The HomeCo Daily Needs REIT (ASX:HDN) has been in the news for its acquisitions of high-quality daily needs-focused properties and its merger in October 2021 with the Aventus Retail Property Fund (previously ASX:AVN) to form a stronger competitor to the biggest retail-focused REITs in the country.

HDN’s deals have an underlying intention to deliver stable and growing distributions for unitholders.

The increased strength and better economics of the merged entity have positioned it for better and more competitive access to capital, generally better bargaining power with tenants, and other advantages in areas such as logistics.

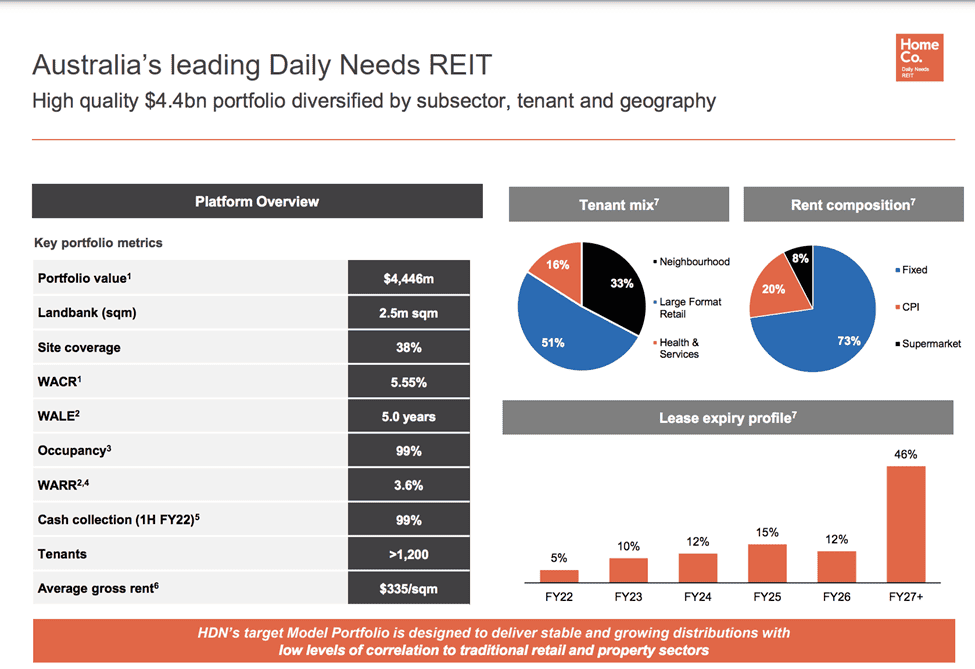

What’s interesting is that the REIT is available below its underlying portfolio value of about $4.4 billion (fair valuation as of Dec 31, 2021) by a significant margin.

The stock is down 14.62% YTD.

Table of Contents

- 1 About HomeCo Daily Needs (ASX:HDN)

- 2 Strong Fundamentals But Tenant Concentration and Lease Structures A Weakness

- 3 Huge Omnichannel Opportunity But Rates Hikes and Potential Recession Pose Serious Risks

- 4 HomeCo Financials

- 5 HomeCo Daily Needs REIT: Valuation

- 6 HomeCo Daily Needs REIT Maybe A Worthwhile Investment In These Trying Times

About HomeCo Daily Needs (ASX:HDN)

The HomeCo Daily Needs REIT (ASX:HDN), is a REIT (Real Estate Investment Trust) promoted by alternative asset manager Home Consortium.

After its recent merger with Aventus, it has become a retail asset major with 51 properties across a land bank of 2.5 million square meters.

The company is a landlord to some of the country’s largest retail brands such as Coles or Woolworth’s in the Daily Needs/Neighbourhood Segment (33% of Income), Harvey Norman or Nick Scali in the Large Format Retail Segment (51% of Income), and the remainder in healthcare services (16% of Income).

