Costa (ASX CGC) is Australia’s leading grower, packer and marketer of premium quality fresh fruit and vegetables. Most of its revenue is generated from five categories: mushrooms, berries, citrus, glasshouse tomatoes and avocados. It’s the number one blueberry grower in Australia, and it is aiming to bolster its avocado sector to be the market leader.

Costa shares listed in 2015 at A$2.25 and had a bumpy start, dipping to as low as A$1.84. However, Costa shares have more than tripled in three years, reaching A$8.5 in Jun 2018, before falling 10% to A$7.5 at the end of August 2018. Such growth over the years owes thanks to the shift in consumer taste to sugar-free superfood that it produces and its changes in technology that allows it to supply its key products all year round and realize extra profits in the shortage season.

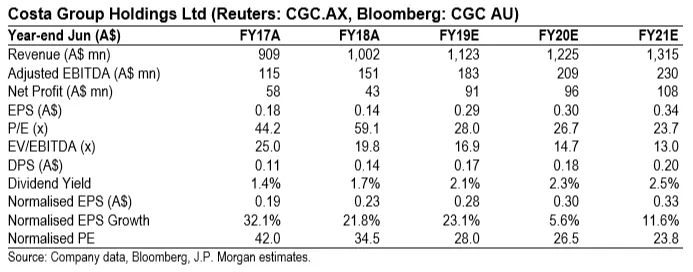

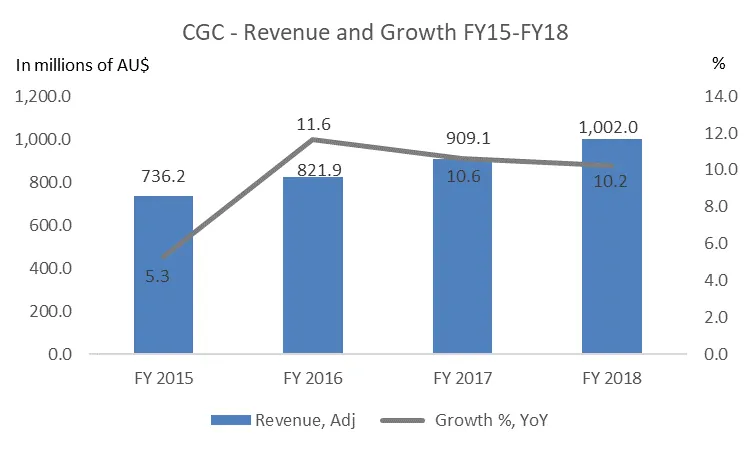

In FY18 Costa shares’ revenue increased 10.2% to A$1002M and its NPAT-S grew 26.4% to A$76.7M with a market cap of A$2.72 Billion.

Figure 1: CGC – Price History

Figure 2: CGC – Key Financials

Table of Contents

Strategic position

As an integrated farmer, packer and marketer, Costa’s products are predominantly grown and sourced from Costa’s extensive domestic and international farms. The vertical integration that Costa put as the strategic focus has allowed it to have high control over the whole production chain and relatively stronger bargain power against its retailers.

Technology makes Costa untraditional. According to Debney, its managing director, he is seeking to ‘turn a horticultural company into a semi-industrial base with a technology overlay’. Its balance sheet partly reflects this pattern: it has very light assets and it would lease many of the properties back from the Costa family.

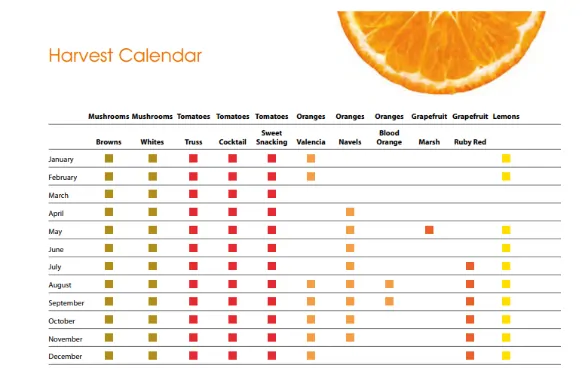

52-week production by protected cropping. Seasonality and weather conditions are the critical risk in traditional agricultural business. In Costa, mushrooms are grown in factories, tomatoes in high-tech glass-houses and 70 per cent of berries are grown in permanent tunnels using hydroponic substrates.

