Today we’ll look at why we like Fisher & Paykel Healthcare (ASX FPH).

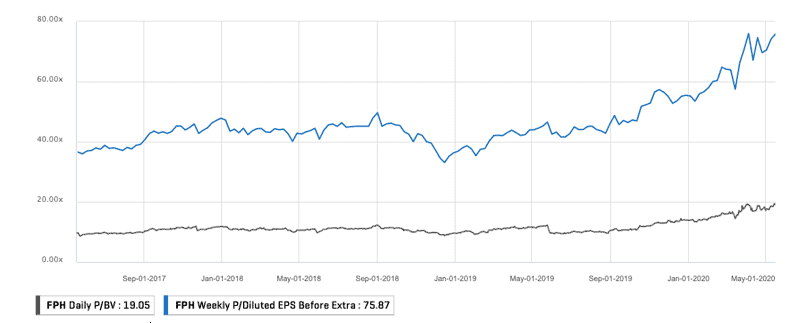

We first looked at this stock back in May 2019, when the stock was at $14.50.

As of writing, the FPH share price is at $28.66 or 98% higher since we first looked at the stock.

The rally in the stock started in August 2019, well before COVID-19 became an issue. This is likely due to its strong revenue growth since then.

Considering that FPH specialises in the manufacture of medical ventilators, the need for governments to hedge against the current and the next outbreak will likely see continual growth in revenue for this stock.

FPH is a world leader in medical ventilator manufacturing, whose consecutive profits in the last five years and accumulated profit reserves are sufficient to finance a rapid expansion to meet the drastically increased needs of ventilators due to COVID-19.

Table of Contents

About Fisher & Paykel Healthcare Corporation Limited

Fisher & Paykel Healthcare Corporation Limited (ASX FPH) is a $16 billion company that produces medical equipment for use in respiratory care, acute care, surgery, and in the treatment of obstructive sleep apnoea.

FPH provides products and services to hospitals and home care by offering respiratory humidifiers, single and reusable chambers, breathing circuits, and accessories. These medical devices incorporate patented and other proprietary technologies.

Only 1% of revenue comes from New Zealand, its headquarters and its products are sold by around 120 countries worldwide.

FPH’s innovation in technology

In 2019 a leading US physician Professor indicated there is a potential benefit in treating chronic obstructive pulmonary disease (COPD) by using FPH’s Opti-flow and AIRVO systems.

FPH’s products can be categorised in hospital and home care products and the hospital-related products are most likely to see short-term escalated demand due to Covid-19.

FPH’s hospital product group constitutes 62% of total revenue, and it includes humidification products used in invasive and non-invasive ventilation, nasal high flow therapy, and open surgery.

In the Pre-COVID period of FY19, the hospital product group saw a 19% revenue growth, and the current demand for ventilators is expected to boost sales in the hospital category.

On the other hand, FPH’s home care product, which contributes 38% of the total revenue, has seen favourable revenue growth in FY19, due to the launch of a new product.

In 2019 H1, FPH launched Vitera, a full-face mask for patients with obstructive sleep apnoea (OSA) in Australia, Europe, and Canada.

Source: Fisher & Paykel Healthcare annual report 2019

Clinical evidence in FPH’s products

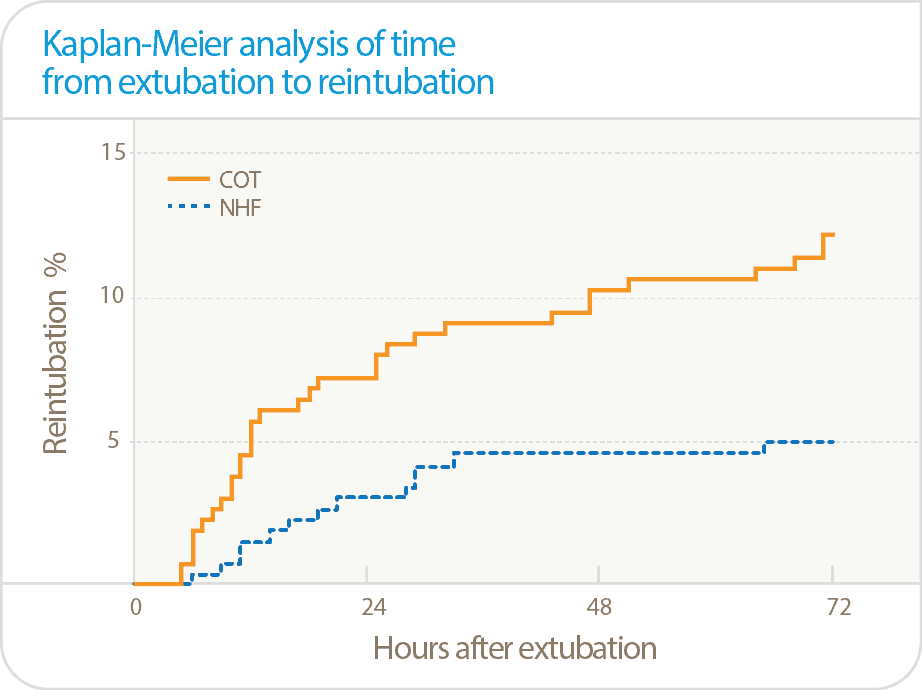

Source: Fisher & Paykel Healthcare

FPH offers a cheaper yet more efficient therapy for COPD. As illustrated above, treatment with FPH’s NHF oxygen therapy reduced 90-day mortality and the need for intubation for acute patients compared with standard oxygen therapy.

