Today, we will look at why we like ResMed (ASX RMD) shares.

ResMed is a market-leading US-based developer, manufacturer and distributor of medical equipment.

With strong margins, growing earnings and a stable dividend, ResMed is a good blue-chip stock for medium to long term portfolios.

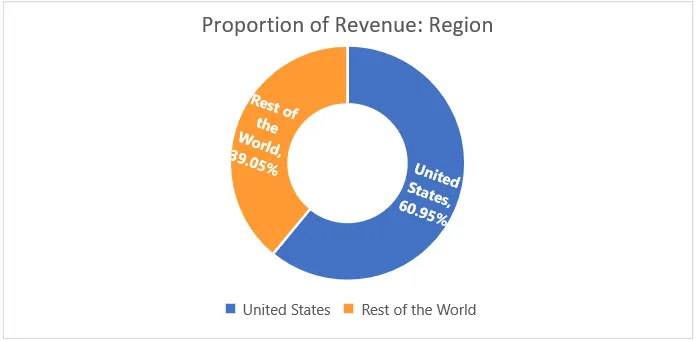

In addition, ResMed earns the vast majority of its revenue in USD.

With the weakness in the Australian dollar, diversification into USD denominated earnings will boost returns in a portfolio predominantly of Australian companies.

Table of Contents

About ResMed Inc.

ResMed (ASX RMD, NYSE RMD) is a world leader in respiratory and breathing mask products.

ResMed Inc. (ResMed) is a holding company for the ResMed Group. The company, through its subsidiaries, is a developer, manufacturer, and distributor of medical equipment for treating, diagnosing, and managing sleep-disordered breathing (SDB) and other respiratory disorders.

The company has developed several products for these disorders, including airflow generators, diagnostic products, mask systems, headgear, and other accessories. SDB includes obstructive sleep apnea (OSA), and other respiratory disorders that occur during sleep.

Its manufacturing operations are located in Australia, Singapore, France, Germany, Malaysia, and the United States.

Its major distribution and sales sites are located in the United States, Germany, France, the United Kingdom, Switzerland, Australia, Japan, Norway, and Sweden.

It has around 44% market share of the continuous positive airway pressure (CPAP) and respirator market.

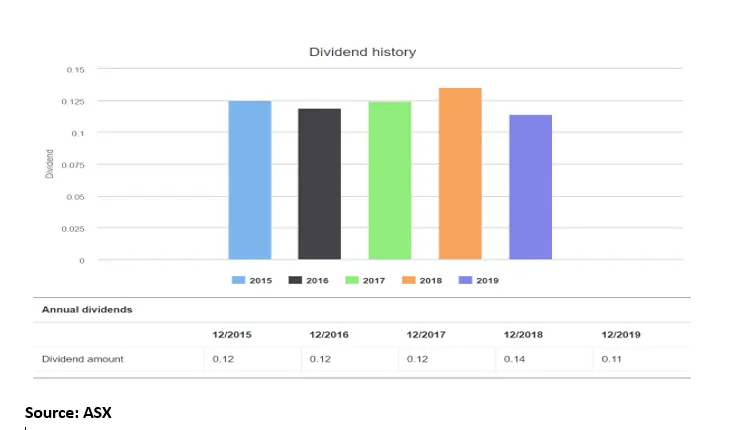

It pays a stable dividend, and its financial performance is attractive in both the US and Australian markets.

Return Comparison 2-year data

Source: Bloomberg

Company’s Strategy

Innovation and tech-driven to achieve superior outcomes, market position, and efficiency.

ResMed will benefit from the growing awareness in the medical community, and among the general population, of the dangers of sleep-disordered breathing (SDB).

With the number of people with sleep apnea nearing 1 billion around the world, ResMed has strong motivation to promote its products and services around the globe.

It targets special interest groups such as the American Heart Association and has partnered with other organizations to conduct medical research.

The company invests 7%-8% of revenue in R&D activities to facilitate the development of new diagnostic and treatment products every year.

During 2017 it launched the Air Fit N20 nasal and F20 full face masks, as well as the Air Mini, the smallest CPAP device on the market.

The following year, it introduced the Mobi portable oxygen concentrator, the Quiet Air diffuser vent elbow for its CPAP full face masks, and the Air Fit F30, its first minimal-contact CPAP full face mask.

Developing new products, completing clinical testing and regulatory approval processes, and providing new products to the market are important factors driving the company’s competitiveness.

Mergers and Acquisitions – Integration of Data & Technology is the key to driving increased awareness & treatment.

