Today, we will look at why we like Newcrest Mining shares (ASX:NCM) and give you a rundown on our NCM share price forecast.

Ever since the COVID-19 induced crash, we have seen unprecedented levels of money printing from governments around the world.

The crash and subsequent flood of money into the financial system is providing very strong tailwinds for gold – an asset we have been bullish on since October 2019.

As the world continues to muddle through issue after issue, gold will continue to be a safe haven hedge for uncertainty in an uncertain world.

Apart from owning gold directly, Newcrest Mining shares (ASX:NCM) as the largest gold producer listed on the ASX is a good way to gain exposure.

With rising revenues, large reserves, and gold & copper mines located around the globe, Newcrest is a stock that we like for exposure to gold.

Table of Contents

Newcrest Mining Shaes (ASX:NCM) Company Profile

Newcrest Mining Limited (ASX:NCM) is the largest gold producer listed on the ASX, with a market cap of A$25.5bn.

It mainly engages in the exploration, development, mining, and sale of gold and gold-copper concentrate.

It currently operates five gold and copper mines globally, two in Australia (Cadia Valley Operations in Ridgeway and Telfer Mine in the Pilbara region of Western Australia), two in Papua New Guinea (Lihir and Wafi-Golpu), and one in Canada, Red Chris.

NCM’s revenue increased 4.8%, from AUD$5.3B to AUD$5.6B FY19-20, and its net income increased 15.3%, from AUD$0.8B to AUD$0.92B FY19-20.

At the current NCM share price, the company’s P/LTM EPS currently sits at 30x, and it has outperformed S&P/ASX 200 by 44% in the last three years.

NCM Share price history

Source: S&P Capital IQ

Newcrest Mining Shares (ASX:NCM) – Financial highlight

Source: S&P Capital IQ, MF & Co Asset Management Research

Newcrest Mining (ASX:NCM) Business Strategy

On-going Drilling Supports NCM’s Sustainable Development

Compared to brownfield explorations that generate quick yet unsustainable profit, Newcrest Mining is committed to investing in greenfield projects to support its longer-term vision of being a leader in the global gold mining industry.

The most recent fruit born by this strategy was the superior exploration result on the Havieron deposit.

A new breccia zone known as the ‘Northern Breccia’ was identified in the Paterson region of Western Australia.

The results from step-out drilling strengthened NCM’s future cash flow and operation.

Strategic Integration Boosts NCM’s Competitiveness

Newcrest Mining’s core strength is its low-cost operation in the mining of gold and copper from low-grade resources.

It has developed an efficient mining process of extracting copper as concentrate and gold as bullion by investing heavily to streamline its operations and build a reliable supply chain.

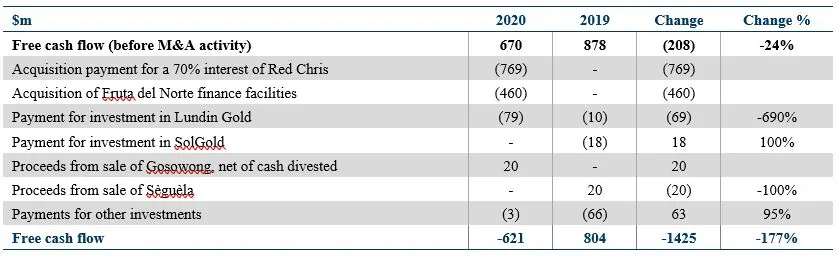

As illustrated below, in FY2020, Newcrest invested AUD$1.3B in M&A activities.

It has successfully integrated numbers of technology companies, enhancing its strong technical capabilities.

NCM – FY19-20 Free Cash Flow Distribution

Source: NCM FY20 Investor Presentation

Industry Analysis

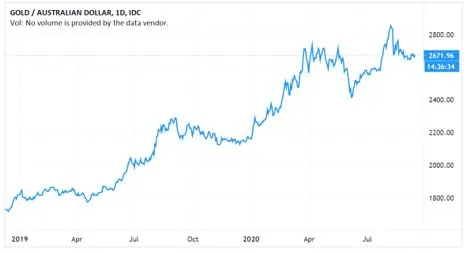

Gold price surges during the COVID-19 outbreak, supporting gold-mining companies, especially NCM

Although there was a recent drop in price, gold has increased by over 23% in value since January.

It reached ten years’ high of $US2, 000 ($2,805) per ounce.

The volatility in gold price is underpinned by the uncertainty in the economy, such as the ongoing outbreak of COVID-19, concerns of delays to vaccine trials, and heightened geopolitical conflict.

The topic of the gold price was comprehensively covered by our previous research and the fundamentals of gold are still strong.

Moreover, Newcrest Mining has the highest proportion of gold production exposed to gold price in FY20 compared to its peers, boosting its FY20 financial performance.

NCM – 1Y Gold price/AUD

Source: tradingview.com

NCM – FY20 Proportion of gold production exposed to the gold price

Source: FY20 NCM investor presentation

Newcrest Mining (ASX:NCM) Key Advantage and Risk

Australia has the largest share of economic gold reserves globally and there are around 75 gold mining operations.

