The Australian markets had a bittersweet week which ended with the market in the red. Last week’s action was driven by a 25 bps hike by the RBA, stubbornly high inflation in the US, and poor economic data out of China.

The long-term implications of high rates sparked recessionary fears among investors globally, also contributing to a weakening of oil prices.

Geopolitically, Putin and his warning of a nuclear war caused nervous jitters in sentiment.

On the flip side, continued steps in the relaxation of COVID restrictions and reopening measures from Chinese officials kept commodity prices strong.

Sectorally, only Materials posted a 1.87% gain for the week. While Consumer Staples ended flat, all other sectors ended in negative territory.

The biggest losers were Technology (-4.87%), Energy (-3.31%), Financials (-2.57%) and Telecom (-2.00%).

The ASX200, ASX300, and ASX Ordinaries ended the week down 1.21%, 1.28%, and 1.3%, respectively.

Table of Contents

Last Week In ASX Stocks

ASX Materials Index (ASX:XMJ)

As we mentioned, the ASX Materials Index (ASX:XMJ) had a strong week at 1.87% up, largely driven by bullish commodities prices from China’s reopening drive.

Iron ore prices closed at multi-month highs while new energy commodities were weak due to poor economic sentiment.

In sector news, mining major Glencore announced that its plans for a coal mining project in Queensland were being put on hold indefinitely.

Gold miners had a decent week owing to strong prices.

| Week Performance | |

|---|---|

| Major Miners | |

| BHP Group Ltd (ASX: BHP) | 3.76% |

| Rio Tinto Ltd (ASX: RIO) | 4.66% |

| Fortescue Metals (ASX: FMG) | 8.69% |

| Mineral Resources (ASX: MIN) | 0.75% |

| South32 (ASX: S32) | 0.00% |

| New Energy Miners | |

| Pilbara Minerals Ltd (ASX: PLS) | -8.02% |

| Allkem (ASX: AKE) | -8.96% |

| Lynas Rare Earths (ASX: LYC) | -5.54% |

| OZ Minerals (ASX: OZL) | 0.07% |

| Lake Resources (ASX: LKE) | -8.74% |

| Sayona Mining (ASX: SYA) | -8.51% |

| IGO Ltd (ASX: IGO) | -7.96% |

| Gold Miners | |

| Newcrest Mining (ASX: NCM) | 1.38% |

| Northern Star Resources (ASX: NST) | 0.54% |

| Evolution Mining (ASX: EVN) | 3.12% |

| Uranium Miners | |

| Paladin Energy (ASX: PDN) | -11.80% |

| Boss Resources Ltd (ASX: BOE) | -10.57% |

The ASX Energy Index (ASX:XEJ)

The ASX Energy Index (ASX:XEJ) had a poor week ending lower by 3.31% as oil prices cratered on a poor macro outlook.

In sector news, Santos announced a further A$350 million stock buyback while Beach Energy backtracked from a bidding war involving Warrego Energy.

Lastly, Andrew Forrest’s Squadron Energy acquired CWP Renewables for A$4 billion.

| Week Performance | |

|---|---|

| Majors | |

| Woodside Energy (ASX: WDS) | -4.28% |

| Santos (ASX: STO) | -1.26% |

| Beach Energy (ASX: BPT) | -7.78% |

| Coal Producers | |

| Whitehaven Coal (ASX: WHC) | -0.51% |

| Stanmore Coal (ASX: SMR) | -3.02% |

| New Hope Corporation (ASX: NHC) | 0.87% |

| Coronado Global (ASX: CRN) | 1.50% |

| Yancoal Australia (ASX: YAL) | 1.41% |

The ASX Financials Index (ASX:XFJ)

The ASX Financials Index (ASX:XFJ) declined 2.57%, despite the RBA’s 25bps hike last week being well-anticipated.

The sector was largely in the red with insurers being the only sub-sector to close higher.