Moreover, Costa’s farms are diversified in geographic locations as it has 60 farms throughout Australia (See Figure 3).

Figure 3: CGC – A Broad portfolio of locations

Additionally, Costa expands its portfolio of products to a full year calendar, making cash inflow relatively stable (See Figure 4). Furthermore, Costa is expanding into foreign markets, whose EBITDA before SGARA increased 81.7% in FY18 and is currently taking up 17% of total EBITDA before SGARA, further diversifying its revenue drivers and reducing risk.

Figure 4: CGC – Continuous production and supply window

Supercomputers in the packing process reduce cost. Investment in packing line technology has dramatically improved the efficiency of Costa’s packing process with the installation of fruit grading technology which utilizes the latest optics and software to take hundreds of images of each piece of fruit in high resolution and then accurately sort this fruit by defect into grades. This technology might partly explain the increase of EBITDA before SGARA from 12.7% to 15% in FY18.

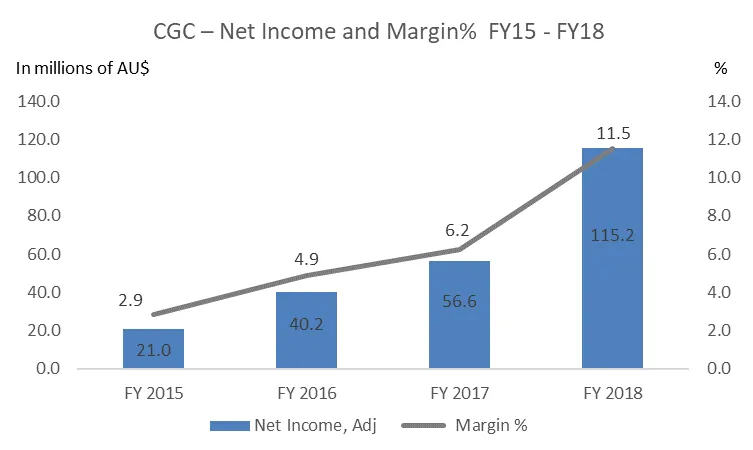

The company’s full-year revenue topped $1 billion and the net income achieved $115.2 million. As illustrated below, all the metrics saw double-digit growth, showing the value of Costa’s diversified portfolio and technological advantages.

Positive Earnings trend: The result looks positive given the 10.2% YOY growth in revenue and 11.5% YOY growth in profit margin in FY18H1. Over three years CGC saw an average of 10% increase in revenue, and accelerating profit margin. These all indicate a positive earnings trend and future performance of Costa shares.

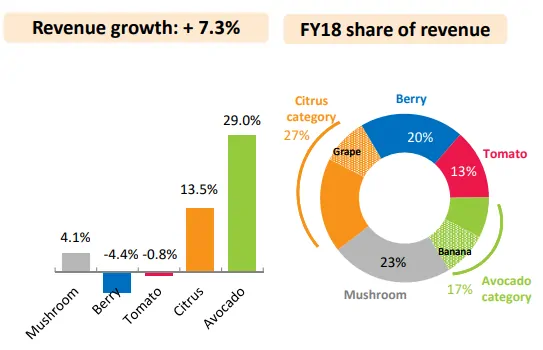

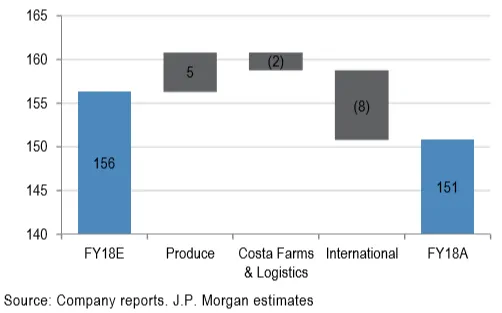

However, the company experienced several headwinds that might continue into the future, especially the poor harvest result of Moroccan African Blue blueberries. This is reflected in -4.4% in blueberry segment revenue growth as shown below.

