Computershare shares (ASX CPU) is an Australian stock transfer corporation that provides corporate trust, stock transfer and employee share plan services to a large number of different countries.

Computershare concentrates on serving high-end individual clients and large-scale companies. Additionally, the business is committed to providing personalised and efficient services related to the public equities market.

Computershare has performed strongly in the past year, reaching record earnings per share and record cash flow and reducing debt.

Table of Contents

Computershare Limited (ASX CPU) is a diversified provider of services including transfer agency and share registration, employee equity plans, proxy solicitation, stakeholder communications and mortgage servicing activities and operates in 21 countries.

Within the requirement to be environmentally and socially friendly, CPU Limited has been developing its global business operations and activities. CPU has approximately $9.523 billion in market capitalisation, which is significant amongst its peer groups in the market.

70% of CPU’s Revenue is From Business Services and Register Maintenance

Register maintenance, corporation activities and business services are the core strengths for CPU, whose revenue ratio is 33% and 37% respectively.

The business service segment is growing and the full year contribution from a number of main products is the major growth catalyst. Although mortgage services and employee share plans account for 11% in 2017, it has had considerable growth due to how much revenue it contributes. Computershare also offers a full range of services across mortgage services in the US and UK.

CPU Limited has generated free cash flow of over $362 million in 2017, the strong free cash flow enables them to reduce debt and increase distributions to shareholders.

(Source: Computershare Limited annual report)

The phenomenon of increased management net profit shows strong growth in recent years. The business employs over 14,000 people across the globe providing services in over 20 countries to more than 16,000 clients.

The American market, which is the largest active market for CPU Limited, is gradually stabilising. Although the revenue from Australia and New Zealand services has declined by 9.9% for last 2 years, the revenue from markets such as China Innovation Alliance (UCIA) has risen 44.2%.

(Source: Computershare limited annual report)

Financial risk is the main risk for Computershare. There is a material proportion of revenue that is derived from transactional activity that is dependent on factors outside their control, which can be challenging to predict.

Changes to market activity and foreign exchange rates could impact on its financial performance. Additionally, the actions of competitors can affect the businesses financial prospects. For example, aggressive price discounting by competitors could adversely affect existing pricing arrangements or ability to retain existing clients and to win new clients.

Computershare is responsible for managing valuable client data. This brings about a range of challenges, from ensuring the security and integrity of that data as well as the continuity of service in the face of internal and external factors. Computershare also undertakes high volumes of transactional processes, some of which are complex. There is a risk that failure to process these transactions correctly could result in liabilities being incurred.

However, to deal with these operational risks, CPU Limited invests in technology and services to protect clients’ data. Moreover, corresponding controls and policies have been made to mitigate this risk.

Computershare Limited experienced an enormous growth on statutory EPS in 2017, as shown in the graph below.

Its statutory EPS has risen dramatically compared to the previous year after the huge fall in PES during 2014 to 2015, which shows that CPU’s profitability has been recovering and has exceeded the peak in 2014.

