TPG (ASX TPM) is an Australian-based multi-media full-service telecommunications company providing consumer, wholesale and corporate telecommunications services. TPG shares are also one of the largest telecommunication service providers in Australia with a market cap of around $5.1 Billion.

The TPG share price has fallen more than 50% from a high of $12.83 in 2016, along with most other telcos such as Telstra (ASX TLS), but with a new mobile network in the works, is this an opportunity to buy TPM shares?

Table of Contents

Thinner profit margin in broadband sector bites into TPG’s profit

TPG FY17 Financial report

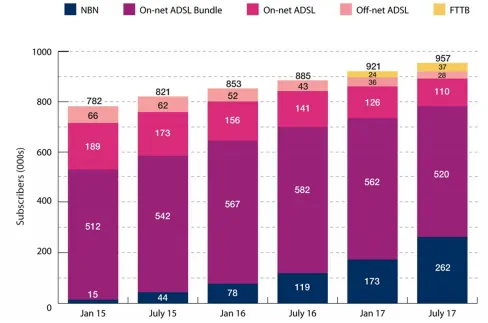

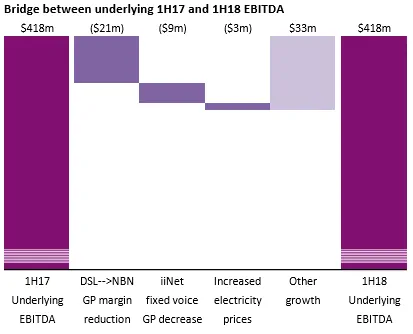

The number of NBN subscribers has more than doubled in one year’s time to 262,000 NBN subscribers in July 2017, which made up about 30% of the total number of TPG’s subscribers. As NBN broadband offers thinner profit margins, the loss of gross profit in NBN services bites into its $33 million growth in EBITDA, resulting in a slight increase in EBITDA of $0.6m in 1H18.

We expect the profit margin in the broadband sector this FY18 will continue to decline, due to the increasing level of competition in the telecommunication industry due to the acceleration of the NBN rollout.

Opportunities and Challenges for TPG in the Mobile sector

Due to the low margins of the NBN service, TPG decided to enter into the mobile sector in Australia by investing $1.9 billion, including $600 million for network rollout capital expenditure over a three-year period, to build Australia’s 4th largest mobile phone network. TPG expects their mobile network will achieve 80% population coverage and $1,260 million for the 700MHz spectrum, which will be payable in three annual instalments.

As a new entrant to the mobile sector, TPG needs to attract clients from Telstra, Optus and Vodafone, the trio of companies control 90% of the mobile phone market. TPG’s entrance to the market with a low-price strategy has stimulated price competition in the mobile sector to a much higher level.

TPG announced it will launch the $0 unlimited data plan for the first six months then $9.99 each month from then on with no lock-in contract. This is 30%-60% lower than the current market price of entry-level mobile plans, some small discount mobile incumbents have already loaded up their plan with new inclusions for free to avoid losing existing clients. Even for the big players in the market, Telstra’s CEO Penn also admitted there will be continuing pressure on pricing and increasing data inclusion, which will finally eat into the mobile industry’s average revenue per user and profit margin.

Despite the market’s concerns of a coming price war, TPG estimated that it needs about 500,000 customers for its mobile network to break even, they have several advantages over its competitors to achieve this.

Firstly, TPG has over 2 million existing broadband subscribers, who are very likely to be potential clients of TPG mobile with a very low customer acquisition cost. TPG’s mobile strategy will be complementary to its fixed-line business, with the ability to bundle mobile and fixed services to achieve a lower fixed service price.

Secondly, for a new entrant, TPG also don’t need to support any legacy 2G/3G mobile networks. TPG also requires fewer sites due to its single network, more modern technology, best available spectrum, and its cherry-picking strategy to serve the areas with high populations. This enables TPG to reduce operating and capital expenditure.

