The Australian markets had a bumper week owing to multiple events and closed at a five-month high.

The markets were slightly bullish but largely rangebound leading up to Thursday, but a better-than-expected US CPI print, which showed the first signs of a moderation in inflation, together with a pivot by China on multiple COVID-zero rules, sent markets soaring.

The US Dollar also fell in tandem with rate hike fears, giving commodities, and the ASX Materials sector, a fillip.

Sectorally on the ASX, the Utilities Sector was the star performer last week, surging higher by over 15% based on a gain of 32% in Origin Energy after it was the target of an $18.4 billion buyout offer by private equity major Brookfield.

Other top gainers were Materials (+8.63%), Real Estate (+5.61%), and Healthcare (+5.6%).

Only the Energy sector (-2.42%) ended the week in the red.

The ASX200, ASX300, and ASX Ordinaries closed the week up 3.85%, 3.8%, and 3.68%.

Table of Contents

Last Week In ASX Stocks

ASX Materials Index (ASX:XMJ)

The ASX Materials Index (ASX:XMJ) chalked up a massive 8.63% gain for the week owing to a strong risk-on sentiment driven by cooling inflation, a weaker dollar, and bullish commodities prices due to China’s relaxations on zero-Covid.

A significant aid package to China’s ailing real estate sector also abetted bullish sentiments.

Lithium miners were lifted after Macquarie lifted its price forecasts for the new energy metal.

Gold miners enjoyed higher underlying prices as moderating inflation drove the dollar lower, thus allowing gold to breach recent highs.

| Week Performance | |

|---|---|

| Major Miners | |

| BHP Group Ltd (ASX:BHP) | 9.15% |

| Rio Tinto Ltd (ASX:RIO) | 10.59% |

| Fortescue Metals (ASX:FMG) | 11.91% |

| Mineral Resources (ASX:MIN) | 11.24% |

| South32 (ASX:S32) | 7.35% |

| New Energy Miners | |

| Pilbara Minerals Ltd (ASX:PLS) | 4.27% |

| Allkem (ASX:AKE) | 8.30% |

| Lynas Rare Earths (ASX:LYC) | 7.55% |

| OZ Minerals (ASX:OZL) | 5.72% |

| Lake Resources (ASX:LKE) | 4.19% |

| Sayona Mining (ASX:SYA) | 6.52% |

| IGO Ltd (ASX:IGO) | 10.76% |

| Gold Miners | |

| Newcrest Mining (ASX:NCM) | 13.97% |

| Northern Star Resources (ASX:NST) | 16.78% |

| Evolution Mining (ASX:EVN) | 29.85% |

| Uranium Miners | |

| Paladin Energy (ASX:PDN) | -0.59% |

| Boss Resources Ltd (ASX:BOE) | -3.85% |

ASX Energy Index (ASX:XEJ)

The ASX Energy Index (ASX:XEJ) had a forgettable week, closing lower by 2.42% with its constituents plagued by production and supply outlook issues.

While crude prices were soft for the better part of the week due to a big buildup of US inventories, prices trended higher on news of China’s reopening for business. Santos tanked after warning of poor production.

Whitehaven Coal’s commentary about adverse weather impact on production sent the entire coal sector tumbling while Coronado Global was sold off after it ended merger talks with Peabody Energy.

The coal sector was also impacted by the Australian Workers Union’s call for price caps on coal burnt for domestic electricity, as well as action on gas prices.

| Weekly Change | |

|---|---|

| Majors | |

| Woodside Energy (ASX:WDS) | 0.86% |

| Santos (ASX:STO) | -6.25% |

| Beach Energy (ASX:BPT) | 7.98% |

| Coal Producers | |

| Whitehaven Coal (ASX:WHC) | -19.36% |

| Stanmore Coal (ASX:SMR) | -19.68% |

| New Hope Corporation (ASX:NHC) | -20.00% |

| Coronado Global (ASX:CRN) | -15.42% |

| Yancoal Australia (ASX:YAL) | -7.43% |

ASX Financials Index (ASX:XFJ)

The ASX Financials Index (ASX:XFJ) ended the week higher by 1.9% but underperformed the broader market.

