Today we will look at why Pepper Money shares (ASX:PPM) are one of the best up-and-coming non-bank finance companies offering a very solid combination of growth and value in our PPM share price forecast and analysis.

In the recent market volatility, the company has stood its ground and corrected far less than other finance companies, especially such as those in the BNPL space.

Pepper Money is also profitable unlike many peers, available at an ultra-cheap valuation, and offers a tasty 6+% dividend yield.

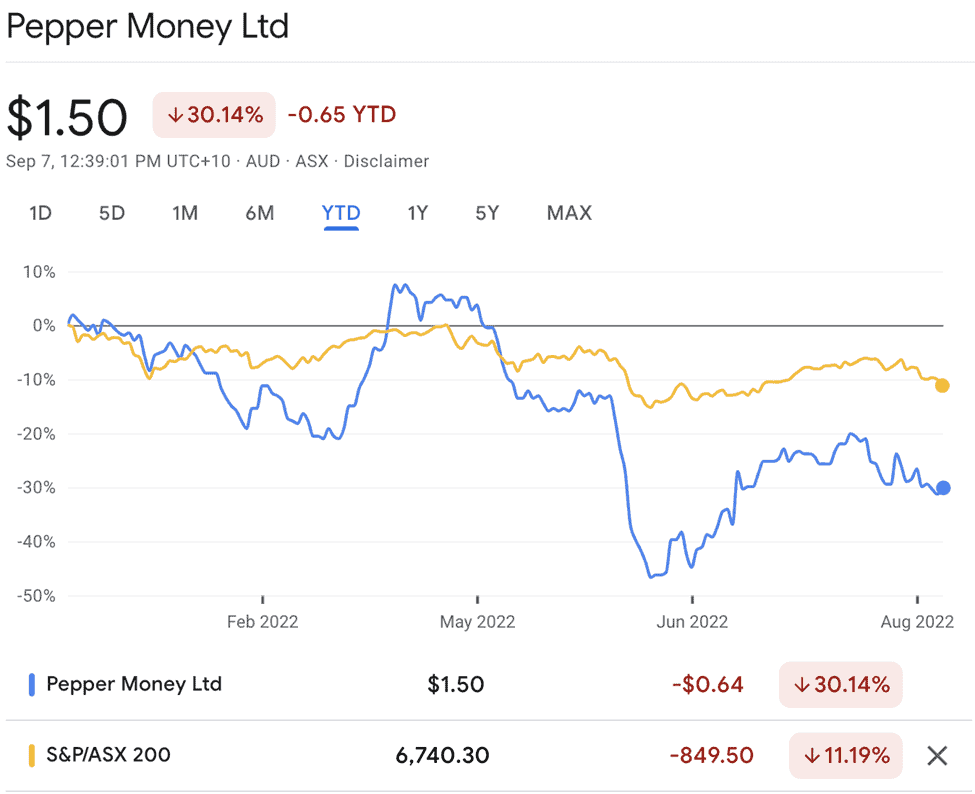

At the current PPM share price Pepper Money shares are trading at A$1.47 and are down about 31% YTD, compared to other new-age finance companies such as Block (ASX:SQ2) or Zip (ASX:Z1P) which are down north of 45% and 80% respectively.

However, opposite the broad market, the stock is still an underperformer YTD as it has lost about 31% against 11% for the ASX200 primarily because rising rates have taken their toll on equities as a whole.

Table of Contents

- 1 About Pepper Money Shares (ASX:PPM)

- 2 Robust Operations and Performance

- 3 Competition and Possible Margin Erosion Are Weaknesses

- 4 Massive Growth Opportunity In Core Business Along With Development Of Direct To Consumer Channels

- 5 Rate Hikes Pose A Major Threat

- 6 Strong Financials With Steady Growth and Solid Liquidity

- 7 Valuation: A Growth Value Hybrid

- 8 Pepper Money Shares (ASX:PPM) Checks All The Boxes For A Value Investor

Pepper Money is one of the leading non-bank lenders in the country and is the ANZ arm of international fintech giant Pepper Global.

The company uses technology extensively to originate loans in a completely paperless process and is focused on big-ticket originations such as mortgages or financing of cars/equipment.

Over the past few years, it has strongly outperformed the mortgage and asset financing sector in terms of growth.

