Today, we’ll look at the best shares to buy right now that we think are undervalued stocks on the ASX.

Undervaluation can come from a few factors – these include competition strength, higher risk future valuations, and most commonly, intrinsic value missed by investors.

Now, market timing is still an important factor – so you will still need to take some care in looking for an entry as the stock price will change day by day.

Best Shares to Buy Right Now which are Undervalued Stocks on the ASX

These stocks are the best shares to buy right now as they show strong potential but are considered to be undervalued stocks as they have not necessarily rallied along with the rest of the market.

Unlike dividend-paying blue-chip shares which tend to hold their value better, these stocks tend to be higher risk.

This is because you are generally buying when the market has been sold off, and there is likely to still either be a fair amount of short holdings or other investors are still looking for opportunities to short it when it rises.

Having said that, if the stock does rally enough, we should see a short squeeze in these stocks which will cause the stock to shoot up.

If you are a longer-term investor looking to add to your portfolio, keep an eye on the fundamentals. A lot of these stocks are beaten down because of issues they’ve had in the past.

If they are not able to overcome them, then it may be wise to cut losses as opposed to holding and hoping.

If you are looking for something with an even higher risk for a better potential return, we have a list of the 5 best penny stocks on the ASX.

Corporate Travel Management (ASX:CTD)

Corporate Travel Management (ASX:CTD) is a travel services provider based in Australia with operations across the globe.

After being one of the worst-hit sectors during the COVID pandemic, the sector is finally showing a strong rebound after a couple of false starts through 2021 and 2022.

The company is well-placed to capitalize on demand surpassing pre-COVID levels with excess capacity on hand to meet demand and synergies from acquisitions on the cusp of kicking in.

Corporate Travel Management (CTM) is a travel services company that provides corporates with a bouquet of travel services such as travel/itinerary planning, event travel planning, etc.

The company’s operations are spread out over North America, Europe, Asia Pacific regions, and ANZ.

CTM is a very technology focussed company that provides bespoke travel software that gives them access to global locations with transparent pricing, planning, and capacity availability along with other metrics.

IGO (ASX:IGO)

IGO Limited (ASX: IGO) is an Australian-based mining company that focuses primarily on the exploration and production of nickel and lithium with a market value of $10.57 billion. Their operations are divided between these two valuable metals, which are essential components for batteries and other electronics.

The booming EV market has driven the increase of demand for lithium-ion batteries in electric vehicles and brought significant benefits through the strategic shift towards lithium production.

Despite a downturn in the lithium price due to oversupply, we believe lithium will make a comeback in the near future as the EV market continues to boom and demand starts to outstrip supply.

Read the full article on how IGO (ASX:IGO) made our list of 5 best shares to buy right now.

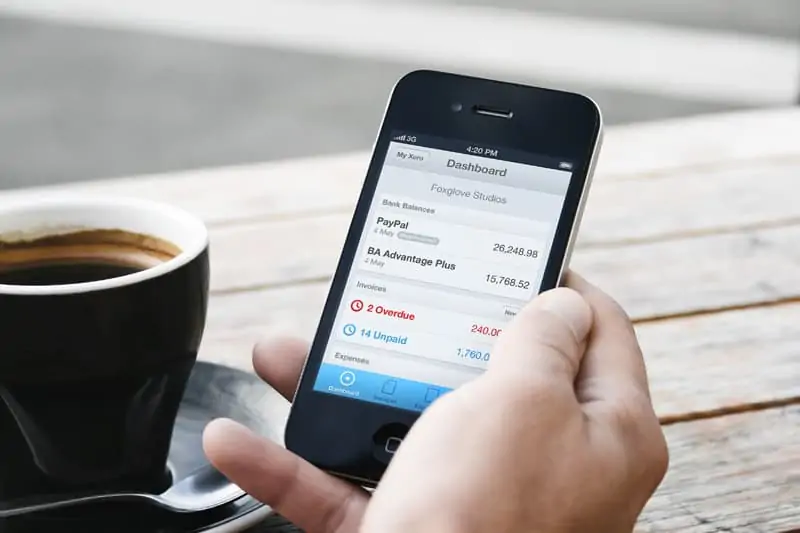

Xero (ASX:XRO)

Xero is one of Australia’s biggest and most successful tech companies.

