Mirvac Property Trust (ASX MGR) is a real estate group focusing on real estate development and investment in Australia. Mirvac shares have seen strong growth this year from is steadily increasing within last month, from 2.1 to 2.43 this year and now has a market cap of 9.03 billion. The company has been named as the world’s most sustainable real estate company by Dow Jones Sustainability Index, differentiating them from other real estate groups.

(Source: MGR 2018 Financial Report)

(Source: IBIS World report 2017 P.12)

Table of Contents

Residential Property Boom Cooling

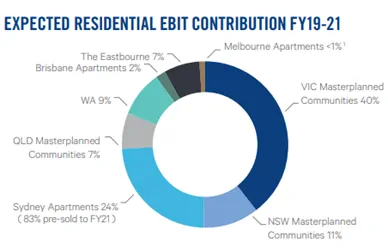

According to IBIS World’s report on MGR, the residential sector has been a cash cow for MGR for the past few years. This sector accounted for around 15% of MGR’s revenue and will account for 24% of MGR’s EBIT in 2019.

Margins for development have been boosted in recent years by across-the-board house price appreciation. However, prices and margins are expected to moderate in the long term with the cooling down of the housing boom in Sydney and Melbourne. Investors continue to retreat further and sellers’ price expectations continue to wind down.

As a result, the auction clearance rate in Sydney and Melbourne is 52% and 58% respectively in August 2018, while the equivalent figures in 2017 were 76.7% and 77%. Tighter lending standards also keep a lot of ineligible foreign and local investors out of the market.

According to the report, real estate prices have grown 6556% in the past 55 years and Australia has one of the worst housing affordability in the world. The Median Multiple (median house price/median household income) in Sydney is 12.9 which is only lower than Hong Kong. The Median Multiple in Melbourne is also near 10 (Top 5 in the world). A median multiple over 8 is generally considered to at the upper range of affordability.

Additionally, the interest rate rise in the US is pushing up funding costs for Australian banks. Smaller banks, which are more sensitive to the market have already hiked interest rates accordingly.

Population growth has also been slowing, which is reducing demand for housing.

Source: Australian Demographic Statistics

All the above factors, combined with the declining total growth of population, indicating the end of the property market boom.

MGR plan to stop buying new residential stock until 2021

The time and cost for pre-sale residential property projects have almost tripled in 2018 compared to 2016. This indicates residential property is taking longer and harder to sell.

MGR announced they will not buy new residential stocks until 2021. Between 2018 to 2020, MGR will sell off stock assets on their balance sheet, which is more than 18,000 Sydney residential lots. Given the headwinds in the residential property market, it is probable that it will be hard to sell all these properties and even if sold, will be at a lower profit margin.

Future growth lies in MGR’s commercial and industrial property portfolio

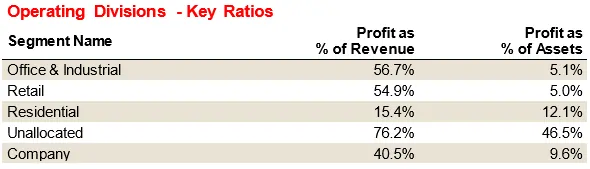

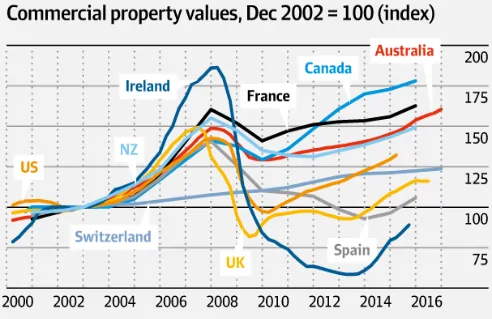

Mirvac has noticed the cooling down of the residential property market and adopted a strategy to invest more in commercial and industrial property portfolio to drive future growth.

MGR has established a partnership with Morgan Stanley Real Estate Investing to keep expanding in industrial business.

