Today, we will revisit gold and why continue to believe gold is still bullish.

The last time we looked at gold was early October 2019, when the gold price was around USD$1500 per ounce.

Today, gold is trading over USD$2,000 thanks to COVID-19 Pandemic.

With the ongoing uncertainty in world markets, we feel gold will continue to be a strong performer and a great uncorrelated hedge to any portfolio.

Table of Contents

Gold on a bullish momentum

The price of gold has traded to a new yearly high in 2020, and this bullish behaviour seems to persist as the Relative Strength Index (RSI) now pushes into the overbought territory.

Since the RSI is an oscillator index, overbought could indicate that the Gold price is ready to break out again.

The run of gold price starts on 31 May 2020, which ran from between USD$1200-$1300 per ounce, the historical average of FY15-FY20, to the current high of just over USD$2000.

As illustrated in the 20Y gold price chart, gold prices haven’t been this high since September 2011.

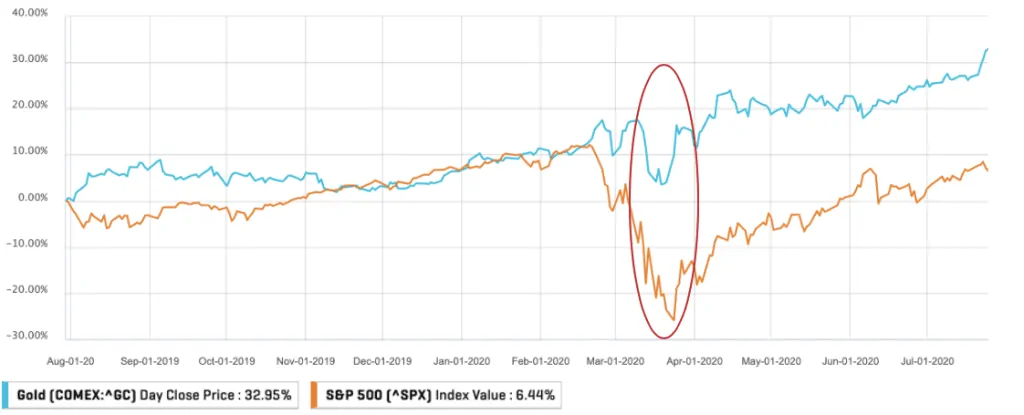

Gold had a remarkable run for last year by growing by over 30%, significantly outperforming all other major asset classes.

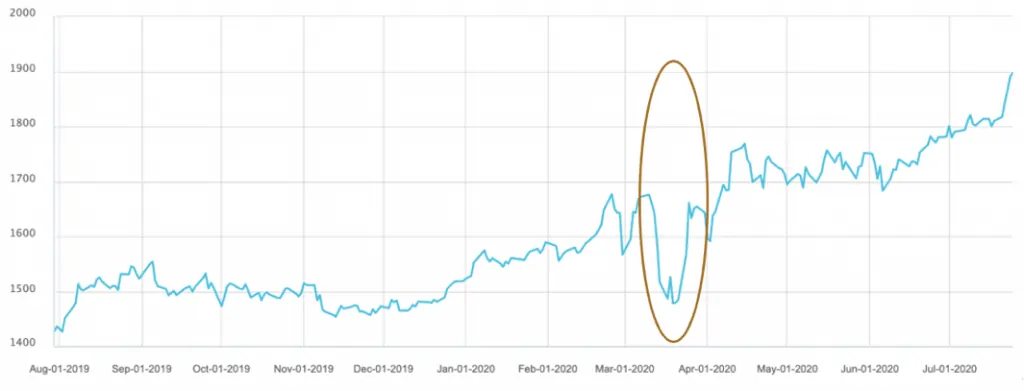

The chart below shows the price movement of gold for the last year and its breakout from the sustained price level.

Gold is currently trading at around USD$2024 an ounce.

As illustrated below, gold has outperformed S&P 500, S&P/ASX 200, and the commodity index in a 20-year horizon.

Specifically, gold prices rose by 26% and the S&P 500 plunged by 56% from its peak during GFC.

For 2020, between mid-Feb and March, Gold gained 12.4%, compared to the decline of 27.8% of S&P/ASX 200.