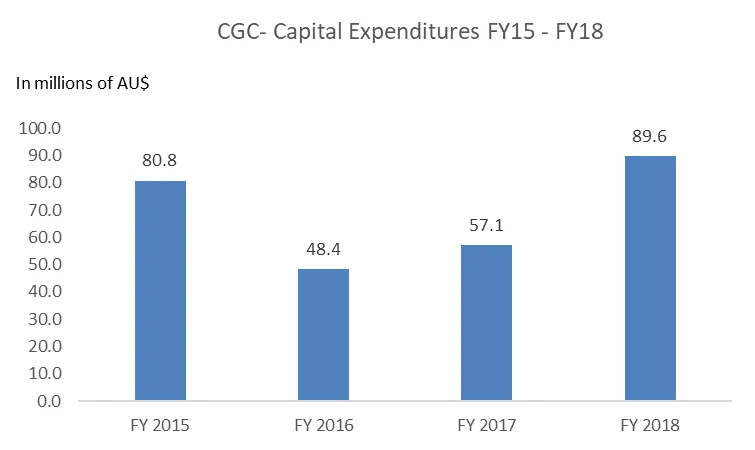

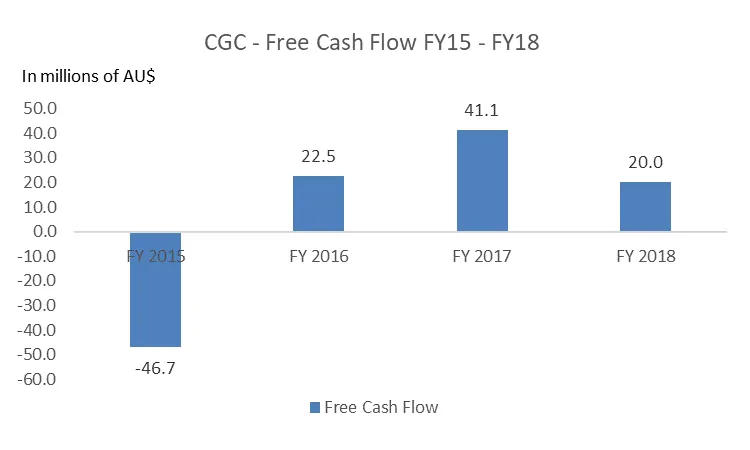

Risky Foreign investment and Decreased FCF: The disappointing results of African Blueberry business, which reduced the yield by about 10%, came just 9 months after Costa paid $68 million to almost double its stake in this JV to 86 per cent. During FY18, Costa’s CAPEX reached 89.6M with net debt doubling, from $84.2M to $176.1M. and free cash flow down to $20 million from $41.1 million the last year. On the flip side, it shows that Costa is betting hard in its foreign market and Costa’s management group have high confidence in its investment and this might signal that foreign market will be a good growth driver.

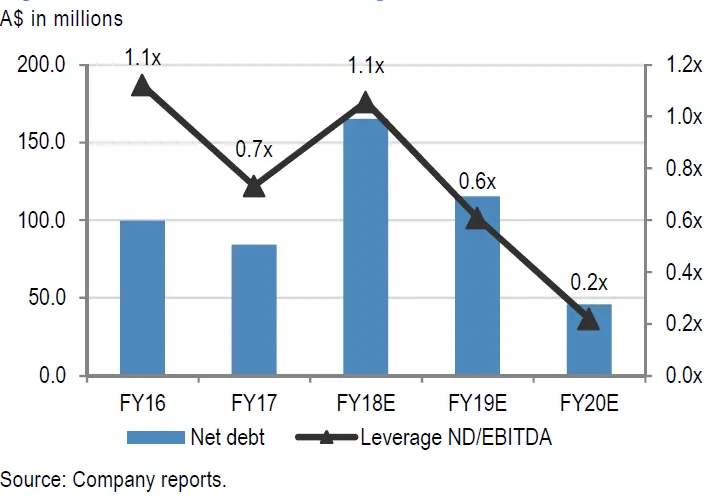

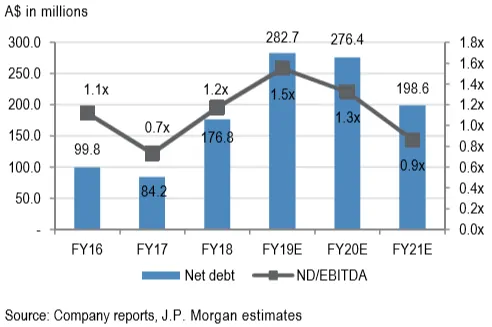

Gearing increased. According to JP Morgan, due to a slightly higher starting point, but mostly due to a material increase in the CAPEX forecasts for FY19E, net debt forecasts rise materially: From A$111m FY19E previously to A$283m now. And thus ND/EBITDA increased dramatically from 0.6x to 1.5x in FY19E and decreased at a pace much slower than previously expected (See Figure 8 and Figure 9). However, ND/EBITDA is still within a reasonable range and we think it will not materially impact on Costa shares’ future performance.