Thirdly, TPG’s plan is unique and innovative as calls will only be able to be made over internet protocol (IP) using applications like Whatsapp, Facebook Messenger calls and Viber. Traditional voice calls made over mobile networks will only be available later as the network is rolled out, but they won’t be available at launch. Initial customer plans will be data only. (https://www.afr.com/business/telecommunications/tpg-telecom-mobile-network-to-launch-without-voice-services-20180523-h10g5j).

Finally, TPG will continue its cherry-picking strategy in concentrating on serving densely populated areas of the country with approximately 2,000 to 2,500 sites. This explains why TPG wants to reach 80% of the population with a skinny $600 million investment in infrastructure to provide broad coverage across densely populated areas of the country. TPG has also made major investments in buying their own 700 Mhz 4G spectrum, at a price of $1.26 billion, which was among the most expensive spectrum bought anywhere in the world. As the 700 Mhz 4G spectrum is currently the best spectrum for sending signals through walls and congested cities, which will boost TPG’s capability to deliver a stable and fast-speed network.

The industry is about to enter another phase of heavy investment ahead of the 5G era, which is scheduled for mainstream launch in 2020, even before the completion of NBN rollout in 2021. The 5G network can outperform the obsolete, slow and unstable NBN in many ways. Therefore, we can expect many customers will choose 5G instead of NBN. Thus, NBN rollout’s adverse impact on profit may not be that large after the 5G network gets launched in Australia.

The feasibility of the technology side

Overall, TPG is carrying on a disruptive strategy to offer data-only mobile plans, which is low cost and has the potential to outperform its peers in the long-term due to its low cost, but can TPG‘s $1.9 billion mobile phone network achieve 80% population coverage while delivering a quality service? This can only be answered after the first 6 months test-drives of their customers.

Recently though the internet failures hurt Optus and Foxtel as Optus Sports’ was unable to live stream the 2018 FIFA World Cup, and how Game of Thrones crashed Foxtel, which were nightmares for both companies with bad publicity as social media flooded with complaints.

EPS declining year on year

| EPS Comparison | |||||

| Year | FY15 | FY16 | FY17 | 1H17 | 1H18 |

| EPS (cents) | 27.7 | 37.7 | 48.4 | 26.4 | 21.5 |

TPG shares EPS has grown from 27.7 cents to 48.4 cents in the financial year ended 2017, however, the EPS declined by more than 15% in 1H18 compared to 1H17 thanks to thinner profit margins due to the NBN rollout.

However, Telstra’s EPS just dropped 3.4% in 1H18 compared to 1H17, which indicates the rollout of NBN has a larger impact on TPG shares’ performance than Telstra.

| P/E Ratio Comparison | Current | Forecast |

| Telcom industry average | 15.9 | 12.8 |

| TPG | 11.6 | 13.3 |

| Telstra | 8.3 | 10.1 |

| Vocus Group | 15.6 | 10.9 |

TPG shares P/E ratio is trading around the industry average, above Telstra and below Vocus, the forecast P/E ratio is 13.3 for the FY18, which is higher than the industry level and both peer companies which are due to TPG shares significant decline in EPS in 1H18. As the NBN rollout continues and TPG’s mobile strategy will not bring in any profit in 2018 due to the “6 month for $0” initial plan, the consensus is TPG ‘s EPS is unlikely to improve in the financial year ended 2018.

Short-term pain for a long-term gain?

The uncertainty of the stability & capability of TPG’s mobile network presents a risk for TPG’s investors at this current stage. The consensus is that TPG shares profit will continue to be squeezed into 2018, as TPG’s plan to give six months of free mobile services to encourage customers to test out its network will be a loss leader. TPG shares are worth keeping an eye on during 2018 and have the potential to be a winner in the telecom industry in the long-run. However, downside risks remain with its new mobile network and uncertainties around whether it will perform.