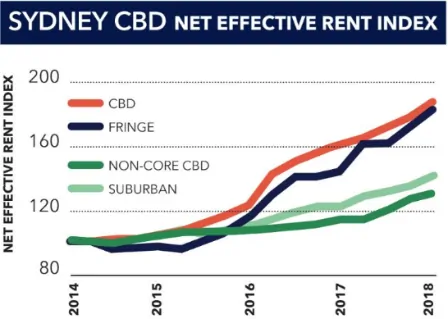

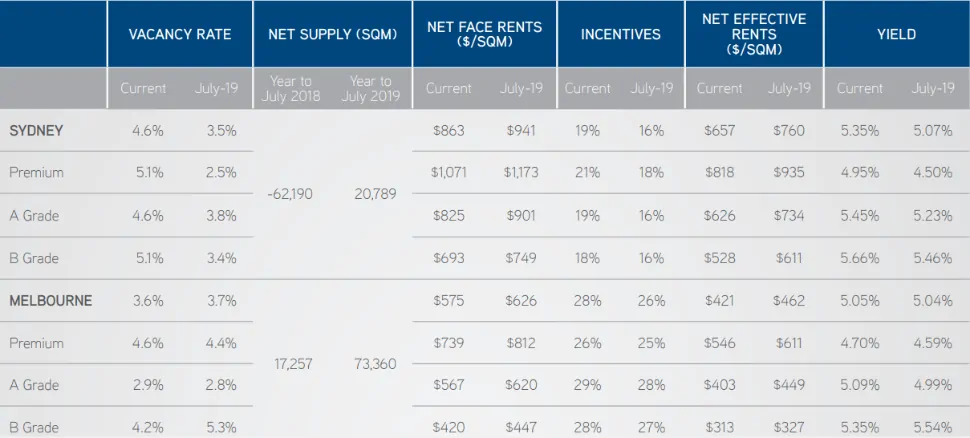

Growth in the services sector, higher employment rate, low supply and the desire of tenants to upgrade to modern office have driven up the demand for high-quality offices in Sydney and Melbourne CBD. There has been a noticeable surge in 2018 in commercial rent and Sydney CBD’s rental growth also hit its highest ever in June 2018.

(Source from: CBRE Australia)

In 2019-2021, MGR expects to accelerate the earning growth of passive investment from 1% in 2018 to 5%, which means they will rely more on rental income to drive future growth. MGR has one of the youngest office portfolios in Australia with a substantial overweight to Sydney and Melbourne. These two cities have a population growth of 1.5% and 2.3% respectively, helping to support this strategy.

MGR also has a series of major projects on track to settle in 2019-2021, which will continue to deliver growth as the rental growth of the office and retail value assets keep increasing.

(Source: AFR)

(CBD office snapshot, Source: Collier International)

