Today, we’ll look at the best Australian shares to buy on the ASX that we think are the best growth stocks.

Some of these best growth stocks have already made strong gains and have a lot more upside potential to go.

With inflation evening out in the past few months, we should start to see more upside potential for growth stocks.

Growth stocks are inversely correlated to interest rates – the reason is that growth stocks tend to require a lot of funding to grow at the pace that they do.

This means funding costs are a really important factor for their balance sheets.

With inflation getting back in control, we should expect interest rate rises to have now peaked.

From then on, our expectation is for rates to fall if any major economies hit a speed bump.

With a fall in interest rates, we should expect to see even stronger growth potential for growth companies as funding becomes cheaper.

Even without a fall in interest rates, a steady predictable interest rate means that growth companies can adjust and make bolder decisions in investing in the future without the risks that come with a rising interest rate.

Table of Contents

Australia unfortunately isn’t really big when it high growth stocks.

Australia’s focus is really on digging up rocks and selling it – that always entails a lot of risk in terms of successfully going from permits to a mine that brings in revenue.

If you look at the current environment that we live in now, where things such as AI are reigning supreme – strong growth comes from technology.

Unfortunately, Australia just doesn’t have the sort of environment where we foster the right environment for them to grow in.

This is why we have a big focus on trading and investing in the US market, where innovation is fairly unfettered, tax breaks aplenty, and investment appetite is plentiful.

If you’re interested in how we pick and trade fast-moving exciting firms in the US, take our free 5-day trading course on how we pick entries and exits with a focus on US tech stocks.

You’ll also get free trade alerts to see how we do it after the course.

Having said that – Australia does offer some gems, you just have to look hard enough.

We’ve outlined the 5 best growth stocks to buy that we have found to have a good business plan with lots of upside potential and represent some of the best that the ASX has to offer.

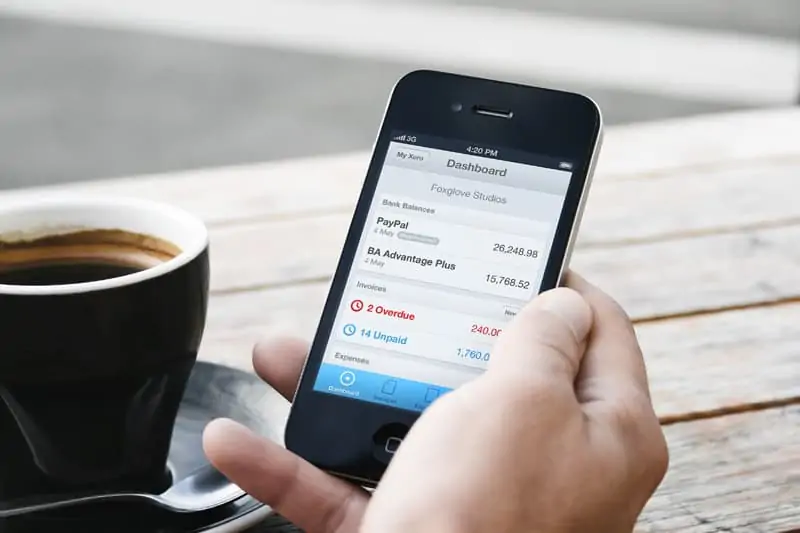

Xero (ASX:XRO)

Xero is Australia’s largest technology company and one of the world’s largest fintech SaaS companies.

Even through the rough macro environment since 2022, the company managed to grow reasonably well owing to the product’s non-discretionary nature and the company’s favorable unit economics.

With the double engine of pandemic-induced digitization and technology pervasiveness that AI will drive, Xero is poised to take advantage of a massive global SME opportunity.

The company has gotten its act together with its restructuring efforts which are showing strong operational efficiency just a year in and has concentrated its future strategy on core segments which enjoys a NZ$76B TAM.

Recent developments and future opportunities paint a very strong picture for Xero.

Read the full research article on why Xero (ASX:XRO) is one of the best growth shares to buy.

