Today, we’ll have a look at why we like Electro Optic Systems (ASX EOS).

EOS is a stock that specialises in electro-optic design and development for the Aerospace and Defence markets.

We first looked at EOS on April 10th, 2019 when the stock was at about $2.70.

Since then, EOS announced profit guidance of +45% CAGR from 2020 to 2021.

After the announcement, the stock rallied more than 22% to over $4 per share, bringing the return to over 48% since April.

We think this stock has strong potential in the long term and this is why we like Electro Optic Systems.

Table of Contents

- 1 About Electro Optic Systems Holdings Limited (ASX EOS)

- 2 30th May 19 – Profit Guidance +45% CAGR from 2020 to 2021

- 3 Emerging Need for Accurate Debris Tracking

- 4 CSIRO Launched Plan to Build a $12bn Industry

- 5 Cutting-edge Technology Enables EOS To Export Around The World

- 6 Regulation Limits Potential Expansion on Customer Base

- 7 Production Backlog Enough For Two Years Of Revenue

- 8 Strong Full Year Results & Low P/E

- 9 Unique Product With Sovereign Customers

- 10 Maintaining Competitiveness is the Key

About Electro Optic Systems Holdings Limited (ASX EOS)

Electro Optic Systems (ASX EOS) is a company that develops, manufactures and sells telescopes & dome enclosures, laser satellite tracking systems, and electro-optic fire control systems.

Electro Optic Systems has customers in Australia, the United States, Singapore, and Germany.

In the defence segment, key competitors of EOS are mostly sovereign-owned companies. These companies have access to almost unlimited funds at low, non-market rates which put EOS at a competitive disadvantage.

However, in January 2018, the Commonwealth government granted defence export companies access to $3.8 billion of sovereign funds through Efic. This significantly improves EOS’s competitiveness.

In the space sector, Electro Optic Systems is one of ASX’s few genuine spaces stocks. EOS’s main competitors are Sky and Space Global (ASX SAS) and space surveillance company Kleos Space (ASX KSS).

30th May 19 – Profit Guidance +45% CAGR from 2020 to 2021

The company said it expected to generate an annual compounded growth rate of 45% in both revenue and profits for 2020 and 2021.

The EOS share price rallied by 22.70% after the release. Read the full release here.

Emerging Need for Accurate Debris Tracking

As a growing number of companies plan to launch mega-constellations of satellites consisting of hundreds of spacecraft, space object tracking is becoming a concern.

Millions of small, hard-to-track bits of orbital debris can collide, damage and possibly destroy these satellites.

Precisely tracking space junk is crucial in avoiding such catastrophic collisions to ensure access to space without having hardware or spaceships damaged by debris.

It is thought that there could be anywhere up to 750,000 objects larger than 1cm in orbit around Earth, all of which can cause damage.

EOS Space has been establishing its global network since 2014 when it entered into the agreement with a US defence contractor – Lockheed Martin.

Under the agreement, EOS and Lockheed Martin will collaborate in the production, deployment and operation of proprietary space tracking sensors. The objective of the joint effort is to provide value-added services to the space industry, based on timely and accurate space data from those sensors.

By taking advantage of Australia’s geographic position in the southern hemisphere, a new facility was established in Western Australia. This is believed to increase the world’s ability to track space debris by 25 per cent.

Electro Optic Systems initial customers are aimed at governments given their advantages in substantial operational space capability. Electro Optic Systems can offer immediate delivery of very high-quality data, unlike all potential competitors.

