Today we will look at why we like Opthea Limited (ASX OPT).

Opthea Limited is an emerging healthcare company that specialises in developing novel treatments for chronic eye diseases such as age-related macular degeneration.

Macular degeneration, also known as age-related macular degeneration (AMD), is the leading cause of legal blindness in Australia, responsible for 50% of all cases of blindness.

Opthea’s main focus is on its OPT-302 combination therapy which focuses on targeting wet age-related macular degeneration and diabetic macular edema.

Last year the company unveiled strong study results for OPT-302 which was shown to deliver statistically significant results in patients.

Opthea also anticipates the potential for the therapy to be used for Diabetic Macular Edema (DME), which is an even more lucrative market.

Combined, this gives OPT-302 a market opportunity of almost US$10 billion.

Earlier this year, Opthea was added to the S&P/ASX 300 index during June.

According to the company, Opthea’s inclusion to the index could help diversify the shareholder base as its OPT-302 advances through clinical stages.

Opthea has continued to demonstrate that its treatments are not only effective but address a debilitating condition that affects a significant percentage of the population, through its successful trials.

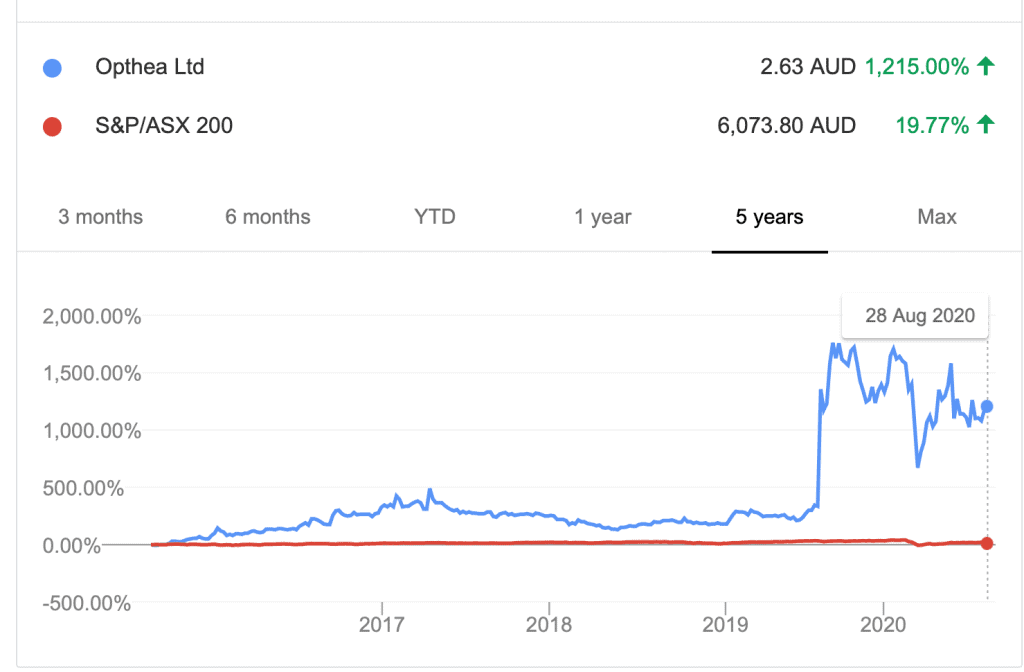

Over the past 5 years, the company significantly outperformed the ASX by 1,215%.

(Source: Google Finance)

Table of Contents

About Opthea (ASX OPT)

Opthea Limited ASX OPT is a public biotechnology company listed on the ASX and based in Melbourne Australia.

The company is focused on the development of new drugs for the treatment of eye diseases.

OPT’s lead asset, OPT – 302, is a soluble form of VEGFR-3 in clinical development as a novel therapy for wet age-related macular degeneration (wet AMD) and diabetic macular edema (DME).

Wet AMD and DME are causes of blindness in the elderly and diabetic populations respectively and are increasing in prevalence worldwide.

Opthea’s novel therapeutic OPT-302, is expected to improve vision and reduce retinal swelling in patients with eye diseases.