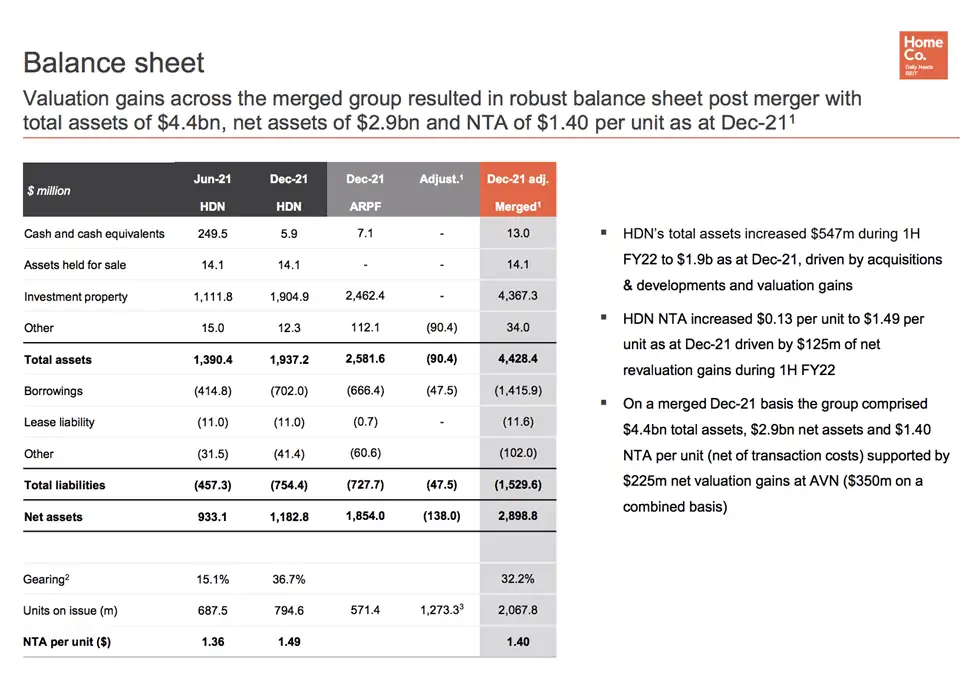

The company is currently trading at a market cap of A$2.74B, which is over 38% below the $4.4 billion valuations (as of 31 Dec 2021) of its property portfolio.

The REIT’s Net Tangible Assets (NTA) metric was $ 1.40 per unit as of the same date.

Strong Fundamentals But Tenant Concentration and Lease Structures A Weakness

The HomeCo Daily Needs REIT checks most boxes that make up a good REIT.

The company has a strong portfolio of well-placed properties that are highly multifunctional in nature.

As a result, it enjoys 99% occupancy, a top-quality client roster that is diversified across non-discretionaries and discretionaries, and a solid average lease life.

The company’s 2.5 million square meter land bank is very strategically placed across Australia such that it can serve nearly half of the country’s population within 10 km with most (78%) in metropolitan cities.

Further, its site coverage is just 38%, allowing for further optimization for increasing leasable capacity.