Corporate Travel Management (ASX:CTD)

Corporate Travel Management (ASX:CTD) is a travel services provider based in Australia with operations across the globe.

After being one of the worst-hit sectors during the COVID pandemic, the sector is finally showing a strong rebound after a couple of false starts through 2021 and 2022.

The company is well-placed to capitalize on demand surpassing pre-COVID levels with excess capacity on hand to meet demand and synergies from acquisitions on the cusp of kicking in.

Corporate Travel Management (CTM) is a travel services company that provides corporates with a bouquet of travel services such as travel/itinerary planning, event travel planning, etc.

The company’s operations are spread out over North America, Europe, Asia Pacific regions, and ANZ.

CTM is a very technology focussed company that provides bespoke travel software that gives them access to global locations with transparent pricing, planning, and capacity availability along with other metrics.

Pro Medicus (ASX:PME)

Pro Medicus is a health tech software company that provides imaging tools/services to an array of clients such as hospital/diagnostics chains and independent practices.

The company got a serious shot in the arm due to the logistical disruption caused by the COVID-19 pandemic and a growing decline in radiology professionals.

While the former gave the company a shot in the arm, the secular tailwind is a global shortage of radiologists and increasingly complex testing data which can run into several gigabytes from a single test.

Pro Medicus’ revolutionary technology allows the easy sharing of huge datasets and brings scale to radiology diagnostics.

Read our research on Pro Medicus (ASX:PME) and how it made our best Australian shares to buy list.

Pilbara Minerals (ASX:PLS)

Pilbara Minerals Ltd (ASX: PLS) is one of the largest pure-play lithium producers with roughly 8% of global production. After a fabulous acquisition of Altura Mining, the company currently owns one of the best operational lithium assets globally at Pilgangoora. Since the acquisition, the company has largely focussed on execution, expansion, and capturing more of the value chain. Recent financial performance has been stellar, showcasing the company’s frugal cost structure and opening of global markets for spodumene. Investors were also awarded an inaugural dividend in 1H’23.

The lithium market has been budding with activity, showing clear signs that the global economy and major corporations are betting big on its prospects. Chile recently nationalized lithium assets, Allkem and Livent entered a merger to become a major player in the sector while Albemarle failed to secure Liontown Resources despite a multi-billion dollar bid. Major carmakers are upping the ante with LG, Ford, and BMW announcing major battery production facilities while GM invested $650M in Lithium Americas.

Read the research on how Pilbara Minerals (ASX:PLS) made our best Australian shares to buy list.

Allkem (ASX:AKE)

Allkem (ASX:AKE) is Argentina’s largest pure-play lithium miner with a global portfolio of lithium ore and processing assets.

The company has benefited significantly from the recent lithium bull run amidst the burgeoning demand for battery metal.

The company reported bumper results recently for 1H23 with multifold profit growth driven mainly by a price surge of its product.

The company, however, is on the cusp of multiplying the scale of its business substantially as new assets come online over the next couple of years.

Read the full article on why Allkem (ASX:AKE) is one of the best growth stocks to buy.

How Do We Find Growth Stocks To Buy?

Growth stocks are generally driven almost entirely by qualitative factors such as first mover advantage, quality and quantity of assets, permits and technology.

Quantitative factors such as profit, revenue and so forth generally take a back seat.

Even though it is imperative that their financials are sound, when it comes to growth stocks, we are buying the story and perceived future value.

However, the very nature of valuing companies through qualitative factors means that there is a lot of room for error, opinion and subjectivity.

This means that high growth stocks tend to be small-cap, high risk and highly speculative.

The hardest part when it comes to finding growth stocks is the ability to process the information and factors at hand to make a good judgement call.

Our Research team specialises in this and has combed the ASX for some of the best growth stocks on the Australian market.

Make Your Money Work Harder For You

Picking the best stocks to buy now, timing the entry and having an edge in the market is not easy.

Download our special report below for another 5 best shares to buy now which comes with a special strategy that we use for our clients to make your money work harder for you.