Galaxy Resources shares (ASX GXY) is a leading lithium miner in Australia which owns 100% of Mt Cattlin mine in West Australia, Sal De Vida in Argentina and James Bay in Canada. Galaxy Resources mines are cash flow generated and have abundant high-quality lithium assets.

However, the trade war between China and the US could cause some disruption for Australian lithium miners. By joining the global lithium supply, GXY stock is subject to the global forces and competition from overseas lithium explorers and miners.

Table of Contents

Galaxy Resources shares (ASX GXY) primarily focuses on lithium carbonate production and mineral exploration. Having benefited from it’s superior “lithium triangle” location, the company’s substantial lithium assets have positioned Galaxy Resources as a potential heavyweight player within the global lithium market. The company currently has a market capitalisation of approximately $1.24 billion.

Among its peers, lithium and tantalum producer Pilbara Minerals (ASX PLS) stands out as holding one of the world’s largest lithium deposits in West Australia with an inferred amount of approximately 1.57 million tonnes. Pilbara Minerals’s market capitalisation is slightly higher than GXY at $1.39 billion. Another major lithium miner within the industry is Orocobre (ASX ORE), which has a market capitalisation of $1.31 billion.

Galaxy Resources Assets Are 100% Cash Flow Generated

Galaxy Resources has managed to ramp up lithium production amidst an industry that is experiencing tightening supply. The lithium concentrate production from Mt Cattlin has been contracted to multiple Asian customers throughout the next five years in a pre-arranged takeoff agreement.

Another potential offtake to end-users is underway with automobile heavyweight BMW. Once the deal is officially signed off, we can expect Galaxy Resources to surge, similar to how Pilbara Mines shares rallied after signing an offtake agreement with Great Wall Motors. The ability to undertake these agreements is primarily due to the companies diversified lithium assets. Holding permits in the world’s three largest lithium deposit regions secures Galaxy Resources’ lithium concentrate supply to meet increasing demand.

However, risks still remain. Although the lithium reserve in Sal De Vida and James Bay appears to be sufficient, the mines are both still under development. There are still questions around how long it will take for the mines to start producing minerals.

Galaxy Resources Will Be Welcomed by China As NEVs Demand Skyrockets

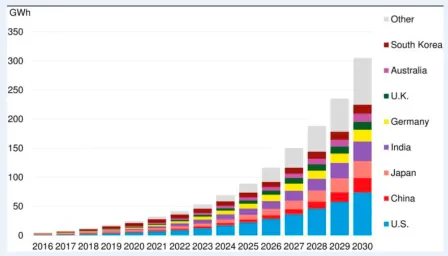

Galaxy Resources growth can be attributed to the growing demand for lithium. Both electric vehicles (EV) and energy storage (ES) are primarily the demand drivers within the global market. According to Bloomberg New Energy Finance, the forecast expects the ES market to double an estimated twelve times by 2030.

Global Cumulative Storage Development

The world is desperate to pursue renewable energy, with worldwide support to accelerate EV adoption from governments as well as Automakers. The surge in lithium prices is testemant to demand outstripping supply. To satisfy EV manufacturing, Automakers, or end-users, would rather pre-order and agree on offtake with a higher price.

China, as the main lithium importer, has set up an aggressive expansion of New Energy Vehicle (NEV). With 794k NEVs produced in 2017, China is now aiming at 7 million NEWs production by 2025. Leading global EV market by more than 50%, China’s lithium import requirements should strongly outstrip supply.

However, the sudden changes in tariffs between China and the US might cause some volatility in the Australian lithium market. An extra tariff is currently imposed on Chinese high-tech products, especially Chinese EV and lithium batteries. However if Chinese NEVs were primarily domestically consumed, the influence on Australian lithium export would be minor, if any impact at all.

The exported lithium from James Bay in Canada is now subject to President Trump’s trade war with potential higher feedstock price at risk of pushing China away to other exporters. Being aware of a slow supply-side response, China is seeking to take over Australian lithium miners. Should this occur, it’s expected Chinese manufacturers’ backward integration may push the price down leaving domestic miners in an unfavourable situation unless Australian regulation intervention is involved.

Galaxy resources shares currently have a PE ratio of 7600. The shares are currently not priced on a quantitative basis as investors anticipate very high future revenue growth. A comparable company such as Orocobre (ASX: ORE) currently has a PE ratio at 41.30 with the industry ratio average PE at 7.27.

GXY is currently priced almost fully on its potential for growth with major investment expenses contributing to low earnings and profit margin. The lithium market is still fairly new in Australia and is supplying an industry in its infancy, so the volatile results and low returns don’t come as a huge surprise.

Potential Growth in A Changing Landscape

The surging demand for both EV and ES will push lithium production forward in terms of revenue and profit. Positioning itself in the Chinese market, Galaxy Resources shares have strong potential to meet demand and grow. Offtake agreements have secured revenue from pre-orders, but lithium export from the James Bay project in Canada won’t be guaranteed if the trade war escalates.

ASX GXY shares are trading at a premium at the moment, though this is because of such strong potential for the stock. Although the financial performance is quite poor, they should improve drastically once projects in Argentina and Canada start producing lithium.