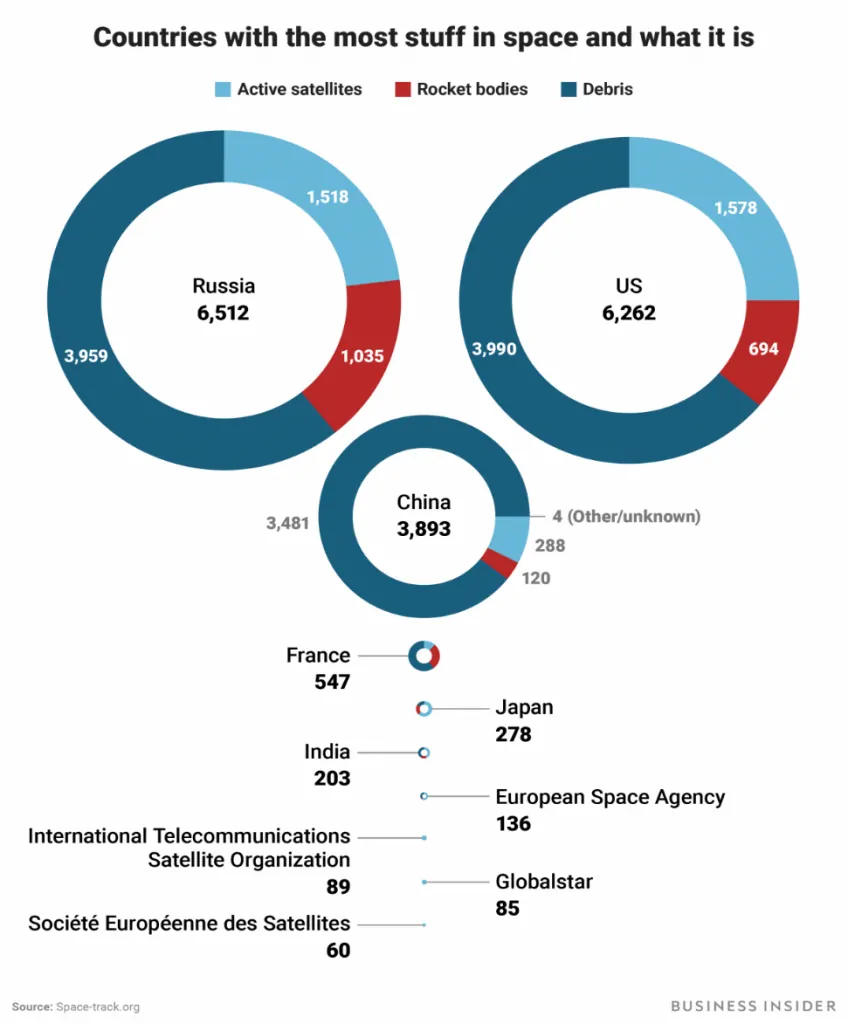

In addition, ground-based space situational awareness is becoming more prioritised by the government. Commercial organisations around the world also want to protect their investments in space. The chart below demonstrates countries with most debris in space and its class.

Russia is ranked first, followed by the US and China. With so much junk accumulating in space that needs to be tracked, there is promising upside potential for EOS’s space sector.

CSIRO Launched Plan to Build a $12bn Industry

On 24th September, the Commonwealth Scientific and Industrial Research Organisation (CSIRO) produced a report that outlined business opportunities in the growing space industry.

The space industry is expected to drive strong jobs growth. It claims if the new ‘space industry roadmap’ is realised, it could be building a $12bn domestic space industry by 2030.

This could be a focal point that drives the progress of the whole Australian space industry as it drives engagement and growth across the space value chain.

One of the key aspects highlighted in the report is to take advantage of Australia’s geographic position in the southern hemisphere. Australia could work with international programs that track objects in space, manage space debris, and enable deep space communication.

Since Electro Optic Systems is a first mover in this space, this is a promising report which could drive further co-operation between EOS and the international community.

This is also a strong upside for the EOS share price in the long term.

Cutting-edge Technology Enables EOS To Export Around The World

EOS Defence has its research labs and manufacturing facilities in Canberra where it employs 180 engineers and technicians. However, 90 per cent of its sophisticated military systems are exported.

The company’s main defence product is a remote weapons system that is integrated with different guns.

Remote weapons systems allow the commander to engage the enemy before the enemy can engage and fire first. This allows the commander to establish the desired “over-match” on enemies.

Additionally, military land vehicles are getting bigger and heavier. Militaries are now looking for weapons systems with superior capability, but no extra weight.

EOS’s R400 mark 2 Remote Weapons Station is very light, weighing in at about 450 kilograms. This weight includes having the system tethered to a large 30mm gun complete with armour and fully-loaded with 72 rounds.

R400 mark 2

According to Grant Sanderson, the chief executive officer of EOS Defence Systems Group “It puts us at least 18 months ahead of the competition globally”.

Its FY2017 report indicated that 15,000 RWS had been sold globally and the replacement and upgrade cycle for this equipment will soon commence.

In the past 12 months, EOS Defence has taken orders for $600 million worth of its products. And it is expected to take approximately $400 million future contracts.