The company has slowly morphed from a niche SaaS (Software-as-a-Service) company into a tech conglomerate due to strong sector tailwinds and gradual but consistent growth.

Even through the rough macro environment of 2022, the company managed to grow reasonably well owing to the product’s non-discretionary nature.

The pandemic accelerated the already rapid growth of digitisation and business processes, a trend from which Xero has benefited hand over fist.

However, At the current XRO share price, Xero shares have corrected about 42% from its all-time high despite doubling the Lifetime Value of its customer base and growing its monthly revenue run rate by 34%.

Read the full article about Xero (ASX:XRO) on how the stock made our ASX undervalued stocks list.

Alumina (ASX:AWC)

Alumina Limited (ASX:AWC) is an Australian company that owns the largest pure-play alumina manufacturer in the world.

The company was recently hit with low margins due to ore quality, high energy prices, delays in mine approvals, and disruption in demand from war among other factors.

However, things are now looking up with clarity on various issues.

AWC is well-placed to shrug off its problems moving forward.

The stock has underperformed the ASX200 by about 38% over the past year and is recovering from being heavily sold off.

About Alumina Limited Stock (ASX:AWC)

Alumina Limited is the largest pure-play alumina maker in the world, accounting for about 9% of total global production.

The company’s sole asset is a joint venture between mining major Alcoa (60%) and Alumina Limited (40%) which owns and operates a network of bauxite mines, alumina refineries, and some investments in aluminum smelters.

The company’s mines and refineries network extends across Australia, Brazil, Guinea, and Spain.

It also owns a stake in joint ventures such as 55% in the Portland Aluminium smelter and 25% with the Kingdom of Saudi Arabia in an ore and refinery complex.

Nearly two-thirds of the company’s production comes from West Australia with the bulk of refining occurring at its Pinjarra and Wagerup refineries, followed by Alumar in Brazil.

These three refineries are world-class assets with the lowest 10% cost structures in the world.

The company produces in the region of 12000 kt of Alumina a year and at the current AWC share price, has a market cap of A$3.09B.

Read the full article on how Alumina Limited (ASX:AWC) made our ASX undervalued stocks list.

Sayona Mining (ASX:SYA)

Sayona Mining (ASX:SYA) is an up-and-coming multi-asset miner based in Australia.

The company is on the verge of commencing operations at its Northern American Lithium (NAL) project in Quebec.

The company has had a head-spinning 1670% rally since its acquisition of NAL in December 2020 and brought it online in record time and at budget.

While the stock has been soft this year with a 21.1% underperformance to the ASX200 due to a correction in lithium prices, it is still rather fairly valued with a high chance of a serious re-rating once it commences downstream production and develops other assets.

How We Pick The Best Shares To Buy Right Now

Stock markets are generally driven by three factors within the markets.

Understanding these forces helps us time the market and buy or sell stock at the most opportune moments.

In general, the markets and stocks are firstly driven on a short-term basis via supply and demand imbalances.

This is the order flow on a day-to-day basis as investors buy or sell a stock for different reasons.

This order flow is generally hard to forecast and requires strong technical analysis and understanding of the underlying market to properly time.

Secondly, markets and stocks are driven by macroeconomic forces in the medium term.

Factors include but are not limited to changes in interest rates, consumer sentiment, government policies, and so forth.

Understanding the nuances and how the different countries interact with each other in terms of trade and politics is key to understanding the forces that drive the markets as a whole.

Finally, stocks in the long term are driven by fundamentals. Factors include but are not limited to quantitative factors such as earnings growth, profit margin, and return on equity.

Qualitative factors include factors such as competition, operating environment, and political and policy environment.

To be able to pick the best shares to buy now, it is essential to combine market timing, macroeconomic, and fundamental analytics.