The mood was somber as multiple data points showed sliding home prices and poor festive season sales.

To add to downbeat sentiment, Q3 GDP lagged consensus and showed that most of the growth was attributible to higher prices and wages, not demand.

In other news, all 4 major banks lifted variable mortgage rates in line with the RBA’s 25 bps hike.

| Week Performance | |

|---|---|

| Major Banks | |

| Commonwealth Bank Australia (ASX: CBA) | -1.84% |

| National Australia Bank (ASX: NAB) | -3.79% |

| Macquarie (ASX: MQG) | -6.77% |

| ANZ Banking Group (ASX: ANZ) | -4.10% |

| Westpac Banking (ASX: WBC) | -1.35% |

| Regional Banks | |

| Bendigo & Adelaide Bank (ASX: BEN) | -0.66% |

| Bank Of Queensland (ASX: BEN) | -2.93% |

| Wealth Managers | |

| AMP (ASX: AMP) | 0.37% |

| Pendal (ASX: PDL) | -0.40% |

| Magellan Financial Group (ASX: MFG) | -6.54% |

| Platinum Asset Management (ASX: PTM) | -2.23% |

| Insurers | |

| Insurance Australia Group (ASX: IAG) | 1.70% |

| Suncorp (ASX: SUN) | 1.99% |

| QBE Insurance Group (ASX: QBE) | 0.23% |

ASX Industrials Index (ASX:XNJ)

The worsening macro outlook also affected the ASX Industrials Index (ASX:XNJ) which lost 1.96%.

In big news from the sector, Downer EDI (ASX: DOW) plunged a staggering 25.85% after revealing accounting misstatements to the tune of A$30 million – A$40 million over the past three years.

There were other regulatory crackdowns too, such as oil and gas services provider Qteq and steel company Bluescope, both of whom were under the scanner for alleged cartelization.

BlueScope (ASX:BLS) nevertheless ended 2.65% higher.

Consumer regulator ACCC’s Airline Report showed that fares remained elevated due to demand-supply imbalances.

Commodities trader Metcash (ASX: MTS) shot up 2.36% for the week after reporting a 9% rise in 1H profits.

| Week Performance | |

|---|---|

| Industrial Commodities Makers | |

| Boral (ASX: BLD) | -1.96% |

| Brickworks (ASX: BKW) | -2.22% |

| Adbri (ASX: ABC) | -2.03% |

| Industrial Majors | |

| Reece (ASX: REH) | -6.29% |

| Reliance Worldwide (ASX: RWC) | -3.58% |

| Brambles (ASX: BXB) | -0.75% |

| Amcor (ASX: AMC) | -0.17% |

| Infrastructure Companies | |

| Transurban Group (ASX: TCL) | -1.91% |

| Qube (ASX: QUB) | 0.00% |

| Airlines | |

| Qantas Airways (ASX: QAN) | 0.65% |

| Air New Zealand (ASX: AIZ) | -0.69% |

The ASX Consumer Discretionary Index (ASX:XDJ)

The ASX Consumer Discretionary Index (ASX:XDJ) ended the week lower by 1.94% after data showed slowing consumer demand.

Australian festive season sales figures showed serious weakness as Black Friday sales this year lagged 2019 by 10% and 2020 by 20%.

Persistent rate hikes are evidently affecting household finances now, and therefore spending, it appears.

The sector was also marred by controversy with both Star Entertainment and Skycity Casinos being pulled up on money laundering charges.