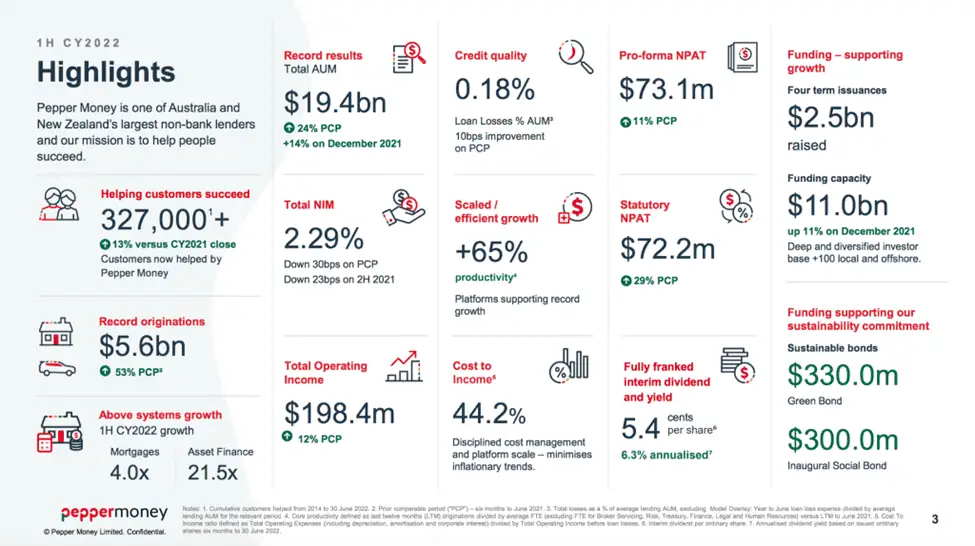

The company has an AUM of A$19.4 billion, A$11 billion of liquidity for new loans, a customer base of over 300,000 people, and an annual origination of A$5.6 billion in FY22.

At the current PPM share price, Pepper Money shares have a market capitalisation of about A$646 million.

Robust Operations and Performance

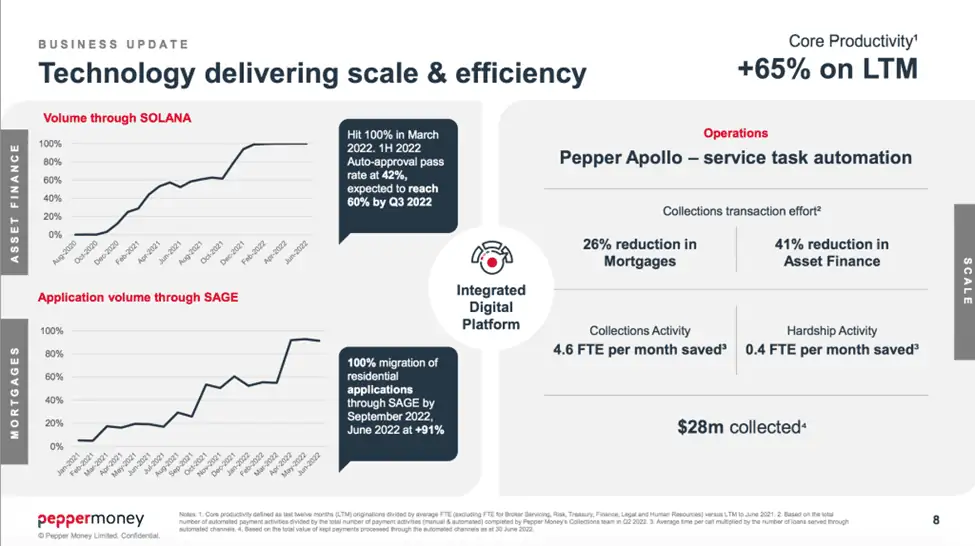

Pepper Money’s (ASX:PPM) biggest strength is its extensive use of technology for origination.

The company’s SOLANA and SAGE origination systems allow rapid, paperless, and largely automated loans at scale and across borrower types.

The format of loans offered by the company is also an advantage compared to other non-bank lenders such as those in the BNPL space as the company’s loans are focused on mortgages and big asset financing (cars, commercial vehicles, equipment, etc.), allowing for a better cost-to-income ratio.

A second major advantage for the company is that these loans have a massive securitization market, allowing for capital to be freed up and de-risking.

Using its technology stack, the company can originate mortgages in as little as 6.8 hours and complete asset purchases in real time.

The process is largely automated and borrowers are classed by quality.

The risk assessment standards are outstanding as the company reported just 0.18% loan losses as a % of AUM.

Digitisation also allows standardisation of standards across the organisation, minimising lapses in borrower quality.

The company’s funding is directly provided by banks, and most of its originations are white-label, meaning they are branded as Pepper Money, but underwritten by its 19 funders which include 4 major banks.

