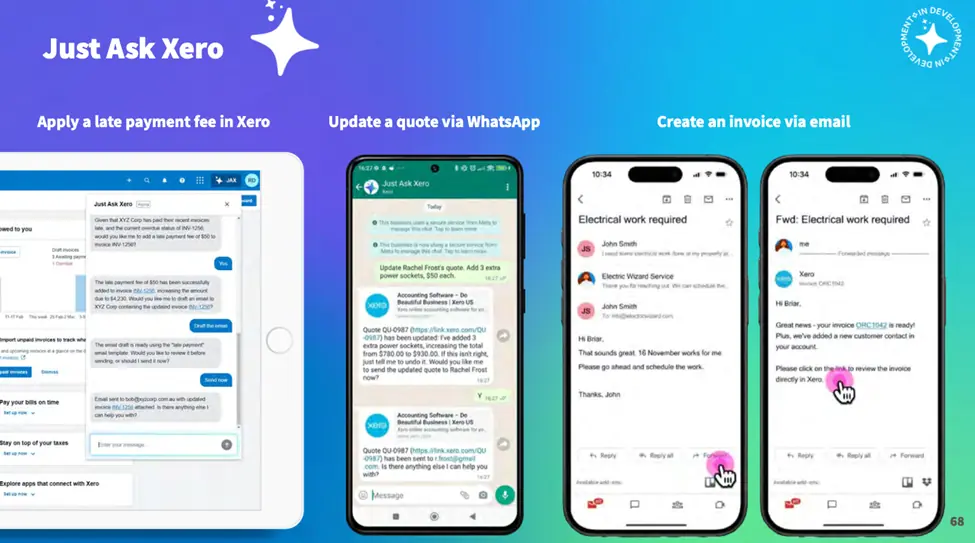

The biggest opportunity for Xero shares (ASX:XRO) is integrating Generative AI to improve product functionality for users.

The company recently launched Just Ask Xero, a comprehensive Gen AI model in Xero.

The model allows users to automate complex tasks such as invoice generation and delivery across multiple platforms such as WhatsApp, email, etc. along with other features such as natural language interaction with the platform to perform tasks such as payroll, payments management, tax information, financial predictions, etc.

Source – 1H’24 Presentation

The advent of Generative AI is sure to drive even more adoption of digitization in the SME space as it will give smaller businesses productivity boosts and new capabilities to grow faster and more efficiently.

At the same time, the successful implementation of generative AI can help unleash a huge value proposition for Xero’s biggest revenue channel, accounting, and bookkeeping practices as they have to work with copious amounts of data across multiple clients.

If Xero can build productive capabilities based on generative AI for accounting practices, it could lead to a massive flywheel effect that attracts B2B clients along with their SME clients in tow.

The company is working towards that aggressively with AI-driven features for key tasks conducted by accounting practices such as auto-reconciliation features, invoice-expense matching, transaction tagging, payroll management, and, cash analytics.

With AI being the big buzzword right now and delivering actual results, integrating AI into Xero’s systems should provide strong upside for the XRO share price.

AI Brings Renewed Competitive Threats and Disintermediation Risk While Macro Threats Remain

While AI is a big opportunity for the company, it is also a big threat as the abilities of general generative AI are growing at an exponential rate.

This trend may hurt the value proposition of individual SaaS products.

For example, Microsoft launched Excel Copilot AI for Finance last week, which offers multiple features such as reconciliation, invoice generation, etc. along with the ability to pull data from multiple sources.

Such features built on AI when bundled with existing pervasive enterprise software such as the above example where Copilot is bundled with Excel and offered along with other ubiquitous products such as Microsoft Teams pose a big threat to companies such as Xero.

Other threats could come from companies like Shopify or Salesforce.

The second risk coming from AI is that if the abilities of LLMs grow to a level where it could hurt the business prospects of accountancy practices, then it could become a spoke in the wheel of Xero’s very efficient business model.

In other words, AI could cause a disintermediation risk.

Lastly, Xero still faces macro risks from a global economic slowdown.

The global economy has shown remarkable resilience from an unprecedented rate hike cycle and multiple wars. However, cracks are starting to show with Japan and the UK having entered a recession recently.

