Today, we will look at why we like Karoon Energy (ASX KAR).

Karoon Energy is a Melbourne-headquartered energy company.

The company was initially an oil and gas exploration company and is now on the verge of entering into the hydrocarbon-based energy production sector.

The company has energy exploration assets in Brazil, Peru, and Australia.

Although the spread of the coronavirus has battered the entire energy sector and cast a cloud over its prospects, Karoon is relatively unscathed compared to other energy players as all its energy assets are in the exploration phase and the company has no production income at this point.

The company is also in a very liquid position with nearly half a billion dollars in cash.

In July of 2019, Karoon announced that it had entered into a binding SPA (Sales and Purchase Agreement) with Brazilian energy giant Petrobras to acquire a 100% interest in the offshore oil block BM-S-40, which contains the Baúna oil field in the Santos Basin, for a consideration of $665 million.

The oilfield produces about 19,000 barrels of oil per day.

Over the past 5 years, the company has severely underperformed the ASX index by 75%.

Source – Google Finance

Table of Contents

About Karoon Energy (ASX KAR)

Karoon was founded as an exploration company. However, with its impending acquisition of Baúna, it is on track to become an energy producer.

In 2014, the company sold its 40% stake in the Poseidon discovery at the Browse Basin for $600 million and has since turned its focus to a new three-pillar strategy aimed at making the company into a global energy player.

After the recent pandemic-induced sell-offs in the equity and crude markets, the stock is currently trading at A$0.55 and a market capitalization of A$304 million.

Cashed Up Karoon Energy Eyeing Lucrative Production Asset

Karoon is currently in the process of realizing a new three-part strategy that involves acquiring lucrative cash-generating energy assets, followed by development and monetization of existing discoveries using that cash-flow and then driving further growth by exploration.

In an official statement in March, the company stated they still intend to move forward with the Baúna acquisition because they believe it is an extremely high-quality asset as it is cash-flow positive even at Brent prices as low as $30 a barrel and also due to the company’s belief in the long-term prospects of the demand for oil.

At the time of writing, Brent oil is trading at $35 a barrel.

In 2019, the company raised A$284 million through an equity offering and arranged a credit facility of up to US$275 million to fund the Baúna acquisition and subsequent capital expenditures.

Following the capital raise, the company has about A$496.5 million in cash, which gives the company excellent financial flexibility and strength given the current economic scenario.

However, the company apprehends a substantial delay in the closing of its Baúna acquisition as regulatory approvals could be stalled due to lockdowns and social distancing following the pandemic.

Further, according to the company’s March quarterly report, the size of the company’s credit facility depends on the dynamics of the market at the time of closing of the acquisition.

Given that the debt funding is crucial to the financing of the acquisition and that the pandemic has made the future of the sector highly uncertain, Karoon may need to have a back-up plan in place.

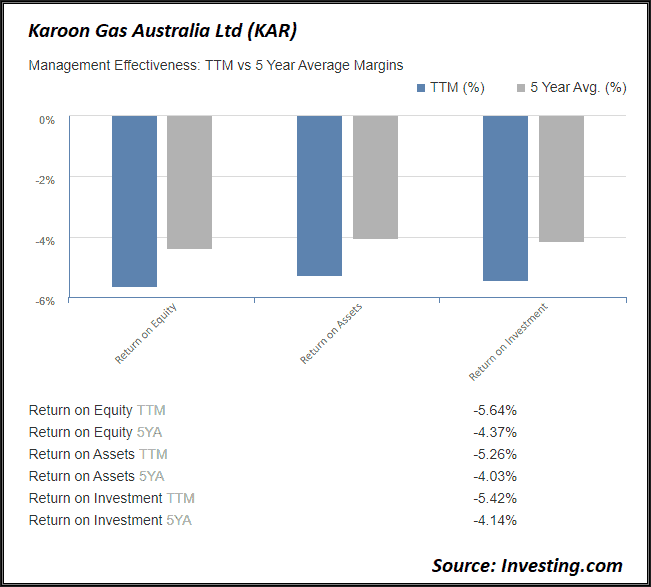

Over the last 12 months, profitability ratios such as return on capital, return on assets, and return on investments have fallen below their 5-year averages.