Gold – 20Y – Historical Performance of Gold, S&P 500, S&P/ASX 200 and Bloomberg Commodity Index

Source: Bloomberg, MF & Co Asset Management Research

Gold – 1Y – Historical Price Chart in USD/oz

Source: S&P Capital IQ, MF & Co Asset Management Research

Gold – 3Y – Historical Performance of Gold & S&P 500

Source: S&P Capital IQ, MF & Co Asset Management Research

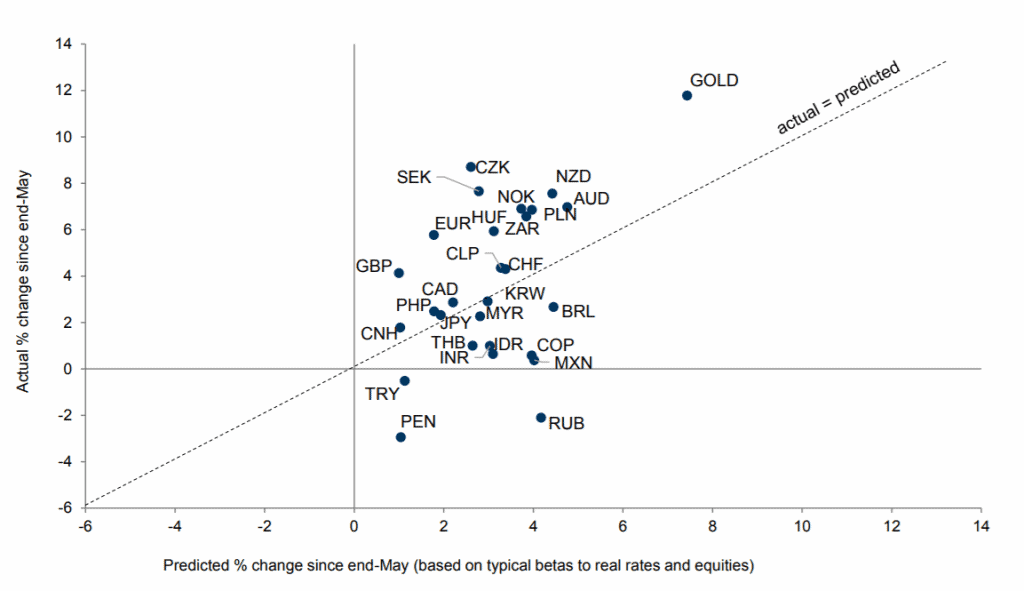

Gold has outperformed all other dollar alternatives

Source: Goldman Sachs Global Investment Research

Gold price fell but recovered due to inflation expectation

“Gold is a way of going long on fear”. – Warren Buffett

The gold price was rising due to fear in mid-March.

Due to the economic volatility surrounding Covid-19, investors have raced to haven assets like gold.

Gold is considered as a hedge against short term volatility and could play a long-term role in a well-diversified portfolio owing to its defensive and growth qualities.

At the onset of COVID-19 breakout and stock market turmoil, gold prices dipped on 16 March 2020.

An easy explanation is that the stock market has crashed so hard and there was so much fear that people needed to liquidate gold to cover their margin calls.

The price of gold fell to USD$1471.4 an ounce during that week of March before bouncing back and it is now trading at a high of USD$1934 an ounce, up by 31% in three months.

However, more factors are coming into play since March.

Inflation expectation has increased against a backdrop of rising geopolitical tensions, elevated US domestic political and social uncertainty, and a growing second wave of COVID-19 related infections.

Combined with a record level of US government debt, people are concerned about the longevity of US dollars as a reserve currency and converting USD into gold.

Gold – 1Y – Historical Performance of Gold & S&P 500

Source: S&P Capital IQ

Gold outlook

When comparing the current gold market to that of the Global Financial crisis (GFC), we saw similar patterns of strong demand for gold and price dynamics during the market turmoil in March.

Moreover, with the US government debt is at a record high level and its benchmark interest rate is at a record low, we maintain that gold price would continue to increase.

A major similarity is a strong demand for Gold.

With economic uncertainty in both these events, investors are moving to gold as a safe asset.

As illustrated below, ETFs have seen their sharpest inflows since the financial crisis, and the net Swiss imports of gold demonstrate that the off-exchange, private demand for gold is rising rapidly.

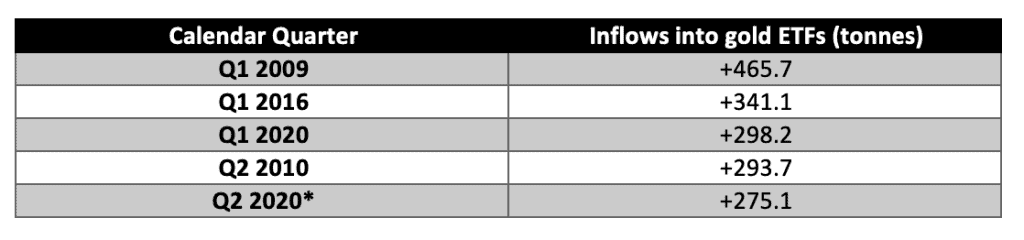

The table below highlights the strong demand for gold and the quarters which saw the highest inflows into gold ETFs.