Westpac underwhelmed the markets following results that showed a 1.4% dip in earnings and its commentary about slower lending volume in FY23 due to a tougher economic environment.

NAB echoed the outlook on Westpac. Fund manager Perpetual (ASX: PPT) soared 18.3% after rejecting a bumped-up acquisition offer from Regal Partners while its previous suitor, Pendal, slumped further.

Medical Insurer Medibank (ASX:MPL) fell 0.18% after announcing that part of its hacked data had found its way onto the dark web and that it will not negotiate with the hackers.

ANZ fell after it traded ex-dividend.

| Weekly Change | |

|---|---|

| Major Banks | |

| Commonwealth Bank Australia (ASX:CBA) | 2.68% |

| National Australia Bank (ASX:NAB) | -2.40% |

| Macquarie (ASX:MQG) | 5.24% |

| ANZ Banking Group (ASX:ANZ) | -3.37% |

| Westpac Banking (ASX:WBC) | -0.25% |

| Regional Banks | |

| Bendigo & Adelaide Bank (ASX:BEN) | 0.33% |

| Bank Of Queensland (ASX:BEN) | 1.23% |

| Wealth Managers | |

| AMP (ASX:AMP) | 3.19% |

| Pendal (ASX:PDL) | -6.87% |

| Magellan Financial Group (ASX:MFG) | 4.60% |

| Platinum Asset Management (ASX:PTM) | -0.28% |

| Insurers | |

| Insurance Australia Group (ASX:IAG) | -0.20% |

| Suncorp (ASX:SUN) | 3.92% |

| QBE Insurance Group (ASX:QBE) | -0.55% |

ASX Industrials Index (ASX:XNJ)

The ASX Industrials (ASX:XNJ) also notched up an impressive 2.44%, but still underperformed the broad market.

However, sector sentiment was strong due to cooling inflation and its effect on the US Fed’s future rate trajectory, along with a better demand outlook from China.

However, James Hardie Industries (ASX:JHX), one of Australia’s largest cement makers, declined about 11% for the week after issuing weak guidance premised on a slowing housing market in Europe, the Asia Pacific, and North America.

| Weekly Change | |

|---|---|

| Industrial Commodities Makers | |

| Boral (ASX:BLD) | 1.05% |

| Brickworks (ASX:BKW) | 0.24% |

| Adbri (ASX:ABC) | 4.88% |

| Industrial Majors | |

| Reece (ASX:REH) | 4.28% |

| Reliance Worldwide (ASX:RWC) | 1.31% |

| Brambles (ASX:BXB) | 0.44% |

| Amcor (ASX:AMC) | 1.98% |

| Infrastructure Companies | |

| Transurban Group (ASX:TCL) | 3.26% |

| Qube (ASX:QUB) | 3.36% |

| Airlines | |

| Qantas Airways (ASX:QAN) | 0.00% |

| Air New Zealand (ASX:AIZ) | -1.33% |

ASX Consumer Discretionary Index (ASX:XDJ)

The ASX Consumer Discretionary Index (ASX:XDJ) rode the bullish wave well to end the week 4.41% higher.

All sub-sectors were largely green. Lottery Corporation (ASX:TLC) jumped 4.43% after a strong performance and rosy commentary on the business outlook at its AGM.

On the other hand, News Corp (ASX:NWS) was down nearly 11% on underwhelming results but recovered on Friday to close 1.3% in the green.

Temple and Webster (ASX:TPW) and fellow retailer Kogan (ASX:KGN) were down on broker downgrades.