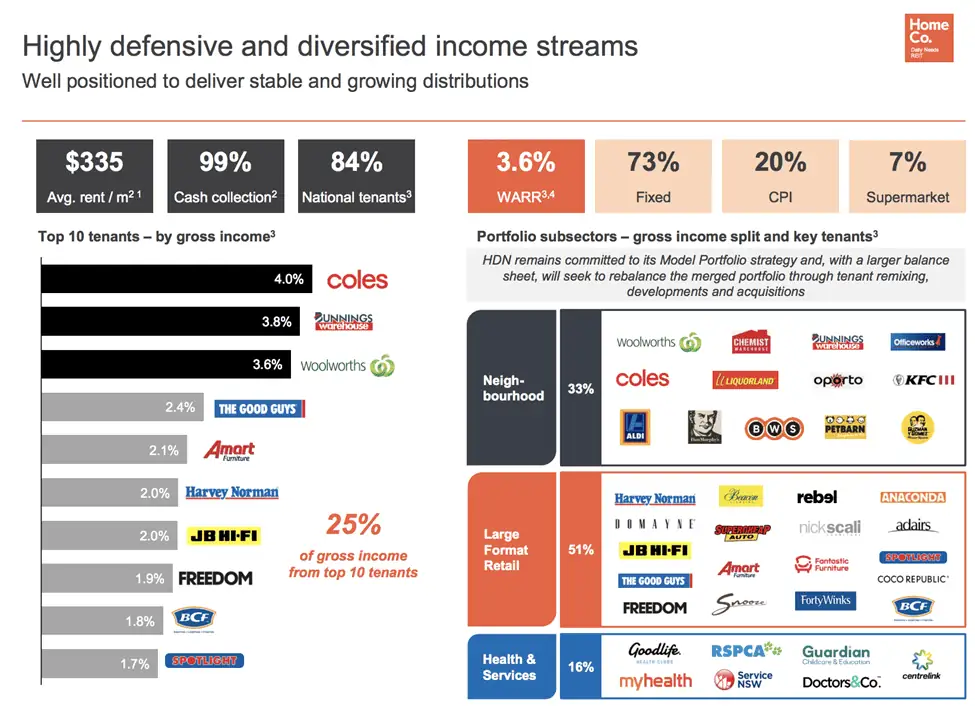

Its client roster is made up of some of Australia’s biggest and most resilient brands such as Coles, Woolworths, Bunnings, KFC, Aldi, and Officeworks in the daily needs segment.

Large format retail clients include JB HiFi, Nick Scali, and Harvey Norman.

Its remaining capacity includes childcare/healthcare/petcare brands such as RSPCA or Guardian and government tenants Service NSW and Centrelink.

This heterogeneous mix of top-quality tenants gives the REIT a diversification in tenancy types whilst maintaining quality.

This results in dependable earnings because business cycles are less likely to significantly affect non-discretionaries such as daily needs, care, and government services.

This is reflected in its cash collection rates of 99%.

To further tweak the portfolio in favor of resiliency of earnings, the company is gradually moving towards a ‘model’ portfolio of 50% Daily Needs, 20% Health/Services, and 30% Large Format Retail, thereby reducing dependency on cyclical from the current 51% and re-allocating them into non-discretionary sectors.

Further, apart from high-quality tenants, most of the company’s current standing leases have long lives with 46% of leases expiring in or beyond FY27.

Its lease structure comprises 73% fixed, 20% CPI/Inflation-linked, and the remainder in supermarket leases, which include a component of receivables linked to sales by one or more anchor tenants.

However, while fixed leases add clarity and resiliency, thereby reducing risk, they also have a flip side, as discussed below.

Lastly, the company has strong growth potential ahead – both within its owned land bank, as well as through the acquisition of adjacents in new developments.

The company has identified A$500 million of development projects, representing an increased leasable area of 23,000 square feet, to which it has committed A$60 million of Capex a year with an expected ROIC of 7%.

However, one weakness is that a large chunk (73%) of HomeCo’s leases is not inflation-linked.

While fixed leases involve a pre-determined escalation of rent every year, these can be unprofitable if inflation far outpaces expectations (as over the past few quarters), and/or lasts for a longer duration.

Persistent inflation will force the RBA to hike rates earlier and by larger increments.

Further, given the fact that tenants are concentrated and are large corporations, the company may have to deal with any potential renegotiations defensively.

Huge Omnichannel Opportunity But Rates Hikes and Potential Recession Pose Serious Risks

A lucrative opportunity for the company could arise through leveraging its well-placed network of assets to facilitate omnichannel sales or pure-play logistics services.

As mentioned above, with close access to more than half of the country’s population and a solid metropolitan presence, the company is well-placed to provide crucial infrastructure to big omnichannel players such as Coles/Woolworths/Aldi who have seen rapid growth in these verticals since the onset of the pandemic and are now investing aggressively in them.

Many retailers (eg. Coles) are adopting the omnichannel model instead of online-only as they are finding it to be more economical whilst being as effective.

For example, servicing deliveries of food where storage and expiries of products are an added layer of complexity, or in the case of big items such as furniture.

A recent CBRE study showed that 34% of in-store sales are web influenced and 61% of in-store collection customers buy more items at the time of pick up.

Therefore, HomeCo’s strategically and proximately located assets make them convenient both for deliveries and pickups, a dual advantage that would be attractive to prospective retail tenants with an omnichannel marketing model.

HomeCo’s portfolio is primed to take maximum advantage of this opportunity.

The CBRE survey findings are validated by HomeCo’s own tenant profile: About 70% of its clients already operate omnichannel verticals.

Furthermore, as mentioned above, average site coverage across the company’s portfolio is just 38%, thus giving the company sizable headroom to optimize space between retail, or for storage/logistics purposes depending on footfalls and client demand, representing a further advantage.

However, the company faces a big risk from rising rates that could lead to a cooling of the real estate market because it is primarily driven by debt.

Due to the unprecedented levels of inflation, we are currently seeing, the real estate market could suffer a double whammy.

Higher debt costs from rising rates have the potential to cool the market due to the heavy use of leverage in purchases, thereby hurting property values; at the same time, lower economic activity due to higher rates could exacerbate the problem, particularly in retail and commercial real estate.

