Click here to watch the full interview. (Free signup to Ausbiz required).

Additional points below regarding where our view is on the markets.

Medium to Long Term and Economy View

Markets continue to be highly bullish with investors rotating from risk-off assets back into equities which can benefit from an economic recovery.

Risk-off assets, such as the US and Australian treasury bond and gold continue to be sold off as money rotates back into risk-on assets such as equities.

The RBA has also indicated they are on target to hold 50% of 5-7 year treasury bills, this is highly aggressive and very dovish support from the Central Bank.

Jobs have also recovered to pre-pandemic levels, which his a great achievement for the Australian economy and government.

Upcoming Risks

The main risk coming up in the next month will be the expiry of JobKeeper at the end of March.

However, this is of less concern now considering the strong job recovery we’ve had to pre-pandemic levels.

Even though it is still too early to tell as to whether this will be of major concern, it is prudent to keep an eye on how this will affect the unemployment rate.

Options volatility is currently still elevated, averaging at about 14%, which is 4% higher than normal pre-pandemic levels.

This indicates that there is quite a bit of caution with investors happy to pay a premium for downside insurance.

The Australian Dollar is also range-bound at the 0.77 level, with the positive correlation between the market and AUD starting to break.

With such a strong AUD, Australian assets are looking expensive which could dampen appetite for our market from international investment.

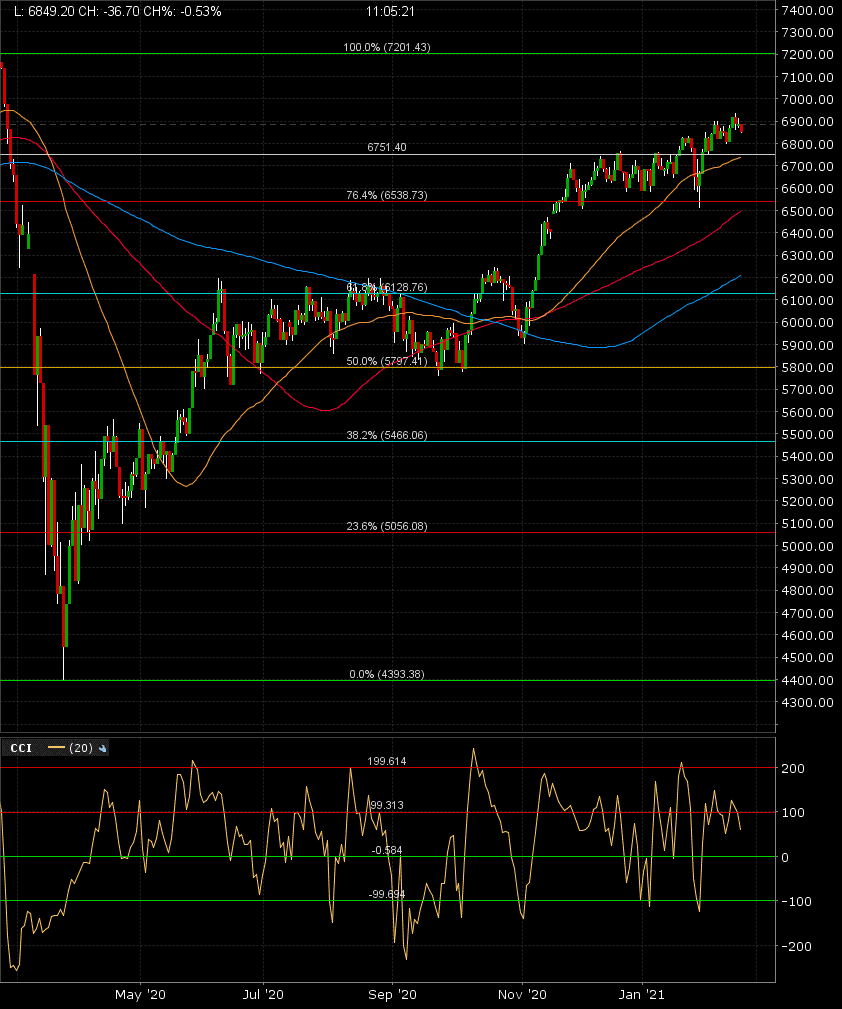

Short-term Technical View

The market is looking neutral to bearish and is due for a pullback.

At the time of writing, options premiums are pricing in a 65% chance the market will retest the 6750 support level and a 40% chance it will revisit the 6550 support level in the next month or so.

Momentum is also starting to fade with a divergence between CCI (Commodity Channel Index) making lower highs whilst the market continued to trend up.

With a pullback to the previous support levels, we will look to start closing our short hedge positions and increasing our long exposure.