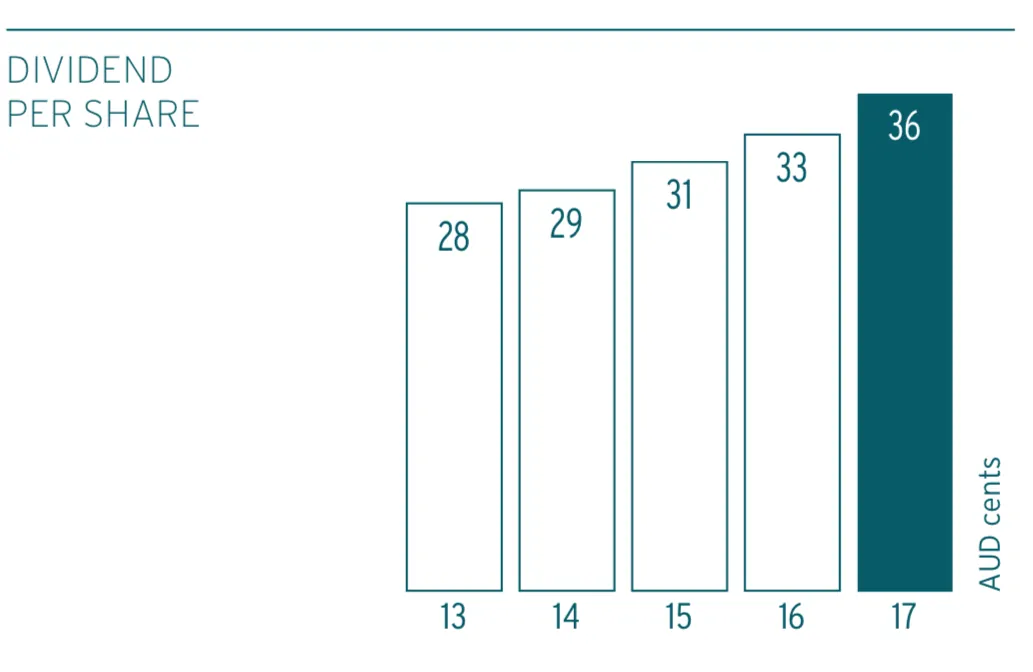

The graph below shows dividend per share during the last five years, which has increased gradually. Both the growth in statutory EPS and dividend per share contributes to bringing about positive change on the stock price and reflects strong profitability.

The table below highlights CPU’s Profit Margin and Return on Equity compared to its main competitor Link Administration Holdings Ltd (ASX LNK).

| Computershare | Link Administration Holdings | |

| Profit Margin | 31.7% | 16.7% |

| Return on Equity | 29.9% | 15% |

On a like for like basis, Computershare has almost double the profit margin and return on equity than Link Administration, which indicates a much stronger business than its main competitor.

Management EBITDA of CPU is slightly higher at around 540 million US dollars during the last five years, which means that CPU has a relatively constant income.

Whether the company is running at a stable level could be found in its cash flows and debts. In CPU’s case, the business has had a strong performance in both fields.

Cash flow from operations has increased to 457.7 million US dollars in 2017 after bottoming out to 305.1 million US dollars in 2016 and exceeding the previous peak, which indicates that CPU reported a strong cash position and has adequate funds thanks to its primary business activities to be financially viable.

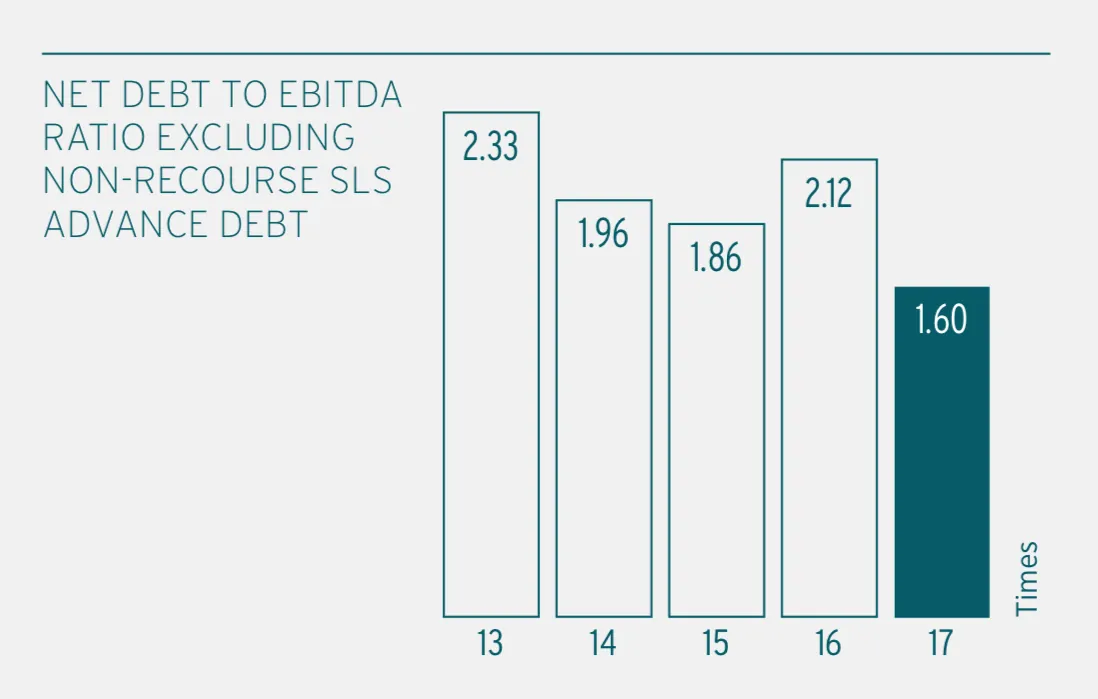

The net debt to EBITDA ratio calculates a company’s interest-bearing liabilities minus cash or cash equivalents, divided by its EBITDA. This ratio goes down with the decrease in interest-bearing liabilities or increase on EBITDA or increases in cash or cash equivalents.

CPU has consistently reduced its Net Debt to EBITDA ratio save for 2016 and reached a new low in 2017, strengthening its balance sheet last year.

Overall, Computershare Limited has been performing for its shareholders with a strengthening balance sheet. CPU’s financial performance should provide confidence in the future potential long-term growth of its stock price.