Top 5 companies in the industry by market capitalization

- Newcrest Mining Limited (ASX:NCM)

- Northern Star Resources (ASX:NST)

- Evolution Mining Limited (ASX:EVN)

- Saracen Mineral Holdings (ASX:SAR)

- Regis Resources Limited (ASX:RRL)

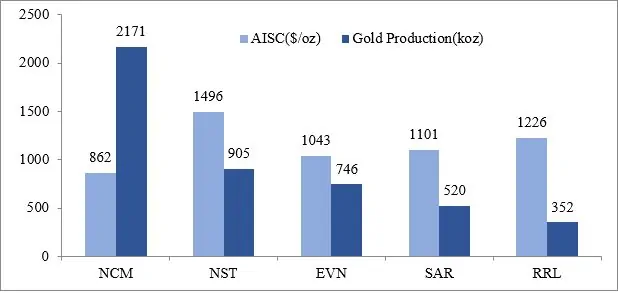

A high-quality asset portfolio allows the highest production with the lowest cost

Newcrest’s mines are exceptionally cost-effective with long life.

NCM’s primary operation in Cadia has AISC (All-in sustaining cost) of $106/oz in FY20, bringing down the group AISC to $862/oz, the lowest among its competitors.

Moreover, Newcrest Mining’s annual production of gold at 2171 koz is more than double of Northern Star, the second biggest gold producers.

NCM – FY20 AISC & Gold Production Comparison

Source: Full Year Results Release from

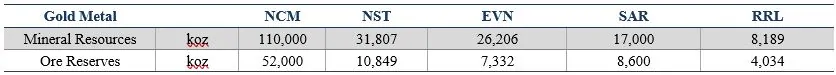

Strong reserve and resource base

NCM’s current gold reserves represent more than 25 years of production at current rates.

As illustrated, Newcrest Mining has the highest quantity of both mineral resources and ore reserves.

NCM – Gold Mineral Resources & Ore Reserves of Selected Companies

Source: Resources and Reserves Reports

Good News about Existing Operations Eases the Stress of the Burdensome Lihir Project

Newcrest Mining reported an exciting exploration update about additional strong gold-copper intercepts from drilling at the East zone high-grade pod at the Red Chris Mine and the expanded extend of the Havieron mineralised system.

However, Lihir production is hampered by the unexpected lower grades and reduced mill recovery, and guidance for FY21 is weaker than the market expected.

The near-term drop in grade from 2.6g/t to 2.3 to 2.4g/t (FY21-FY23) at Lihir will have a negative impact on the company’s results in the short term.

Nevertheless, there could be room for further optimization to achieve a higher grade.

Poor Demand Forecasting and Product Diversification Cast a Shadow into the Future

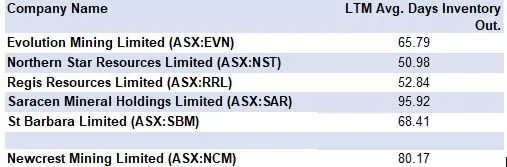

Newcrest Mining has been reporting higher days inventory than its competitors due to its weak demand forecasting performance.

Another weakness of the company is that it generates revenue mostly from its core business in gold.

NCM – FY20 LTM Avg. Days Inventory Outstanding

Source: S&P Capital IQ

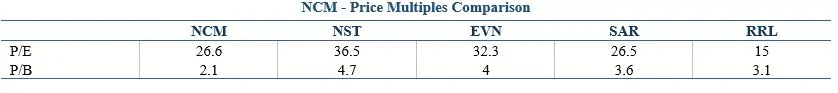

Solid Profitability and Healthy Leverage Ratio Make Newcrest a Wise Choice

Newcrest Mining shares have always maintained a high EBITDA growth rate and margin in the past few years.

In the FY19-20, NCM’s EBITDA increased by 10% to $1,835 million, with a margin of 47%.

The profit is mainly generated by its two operations, 71% from Cadia, and 25% from Lihir.

Newcrest Mining Shares – EBITDA & EBITDA Margin in the past 5 years (%)

Source: NCM Financial reports

Healthy Leverage

Newcrest Mining shares have always maintained a satisfactory debt to equity ratio below 30% since FY2016.

The net debt/EBITDA is 0.3x, total debt/equity is 24%.

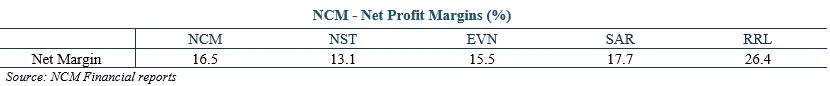

Newcrest Mining shares Stands Out with low P/E ratio

At the current NCM share price, the company maintains a reasonable P/E ratio of 26.6 taking its high-quality earnings into consideration.

It also has a lower P/B ratio of 2.1x compared to AU Metals and Mining industry average (2.3x) and is considered good value among the top 5 gold mining companies as well.

Conclusion

Solid fundamentals and promising drill results support a strong outlook for Newcrest.

The NCM share price recently outperformed the market mostly due to the rally in gold, but it has more room for growth.

With a long-term focus on greenfield development and strategic acquisition to improve operation cost-efficiency, Newcrest Mining shares have managed to become the biggest gold producer with the lowest AISC within Australia.

However, the unexpected lower grade in the Lihir project and the decreasing inventory turnover due to poor demand forecasting may precipitate near-term tailwind.

Nevertheless, our model shows that the sustained gold price would accelerate NCM’s revenue growth, as well as improving its profit margins in FY21-23.

In the unlikely circumstance that gold price plummets in the near term, Newcrest Mining’s low debt should provide sufficient support for the NCM share price.