The fruits of Restructuring Are Showing

Source – 1H’24 Presentation

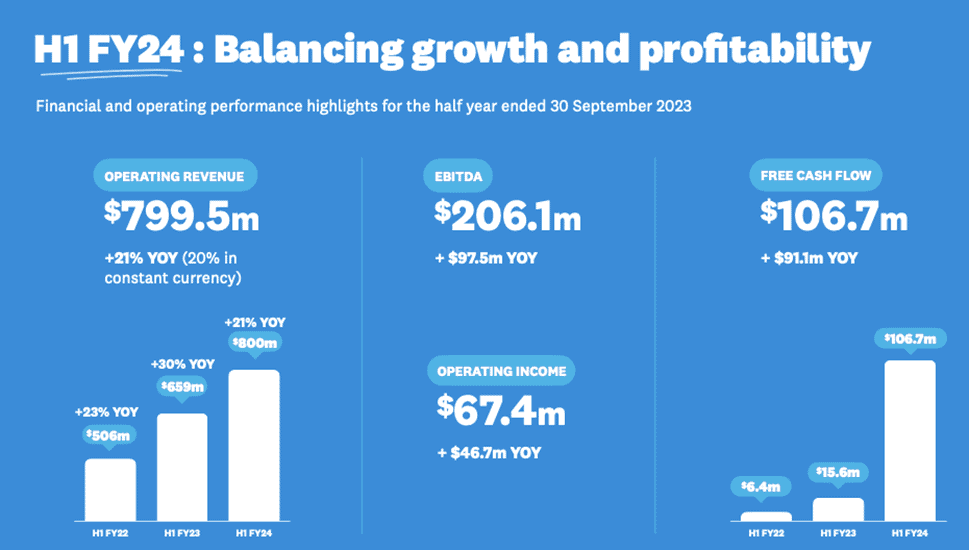

In 1H’24, Xero (ASX:XRO) reported revenues of NZ$799.5 million (up 21% YoY in constant currency terms), EBITDA of NZ$206.1 million (up 90% YoY), and Net Profit of NZ$64 million, up from a NZ$16.1 million last year.

Free Cash Flow for the year was NZ$106.6 million (up 580% YoY).

The improvement was mainly on account of last year’s financials being hit by write-downs and impairments from underwhelming acquisitions.

The company currently has a total liquidity of NZ$ 1.3 billion, with net cash of NZ$179 million, up from NZ$24 million YoY.

The company’s convertible debt liability stood at A$1.08 billion, which is payable in cash or stock.

Xero reported modest improvements in terms of its SaaS metrics.

ARPU grew to NZ$37.38 (up 6% YoY mainly on account of price increases), LTV grew NZ$1.8 billion to NZ$14.8 billion (up 13.8% YoY), and Subscribers grew to 3.945 million (up 5.4% YoY).

As we mentioned above, the company has renewed its focus on operational efficiency and focusing on key revenue drivers after some underwhelming strategy decisions such as its acquisition of Waddle and its impairment of Planday.

The company successfully reduced operational expenses from 83.9% of revenue to 79.3% YoY and has targeted to bring it down to 75% by 2H’24.

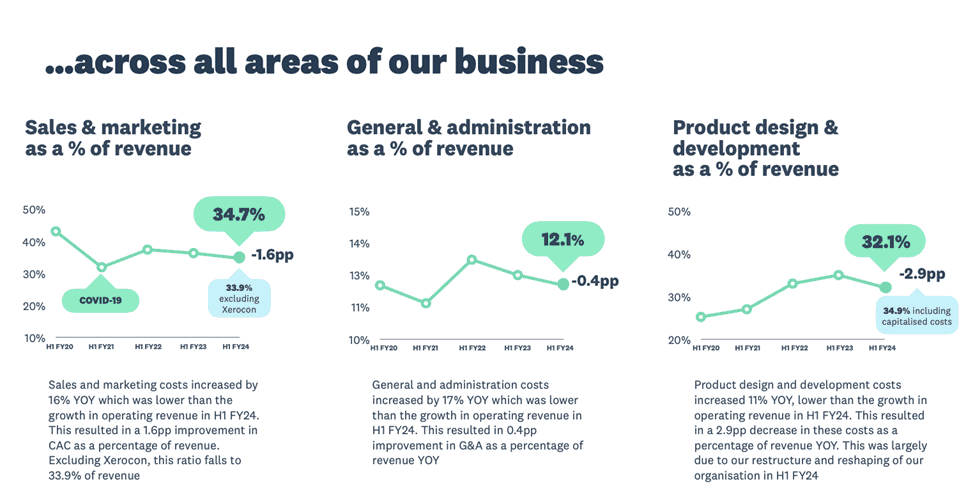

The company reduced Sales/Marketing, General Administration, and Product Development cost growth to below revenue, showing that Xero is on track to building better operating leverage over the next few years.

Source – 1H’24 Presentation

We will be comparing Xero shares (ASX:XRO) to Intuit (NASDAQ: INTU), a US-listed software accounting company that is the world’s largest in the space, and Sage (LON: SGE), a UK-listed enterprise software firm and one of the biggest accounting software firms in the world by market share.

| Metric | Xero Ltd | Intuit | Sage |

|---|---|---|---|

| Price/Sales | 14.15 | 11.89 | 5.77 |

| Price/Free Cash Flow | 48.29 | 37.99 | 33.01 |

| 5 Year Sales Growth | 28.05% | 18.98% | 3.42% |

Source – Investing.com

As you can see, at the current XRO share price, Xero shares are more expensive compared to peers based on price metrics.

However, these premiums can be justified by the company’s substantially higher growth rate than both peers.

This has long been the case for Xero as far as relative valuation is concerned.

Conclusion

Xero’s (ASX:XRO) recent restructuring efforts and focus on core product markets are now showing strong results in operating efficiency.

Xero has a big TAM opportunity which has been supercharged by the digitization that pervasive AI will drive.

Further, the company has a strong balance sheet, a non-discretionary product, and a sound business model.

Overall, Xero remains a solid growth story with good potential upside for the XRO share price.