Figure 8: CGC – Costa Previous Leverage Forecast

Figure 9: CGC – Costa Updated Leverage Forecast

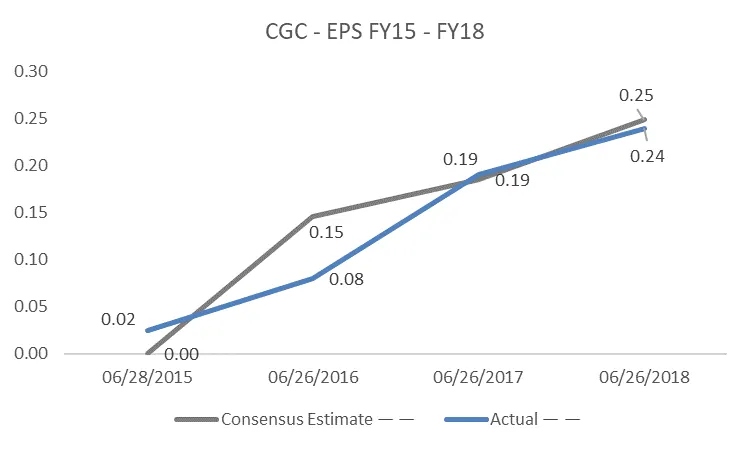

Market Overly Pessimistic: FY18 EPS of $0.24, though 26% higher than $0.19 the previous year, is 3.6% lower than previous consensus estimation. P/E ratio dropped from 33x to 23.61x within three years and is declining further, indicating a potentially good time to buy in at a reasonable P/E.

Peer Comparison – Freedom Foods (ASX PNC)

Freedom Foods Group (ASX:FNP) is a diversified food company with a focus on health and wellness sector through a range of products including milk, snacks and nutritional products. This stock is selected to compare with CGC due to its operation in the health sector, and its superior share price performance which has more than doubled from A$3 to A$6.7 in three years.

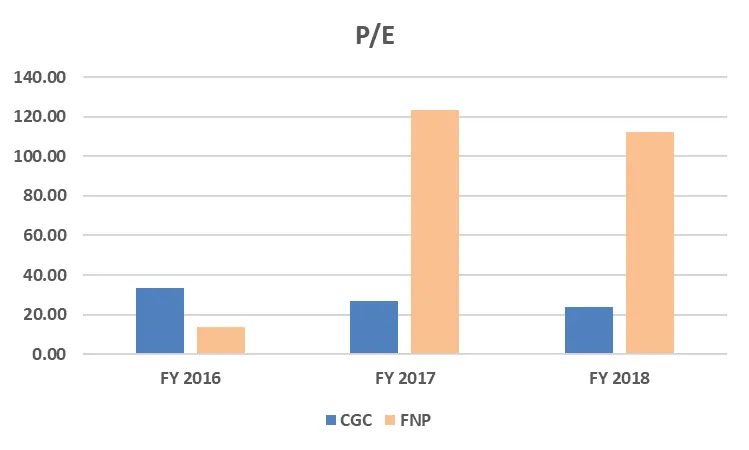

CGC has a better P/E trend than FNP. CGC’s P/E started at 33.21 in FY16 and gradually declined to 23.61 in FY18. In comparison, FNP’s PER rose from 13.75 to 123 FY15-16, before dipping slightly to 112.5 in FY18.