COVID-19 events ranked 3rd (Q1 2020) and 5th (Q2 2020) for gold demand in history.

Indeed, the Perth Mint sold more than $340 million worth of gold bullion in April 2020, a yearly increase of 500%.

Gold – Gold ETFs Net Inflow vs 5 Yr Real rate

Source: Bloomberg, Goldman Sachs Global Investment Research

Gold – 7Y – Net Swiss Imports of Gold

Source: WGC, Goldman Sachs Global Investment Research

Gold – The highest Gold ETFs Inflow in History

Source: The Perth Mint, World Gold Council

Similar gold price dynamics during market volatility.

Gold prices were heading strong at the onset of the GFC, suffered a pullback as investors needed immediate cash, and then rebounded.

A similar dynamic has been observed with gold performing extremely well at the onset of COVID-19, suffering a pullback in March 2020, and then recovering its losses completely.

The government debt level is much higher.

As per an April 2020 update from the IIF (Institute of International Finance), global debt levels have topped USD 225 trillion, more than 322% of the global GDP.

This is nearly 40% higher than the debt level during the GFC.

More importantly, the US government debt to GDP ratio is projected to increase further from 106% to 127% 2019-2020.

The expanded balance sheet and vast money creation of US spurs debasement fears of USD, on which gold is denominated, and builds inflation expectation that after the economy returns to normal, governments are incentivized to allow the inflation to go up to reduce the debt burden.

Gold – Global Gross Government Debt Projections

Source: Economist

Gold – 10Y – US Government Debt in USD/millions

Source: U.S. Department of the Treasury

Systematic decline of the benchmark interest rates

The US 10-year treasury yields averaged 4.1% during 2007 and 2008.

And on 23rd July, the US 10-year yield is sitting at 0.60%, a huge decline of almost 89%.

This problem is not unique to the U.S. During the GFC, the cash rate in Australia never dropped below 3% and today the cash rate is 0.25%, with yields suggesting there will be further cuts in the future.

This means that prospective safe returns for investors are far lower than they’ve been in the past.

How to invest in gold

There are several ways to invest in gold:

Physical Gold

You could purchase physical gold and pay storage fees by yourself. In this case, you eliminate third party risk, and the investment perfectly tracks the gold price.

Keep in mind, however, that physical gold is not very liquid, and you should not expect to be able to buy and sell it as frequently as in the case of an ETF.

Physical gold is advisable more for value preservation, and its higher security compared to the risks from financial markets.

Given these factors, invest in physical gold only if you have a timeframe of 8 to 10 years, and can do without any recurring return during this period.

Also, carefully consider the problem of keeping the gold safe.

Gold ETF

Investors not wishing to deal with physical gold may Instead buy a gold Exchange Traded Fund (ETF).

These funds meticulously track the gold price, thereby giving the investor all of the metal’s returns without the hassle of physical storage. ETF’s are also a more economical way to invest.

More speculatively oriented investors could buy ETF’s that offer leverage. Therefore, the investor could gain (or lose) 2X or 3X times the movement in the underlying gold price.

There are three 100% gold-bullion backed ETFs listed on the ASX:

- BetaShares Gold Bullion ETF [ASX: QAU]

- ANZ ETFS Physical Gold ETF Fund [ASX: ZGOL]

- ETFS Metal Securities Australia Ltd [ASX: GOLD]

However, one of the biggest drawbacks of a gold ETF is that you don’t hold the gold yourself. You own the security instead. The security is in theory backed by physical gold, which is held by a third party on your behalf.

Gold Mining Company

Investing in gold mining companies is another option to gain exposure to gold.

Keep in mind that the prices of gold stocks do not accurately track the underlying gold price. That is because the company could have a host of other risks such as management issues, accounting problems, or regulatory action.

Recognize therefore that you are only indirectly investing in gold when you buy a gold stock.

That’s because your investment is simply the ownership of a small slice of the company’s assets.

However, gold stocks do pay a dividend, and the better-managed ones may provide a much higher return than the metal itself.

While on management, do remember that most gold mining companies have been able to right ship during the gold bear market of the past few years. Their running costs and debts are far lower today than they were, say, six years ago.

Though purchasing a gold stock is a riskier option compared to the physical metal, it may prove more rewarding over the longer term.

Summary

While there are similar patterns of demand for gold and the gold price movement, the prediction of the gold price is complicated by the higher government debt levels and the lower global interest rates.

These factors combined with aggressive monetary policies and fears of currency debasement is expected to offer solid support for the gold price in the future.