Amcor (ASX: AMC) has had a rough couple of years owing to high rates and inflation, which crippled customer spending and changed spending patterns. Given the high volume and commoditized nature of Amcor’s business, revenues and earnings growth were muted.

However, the company has capitalized well on this slowdown to consolidate its market position through a merger with American rival Berry. This has positioned the company well to capitalize on the recovery of consumer spending that is on the horizon.

Table of Contents

About Amcor

Founded in 1860, Amcor (ASX: AMC) is among Australia’s oldest companies and has evolved into one of the world’s largest packaging firms. Its business model is centred on substantial economies of scale across key packaging verticals.

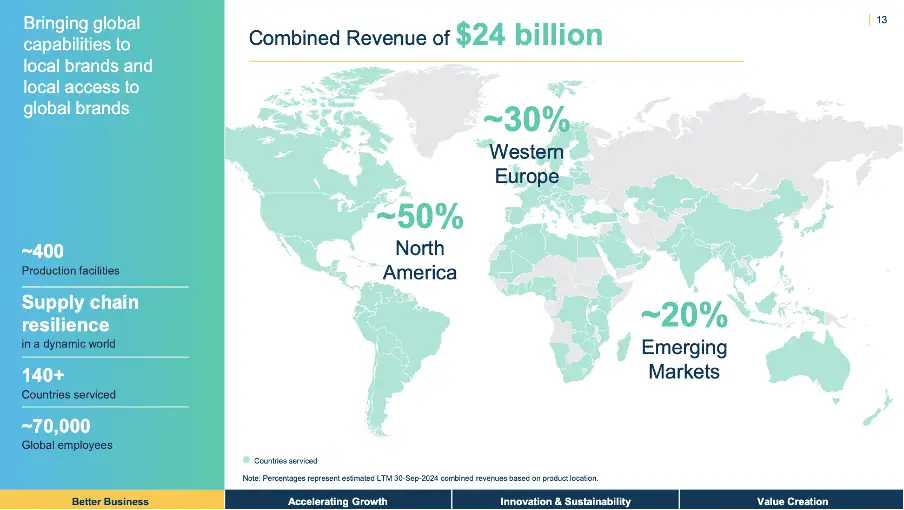

Source – Amcor Merger Presentation

Post-merger, the company will operate through two primary segments: flexible packaging (contributing 60% of revenue) and rigid packaging (accounting for 40% of revenue), both serving a wide array of global consumer brands.

Amcor Berry operates 400 packaging plants across 140 countries, spanning nearly every continent.

Amcor is currently trading at a market capitalization of A$18.5 billion.

Dominant Business To Get Stronger With Merger

The packaging business is volume-driven. Amcor’s (ASX: AMC) strength lies in its client roster of major global brands, which facilitates economies of scale, enabling the company to attract and retain significant clients.

This advantage provides Amcor and Berry with a diverse portfolio of accounts across various geographies and sectors, enhancing operational stability. The company serves two major sectors – Food/Beverages and Healthcare.

The company provides packaging for various stable and non-cyclical products, including packaged meats and healthcare products (contact lenses, tablets, and liquid drugs).

The essential nature of healthcare and consumer staples, combined with rising global incomes driven by economic growth, presents considerable long-term growth opportunities.

With the company’s upcoming merger with Berry, the company will enjoy a more even split of sales between flexibles and containers, de-risking the company’s operations further and increasing resilience.

Source – Amcor Merger Presentation

The merger will improve the company’s ability to offer differentiated and complementary solutions to customers by leveraging the manufacturing capabilities of both firms.

The merged company will benefit from a substantial presence in high-growth emerging economies, with increased synergies and market access in Asia, Latin America, and Eastern Europe.

These economies are approaching critical inflection points in GDP/capita, which are expected to drive increased consumption.

The merger will also lead to a margin expansion through projected synergies amounting to $530 million/year in operations, $60 million in growth synergies, and another $60 million in financial savings.

The company expects operating cash flows of the combined firm to be double those of standalone Amcor, while EPS growth is expected to grow at 10-15% from the current 5-10%. Amcor Berry will also enjoy a 250% increase in resources to fund acquisitions and buybacks.