Recent acquisitions have helped expand the company’s product portfolio and devices’ functions.

After decades of development, the company has a range of products well accepted in the market.

The company used mergers and acquisitions in recent years to expand its business. These transactions also enabled the company to keep abreast of technology and manufacturing processes.

Since 2015, ResMed has acquired 13 companies. Of these, eight were SaaS-related, as the company honed its focus on connected health.

The more recent acquisitions are as follows:

In 2018, ResMed acquired HEALTH CARE first, which provides cloud-based software for home health and hospice agencies, for an undisclosed amount.

It then bought MatrixCare, a provider of software for long-term care providers, for $750 million. These deals complement the company’s Brightree operations, acquired in 2016 for $802 million.

In 2019, ResMed bought digital therapeutics firm Propeller Health for $225 million. Propeller Health specializes in helping patients manage chronic obstructive pulmonary disease and asthma.

It continues to operate as a standalone business. The company acquired South Korea’s HB Healthcare Safety in March, which specializes in sleep and respiratory care devices to help treat sleep apnea.

Geographic Reach – Trying to capture more share in the global market

ResMed is also investing in sales and marketing activities to promote itself around the world.

ResMed manufactures its products primarily at its Australian facility, though it has additional production plants in China, Singapore, Malaysia, France, and the US.

The company also has R&D and office facilities in Australia, China, Germany, Singapore, and the US.

It leases warehousing and distribution facilities in the US, the UK, Germany, France, Switzerland, Sweden, Norway, Japan, and China.

The company’s products sell in about 120 countries and the US accounts for around 61% of annual revenues.

The company has set its sights on the growing market potential for SDB, COPD, and respiratory care products in China.

Financial Performance & Peer Analysis

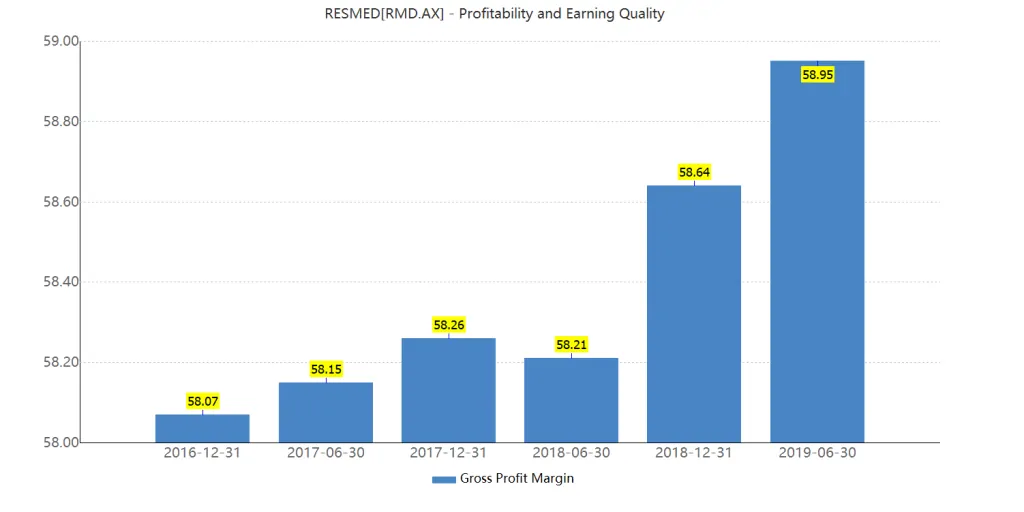

ResMed’s revenue has been trending upward in recent years.

With sleep apnea patients worldwide nearing 1 billion in number, demand for ResMed’s products has grown.

In fiscal 2018 (ended June), revenue increased 13% to $2.3 billion. That growth was primarily due to higher unit sales of devices, masks, and accessories. However, a decline in average selling prices offset that in some measure. Overall, product sales increased around the world.

However, net income declined 8% to $315.6 million in 2018, as the company spent money to produce and launch new products.

The company incurred higher expenses that year because it built up its personnel numbers to boost commercial activities and invested heavily in R&D to create new products. It also suffered restructuring expenses of more than $18 million, which further eroded the bottom line.

Net profit surged 28.2% in 2019 to $404.6 million, due to higher gross profit margins and a much lower tax payment compared to 2018.

Earning per share and gross profit margin in 2019 is the highest in recent years. Return on Equity (ROE) ranged from 15%-22% in the last five years, which is attractive to investors.