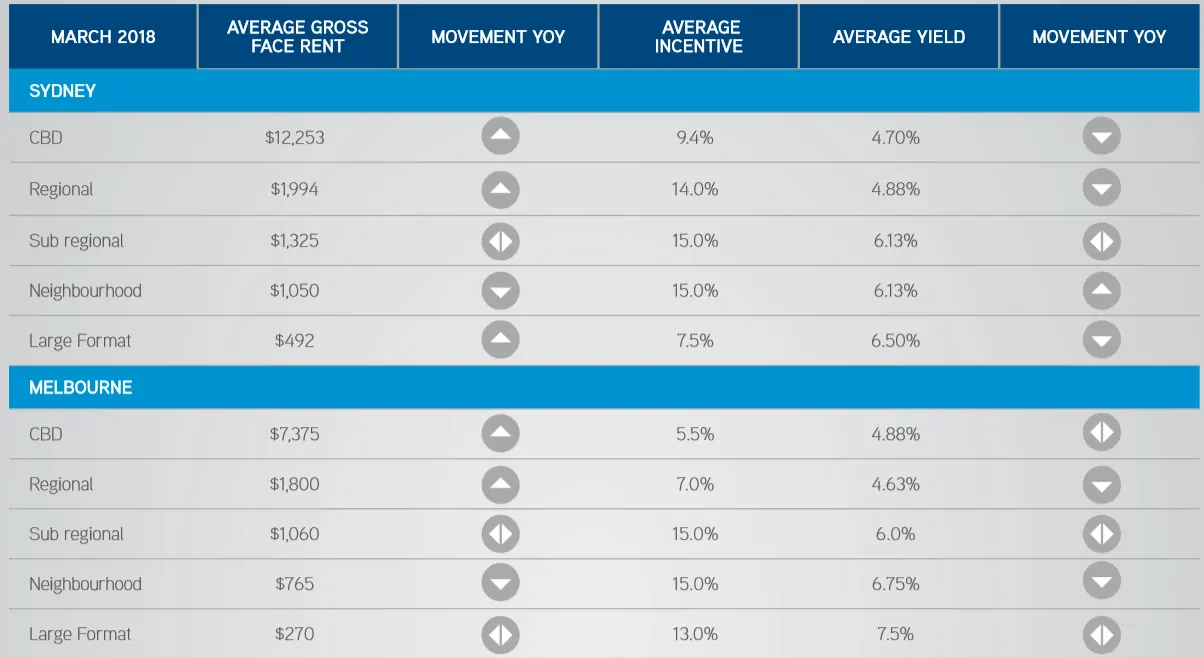

(Retail Property snapshot, Source: Collier International)

Peer Comparison

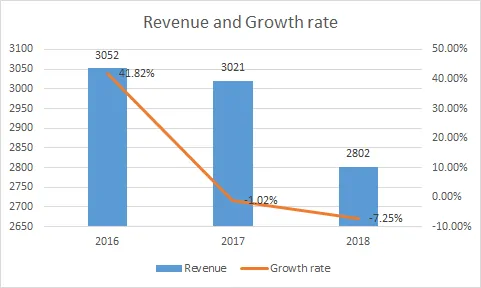

Mirvac shares’ revenue in FY18 was 2,802 million, well above the industry average of 1,509.6 million. After the significant growth rate of 41.82% from FY15 to FY16, revenue has fallen from 3,052 million to 2,802 million from FY16 to FY18.

Figure 1 Revenue and growth rate change of Mirvac from FY16-FY18

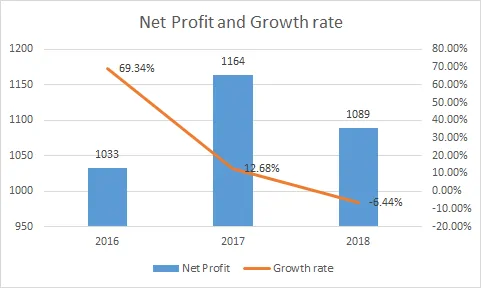

Net profit increased from 1,033 million to 1,164 million from FY16-17 and fell 6.44% to 1,089 million in FY18. The decrease in both revenue and profit is due to the decrease in development revenue (revenue recognised upon settlement of the development projects).

Figure 2 Profit and Growth rate change of Mirvac from FY16-FY18

The main competitors in the real estate industry are Abacus property group (ASX ABP), Stockland (ASX SGP) and Shopping Centres Australasia Property Group (ASX SCP). As shown in Figure 3, the average net profit margin of the whole industry is 52.15%. This is skewed by SCP’s astonishing net profit margin of 81.34% as over 50% of the net revenue was generated from revaluation surplus. Rapid growth in housing prices in Sydney, Melbourne and Brisbane is also a vital reason for the extremely high net profit margin among the industry. Compared to other competitors, Mirvac shares’ net profit margin at around 40% is below average.

Figure 3 Net Profit Margin of main competitors from FY15-18

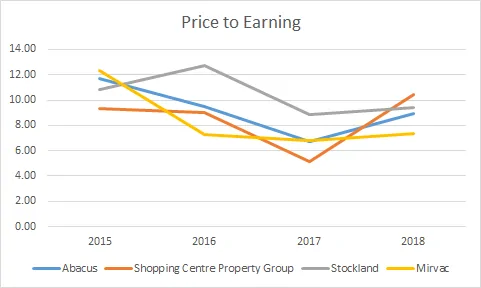

The real estate industry tends to have a relatively low P/E ratio, with an average of 9.04. With a P/E ratio of 7.38, Mirvac is considered to be quite cheap compared to its peers.. However, a fall in the residential property price could potentially reduce Mirvac’s revenues and the lower PE may be pricing Mirvac headwinds in the residential sector.

Figure 4 Price to earnings ratio of main competitors from FY15-18

Mirvac has seen the writing on the wall in terms of the cooldown in the residential sector and has taken action to derisk this side of the business. The focus now towards commercial property will definitely help the bottom line and is a move in the right direction. However, the fall in revenue, profit and low margins is a concern in the medium term for Mirvac shares. Having said that, Mirvac shares’ low PE is attractive and if they are able to mitigate revenue loss from the residential side, Mirvac shares could be an attractive buy in the long term.