Given that the debt funding is crucial to the financing of the acquisition and that the pandemic has made the future of the sector highly uncertain, Karoon may need to have a back-up plan in place.

Over the last 12 months, profitability ratios such as return on capital, return on assets, and return on investments have fallen below their 5-year averages.

Though this is a cause for concern, the situation will likely be rectified after the company completes its Baúna acquisition.

Meanwhile, the Board, senior management, and the majority of employees will take a 20% temporary reduction in salaries and fees.

Karoon Energy May Have a Solid Advantage in the Battered Energy Sector

Karoon energy has a unique opportunity to grow in the stricken energy sector because its recent acquisition (Baúna) is a cash-flow positive asset even at Brent prices as low as $30; also the company did not take a hit from the crash in oil prices as it has no production stream or debt servicing burden.

As the nature of the energy sector is very capital-intensive, there are many players in the market with extremely leveraged balance sheets who might not be able to weather this crisis.

These companies might fold up leaving behind a void that can be filled by financially healthier and debt-free companies such as Karoon.

A major threat for Karoon and other energy companies is the fact that in the wake of the pandemic the energy sector might find it difficult to raise further capital.

Energy and exploration companies in the U.S., such as Whiting Petroleum and Diamond Offshore Drilling have filed for bankruptcy because oil demand has slumped to multi-decade lows.

According to energy research and intelligence company Rystad, there could potentially be 100 energy companies bankruptcies this year, leading to defaults of over $70 billion in 2020 and up to $177 billion in 2021.

As per Fitch Ratings, nearly $43 billion of high-yield junk bonds of the energy sector could default globally in 2020 – nearly five times the average yearly defaults for the sector.

Such a high rate of defaults and its seemingly bleak prospects may lead to the sector being locked out of bond and debt markets.

However, a fortuitous equity raise in 2019 places Karoon in an advantageous position.

Karoon’s Financials

Since Karoon has focused on an entirely new business strategy over the past 5 years, the company has mainly been investing in future projects and incurring capital expenditure rather than generating operating cash-flows.

Hence, the following metrics will be used to weigh the company’s financials and compare it to Strike Energy (ASX STX), another company that is going through a capital expenditure cycle.

Strike is an independent ASX-listed company involved in the exploration of oil and gas.

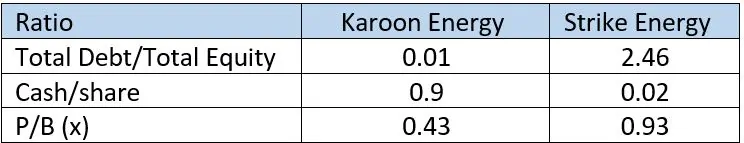

On the Price-to-Book metric, Karoon is much cheaper at a P/B of 0.43 and less than half when compared to Strike’s P/B of 0.93.

On leverage metrics, too, Karoon significantly outperforms Strike Energy.

Karoon has a total debt to total equity ratio of 0.01, or almost nil, compared to Strike’s 2.46.

However, it should be noted that Karoon will need to borrow a significant amount of cash to fund its acquisition of Baúna when it receives regulatory approval.

Karoon is significantly more liquid than Strike having a Cash/Share ratio of 0.9 compared to Strike’s 0.02.

However, the company will use a large amount from its cash reserves to fund the Baúna acquisition when it materializes.

(Data source – WSJ for Karoon and Strike)

Karoon Appears To Be Undervalued Relative To Its Fundamentals

It is interesting that the value of Karoon’s cash and cash equivalents as at the quarter ended March 31, 2020, stood at A$504 million whereas its market cap was A$249 million.

Effectively, the market valued the company at less than half of its cash assets.

Moreover, over 90% of the company’s cash is held in US Dollars to avoid currency risk.

Further, energy demand destroyed by the COVID-19 crisis may return after lockdowns and travel bans are gradually lifted globally.

This can revive oil prices and the valuation of players in the energy sector.

The rising tide could lift all energy boats, including Karoon.