This is a guest post by our good friends Louise Bedford and Chris Tate, over at The Trading Game. For more information about their trading education and trading courses, head over to tradinggame.com.au.

As technical analysts, we strive to gather facts and make hefty decisions in light of the evidence. When we place our trades, we pride ourselves on being logical, focussed, and non-emotional. I know that’s what Chris Tate and I encourage members of our Trading Mentor Program to think. So, you can imagine my surprise when I heard two traders talking about how ‘money isn’t really all that important’.

“People make too much of a big deal about money. It really doesn’t matter that much. I mean it’s not like the rich people end up with kids who are more intelligent is it?” said one to the other.

Well, I have to say, that comment got me thinking. Do the children of people with money have more advantages in life than the kids of the least well off? Just what do the facts say?

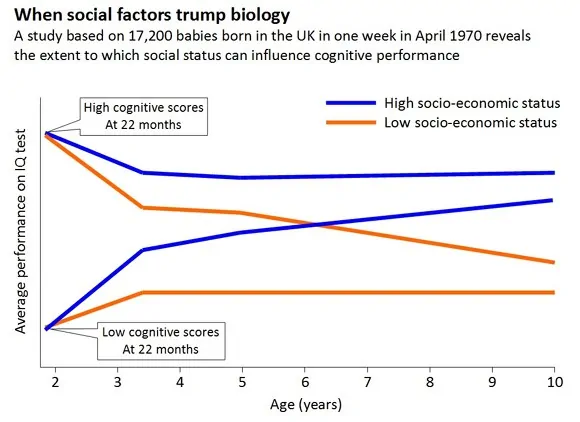

There was a study by Michael Marmot, based on 17,200 babies born in the UK in one week in April 1970 to look at just this very question. Significant health inequalities existed between the poorest and the richest groups for a start. For example, even if you exclude the richest and poorest 5% of people in England, the richest remainder can expect to live 6 years longer and enjoy an extra 13 years free of disability.

And that’s not all.

It ends up that babies with low IQs at 22 months who were born to rich and well-educated parents had caught up by the age of 6 with kids who started out with high IQs born to those with parents less well off and educated.

Oh my gosh – read that sentence again! Far out!

By the age of 10, the kids from the well-off parents were still progressing well with IQ tests, whereas the less well-off group were falling further and further behind.

(Crikey – I know what you’re thinking! This is a line chart! Yes, yes, yes. I’ll get right back to using candle charts when I’m trading the sharemarket.)

These findings have been duplicated in other studies as well (Robert Wood Johnson Foundation April 2009).

So as a trader, what does this mean to you?

Holy beegeebeez, when you’re planning to significantly increase your wealth, you’re not just doing it for yourself! You’re also creating a ripple effect that spreads beyond your own generation and could directly affect the IQ of your own children.

Couples – Stop Fighting About Money

I’ll bet that because you’re reading this article – I already know a few things about you. After years of watching thousands of traders progress and grow through various techniques such as practice trading, attending professional trading courses, or even educating themselves through various trading books, I have found that the best traders are the ones who maintain an objective mindset. They examine their results with realistic honesty – not over-rating their abilities, yet not over-emphasising their flaws. They are stable and balanced in their approach and self-evaluation. They also don’t rely on others for external confirmation or flattery.

The best traders are self-reliant, and detached when it comes to reviewing their trading results and personal abilities. Because you’re reading this article, I know that these are the qualities you’re aiming to emulate, regardless of whether you use candlesticks or Gann to help you make your trading decisions. I can also tell you that you’re more likely to be financially savvy in comparison to those out there in ‘non-financially educated land’. Sure there’s still a lot of anxiety about it. And I feel so strongly about helping people through this, I wrote a free special report on the topic. However, when did you last make a budget or seriously talk about your spending habits with those you love?

Census information from America has sent the researchers scurrying away to find side spin off projects to investigate. Did you know that 4 in 10 married couples have serious, recurring arguments about money. Those who have a written budget are 30% less likely to argue on a recurring basis than those without. Of the battles, 49% argue about what to buy or not buy and at what price, 33% fight about debt and 26% about savings. (Source: Matt Bell, author ‘Planning for Fewer Financial Fights with Your Spouse’)

My advice? Next time you have a chat with your partner about the latest chart that has caught your eye – open up the discussion a little. Have a talk about your budget and jot down a few notes. You’ll fight less, and have more time for the fun things in life.

Interestingly, the fastest growing age segment is 65+. So move over Gen Y, the grey nomads are muscling in. Also, from the US census data we know that in 2010 there are 67 retired/dependents for every 100 workers paying into social security. By 2050 this ratio will shift to 85 retired/dependents relying on the efforts of every 100 workers.

And here’s the squeeze too. The average parent spends 16.8 hours in a typical week playing with their children up to 12 years. Yet, 48% of parents feel guilty because they don’t spend enough time playing with their kids. 47% worrying that their kids are playing too many computer games or spending too much time in front of the idiot box. Ad 31% of parents blame themselves for these addictions because they don’t feel that they’re involved enough (Source: Playreport USA, ikea-usa.com). So if ever there was a time to work smarter instead of harder by trading effectively, that time is now. You’ll feel less guilty, you’ll develop an additional source of income both now and in the future which will help bridge the gap as the ratio of retired/dependents to workers increases, and you’ll also positively effect your children’s IQ!

Quit your search for ‘trick of the month’ that you can use to make money. Immerse yourself in your own education. The best traders are interested in ‘becoming’ not just ‘getting rich’. ‘Becoming’ the type of person who understands the sharemarket as well as themselves. ‘Becoming’ the type of trader who can make money out of an uptrend as well as a downtrend. They’re determined to grow in terms of knowledge and depth and richness of thought, not just viewing the amount of money in their bank account as being the goal. These traders are the ones who have it in the very cells of their body and the fabric of their souls. These are the traders who will change their financial destiny – both now and in the future.

Next time someone tries to convince you that money isn’t important, you’ve now got some ammunition. You are different from the majority. You’ve taken action by being involved in this incredible trading community and working on your own education.

Remember – it’s not just for your benefit. It’s also for the benefit of those you love.

Louise Bedford (www.tradinggame.com.au) is a best-selling author of books on the sharemarket. Do yourself a favour. Download her free trading plan template. You’ll love it!