Today we will take a look at why we think IDP Education shares (ASX:IEL) have good potential upside in our IEL share price forecast and analysis,

IDP Education Ltd, based in Melbourne, Australia, is a leading provider of international education services with a history of 50 years.

The company has a global presence with offices in over 30 countries.

IDP Education’s main business activities include management and administration of the IELTS test as a co-owner of IELTS, support for placements for study abroad, and management of language schools.

Andrew Barkla led the company since August 2015, but stepped down in September.

His tenure was notable for a sharp upswing in the stock that took it nearly 10X from the pre-IPO level around the time he took over.

His position has been assumed by Tennealle O’Shannessy, who previously led Adore Beauty.

Over the past 12 months, IDP Education shares have outperformed the ASX 200 by a small margin.

At the current IEL share price, IDP education shares are up 10.86% during that period versus the ASX 200’s gain of 9.21%.

Table of Contents

- 1 About IDP Education Ltd (ASX:IEL)

- 2 Asia’s Growing Middle-Class And Its Education Aspirations Presents A Huge Opportunity For IDP Education shares (ASX:IEL)

- 3 The Digitalization Thrust By IDP Education (ASX:IEL) Has Become A Serious Strength And Demonstrates “Industry Transformation”

- 4 New Initiatives By Governments To Localize Top Notch Universities Are An Emerging Threat

- 5 A Leadership Switch Is Cause For Concern

- 6 IDP Education Shares (ASX:IEL) Financials

- 7 IDP Education Shares (ASX:IEL) Valuation

- 8 IDP Education Shares (ASX:IEL) Are Addressing A Highly Aspirational Need In Rapidly Prospering Emerging Countries

About IDP Education Ltd (ASX:IEL)

IDP Education is a leading provider of international education services, renowned for its expert counseling and cutting-edge digital technology.

The company assists students in achieving their academic aspirations in popular study-abroad destinations such as Australia, Canada, the US, the UK, New Zealand, and Ireland, offering comprehensive support throughout the study-abroad process.

This includes assisting with selecting the best destination, program, and institution, completing applications and visa requirements, arranging for education loans, health insurance, money transfer services, and accommodation, and assisting with setting up an overseas bank account and obtaining a SIM card.

Broadly, the company’s businesses are categorized around the key areas of Student Placement and English Language Testing (IELTS), as well as English Language Teaching, and Digital/Event Marketing.

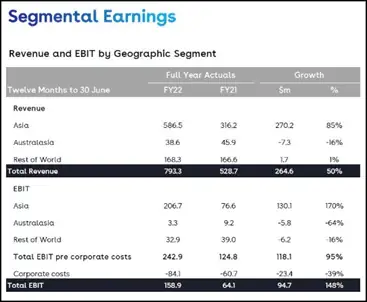

Asia clocks the lion’s share of IDP Education shares Revenue and EBIT.

In FY22, Asia accounted for 74% of revenue (up 85% y-on-y) and 85% of EBIT Pre-corporate Costs (up 170% y-on-y).

India is a huge market for the company, where it recently opened four new offices, bringing the total number of its establishments in that country to 73.

The company also expanded in Nigeria, and now has 157 student offices globally.

IEL has a market capitalization of A$8.5 billion.

Emerging markets that are IEL’s operational territories represent a huge latent opportunity for IEL.

Burgeoning middle classes that are raking in higher incomes desire for their children to be well-educated.

At the same time, educational facilities in home countries are limited or too difficult to secure admissions into due to extremely high competition.

Foreign degrees are a solution, though an expensive one.

But they become attractive because they increase the chances that the child would secure a lucrative career in a foreign country.

India is a case in point, and a country where IEL has rapidly expanded its footprint.

“The demand for international education is witnessing a boom currently.

This is perhaps the golden period for Indian students aspiring to study abroad, as all major destination countries such as the US, UK, Canada, Australia, are competing to attract foreign students,” said Piyush Kumar, Regional Director- South Asia and Mauritius, IDP Education, in a media report.

A report by Redseer Strategy Consultants says that nearly 1.8 million Indian students are expected to study abroad by 2024 with a total spending of over $75 billion.