However, footwear/apparel brand owner Accent Group (ASX:AX1) rocketed 7.35% after a very strong Q1 trading update.

| Weekly Change | |

|---|---|

| Travel Companies | |

| Webjet (ASX:WEB) | 6.02% |

| Corporate Travel (ASX:CTD) | 4.16% |

| Flight Centre (ASX:FLT) | 0.41% |

| Entertainment and Hospitality | |

| Star Entertainment (ASX:SGR) | -0.34% |

| Skycity Entertainment (ASX:SKC) | 0.77% |

| Retailers | |

| Kogan.com (ASX:KGN) | -2.66% |

| Temple & Webster Group Ltd (ASX:TPW) | -23.37% |

| JB Hi-Fi (ASX:JBH) | 2.31% |

| Harvey Norman Holdings (ASX:HVN) | 1.97% |

| Consumer Durables | |

| Breville Group (ASX:BRG) | 6.85% |

| Food Brands | |

| Domino’s Pizza Enterprises (ASX:DMP) | 12.50% |

| Collins Foods (ASX:CKF) | 7.55% |

ASX Consumer Staples Index (ASX:XSJ)

The ASX Consumer Staples Index (ASX:XSJ) was more or less in line with the broader market closing higher by 3.61% for the week and all sub-sectors ending in the green.

In sector news, A2M Milk (ASX:A2M) announced a NZ$150 million share buyback.

| Weekly Change | |

|---|---|

| Food Producers | |

| Tassal Group (ASX:TGR) | 0.00% |

| Graincorp (ASX:GNC) | 1.47% |

| Elders (ASX:ELD) | 1.15% |

| Costa Group Holdings Ltd (ASX:CGC) | 5.00% |

| Bega Cheese (ASX:BGA) | 5.92% |

| Majors | |

| Wesfarmers (ASX:WES) | 5.73% |

| Woolworths (ASX:WOW) | 5.31% |

| Coles Group (ASX:COL) | 4.88% |

| Processed Foods | |

| A2 Milk (ASX:A2M) | 7.75% |

| Bubs Australia (ASX:BUB) | -1.33% |

ASX Technology Index (ASX:XTX)

One of the biggest beneficiaries of cooling inflation in the US was the ASX All Technology Index (ASX:XTX).

Markets took it as the first conclusive sign of rate hikes proving effective at reining in inflation and hoped it might warrant some dovishness from the Fed moving forward.

The XTX Index jumped 5.6% after the CPI report, but a lackluster performance from the sector the rest of the week meant it gained just 0.8% in the green.

BNPL players rocketed while most sub-sectors ended in the green.

Xero (ASX:XRO) fell sharply after underperforming guidance while Computershare (ASX:CPU) rose 1.51% for the week after boosting guidance.

Domain Holdings (ASX:DHG) fell after it issued weak outlook commentary at its AGM.

| Weekly Change | |

|---|---|

| Platform Companies | |

| REA Group (ASX:REA) | 2.17% |

| Carsales.Com (ASX:CAR) | 1.97% |

| Domain Australia (ASX:DHG) | -8.33% |

| SaaS | |

| Xero (ASX:XRO) | -6.41% |

| Nuix (ASX:NXL) | 6.31% |

| Wisetech Global (ASX:WTC) | -0.17% |

| Appen Ltd (ASX:APX) | 5.62% |

| Datacenters and Semiconductors | |

| NextDC (ASX:NXT) | 7.47% |

| Altium (ASX:ALU) | 0.92% |

| BNPL | |

| Block (ASX:SQ2) | 4.00% |

| Sezzle (ASX:SZL) | 7.69% |

| Moneyme (ASX:MME) | 2.86% |

| Zip (ASX:ZIP) | 12.12% |

ASX Healthcare Index (ASX:XHJ)

The ASX Healthcare Index (ASX:XHJ) performed very well gaining 5.6% for the week.