The former was slapped with a A$100 million fine.

| Week Performance | |

|---|---|

| Travel Companies | |

| Webjet (ASX: WEB) | -1.25% |

| Corporate Travel (ASX: CTD) | -8.74% |

| Flight Centre (ASX: FLT) | -5.89% |

| Entertainment and Hospitality | |

| Star Entertainment (ASX: SGR) | -3.05% |

| Skycity Entertainment (ASX: SKC) | -2.34% |

| Retailers | |

| Kogan.com (ASX: KGN) | -5.95% |

| Temple & Webster Group Ltd (ASX: TPW) | -8.82% |

| JB Hi-Fi (ASX: JBH) | -0.67% |

| Harvey Norman Holdings (ASX: HVN) | -0.46% |

| Consumer Durables | |

| Breville Group (ASX: BRG) | -4.80% |

| Food Brands | |

| Domino’s Pizza Enterprises (ASX: DMP) | -1.60% |

| Collins Foods (ASX: CKF) | -5.34% |

The ASX Consumer Staples Index (ASX:XSJ)

The ASX Consumer Staples Index (ASX:XSJ) ended the week nearly flat at 0.37% up.

There was no news from the sector other than record fruit and vegetable exports from Australia this year of A$72 billion.

| Week Performance | |

|---|---|

| Food Producers | |

| Tassal Group (ASX: TGR) | 0.00% |

| Graincorp (ASX: GNC) | 0.50% |

| Elders (ASX: ELD) | -3.94% |

| Costa Group Holdings Ltd (ASX: CGC) | -2.60% |

| Bega Cheese (ASX: BGA) | -0.55% |

| Majors | |

| Wesfarmers (ASX: WES) | -1.11% |

| Woolworths (ASX: WOW) | 0.00% |

| Coles Group (ASX: COL) | 0.30% |

| Processed Foods | |

| A2 Milk (ASX: A2M) | 4.42% |

| Bubs Australia (ASX: BUB) | -3.12% |

The ASX Technology Index (ASX:XTX)

The ASX Technology Index (ASX: XTX) closed the week down a painful 4.87%, a big casualty of this week’s poor macro sentiment and rate hike.

In sector news, Bigtincan Holdings (ASX:BTH) tanked nearly 26% after going ahead with its A$35 million fundraising despite objections from major shareholder and buyout suitor SQN.

Link Holdings (ASX:LNK) slumped 2.88% after calling off its acquisition by Dye and Durham.

This week’s 25 bps hike took a big toll on BNPL players.

Video Technology company Atomos (ASX:AMS) was down 25.29% this week as Black Friday sales came in much lower than expected.

Another major loser this week was enterprise networking provider Megaport (ASX:MP1), which crashed 7.71% on a weak demand outlook including cloud.

| Week Performance | |

|---|---|

| Platform Companies | |

| REA Group (ASX: REA) | -4.65% |

| Carsales.Com (ASX: CAR) | -6.67% |

| Domain Australia (ASX: DHG) | -7.28% |

| SaaS | |

| Xero (ASX: XRO) | -6.84% |

| Nuix (ASX: NXL) | -6.21% |

| Wisetech Global (ASX: WTC) | -7.71% |

| Appen Ltd (ASX: APX) | -15.36% |

| Datacenters and Semiconductors | |

| NextDC (ASX: NXT) | -1.61% |

| Altium (ASX: ALU) | -4.06% |

| BNPL | |

| Block (ASX: SQ2) | -6.47% |

| Sezzle (ASX: SZL) | -8.93% |

| Moneyme (ASX: MME) | -10.29% |

| Zip (ASX: ZIP) | -5.48% |

The ASX Healthcare Index (ASX:XHJ)

The ASX Healthcare Index (ASX:XHJ) ended the week lower by 1.98%.

Equipment makers were down owing to a poor global demand outlook while care providers were reeling from lower revenues from declining testing volumes.