Amcor expects the growth in margins and synergies combined with higher cash flow from buybacks to drive long-term returns in the region of 13%-18%.

Exposure To Macro Environment And Supply Chain Disruption Is A Weakness

Amcor’s (ASX: AMC) major weakness is its exposure to the macro-environment. As seen in the recent past, the combination of high rates and inflation led to a meaningfully tough environment for the company, as witnessed by shrinking margins and muted sales growth.

Should inflation and high rates persist longer than expected or lead to a downturn in the economy, it could spell tough times for Amcor Berry.

As a packaging company, the company operates an intricate global supply chain of various commodities it uses in production.

Supply shocks or logistic issues, such as the recent port lockdown in the US, the blocking of the Panama Canal, or disruption caused by wars, have a material impact on the company’s operations.

Research And Development Along With AI: A Huge Market Opportunity

The combined Amcor (ASX: AMC) Berry merger will give the company a combined $180 million in Research and Development investment combined with both companies’ considerable experience and expertise, presenting significant product development opportunities.

The packaging industry is ripe for big change with the onset of climate change and Generative AI.

Global warming from climate change is straining supply chains the world over, while climate action/ESG is forcing large firms such as Amcor’s clients to rethink their operations. Climate change will have an impact on the shelf life of products such as packaged meats, other edible items, and sensitive healthcare products.

While this seems like a threat, it presents a huge opportunity for Amcor given its vast resources, experience, expertise, and troves of data to apply to AI. Of late, AI has shown shattering promise in chemistry and biochemistry by solving multi-decadal problems in the sciences and enabling rapid research and iteration.

Given its extensive client base, Amcor has the resources to develop solutions that smaller players like start-ups may not be able to afford or test in the market. The company is clearly focusing on this opportunity to collaborate with these start-ups to build innovative solutions, as indicated in their literature and management statements.

In the short to medium term, Amcor is focusing on recycling and efficient design, while in the long term, it is developing more resilient bio-packaging.

Geopolitical Tensions and Tariffs Are A Threat

A significant risk for Amcor (ASX: AMC) is geopolitical posturing and tariffs. US President Donald Trump’s second term has been marked by trade tensions arising from his intention to tariff imports of all sorts of goods into the US.

This, in turn, has prompted reciprocal tariffs from other major economies such as the EU and China. Such tariffs threaten to upend the economics of the company’s supply chain, both of finished goods and production inputs. (For example, the US has recently imposed a tariff on Aluminium imports, which are a key input in the company’s flexible packaging offerings that use Aluminium foil.

Amcor Financials

Amcor’s (ASX: AMC) merger with Berry Global has received a solid reception from investors of both firms due to the strong operational and financial synergies of the combined entity. The merger transaction is being carried out through an all-stock deal.

Under the transaction, Amcor investors will own 63% of the combined firm, while Berry Global investors will own the remaining 37%. Amcor will refinance and assume Berry’s long-term debt obligations.

The combined entity is expected to have revenues of $24 billion with EBITDA of $4.3 billion after adjusting for synergies. Operating cash flows are slated to more than double to $3 billion from the present $1.5 billion. The firm’s EBITDA margins are expected to improve by a fifth to 18% from standalone Amcor’s 15%.

The cash flows of the combined firm net of synergies will increase resources available for buybacks and acquisitions by more than 60% to about $1 billion, improving long-term returns for investors.

The synergies are the centerpiece of the rationale of this merger due to the creation of value involved. This is best evidenced by the more than doubling of the firms’ cash flows and improvement in margins while its leverage ratio is expected to stay the same at 3x, thus reflecting stable risk along with stronger operations.

The merger is expected to conclude by the second half of this year, hence, financials of the combined entity are not available at this time.