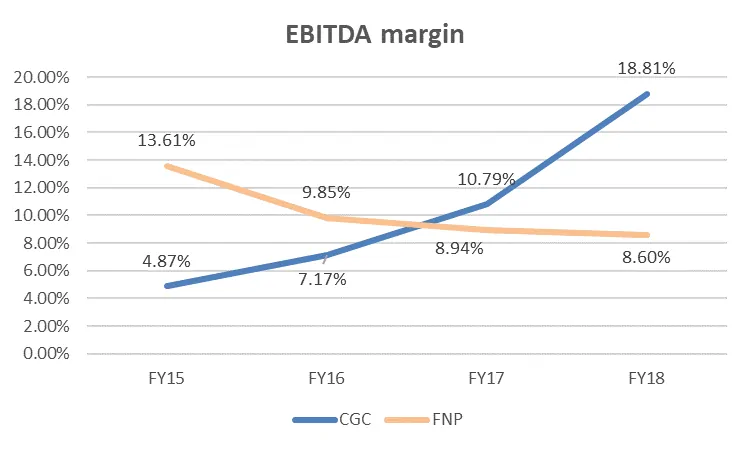

Favourable EBITDA Trend. CGC also has consistently improving EBITDA margin which increased from 4.87% to 18.81%. In comparison, FNP’s EBITDA margin experienced a rapid decline from 13.61% to 8.6% during FY15-18.

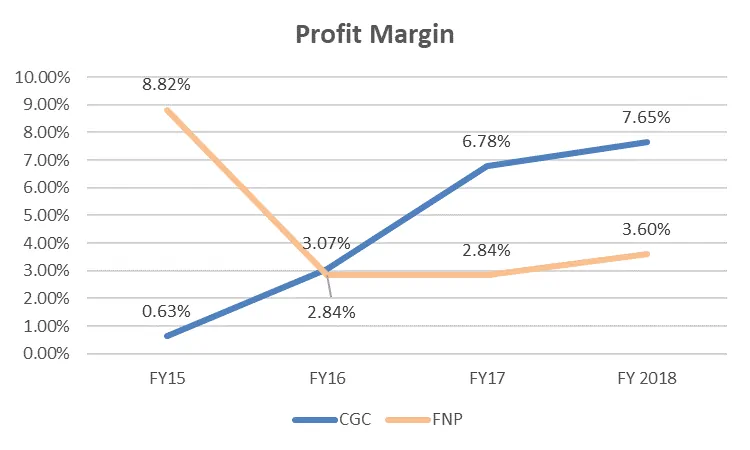

Profit Margin Increased. Like EBITDA, CGC persistently improved its profit margin during FY15-18 from 0.63% to 7.65%, while FNP’s margin decreased sharply from 8.82% to 3.07% FY15-16, before struggling to recover to 3.6% in FY18, a half of CGC’s profit margin.

Regarding financial ratio, P/E, EBITDA margin and profit margin all show that CGC is superior to FNP. However, FNP underwent significant CAPEX expenditure in FY15-18, and its balance sheet has not yet benefited from the new equipment, while CGC is in a healthy growth trajectory by focusing on both market expansion and cost-saving. Despite the different risk profile that they have, it is undeniable that CGC has good financial performance and growth these years.

Strong Growth in Avocado Markets

Debney’s growth plan centres on further expansion in berries, acquisitions to develop a national avocado footprint and growing its relatively young operations in Morocco and China.

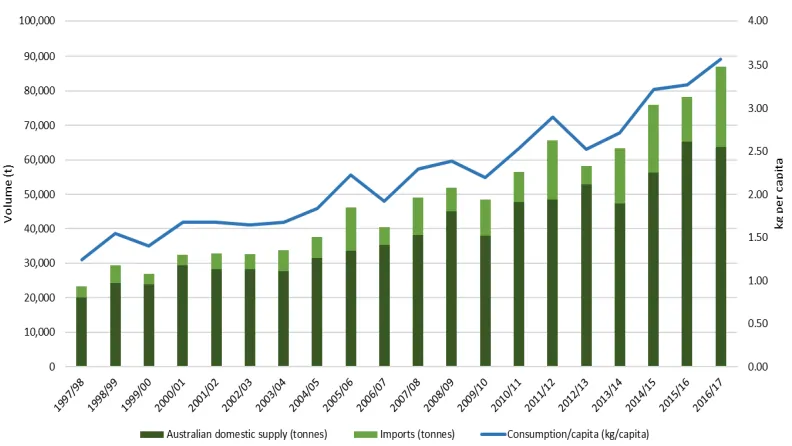

Good avocado prospects. In Australia, Costa has big plans to produce avocados year-round within two years, making it the most significant player in a fragmented market. A risk to avocado market is potential for considerable supply glut soon, as there is a 3Y lag from planting seedlings to first production and last few years of higher prices may have encouraged growers to expand. Countering this risk is increasing demand, growing at 18-20% p.a., with industry targeting per capita consumption to increase from 3.5kg to >5kg. N.B (See Figure 5). At 60-70% household penetration this equates to avocado eaters raising consumption from 1.8 avocados per month to 2.6.