Sector major Ramsay Healthcare (ASX:RHC) shot up a huge 6.97% after a very bullish Q1 performance update and said activity levels improved across all regions in the quarter as COVID-19 cases declined.

| Weekly Change | |

|---|---|

| Care Providers | |

| Primary Health Care/Healius (ASX:HLS) | 2.98% |

| Fisher & Paykel Healthcare (ASX:FPH) | 0.39% |

| Ramsay Health Care (ASX:RHC) | 6.97% |

| Equipment Makers | |

| Sonic Healthcare (ASX:SHL) | 4.16% |

| Resmed (ASX:RMD) | 3.02% |

| CSL (ASX:CSL) | 6.06% |

| Cochlear (ASX:COH) | 7.79% |

| Biotech | |

| Imugene Ltd (ASX:IMU) | -2.50% |

| Mesoblast (ASX:MSB) | -3.68% |

ASX Real Estate Index (ASX:XPJ)

The ASX Real Estate Index (ASX:XPJ), also a big beneficiary of a dovish Fed due to the leveraged nature of the sector, shot up 5.61%.

Almost all major players ended in positive territory.

| Weekly Change | |

|---|---|

| Majors | |

| Goodman Group (ASX:GMG) | 8.56% |

| Charter Hall Group (ASX:CHC) | 6.34% |

| Dexus (ASX:DXS) | 5.95% |

| Scentre (ASX:SCG) | 2.79% |

ASX Telecom Index (ASX:XTJ)

The ASX Telecom Index (ASX:XTJ) rose 1.86% for the week but underperformed the market.

No major news came from the sector and most players ended marginally in the green.

| Weekly Change | |

|---|---|

| Telstra Corporation (ASX:TLS) | -2.67% |

| TPG Telecom (ASX:TPG) | 0.05% |

| Aussie Broadband (ASX:ABB) | -0.21% |

| Chorus (ASX:CNU) | 2.56% |

| Spark New Zealand (ASX:SPK) | 1.87% |

| Seek Ltd. (ASX:SEK) | 4.78% |

| Macquarie Telecom Group (ASX:MAQ) | 1.40% |

ASX Utilities Index (ASX:XUJ)

Lastly, the ASX Utilities Index (ASX:XUJ) closed the week up a huge 15.16% for the week, the bulk of that gain being driven by an $18.4 billion buyout offer for Origin Energy by private equity major Brookfield.

The Origin board welcomed the deal and will endorse it at the next shareholder meeting if there are no competing bids.

Other players in the sector were also up, driven by bullishness in the broader market.

| Weekly Change | |

|---|---|

| Majors | |

| APA Group (ASX:APA) | 4.48% |

| Origin Energy (ASX:ORG) | 32.06% |

| AGL Energy (ASX:AGL) | 7.13% |

This Week In ASX Stocks

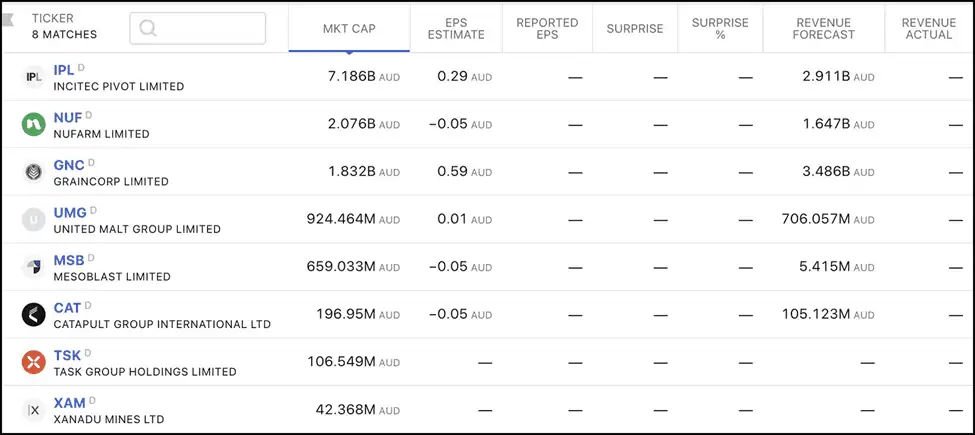

Companies declaring next week are as follows –

New Listings

| Name | Date | Ticker | Business | Amount Raised | Price/Share |

|---|---|---|---|---|---|

| Tiger Tasman Minerals | 14th November | ASX:T1G | New Energy Mining and Exploration | A$8M | A$0.20 |