In sector news, Healius announced the A$140 million sale of 11 hospitals to Nexus Hospitals.

| Week Performance | |

|---|---|

| Care Providers | |

| Primary Health Care/Healius (ASX: HLS) | -4.95% |

| Fisher & Paykel Healthcare (ASX: FPH) | -5.87% |

| Ramsay Health Care (ASX: RHC) | -0.41% |

| Equipment Makers | |

| Sonic Healthcare (ASX: SHL) | -6.18% |

| Resmed (ASX: RMD) | -4.22% |

| CSL (ASX: CSL) | -1.14% |

| Cochlear (ASX: COH) | -3.16% |

| Biotech | |

| Imugene Ltd (ASX: IMU) | 0.00% |

| Mesoblast (ASX: MSB) | -14.48% |

The ASX Real Estate Index (ASX:XPJ)

The ASX Real Estate Index (ASX:XPJ) took a 1.3% hit this week due to rising rates and poor retail sales over the holiday season so far.

There was no news from the sector.

| Week Performance | |

|---|---|

| Majors | |

| Goodman Group (ASX: GMG) | -1.25% |

| Charter Hall Group (ASX: CHC) | -6.08% |

| Dexus (ASX: DXS) | 1.26% |

| Scentre (ASX: SCG) | -1.71% |

The ASX Telecom Index (ASX:XTJ)

The ASX Telecom Index (ASX:XTJ) was down in line with the broader market ending 2% lower.

In sector news, the government-owned National Broadband Network, which sells wholesale capacity to telecom companies, is proposing to hike prices to recoup investments in the network.

Thus, consumer broadband prices are slated to increase.

The new NBN pricing proposal will increase prices on slower but mass-market market broadband plans while decreasing the prices on faster and more expensive ones.

| Week Performance | |

|---|---|

| Telstra Corporation (ASX: TLS) | 0.00% |

| TPG Telecom (ASX: TPG) | 1.20% |

| Aussie Broadband (ASX: ABB) | -11.66% |

| Chorus (ASX: CNU) | 1.99% |

| Spark New Zealand (ASX: SPK) | 3.10% |

| Seek Ltd. (ASX: SEK) | -5.91% |

| Macquarie Telecom Group (ASX: MAQ) | -2.51% |

ASX Utilities Index (ASX:XUJ)

Lastly, the ASX Utilities Index (ASX:XUJ) was bearish and closed 1.94% in the red.

There was no news from the sector.

| Week Performance | |

|---|---|

| Majors | |

| APA Group (ASX: APA) | -3.10% |

| Origin Energy (ASX: ORG) | -1.27% |

| AGL Energy (ASX: AGL) | -0.62% |

This Week In ASX Stocks

No major companies are due to declare earnings next week.

New ASX Listings

| Name | Date | Ticker | Business | Amount Raised | Price/Share |

|---|---|---|---|---|---|

| Desoto Resources | 16th Dec | ASX: DES | Mineral Exploration | A$12M | A$0.20 |

| Mackerel Metals | 5th Dec | ASX: MKM | Mining In WA, Queensland, and NSW | A$10M | A$0.30 |

Market and Economic Outlook

Last Week’s Print

The week kicked off on Tuesday with the RBA interest decision, which came in as expected at 25bps, taking Australia’s cash rate to a multi-decade high of 3.1%.

The rate statement showed that the central bank expects inflation to peak at around 8% at the end of this quarter and that the labor market remained very strong.

In an ominous sign to bulls, Chinese economic data surprised sharply to the downside with exports contracting 0.3% in November while YoY growth came in at 8.7%, marking the biggest decrease in 30 months.

Price adjusted exports contracted 6.8% in dollar terms.

Lastly, imports declined 10.6% in dollar-terms, painting a dismal picture of domestic Chinese demand.

On Wednesday, Australian Q3 GDP printed at 0.6%, underperforming both expectations of 0.7% and last quarter’s 0.9% figure.

YoY growth stood at 5.9%.

Over the quarter, aggregate wages were the biggest driver of growth as they rose 3.2%, marking the biggest increase since the December 2006 quarter.

Analysts expect that this quarter could be the last positive GDP reading for the foreseeable future as rate hikes will soon start to eat into demand and damage household balance sheets.

Many borrowers are facing a mortgage cliff, post which their mortgages will re-adjust to the current variable rate.

This could result in a 65% bump in monthly payments.