RMD(US)-Financial Summary Unit: 1Million USD; Consolidated

RMD appears to be gaining share in both masks and flow generators.

The flow generator market grew in the mid-single digits while the mask market grew in the upper single digits.

RMD will likely gain share in both categories in F4Q19.

New mask launches, higher adherence rates, and broader adoption of ReSupply software drove gains in market share in masks.

Increased adoption of digital solutions and strong underlying patient growth drove the market share gains in flow generators.

Industry analysis

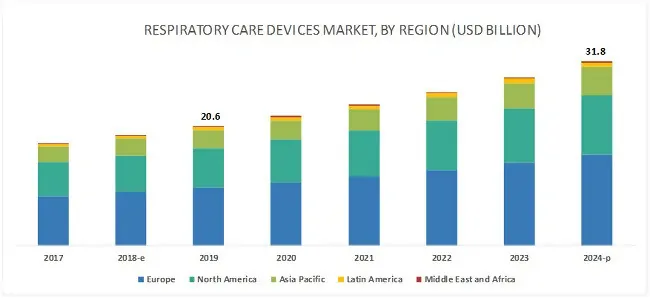

North America and Europe are expected to be the biggest markets in 2019.

North America and Europe are expected to be the largest markets because of the presence of many major manufacturers of respiratory care devices, rising geriatric population, high prevalence of smoking and respiratory diseases, and the presence of a well-developed healthcare system.

Moreover, the presence of advanced healthcare infrastructure and higher expenditure on healthcare will also drive the growth of the market in this region.

The Market in the Asia Pacific region is expected to be the fastest-growing in 2019.

Though the market for respiratory care devices in the APAC is relatively smaller compared to developed markets in North America and Europe, it is expected to grow at a much higher rate.

In Asian countries, the rising geriatric population, growing per capita income, increasing investments in the healthcare industry by key market players, higher demand for cutting-edge technologies, and the expansion of private-sector hospitals to rural areas are major factors driving the growth of the respiratory care devices market.

The global prevalence of sleep apnea is enormous and growing.

Around 80% to 85% of the suspected population with sleep apnea remains undiagnosed.

With increasing awareness regarding the ill effects of untreated sleep apnea, the global sleep apnea patient pool is likely to grow in the coming years.

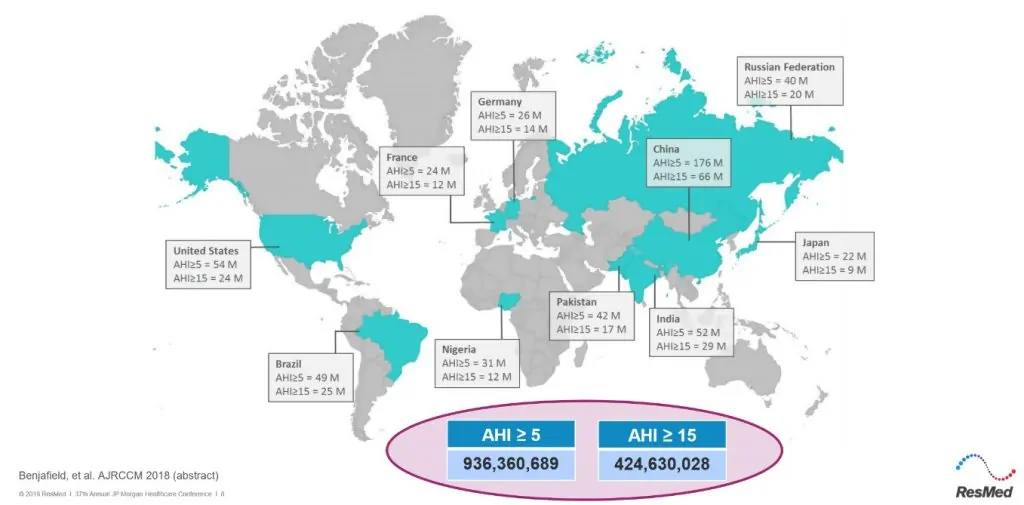

According to The LANCET‘s estimate, globally about 936 million adults aged between 30–69 years have mild to severe obstructive sleep apnea, while 425 million adults in the same age bracket have moderate to severe obstructive sleep apnea.

The number of affected individuals was highest in China, followed by the USA, Brazil, and India.