It’s a win-win situation really for IDP Education shares (ASX:IEL), which offers its expertise free of charge to students but collects a commission from its partner educational institutions and universities.

While universities are doing everything possible to attract Asian students, there is a huge demand for foreign education from increasingly prosperous families.

The Digitalization Thrust By IDP Education (ASX:IEL) Has Become A Serious Strength And Demonstrates “Industry Transformation”

The company is shifting from a physical office network to becoming a global omni-channel industry transformer, as outlined in a recent document on IDP’s FastLane service.

This service aims to digitally transform the industry and has already attracted 61 clients in Australia and the UK as of June 30, with an additional five clients in Canada shortly after launch.

IDP also hit success with its IDP Live app, which has been downloaded over 900,000 times as of August 23, and reports that 3,000 students have received formal offers through FastLane in FY22.

Clients using the service have an average application-to-offer turnaround time that is six times faster than normal.

IDP aims to grow formal offers in FY23 by at least three times and expand further into undergraduate programs.

Additionally, IDP Education has launched IELTS Online, a platform that provides test-takers with more choice and flexibility, and allows for more tests to be conducted at one time.

IDP has also introduced new data-driven study application services to drive innovation in the industry.

New Initiatives By Governments To Localize Top Notch Universities Are An Emerging Threat

Earlier this month, India’s University Grants Commission (UGC) announced draft norms that allow foreign universities and educational institutions to set up campuses in India.

These norms allow them autonomy in determining fees, as well as a 90-day approval process by the government from the date of the university’s application.

The initial approval will be for 10 years, which can be extended.

A foreign university with a rank among the top 500 global rankings or a foreign educational institution of repute in its home jurisdiction can apply to the UGC to set up a campus in India.

A local establishment of a reputed university would dent IEL’s market by reducing the need for its consultancy and reliance on the partner network.

However, IEL has put up a brave face and said that the policy “wouldn’t affect student mobility as aspirants would still look forward to studying in a foreign country to experience a better ecosystem.”

Moreover, IDP Education shares (ASX:IEL) has not been sitting on its laurels, and has boosted growth with a strategic acquisition.

In September, it entered into a binding agreement to acquire 100% of Intake Education for about A$83 million.

Intake is a leading student placement agency that has operations across Nigeria, Ghana, Kenya, Philippines, Thailand, Taiwan, India and the UK.

It boasts of three decades of industry leadership in the UK-bound international education sector.

IDP will acquire Intake’s offices based across Nigeria, Ghana, Kenya, Philippines, Thailand, Taiwan, India and the UK.

“Intake’s geographic footprint complements IDP’s global network.

In some markets such as the Philippines and Thailand, IDP and Intake are the two clear market leaders, whereas in other areas, such as West Africa and Taiwan, IDP can learn from Intake’s market presence,” the company commented on the acquisition.

A Leadership Switch Is Cause For Concern

IEL’s solid growth in recent years was spearheaded by Andrew Barkla since 2015.

Barkla resigned in September and IEL is now helmed by Tennealle O’Shannessy, who comes from a position as CEO at Adore Beauty (ASX:ABY) which she held for only two and half years.

That apart, her primary experience has been in online employment services in Australia & New Zealand.

O’Shannessy’ hands-on exposure to education has been as Head of Strategy at Seek (ASX: SEK) Learning for a period of just five and half years.

With IEL now embarking on a high growth path (post-pandemic restrictions), China re-opening, and a strategic acquisition to digest, the company needs a highly experienced hand at the wheel.

The leadership transition may have been unavoidable, but it calls for close monitoring by the Board.