On Friday, US Initial Jobless Claims came in at 230k, exceeding expectations of 225k.

Though the jobless filings surged to a 11-month high, the markets hoped the data may temper hawkish sentiment at the Fed, due to meet next week.

Finally, US PPI (Producer Price Index) came in hotter than expected at 0.3% MoM and 7.4% YoY, showing that inflation is still sticky.

On other news, Canada raised its rate by 0.5% to a decade-plus high of 4.25% but also signalled that it is keen on pausing hikes in the medium-term till they have more economic visibility.

Next Week

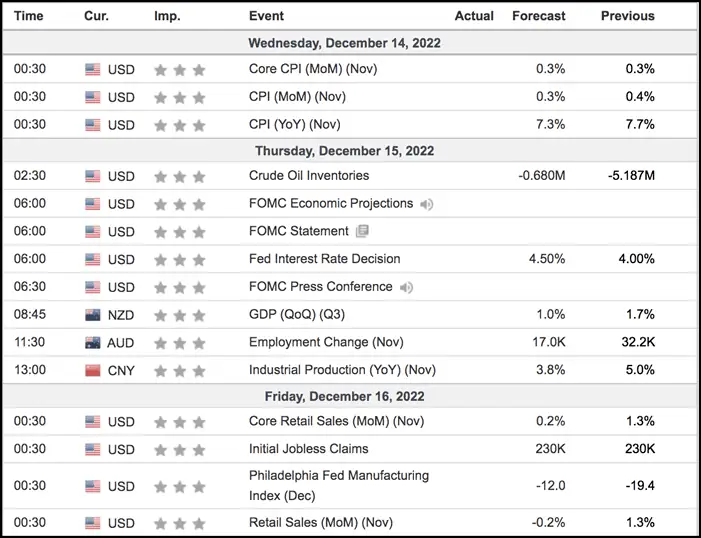

Important data events for next week are as follows :

Forex Outlook

AUD/USD

AUD/USD closed at 0.67949, almost unchanged from the previous weekly close of 0.67938, after retracting from a high of 0.68526.

Technically, the current uptrend of the pair has again taken pause at the significant resistance zone of 0.68000 to 0.68500.

The RBA belied hopes of a pause in rate hikes, and pushed through a 25bps hike with accompanying hawkish inflation commentary by its Governor.

Australian GDP came in at 0.6%, though it disappointed on expectations and fell short of the previous quarter’s 0.9%.

However, post the RBA action, AUD/USD responded with three back-to-back green candles to close the week poised at, and respecting, a significant resistance.

The US Fed will meet next week and the consensus is for a 0.50% rate hike.

It is a moot point how much the recent hotter-than-expected PPI print will affect the bank’s decision, however.

Meanwhile, some of the US dollar’s impact on the Aussie may be affected by China’s positive policy moves to push back on the country’s economic slowdown.

Stimulus in China will add to the Australian currency’s allure as a risk-on asset.

In sum, AUD/USD is critically poised amidst conflicting factors.

Technical guideposts say it is likely to head higher if it manages to surpass the 0.68000 to 0.68500 zone.

AUD/NZD

AUD/NZD ended the week at 1.05853, and below the previous week’s close of 1.05949 after touching a low of 1.05335.

Also, the last day’s close has bearish portent for the coming week.

It may also be noted that 1.05038 is a hugely important line in the sand for AUD/NZD, being a support zone that has largely played its part since over three decades.

On the monthly chart below, AUD/NZD has sketched its fall from 1.15000 with a bearish three-black-crow candlestick pattern that is shaping to challenge the 1.05038 support line.

Meanwhile, fundamentally, the hawkish “come-if-recession-may” stance of the RBNZ is at odds with the comparatively softer positioning of the RBA and US Fed, and it appears that situation will continue for a while – to the detriment of AUD/NZD.

If AUD/NZD breaks down through the 1.05038 line, expect 1.03000.