Join the 3,600+ other investors and traders chatting about this in our Facebook group.

Today, we’ll look at how we as investors should handle a market correction or potentially a crash.

The latest market correction is thanks to the markets relatively extreme but not unexpected reaction to the coronavirus outbreak.

Incidentally, I have been saying for over a month now that the market did not treat the potential effects of the virus with respect.

Instead, the market made new highs hand over fist as if the production centre of the world (China) is not in a devastating lockdown.

This is due to a number of reasons. Record low-interest rates, central bank support and lack of other options has forced the market to rally to new irrational heights.

A strong rally such as this meant that the correction tends to be much sharper, as investors look to take profit quickly on jittery bets when there are signs of market weakness.

Table of Contents

Markets actually correct steeply quite often

Case in point, the correction in the market that we are going through right now is pretty steep.

In the broking world, we call this up the escalator and down the elevator.

However, you may have noticed something else – the correction in August was just as steep and almost as deep.

The correction in September 2018, was relatively steep, much deeper and sustained for 3 months.

Corrections, in fact – are more common than you think.

So how should you respond to corrections such as these?

How you shouldn’t respond to a market correction

Firstly, don’t panic.

Markets correct all the time. In fact, statistically, markets will correct twice a year in the 5 to 10% range.

Yes, this can also turn into a full-blown crash; we are due for one.

However, this isn’t the first time the world has gone through something as challenging as the coronavirus.

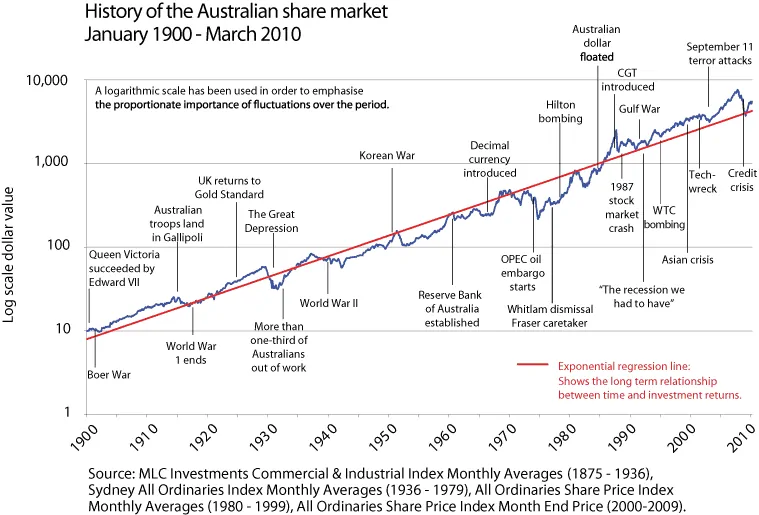

If you think “this time it’s different”, you would have been wrong 100% of the time since 120 years ago.

Yes, there are new factors in play such as too much credit in the world or unconventional methods such as negative interest rates.

However, monetary (interest rates, etc) and fiscal policy (tax rates, etc) are set by central banks and governments respectively – this means that they have full control to keep kicking the can down the road.

And they are very good at kicking the can down the road, for a very long time.

They have been doing it for over 10 years – they can easily do it for another 10.

Trying to pick the top against the central bank is like trying to stand in front of a freight train, not knowing how fast or close it is.

It’s not a wise thing to do.

Secondly, don’t be too greedy or too fearful. Market’s don’t care about your emotional state.

The major sell-off now is driven by an intense fear of how much damage the coronavirus will do to our economy.

The massive rally before the correction from 6,700 to 7,200 was driven by extreme greed.

Incidentally, if you gave in to your greed and bought heavily into the rally above 7,000 points – then gave in to your fear and closed your long positions today at 6,700 points, you would have bought at the top and likely sold near the bottom.

This is a classic example of what you shouldn’t do, buying at the top and selling at the bottom.

Granted, there are good examples of when this needs to be done – such as adding to positions and risk control through stop losses.

However, if you are just a long term or amateur investor, don’t stress yourself with trying to time the market.

And stay away from the screen when you are feeling particularly greedy or fearful.

How you should respond to a market correction

Firstly, we know for a fact that the market trends up and has been doing so for 120 years.