FPH has thus established a dominant market share and a high-profile brand in the core hospital business in ICU, in the application of Nasal high flow (NHF) and Non-invasive ventilation (NIV).

FPH’s diversification in revenue

Source: Fisher & Paykel Healthcare annual report 2019

The company sells in more than 120 countries, and the North America region accounts for around 45% of annual revenues, followed by Europe (28%), Asia Pacific (22%) and others (5%).

FPH aims to increase the effectiveness and efficacy of treatment of COPD through its proprietary patented equipment such as Opti-flow and nasal high flow technology.

Its unconventional treatment has reduced costs, treatment intensity, and duration of hospital stay for patients.

Additionally, FPH is market-leading in the ICU sector with limited competition.

In the last five years, its applications consumables sales of NHF and NIV has grown at over 20% per annum and is currently making up 60% of hospital sales.

FPH also produces respiratory humidifiers and consumables that are essential to treating patients infected by Covid-19.

Financial Performance

FPH updated its revenue and profit guidance on 21/02/2020 due to the coronavirus pandemic.

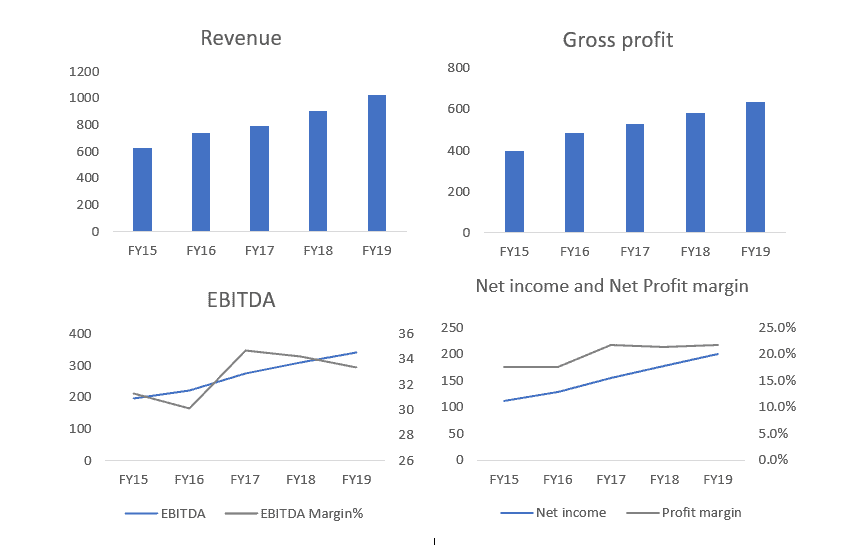

FPH’s revenue is showing a predictable upwards trend which will most likely accelerate thanks to COVID-19.

Source: Bloomberg

FPH’s net income surged 12.09% in 2019 to 200.3 million, due to improved profit margins.

The adjusted dividend and earning per share continues to improve, reaching 22% and 38.5% per share in FY19, respectively.

Consequently, FPH’s P/E was trending up steadily before seeing a spike around 03/2020 due to the coronavirus.

FPH to increase production to meet demand

FPH will ramp up production in Auckland and Mexico by putting on extra shifts and hiring more workers.

Along with respiratory humidifiers, FPH will make other medical consumables such as nasal cannulas and mask interfaces used in the treatment of COVID-19.

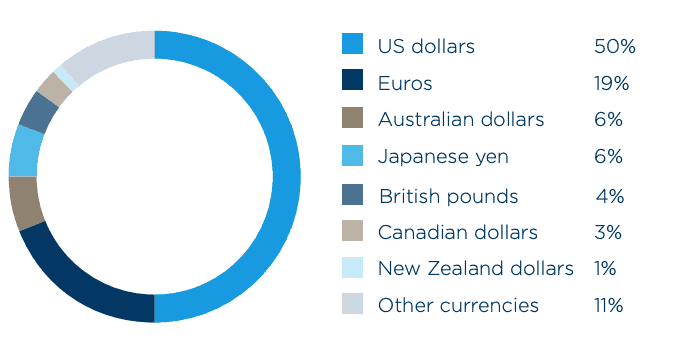

Source: Fisher & Paykel Healthcare Annual report 2019

FPH generates over 99% of sales in foreign currencies and the company may face currencies mismatch as around 40-50% of the costs is incurred in NZD.