Both potential outcomes present repricing risk for the company’s portfolio because market valuations of properties might fall significantly, thus lowering the asset value of the firm and its share price.

A second-order risk is that sharp increases in the cost of mortgages, as well as on other borrowings, could adversely impact consumer spending over the medium term. In turn, this could cloud the business outlook of large-format retail category lessors (about 51%) and sales-linked supermarkets leases (7%).

HomeCo Financials

For 1H’22, the REIT reported FFO (Funds From Operations) of 4 cpu (cents per unit).

This was up 38% on the combined (post-merger) Net Tangible Assets (NTA) per share of A$1.40 and gearing of 32% in the previous corresponding period last year.

Net Operating Income for the 1H’22 period was A$44.3 million while EBITDA was A$37.9 million and FFO was A$30.6 million.

The company currently has net liquidity of A$205 million, of which A$192 million is undrawn credit.

Debt stands at A$1.427 billion with a weighted average tenure and cost of 3.9 years and 1.9% p.a., respectively.

Operational metrics were stellar at 99% occupancy and cash collection.

The company also has interest rate hedges in place to the extent of 56% of exposure.

The company reported 69 new leases and renewals at a leasing spread of 4.9% (a leasing spread is a difference in rates between the old/original lease rate and the new/lease rate at renewal). All of these figures are proforma post-merger performance of the new entity.

In 2H’22, the company has targeted A$30 million of new developments with an expected ROIC of 10%, with a further A$60 million due FY23 with an ROIC of 7%.

The company has upgraded its full-year distribution for FY22 by 3.5% to 8.28c per share in light of its successful merger and acquisition of certain earnings accretive assets.

HomeCo Daily Needs REIT: Valuation

We compare the HomeCo Daily Needs REIT (ASX: HDN) to the Charter Hall Retail REIT (ASX: CQR) and the SCA Property Group REIT (ASX: SCP), both of which are Australian REITs with similar asset portfolios whilst being managed by the best real estate companies in the country.

All figures are based on FY22 guidance as given in the 1H’22 results of the individual REITs, the latest numbers reported by these REITs.

Distribution yields are based on projected FY22 guidance and current market prices.

| Metric | HomeCo Daily Needs | Charter Hall Retail | SCA Property Group |

| Price/FFO | 14.51 | 15.10 | 16.90 |

| Price/NTA per Unit | 0.964 | 0.944 | 1.045 |

| Price/Distribution Per Unit | 16.3 | 17.5 | 19.96 |

As seen, HomeCo is the cheapest on Price/FFO and Price/Distribution Yield, thus showing its value compared to its peers.

In terms of Price/NTA, it is only slightly more expensive than Charter Hall while being much cheaper than SCA.

HomeCo Daily Needs REIT Maybe A Worthwhile Investment In These Trying Times

HomeCo Daily Needs REIT (ASX: HDN) is likely the answer to the question on most investors’ lips these days: Where do you hide?

HDN’s focus on assets that are relevant to the common man’s everyday needs could be a strategy suitable for an economic scenario threatening a recession.

Properties that deliver food, staples, and medicines, when run by established retail majors such as those among HomeCo’s tenants, are likely to remain in place and generate rental returns regardless of economic conditions.

On a more general note, real estate has usually performed well in an inflationary environment over the longer term.

But HomeCo could have an edge here due to its diversified tenant base, high-quality, strategically located assets, and resilient earning stream.

With a merger and recent strategic asset acquisitions under its belt, HomeCo has revised upward its distribution guidance for FY22 amidst a perfect storm of negative events including war, rampant inflation, stock meltdown, and interest rate hikes.

That shows the REIT’s confidence in its income flow and translates to a potentially steady distribution yield for unitholders – surely a valuable consideration in these times.

According to a Goldman Sachs forecast, HomeCo could distribute a dividend of as much as 9c in FY23, implying a yield of 6.7% on the current unit price of $1.35.

Though a recession cannot be ruled out, consider the plus factors such as the return of international tourism and foreign students to Australia as the economy reopens after COVID restrictions.

Further, emerging skill shortages and record low unemployment would spur immigration.

These factors are all positive for HomeCo’s retail tenants, and therefore, for the company itself.

Lastly, HomeCo appears to be valued cheaper than peers and could be considered a value pick at current levels.