This lead therapeutic (OPT-302) is currently being investigated in 2 large Phase 2 clinical trials to find out if OPT-302, improves visuals in patients receiving the standard therapy for wet AMD and DME.

Significant advances in a lucrative market

Opthea has made significant advances in the progress of these studies over the past 12 months and anticipates reporting outcomes from these trials.

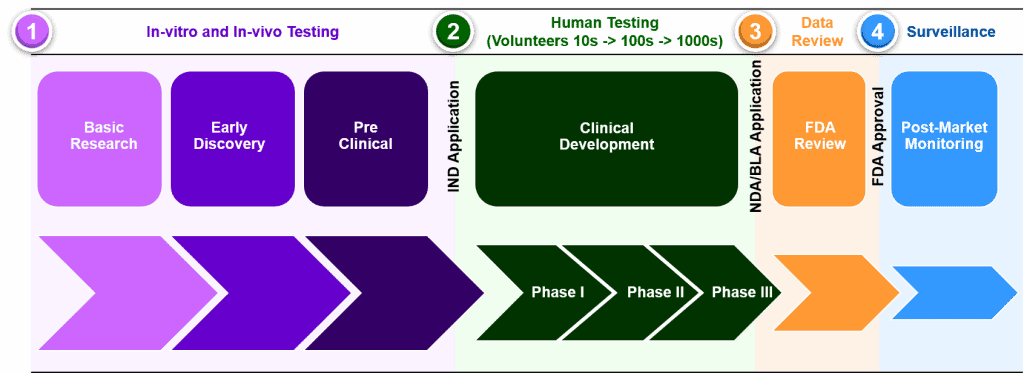

Opthea is currently in its clinical development phase, where it is in the phase of conducting trials.

Wet (neovascular) age-related macular degeneration (wet AMD) and diabetic macular edema (DME) are the leading causes of visual impairment in the elderly and diabetic populations respectively.

Globally, progressive vision loss associated with wet AMD and DME contributes to significant healthcare and economic costs and greatly impacts patient independence and quality of life.

Current treatment options for wet AMD and DME patients are limited and work sub-optimally in the majority of patients.

US$10bn+ market opportunity in the Global Market

Opt-302 is Opthea’s approach to address the unmet medical need for patients with retinal disease.

The basis of Opthea’s strategy is essentially differentiation. Opthea is committed to integrate its drug OPT-302, for the treatment of wet AMD and DME.

If used in conjunction with the existing standard of care treatments, opt-302 has the potential to address the unmet need of wet AMD and DME patients around the world.

Encouraging Clinical Trials

Opthea conducted its phase 2b trials in wet AMD patients.

The outcome was highly positive demonstrating significant superior vision gains in patients’ treatments with opt-302, combination therapy compared to the standard of care Lucentis (this is the standard therapy) therapy alone.

This positive outcome of the clinical trial represents a major achievement for the company and position Opthea as a global player in ophthalmology.

But it doesn’t stop there.

Opthea also has its eyes on the Diabetic Macular Edema (DME) market.

Management notes that there is potential for the therapy to be used for DME, which is an even more lucrative market.

According to the company, the current standard of care generates sales of US$6.2 billion per annum at present. Combined, this gives OPT-302 a market opportunity of almost US$10 billion.

Wet AMD (wAMD) and DME Represent Large Commercial Opportunities for Novel Therapies

The current treatment options for wet age-related macular degeneration and diabetic macular edema are limited and work sub-optimally for the majority of patients.

Both these diseases are on the rise given the ageing population and rising incidence of diabetes worldwide.

This presents a significant market opportunity for novel therapies that can improve vision in patients with these diseases.

Diabetic Macular Edema; a large and growing market (30% of opportunity)

DME is a common eye disease affecting those with diabetes.

As such, the indications of the 2 diseases are somewhat biologically similar, it is anticipated that the positive results shown by OPT-302 in wAMD de-risks the upcoming DME data.

More than 2m people suffer globally from DME, both prevalence and diagnosis are increasing so this market is expected to grow faster than wAMD.

There is a strong view among analysts that doctors could use Opthea’s treatment as a first-line treatment in conjunction with existing treatments adding further value.