Figure 5: CGC – Australian annual domestic avocado supply, NZ imports and Australian per capita consumption. Sources: Infocado, IHS Global Trade Atlas (2017) and population based on ABS data

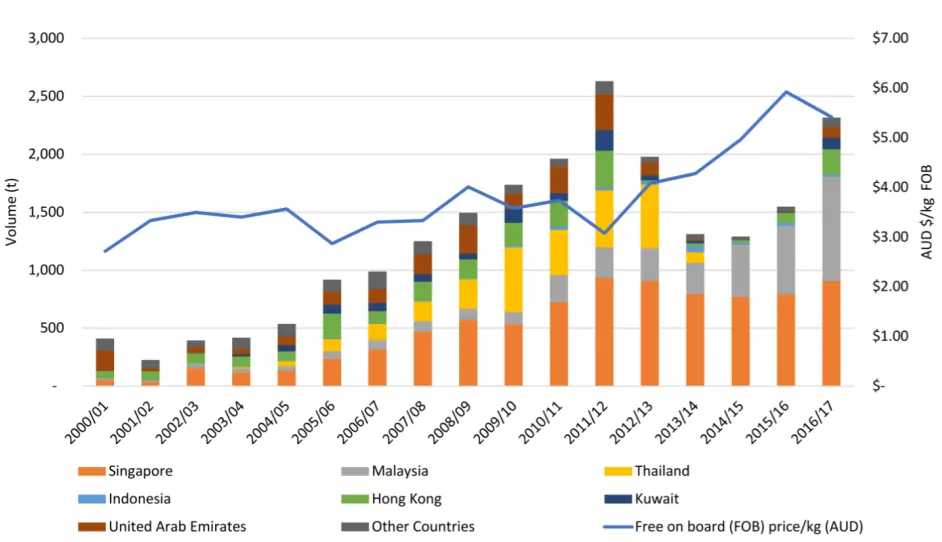

Moreover, demand from the overseas market sees around 30% YoY growth from 2015-2017 (See Figure 6). In Costa, avocado has growing importance, whose revenue takes up 17% of total revenue and grows at 29% YoY, the highest growth among all segments. Costa is targeting avocado growth to 1.9m trays in the next six years (current Australian market 12M trays) and higher yields could be expected from likely further M&A and higher management target (>1000ha vs. 600ha currently).

Figure 6: CGC – Australian annual avocado export volumes in tonnes by country and AU$/kg FOB (blue line). Source: HIS Global Trade Atlas (2017)

Oversuppply of Blueberries Put Pressure On Revenue

African Blue in Morocco and the industrial oversupply of blueberry in the FY18 report has partly explained the 10% drop in share price on 24/08. Although this is a one-off issue, deflation is still threatening to Costa in the future. In FY18 Morocco experienced prolonged cold weather causing a delay in crop maturity and an intensely concentrated late harvest. The industrial oversupply of blueberries (volume +25.2%, price -7.5%) has resulted in -4.4% growth in Costa’s berry segment in FY18. Overall, this saw a -4% FY18 EBITDA miss and -8% FY18 NPAT miss. On the positive side, Morocco is a one-off issue and the management reiterated that they don’t expect it to happen again next year. Morocco blueberry farm is in its early phase and is undergoing fast expansion. When glasshouses are fully built up soon, such problem will no longer be an issue.

Figure 8: CGC – Costa FY18 actual EBITA vs estimate EBITDA

As the leading grower, packer and marketer of premium quality fresh fruit and vegetables in Australia, Costa is seeking further expansion in berries and acquisitions to develop a national avocado footprint. Given its technological advantage over other conventional farming companies in protected cropping, computer screening and its early action on changing consumer taste to avocado, Costa shares is well positioned to outperform the market in the long run despite short-term headwinds.