CSR shares (ASX CSR) is an Australian listed company that manufactures and sells building products, aluminium, and house design solutions.

Like a number of its industry counterparts, CSR incorporates a range of self-owned products in residential and commercial construction markets. With a strong sense of social and environmental responsibility, CSR is actively involved in advanced materials innovation, sustainable workplaces, and providing integrated housing solutions.

CSR is also one of our top dividend stocks to buy for 2019.

Table of Contents

CSR Limited is a well-diversified manufacturing company with operations across a wide range of sectors including building products, aluminium, and property.

The business has ten registered brands and offers products including structural walls, insulation and solar systems, fibre cement system, plasterboard, ceiling systems, ventilation, roof tiles, bricks and pavers, glass and aluminium.

CSR has approximately $2.84 billion in market capitalisation, which is medium sized amongst competitors in the materials industry.

63.7% of CSR’s Revenue Is From Building Products

Integrating products with construction solution is CSR’s core strength. EBIT generated from residential construction building product in Australia, and New Zealand accounts for 63.7% in 2017, which exceeded 2016’s record by 21%.

As dwelling statistics increased from 0.1% to 3.1% over the first quarter in Australia, the future for residential property is optimistic. CSR is a well-recognised brand name, and customer loyalty is strong, especially in the Viridian glass set.

Customers of CSR have the assurance that company products meet all relevant building codes and standards and are loyal to the brand.

(Source: CSR Limited Annual Report 2017)

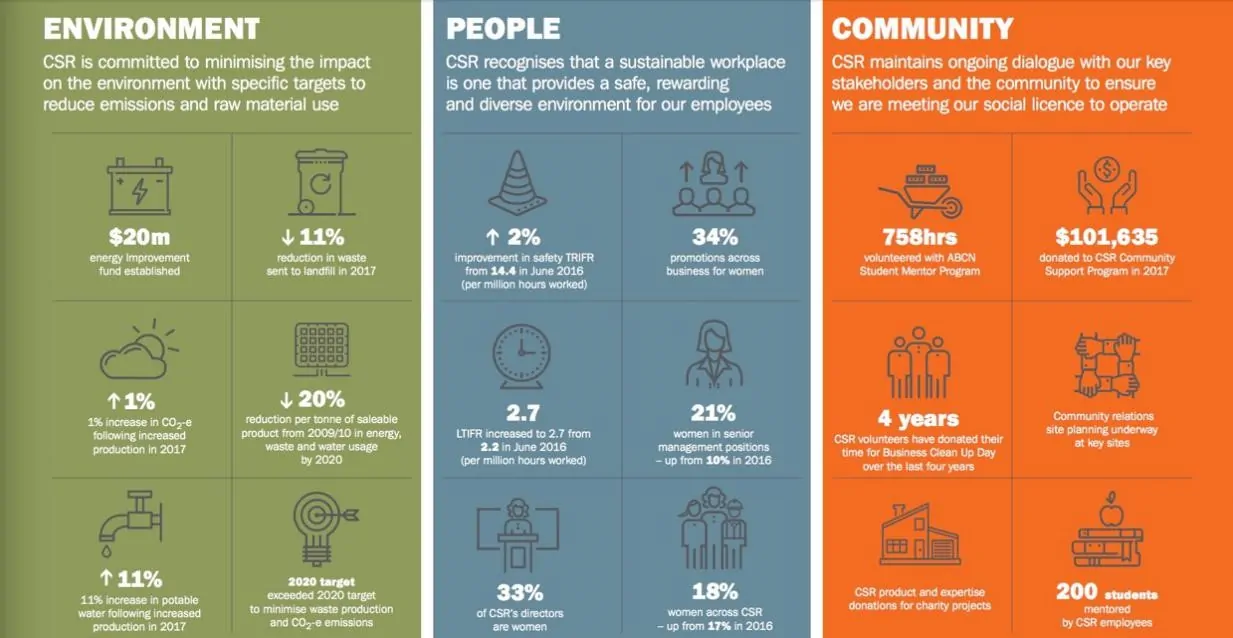

Working towards energy efficient and comfortable homes and buildings is a core vision for the company and sustainability of operations is a key priority at CSR.

Focused on innovation, the business has established a factory to manufacture a new generation of pre-fabricated combined rain screen facades for commercial constructions. CSR also contributes to reducing greenhouse gas emission and ensures a positive impact on the communities in which it operates.

(Source: CSR Limited Annual Report 2017)

CSR Limited Aluminium Sales Subject to External Risks

An upswing in eastern property sector has been fuelled partly by low-interest rates and high levels of immigration.

BIS Oxford Economics research suggests that the increase in population growth has coincided with a built up of significant housing stock deficiency in some markets, especially in the NSW region.

RLB Crane Index reveals Australia’s construction industry is steadily humming along, with a total of 684 cranes currently on projects across the country.

With a stable detached housing market, multi-residential construction has increased as a proportion of total new home construction and now represents over 50% of housing construction stats.

With 30% of its revenue earned from aluminium, CSR is highly sensitive to global aluminium prices.

On account of sanctions placed upon U.C. Rusal by the U.S. Treasury Department, aluminium rallied to its highest price since mid-2011 and then tumbled after sanctions relaxed. The price is going to remain volatile depending on how the sanctions play out.

In this part of its business, CSR is subject to external forces. Compared with Brickworks (ASX BKW) and Boral (ASX BLD), it is not actively seeking expansion outside Australia and New Zealand which creates further risk for the aluminium business.

EPS of CSR Has Been Increasing Steadily In the Past Three Years

ASX CSR stock EPS increased from 0.23 (2015) to 0.32 (2017), reflecting strong growth in earnings.

Its profit margin currently sits at 8.02%, twice that of average industry level’s 4.17%. However, its competitor Brickworks has a profit margin of 22.13%, which indicates even though CSR is using resource efficiently in the industry, Brickworks is even more efficient at keeping costs low.

The company’s ROE is 15%, higher than that of Boral (5.41%) and Brickworks (9.15%), indicating that ASX CSR stock is a better investment than other competitors in the industry.

CSR stock P/E ratio of 12.47 is lower than that of Boral (27.12) and Brickworks (13.32) as well as the industry average of 17.19, which can indicate that CSR stock is undervalued.

Its P/B ratio is 2.14, higher than that of BKW (1.33) and lower than that of BLD (3.51). Regarding P/B, these three companies are all lower than the industry level (9.86), which could mean that these companies are all potentially undervalued.

As a mid-range player, CSR has accumulated a reputation in Viridian glass set, lightweight systems, and integrated construction solutions.

With statistics showing indicators for a growing housing market in NSW, VIC and QLD, CSR Limited should continue to seize this part of the business. However, the recent royal commission into the banks and subsequent tightening of lending could potentially lead to a slow down in the housing market, which could drastically affect CSR shares.

Under the backdrop of higher energy cost and a focus towards sustainability, homeowners demand for more efficient energy management systems will be a growth area for CSR to tap into.