When Opthea released their research results in August last year, the share price doubled and reached above $3 and continued to rise before plunging in March this year due to the global economic conditions.

Some analysts believe that industry majors like Novartis, Regeneron, Bayer and Roche could be interested in the research undertaken by Opthea, since it would benefit their existing treatments.

It is also believed that the existing Lucentis’ treatment will lose its IP protection within a year and a similar treatment called Eylea, in another couple of years.

The most important observation from Opthea’s recent clinical trial results was the apparent ability for OPT-302, to preserve vision.

Less than 1% of patients treated with Opthea’s drug lost visual acuity compared to 3-6% of patients treated with the current standard of care.

Global market Opportunity for Opthea

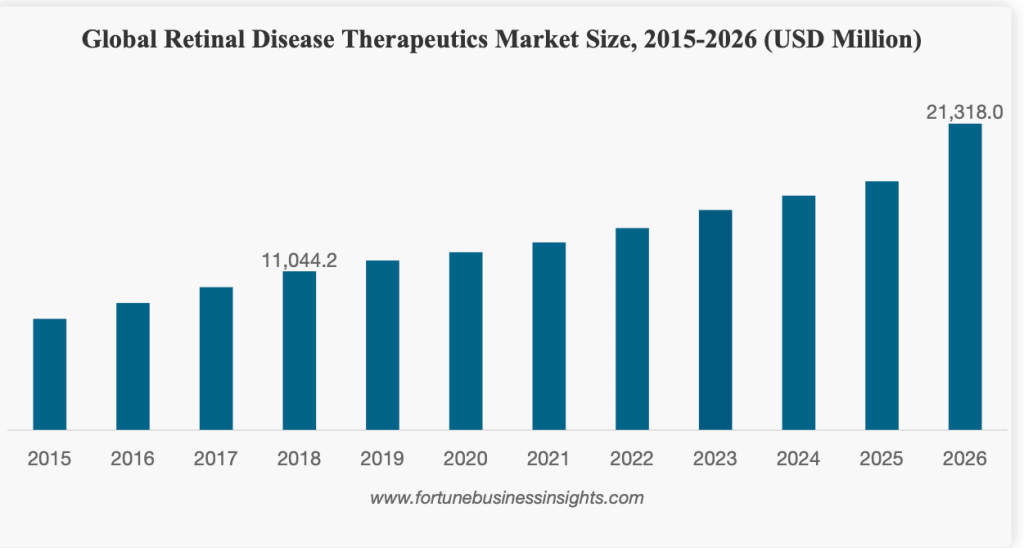

The global retinal disease therapeutics market size is currently valued at nearly USD 12,000 Million and, is projected to reach USD 21,318.0 Million by the end of 2026, exhibiting a CAGR of 8.6%.

Affecting the lives of over 253 million people across the globe, retinal diseases are a major problem in both developed and developing countries and a big burden on the healthcare industry over the coming years.

Considering the current demographic trends, the improved life expectancy of the population is expected to put enormous pressure on the ophthalmic industry.

The rising prevalence of diabetes in patients in emerging countries is causing a surge in cases suffering from retinal diseases such as diabetic macular edema, retinopathy.

The improved reimbursement policies in many countries for costly treatment of retinal diseases is anticipated to boost the expansion of the retinal disease therapeutics market by 2026, as per a report by Fortune Business Insights.