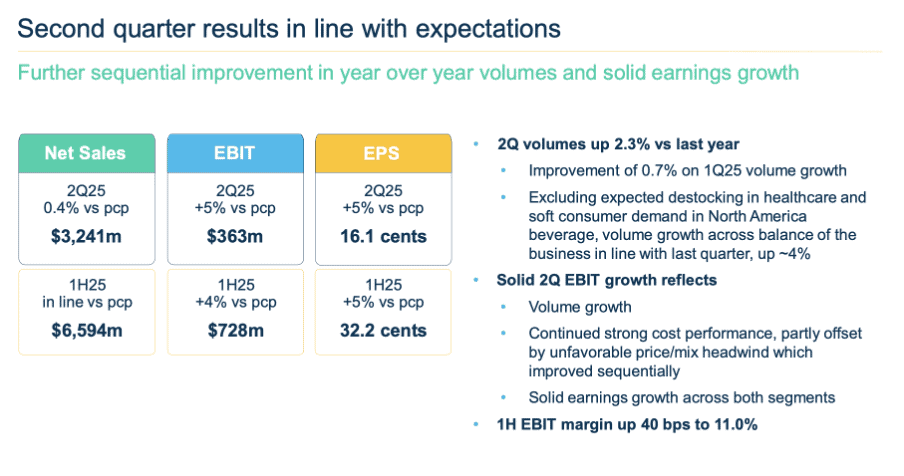

However, Amcor’s standalone 1H financials paint an optimistic picture of recovering demand. While sales were marginally down by 1.5 % to $6.59 billion, EBIT was up 2.6% to $728 million.

Source – Amcor Results Presentation

Return on funds employed improved to 15% from 14.5% YoY. Volumes grew 2% YoY, but lower prices in high-end healthcare categories pushed revenues lower. At the same time, a strong dollar impacted foreign earnings. On a constant currency basis, EBIT was up 4% YoY.

Amcor emphasizes dividends as a means of driving shareholder value, as evidenced by the company’s 90% dividend payout ratio. The company presently has a dividend yield of 5.12%. Amcor has a net debt of $6.496 billion against operating cash flows of about $1.5 billion for FY25.

Management commentary was optimistic on a note of improved demand from the margin-rich healthcare category in the second half of the year and moderating costs of labour.

Management guidance projects volumes to rise low to mid double digits YoY while earnings are expected to grow 3-8% on a constant currency basis. Free cash flows for FY25 (Amcor Standalone) are expected to be between $0.9-$1 billion.

Amcor Valuation

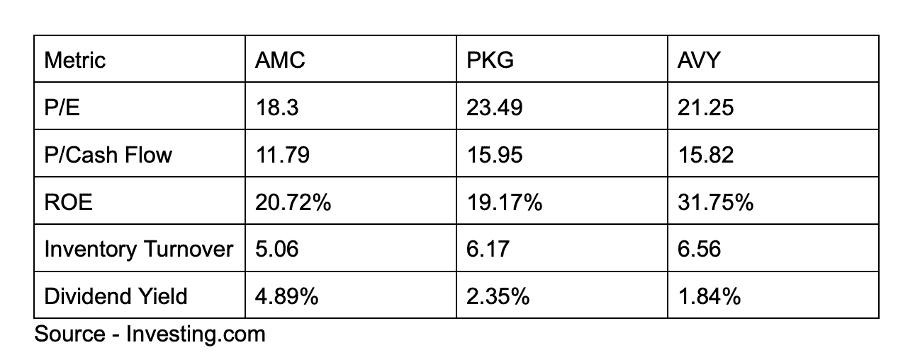

Amcor (NYSE: AMCR / ASX: AMC) is compared to Packaging Corporation of America (NYSE: PKG) and Avery Dennison (NYSE: AVY), both of which are global consumer-facing packaging majors headquartered in North America.

As can be seen, Amcor is cheaper than its peers on price ratios and in the middle on ROE. However, the company stands out in Inventory Turnover, which is a mark of management skill and pays a higher dividend.

Note: These figures are for standalone Amcor and do not reflect the impact of its upcoming merger.

Conclusion

Overall, Amcor (ASX: AMC) is a world-class firm in its sector with global market exposure and a solid product portfolio serving various sectors. The company’s upcoming merger with Berry Global will strengthen its position further through synergies and scale.

The company is ripe for a re-rating with an improving macro environment and lower rates, substantial impact from tariffs notwithstanding, given its global manufacturing network.

Recent management commentary re-iterated improving macro conditions and highlighted the slowdown in growth being mainly caused by reluctant discretionary spending, which should bounce back with lower rates.