As illustrated, 50% of currency exposure came from U.S. dollars, followed by Euros (19%), Australian dollars and Japanese yen (6%), and other currencies (25%).

FPH’s strength in a post-COVID-19 world is that it takes advantage of the coronavirus pandemic while most industries shut down and downgrade their profit guidance.

We believe the impact of coronavirus is not entirely reflected in the FPH’s stock price yet, and the rising demand for medical equipment and a weakening NZD would contribute positively to FPH’s bottom lines.

Peer Analysis

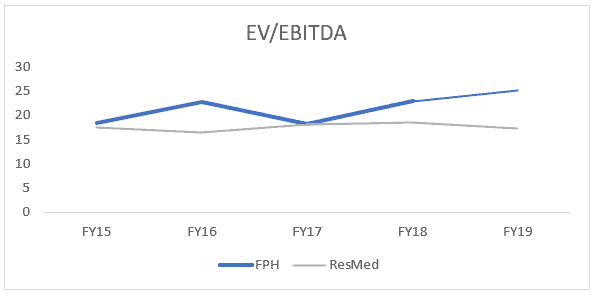

ResMed (ASX RMD) is a manufacturer and distributor of medical equipment based in the US, a strong competitor of FPH.

ResMed has higher revenue growth than FPH.

FPH saw an average of 13% of revenue growth, from $631M to $1026.7M, while ResMed managed 14.3% of average revenue growth, from $2186M to $3717M FY15-19.

ResMed

ResMed saw higher average revenue growth in FY15-FY19. FPH and ResMed both saw an upward trend in both revenue and gross profit but ResMed managed a slightly higher revenue growth, despite its higher volatility in profit margin.

FPH expects to see higher revenue growth than ResMed in FY20, as although ResMed produces ventilators, this category makes up less than 10% of its sales.

Industry analysis

Rapid growth in the global market of respiratory humidification

Source: Market Watch

COPD is the fourth leading cause of death in the United States. It is estimated that up to fifteen million US adults are diagnosed with COPD, and twelve million more COPD patients remain undetected in 2020.

COPD costs the U.S. about USD$30B in healthcare expenses per year, and this cost is expected to increase to $49 billion by 2020.

The global medical equipment market is expected to grow at 8.6% CAGR FY19-24, from USD$690M to USD$1130M.

Furthermore, the consumer price index for medical care services and commodities in the U.S is showing strong year on year growth.

This will contribute significantly to revenue growth for FPH.

Source: Statista

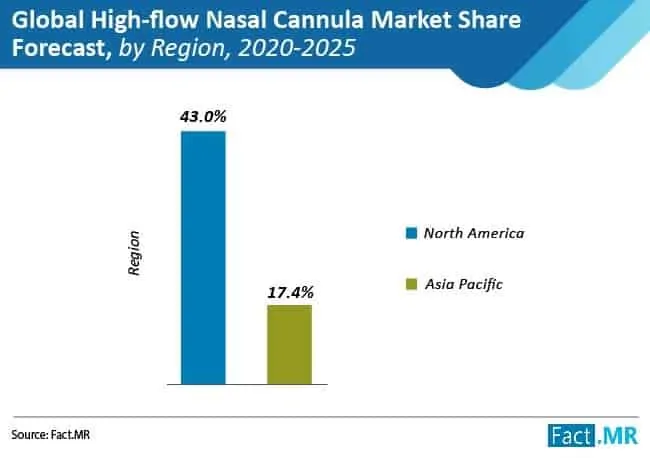

High-flow Nasal Cannula market is forecasted to grow at CAGR of 11.8% in 2020-2025.

The North American and Asia-Pacific HFN market shares are projected to be 43% and 17%, respectively.

Source: High-flow Nasal Cannula Market Forecast

The efficiency of FPH’s solutions has decreased the need for invasive therapies, and thus the demand for FPH’s products has risen substantially.

In particular, the proven benefits of the AIRVO and Opti-flow system nasal high flow therapy for COPD patients are expected to drive higher sales growth in both the hospital and the homecare settings.

Conclusion

Fisher and Paykel Healthcare is a global leader in manufacturing medical devices related to sleep apnea, chronic obstructive pulmonary disease, and other respiratory conditions.

FPH aims to provide products both at home and in hospitals to relieve COPD symptoms and reduce medical costs for patients.

COPD is globally prevalent, and treatment in this field has high market potential.

Moreover, respiratory ventilators that FPH products are expected to see escalated growth in demand due to the COVID-19 pandemic.

With strong revenue growth and products that will likely see strong demand now and into the future, FPH is a stock that we like with strong potential upside.