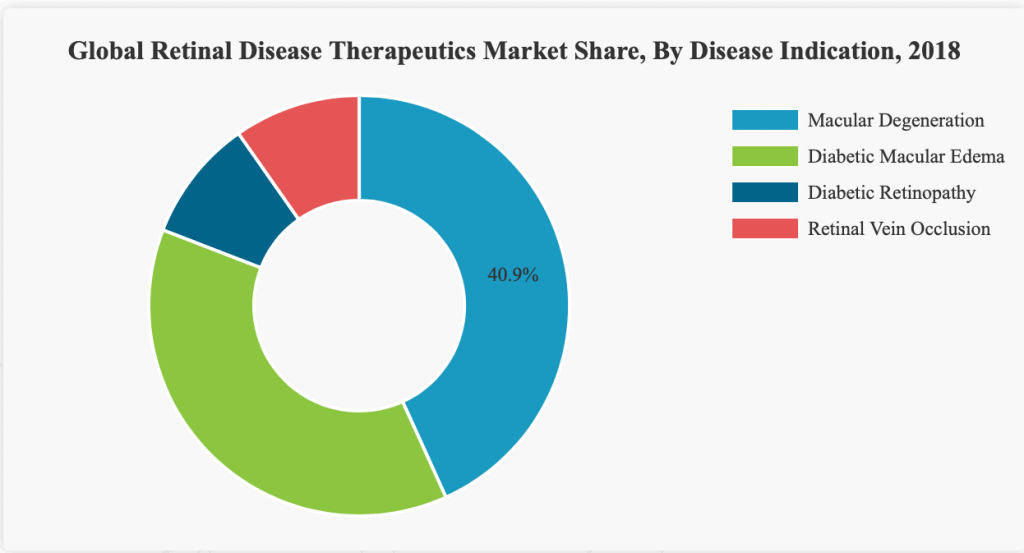

Among the various diseases in the retinal disease therapeutics market are diabetic retinopathy, macular degeneration (MD), diabetic macular edema (DME) and others.

As can be seen in the chart, Macular degeneration accounts for a market share of 42.9% and is expected to remain dominant throughout the forecast period.

Along with this, the rising burden of diabetes in developed countries is propelling the number suffering from diabetic retinopathy.

This is likely to propel the expansion of this segment in the near future.

Opthea’s soluble drug OPT-302, showed a significant positive outcome in patients in conjunction with the existing therapy for wet AMD.

This presents a major achievement for the company and position Opthea as a global player in ophthalmology.

Opthea has continued to raise the profile of its company’s technology to both international and local investment community.

This also places Opthea well ahead in the competitive landscape of other companies developing new therapies with novel mechanisms of actions for the treatment of wet AMD.

A commercial assessment of OPT-302, conducted by an Independent Research Firm, forecasts worldwide annual peak sales of OPT-302 for wet AMD and DME alone to be USD 5.3 Billion, which is a huge opportunity for Opthea.

Impact of Covid-19

The equity valuations of small-cap biotech companies would inevitably face challenges, in the current market scenario.

However, OPT is considered to have the least Covid-19 risk of most small-cap biotech firms.

With no active clinical trial recruitment and a sound balance sheet with no debt, there is scope for outperformance when conditions begin to normalise in the market.

The key reason for this is that OPT is in its pre-commercial operations at the moment.

Additionally, its soluble drug OPT-302, is unlikely to receive regulatory approval before 2023 and hence no material impact is expected on any of the company’s previous commercial timelines as a result of Covid-19.

OPT is a pre-commercial biotech company with its primary focus on the following:

- Processing its trial design for the treatment of DME (Diabetic Macular Edema)

- Finalising its regulatory discussions for its lead indication- wet age-related macular degeneration.

The company also completed its patient dosing and follow up visits for its PH2 trials, in accordance with regulatory requirements.

What’s Opthea eyeing now?

After successfully proving the effect of its drug on 2 eye diseases, Opthea is looking for future treatment options.

The immediate consideration is a phase 3 study on Diabetic Macular Edema (DME).

The solid result of its drug OPT-302, on two diseases, could potentially open the doors to more diseases.

A positive outcome in the DME study has demonstrated that OPT-302, may have broad applications across many retinol diseases potentially enhancing clinical and commercial interest in the drug.

This presents a huge opportunity for Opthea to gain market share outside of its current focus of diseases.

As per the latest investor’s presentation, Opthea will target a total of 1,320 patients over a period of 48 weeks against the same drug it outperformed in the phase 2 trial.

This is over three-and-a-half times the size of the phase 2 trial which trialled 366 patients.

Opthea will start the trial in the fourth quarter of 2020 and readout in the first half of 2023.

The company is also undertaking a phase 2a clinical trial on diabetic macular edema (DME).

It anticipates reporting in the first quarter of next year.

Industry Outlook

Australia’s health care industry has grown remarkably over the past few years, in terms of size and reputation for its world-leading technology, advanced R&D, innovation, leading scientists and health care professionals.