| Toubani Resources | 16th November | ASX:TRE | Mineral Exploration And Development | A$6.5 | A$0.20 |

Market and Economic Outlook

Last Week’s Print

The major scheduled economic event last week was the market-moving US CPI for October, which came in at a better-than-expected 7.7% against expectations of 7.9% and down from 8.2% in September.

Core CPI, which excludes food and energy, came in at 6.3% YoY, down from 6.6% last month.

This CPI print was pivotal, being the first one to show signs of moderating inflation since the US Fed embarked on its rate hiking cycle, and likely to sow the seeds for a more dovish trajectory on rates.

Later in the day, US Initial Jobless Claims came in at 225k, rising by 7k over last week, but still in the record-low territory.

In other news, China shocked markets on Friday after announcing a slew of relaxations around its COVID-zero policy.

While markets cheered the move and rallied thereafter, COVID in China is far from dead as cases in certain jurisdictions continue to rise.

China also announced a $56 billion aid package to its ailing property sector, giving markets yet another reason to rally.

This Week

Important data events for next week are as follows :

Forex Outlook

AUD/USD

AUD/USD closed at 0.67030, well above the previous weekly close of 0.64682, and after touching a high of 0.67180.

The moderated inflation number out of the US has sparked a global rally in most assets.

It appears our view last week – that risk was making a comeback and a technical reversal may be on the cards – has played out well.

Technically, AUD/USD has carved out a classically perfect Inverted Head-and-Shoulders pattern that heralds a reversal from a downtrend.

The pair has surged past the Neckline of the pattern but respected the resistance line at 0.67100.

Given the size of the rally, there is every chance that a pullback may emerge next week.

However, news has broken on Sunday that China has rolled out its most sweeping rescue package yet for its beleaguered real estate sector.

This is likely to further boost the ‘risk-on’ sentiment and nudge AUD/USD higher.

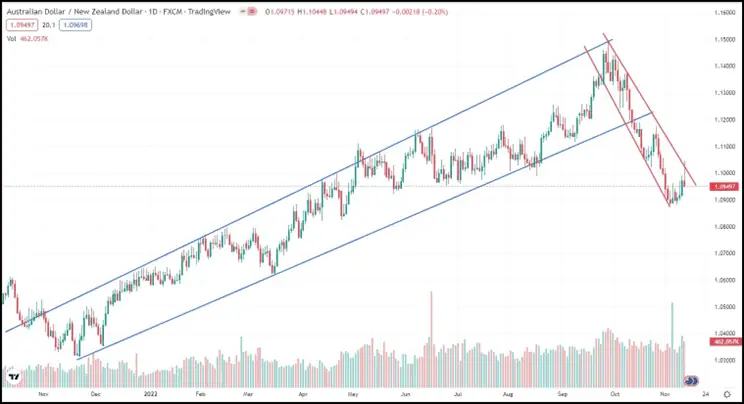

AUD/NZD

AUD/NZD ended the week at 1.09497, and above the previous week’s close of 1.09053, after touching a high of 1.10450.

There has been somewhat of a pullback rally in AUD/NZD last week, as anticipated, amidst a bullish global environment sparked by a somewhat benevolent inflation printout of the US last week.

Meanwhile, strength in the US dollar has evaporated, at least for now, and globally hopes have risen for moderating inflation.

Risk assets, including AUD/NZD are likely to be bid higher.

Accordingly, the pair could make a lunge for 1.11010.