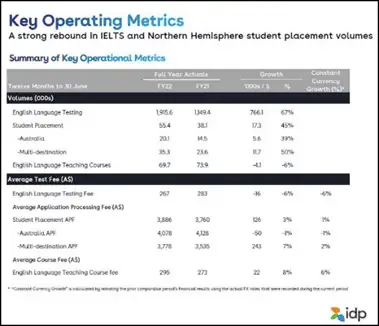

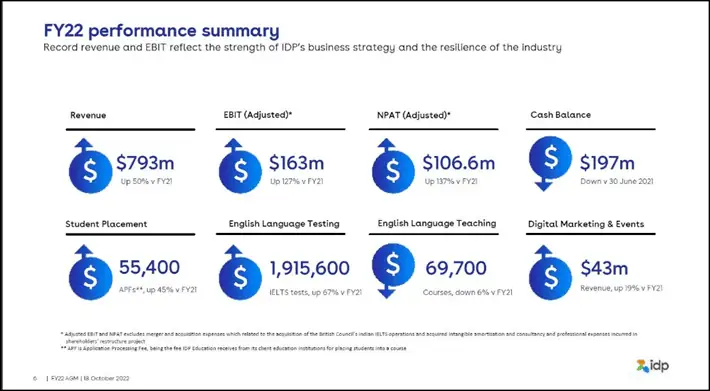

IDP Education shares’ revenue clocked $793 million, up 50% (Y-on-y). IDP’s FY22 adjusted earnings before interest and taxes were up 127% reaching $163 million and net profits after tax up 137% to $106.6 million.

Gross profit margins for student placement hit 84.9% in FY22 – the highest since FY18 – up from 78.3% last year.

IELTS business gross margin profit reached 45.4%.

The company placed students into 55,400 courses, a growth of 45% over last year.

53% of the number of placed students was accounted for by India, marking a growth of 78% Y-on-y.

Growth in placements in other countries was 153% in the US, 50% in Canada, 36% in the UK, and a decline of 21% in China.

Consolidation in the Indian market led to a record 1.92 million tests in India.

Overall, the company said there was a “strong rebound in IELTS revenue (+57%) with volumes returning to pre-pandemic levels for most counties.” IELTS testing volumes grew 67% year-on-year.

“This year, as global mobility resumed, IDP customers reignited their international dreams,” said IDP chief executive officer, Andrew Barkla.

“When they did, our teams were by their side with new innovations that helped them fast track their goals.”

IEL declared a dividend of 13.5 cents share for H2 FY22, bringing the total FY22 dividend to 27 cents.

The company has bounced back into the league of dividend-paying companies after its impressive FY22.

It had skipped dividends in 2021.

There appears to be no comparable listed player that has a similar and large-scale foothold in student placements as well as IELTS testing.

We compare IEL with Chegg (NYSE: CHGG), an American education technology company based in Santa Clara, California, and G8 Education (ASX:GEM), Australia’s largest private provider of quality early childhood education and care.

| Metric | IDP Education (ASX:IEL) | Chegg (NYSE: CHGG) | G8 Education (ASX:GEM) |

|---|---|---|---|

| Price/Earnings (TTM) | 81.41 | 8.95 | 32.61 |

| Price/Free Cash Flow (TTM) | 75.26 | 18.97 | 35.41 |

| Debt/Equity (MRQ) | 56.27% | 114.65% | 82.61% |

| Operating Margin (TTM) | 20.08% | 4.78% | 10.15% |

| Dividend Yield (ANN) | 0.57% | – | – |

From the table, it is clear that at the current IEL shares price, IDP Education shares are much more expensive compared to both the other companies in terms of Price/Earnings and Price/Free Cash Flow.

However, it is head and shoulders above them in terms of lower debt, a high operating margin, and a dividend payment.

In August, post-FY22 result, Goldman Sachs rated IEL as a Buy with a 12-month IEL share price target of A$35.50.

That represents an upside of 16.28% from the current IEL share price of A$30.53.

IEL has consolidated its presence in student placement and English Language testing across emerging countries including India, Philippines and Nigeria.

It has complemented its expansive physical network with a highly digitalized platform that makes the whole process of student enrolment much faster and smoother.

This meshes with a solid network of partner educational institutions that are hungry for student enrolments from IEL’s geographical footprint.

Strategic acquisitions made in 2021 (British Council/India) and 2022 (Intake Education) have further expanded IEL’s market presence.

These are all positive factors as IEL looks at a world that is normalizing from the pandemic with people wanting to get on with their lives (and careers).

The company’s robust performance in FY22, and the resulting dividend, are encouraging pointers to a potentially very bright future.

At the current IEL share price, IDP Education shares can be accumulated on pullbacks for a lower risk entry.