This is through thick and thin – depressions, multiple wars, global political upheavals – the list goes on.

Why does it do that? Quite simply because the world is almost always in an inflationary period.

In fact, central banks have a positive inflation target.

There is one major reason why this is the case – it is to create a positive sentiment feedback loop.

The positive feedback loop works in this way:

- Prices of goods go up, creating higher earnings

- As company earnings go up, their share price rises and wages rise

- As wages rise and asset prices rise, consumers feel more confident to spend

- Higher confidence in spending increases the price of goods, taking us back to number 1

This means that markets and asset prices are in a continuous state of an uptrend. In other words, trade with the trend.

Secondly, thanks to the first fact, central banks will support the market to ensure that we stay in an inflationary period.

Since the central bank controls money flows which are highly correlated to asset prices, we can be certain that the central bank will support the market.

Even though this is not a good mindset to have as it creates moral hazard, this is the current reality.

When central banks and governments loosen monetary and fiscal policy, don’t fight the market and just go with the flow. In other words, buy the dips.

Thirdly, don’t try to time the bottom of the dips

It’s better to just average in or pick a spot and buy it.

Timing the bottom of the dips requires a lot of market knowledge, strategy, experience and most importantly – time.

As an example, we do a combination of these things to try to increase the accuracy we have in terms of timing the bottom.

- Watching all macro news flows globally

- Technical analysis of support levels

- Technical analysis of volume

- Analysis and forecasting of fiscal and monetary policy

- Interest rate, bond yields, gold, volatility and foreign exchange trends

- Money flows between risk-on and risk-off asset types

Even with all this, we almost never get the exact bottom.

Just keep in mind that the moment you buy-in, you will participate in both the upside and downside risk.

Since nobody ever picks the exact bottom, it is almost inevitable that your position will suffer a loss before becoming profitable.

Fourthly, don’t panic sell your long term positions (i.e. blue-chip and ETFs).

The moment that you capitulate to your fear and close your long positions, you lose the ability to participate in the inevitable upside rally.

This is the mistake a lot of people made in 2008. A lot of investors sold right at the bottom when the market was sub 4,000 points and swore never to buy in again.

Since then, the market recovered to 7,000 points at its peak with an average dividend yield of 5-6% a year to boot.

Don’t panic sell positions, especially assets such as ETFs as they are well diversified. If you feel nervous because you are a new investor, don’t look at your positions – they will still be here, long after the correction has completed its course.

Fifthly, diversify and hedge

If you still feel uncomfortable about where the world is headed and want something to hedge, buy some gold.

Gold is one of the best ways to hedge against a market crash. In fact, we have been bullish gold since October.

We were a bit early, but if you bought in then, your gold positions would be winning today.

It’s always good to have a bit of gold in your portfolio. Not only does it act as a hedge against market crashes but it is also a hedge against inflation.

An example I like to give is that an ounce of gold can buy you a (very) nice bike today – just as it was able to buy you a horse and buggy a hundred years ago.

If the price of a bike costs $15,000 in 30 years time – it is very likely that an ounce of gold would be worth that too by then.

For USD exposure gold, use ETF Securities GOLD ETF.

For AUD hedged gold, use the Betashares QAU ETF.

If you are like me and like to hold some of the physical stuff because it’s shiny, you can do that too. Head to your local gold dealer but beware the spread (the difference between the bid/offer price) is really high.

I have also traded Perth Mint PMGOLD on the ASX before. This allows you to redeem your gold directly from the Perth Mint. They are also government guaranteed.

Don’t buy numismatics (i.e. fancy coins) unless you are into gambling the coins extrinsic value as they are priced well above what the gold itself is worth.

If you want to take one more thing out of the equation (i.e. USD currency risk), it’s best to use the QAU ETF or PMGOLD as these are both priced in AUD.

Finally, don’t stress.

The world goes through major events constantly (bushfires, floods, wars, etc) and they are individually out of our control.

If we stressed about things we can’t control, then we would be constantly second-guessing everything that we do.

Humans are very adaptable and so are markets. If I was to make a bet that the market will still be here in 10 years time and higher than it is now, I would be happy to make that bet.

If I am wrong – chances are money and markets will be the least of our worries.