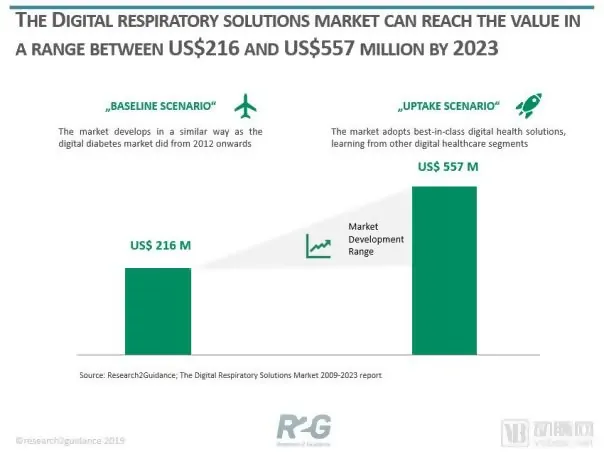

Excellent development opportunities exist in the digital respiratory care market.

The increased prevalence of two major chronic diseases, asthma, and COPD will drive growth in the global digital respiratory care market.

By the end of 2023, on a global basis, the digital asthma solution market will increase to 152 million patients, while the digital COPD solution market will increase to 121 million patients.

The value of the digital respiratory solution market will reach US$557 million.

German healthcare digitisation could be a significant opportunity.

The new Digital Care Act passed in Germany encourages a shift to electronic patient records and the broader adoption of digital solutions.

Given that ResMed has a market-leading digital health offering and demonstrated success in the US and France, we foresee significant opportunities from this ‘pro-digital health’ policy in the company’s second-largest market.

Source: R2G

Healthcare spending will continue to grow around the world as the current demographic ages. Companies with strong competitive advantages, like superior technology and patent protection, will enjoy larger market shares.

Advantage & Risk

Advantages

ResMed has built an ecosystem that improves the delivery of care for patients and drives efficiencies for providers.

The company has the world’s most advanced automatic sleep ventilator, with the most advanced automatic algorithm, a silent motor, EPR breath decompression technology, and heated humidification thermostat function.

As the largest player in the market, it has strong pricing power and a good brand reputation.

Healthcare has many profitable niches where competitive advantages generate high returns over long periods. Respiratory care is one such area.

ResMed is both a successful device maker, as well as a software company that is leading the way in digital healthcare management.

It’s Digital Health ecosystem operating at scale creates a formidable competitive advantage.

With approximately 10 million 100% cloud connectable devices installed in the market, ResMed has a repository of big data that is convertible into actionable information.

RMD has over 4.5 billion nights of sleep data and is able to provide digital solutions that span the whole process of treatment of patients.

Risk factors

The company is subject to various risks relating to its international activities that could affect overall profitability.

- Fluctuations in currency exchange rates. The Australian dollar has been weak, and ResMed is a major beneficiary because 95% of its revenue comes from overseas, and it incurs 80% of its R&D expenses in Australian dollars. However, this scenario could change

- Tariffs and other trade barriers

- Compliance with foreign medical device manufacturing regulations

- Difficulty in enforcing agreements and collecting receivables through foreign legal systems

- Reduction in third-party reimbursement for its products

- Changes in trade policies and foreign tax policies

- The modification or introduction of other governmental policies with potentially adverse effects

- Failure to integrate acquisitions with operations

- Patent litigation risk

- Consolidation in the health care industry could harm revenues and results of operations. It may result in a greater concentration of market power in the competition

Any of the above factors may harm its ability to grow the business or its sales.

Conclusion

ResMed is a global leader that focuses on respiratory and breathing mask products.

It provides products both at home and in hospitals. It has a well-developed Cloud and SaaS service for consumers.

The company invests a lot of money in research and development each year to maintain its competitiveness.

It has a treasure trove of IP that includes approximately 5,800+ patents and designs.

The company entered into 13 mergers or acquisitions since 2015 to develop its digital treatment services through big data and digital solution technologies.

The global prevalence of sleep apnea is widespread and growing, and RMD is already a market leader.

Additionally, there are extensive development opportunities in the digital respiratory care market, as COPD is the third leading cause of death globally.

The global population of COPD patients is approximately 380 million.

Its SaaS business and Digital Health Technology unit have provided the base to make RMD the global leader in connected health.

ResMed will maintain its leadership in the global market, and grow its presence further in the digital respiratory care market.

The RMD stock has substantially outperformed both the broad market index (S&P/ASX 200) and the sector index (S&P/ASX 200 Healthcare Sector GICS Level 1 Index).

Total shareholder return on NYSE listed shares over five years was 164% and we see a lot of upside for RMD.