In September 2018, Electro Optic Systems (ASX EOS) released a new lightweight remote weapon system called the R-150. EOS is expected to receive orders for this system towards the end of 2019.

R-150

Regulation Limits Potential Expansion on Customer Base

The Electro Optic Systems (ASX EOS) defence sector is reliant on the timely release of export licenses for customers by both Australia and the US.

This restriction means that only certain countries are approved by both the USA and Australia for receipt of advanced military technology.

This severely limits the number of potential customers that EOS has.

However, any countries requesting a license to import have had their license issued – so there doesn’t seem to be any issues at this time.

However, as Electro Optic Systems products become more popular, there will be potential regulation risks for future customers.

Production Backlog Enough For Two Years Of Revenue

Filling of the order backlog has exceeded management expectation in terms of capacity, yield and quality.

In 2018, revenue for the defence sector grew more than 200% to $85 million. The company has forecasted this will grow another 100% to over $170 million in 2019.

This is a very positive sign for the EOS share price, as such strong revenue growth will lead go growing profits.

On 1 January 2018, the production backlog was around $581 million. This has grown to $667 million on 1 January 2019.

With the strong growth in undelivered orders and customer commitments, Electro Optic Systems (ASX EOS) has enough orders for this sector to operate for another two years from 2020.

The product quality achieved has met or exceed customer expectations. No competitor has yet offered a qualified product into the market created by EOS with the R-400S Mk2 weapon system.

Regarding new orders, Electro Optic Systems has achieved new orders with three main customers to deliver at least 200 and up to 700 units over 8 years.

Two of the customers are foreign with significant long-term requirements, and another local customer is the Australian Army.

Prospects for other substantial orders requiring delivery from 2019 are strong.

Strong Full Year Results & Low P/E

The latest full-year 2018 results indicate strong operating profit after tax of $15 million, up from a $9 million loss last year.

Revenue has grown strongly year on year at 274% from $23.26 million to $87.13 million. Electro Optic Systems (ASX EOS) expects revenue to grow again next Financial Year.

Importantly to note, half of this profit ($7.7 million) was from foreign exchange gains.

This is due to the fact that 95% of current production and export contracts are priced in USD. The weakening Australian dollar has been a boon in the past year (0.7805 down to 0.7052) for EOS shares.

However, this can also be a potential downside for the EOS share price.

If the Australian dollar recovers or USD falls, they could see a large loss in Foreign Exchange. EOS would need to consider hedging their foreign exchange risk.

Hedging will be required to eliminate or reduce this potential impact on profit and the EOS share price.

Part of the profit was due to the $410 million contract won for delivery.

The delivery was for a ‘significant’ quantity of its new R-400S-Mk2 remote weapon systems (RWS). The delivery was for undisclosed overseas customers.

With the strong financial performance last year, the EOS share price to be undervalued trading at just 15.7x P/E.

Unique Product With Sovereign Customers

There is currently no competitor offering a qualified product to compete with the R-400S-Mk2 remote weapon system.

Electro Optic Systems (ASX EOS) has a relatively stable source of the customers (mostly qualified sovereign customer) and continuous development in cutting-edge technology.

This gives the company has a significant advantage over its defence competitors.

Meanwhile, substantial operational space capability that only a few nations can compete with, compliments its development in the space sector.

However, countries aligned with the US and Australia are now faced with specific threats. These threats arise from new weapons provided by strategic competitors.

Based on customer intelligence it was clear to EOS that a technological response was required. The response is required to restore RWS over‑match and tactical superiority to coalition forces.

In addition, new entries of competitors will most likely to offset the potential benefits brought by its R-400S Mk2.

The company’s cumulative market share for all permitted customers is expected to fall from 100% in 2017 to below 50% by 2025.

This could apply pressure to the EOS share price as new entrants steal market share.

Maintaining Competitiveness is the Key

Continuous development in cutting-edge technology and intensifying global conflicts support EOS’s growth in its defence sector.

However, given the nature of the product, government regulation restricts its ability to acquire more customers.

EOS’s space segment is also showing good upside. The emerging markets for debris tracking and the CSIRO’s report have signalled strong growth potential for the sector and the EOS share price.

We think that Electro Optic Systems (ASX EOS) is on the right track and there is a lot of upside potential for the EOS share price.