A significant trend in the Australian healthcare industry is the rise of the ageing population.

There were 3.8 million Australians aged 65 and over in 2017, as per a report by the Australian Bureau of statistics.

In fact, the report revealed that by 2057, the ageing population will grow to 8.8 million in Australia (22% of the population).

This trend towards the older population will provide big opportunities to Opthea Limited, considering its target market is mainly the aging population.

Financials

OPT currently has no debt on its balance sheet, which is quite unusual for cash-burning biotech, which usually has a high level of debt relative to its equity.

This means that OPT has been operating purely on its equity investment and has no debt burden.

This aspect reduces the risk of investing in the loss-making company.

In light of Opthea’s strong share price performance, we will investigate how risky Opthea’s cash burn is.

For reference, the cash burn rate is essentially the rate at which a company uses its cash reserves/balance to fund its growth typically.

So, the essential question we’re trying to answer is how fast is Opthea using up their cash reserves?

Cash Runway Analysis

While Opthea does have statutory revenue, it comes primarily from its investments and non-operating activities.

This makes it a pre-revenue company.

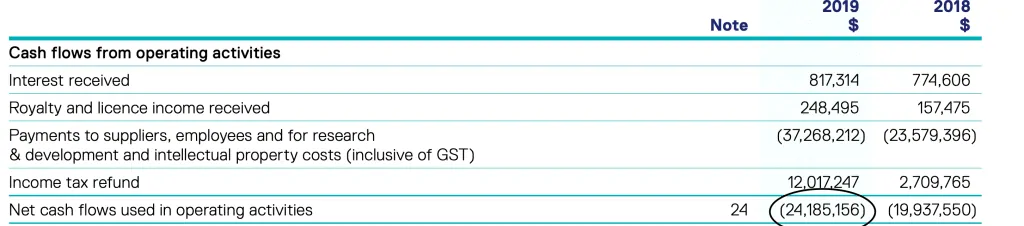

Looking at the last year, the company burnt around $ 24m in cash.

This means that Opthea has a cash runaway of nearly 12 months.

However, this doesn’t raise a concern flag, since cash burn metric is reducing over time.

Since Opthea has a market capitalization of A$ 660 million, Opthea’s cash burn of $24 million is 3.6% of its market value.

Additionally, the company raised $50 million in equity capital in December 2019. In addition, in September 2019, Opthea received a A$14.6 million research and development (R&D) tax credit from the Australian taxation office.

Consequently, Opthea is fully funded through the completion of the Phase 2a clinical trial.

The company also has sufficient funds to progress Phase 3 preparatory activities, including the manufacture of OPT-302 and initiation activities for a phase 3 program in Wet AMD.

It is important to note that Opthea does not have any significant revenue or profit since it is still in its pre commercialisation phase.

However, it is important to note that Opthea’s business plan is very promising and has a lot of potential for future growth.

Plenty of cash at the bank

They reported a cash balance of AUD 75 million in December 2019. This allows management to focus on growing the business and not worry a lot about capital.

And the fact that the share price has risen 18% per year over the last 5 years, it is fair to say that investors believe in the management’s potential for future vision.

The chart above shows how Opthea’s cash levels have changed over the past few years.

According to 3 industry analysts, the consensus is that breakeven is near for Opthea.

They expect the company to post a final loss in 2020, before turning a profit in 2021.

Therefore, OPT is expected to breakeven roughly a few months from now.

The company’s $50m injection also means the company is fully funded until the first half of 2021.

Opthea is a high growth, relatively lower-risk small-cap with great potential

Healthcare company Opthea Ltd ASX OPT has had a volatile year, but it could still be on the path to delivering substantial gains to long-term shareholders.

Opthea has continued to demonstrate that its treatments are not only effective but also address a debilitating condition affecting a significant portion of the population.

Sales of Lucentis and Eylea show that this is a potentially lucrative market if Opthea can successfully commercialise its treatment.

With the company forecasted to breakeven in 2021 and a very strong balance sheet, OPT is a high growth, relatively lower-risk small-cap with great upside potential.