Once loans are originated, most of them are securitized and sold directly as a prime or subprime mortgage-backed securities (MBS) through Pepper Global’s security platforms.

Auto loans are similarly securitised.

The company has a solid track record in debt markets and strong relationships with funders as it has successfully originated more than A$30.7 billion over the past 19 years.

Pepper Money (ASX:PPM) also engages in direct lending which is funded through debt issuance.

Competition and Possible Margin Erosion Are Weaknesses

A major weakness for the Pepper Money shares (ASX:PPM) is that business models based purely on technology have been shown to be less persistent given that banks with their large balance sheets and access to data can directly invest in and build their own paperless loan origination platforms.

This could put pressure on the company’s business model.

Secondly, data advantages in lending are scarce as most credit data is widely available by law, making it again, relatively easy for banks to build their own platforms and leverage their balance sheet/cost of capital advantages, especially given the growing power of data analytics and automated credit risk assessment.

Thirdly, in asset financing, the company relies on various agents and vehicle sellers as its distribution channel.

These channels are bound to get more competitive as they will also start to provide products from other lenders, thus putting pressure on margins.

Massive Growth Opportunity In Core Business Along With Development Of Direct To Consumer Channels

A major opportunity for Pepper Money shares (ASX:PPM) lies in scaling its platform, which has performed so well by growing origination at a rapid pace without compromising on borrower quality.

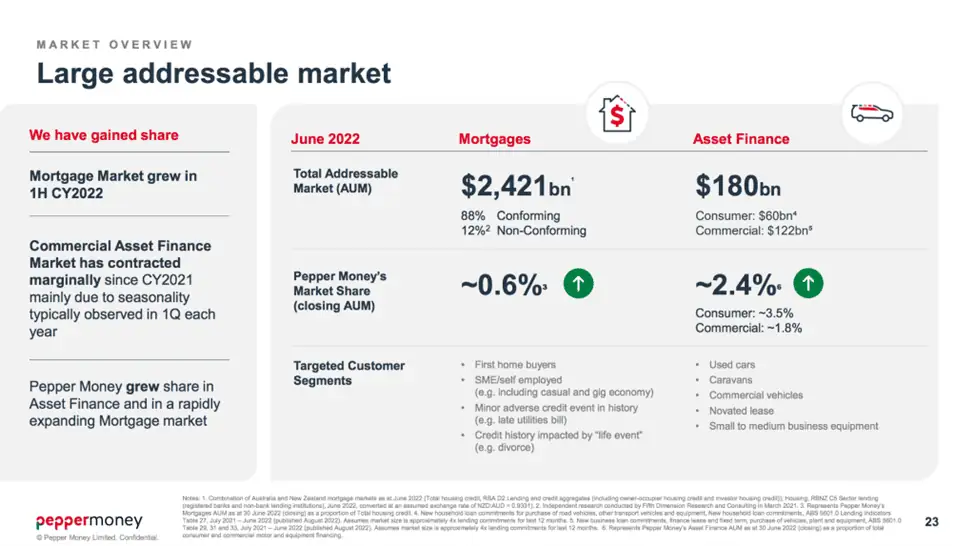

According to company reports, the company currently has just a 0.6% market share in mortgages and 2.4% in asset financing, both of which are very robust and promising verticals for the long and medium term, presenting a market opportunity of over A$2.6 trillion.

Even with higher borrowing rates, the pandemic has induced a secular shift towards work-from-home, thus making home-ownership a very attractive option.

This can be a robust growth driver for the mortgage segment.

Pepper Money shares (ASX:PPM) has also opened up tremendous scope in asset financing after its acquisition of a majority stake in Stratton Finance, one of Australia’s largest asset financing brokers with over 23 years of operating experience and brand value.

The acquisition will help the company directly reach the borrower with lower reliance on distributors as well as lower costs.

It will also provide a base to cross-sell mortgage products.

Furthermore, should the acquisition deliver on its promise, Pepper Money owns an option to acquire the remaining part of Stratton.

The company is also going to expand into SMSF loans, which are securitized loans against retirement savings.

Rate Hikes Pose A Major Threat

However, a major threat facing the company is the threat of a potentially long-drawn-out cycle of rate hikes which can both increase the cost of capital and hurt demand.

Recent media reports have said NBFCs will “increasingly be challenged” by rising funding costs, will “struggle to pass on higher funding costs to their customers,” and therefore cede market share to big banks.

However, Pepper Money (ASX:PPM) joined this debate and said an NBFC’s ability to be nimble and tailor financial options to specific borrower requirements is an advantage, allowing them to serve the real-life needs of its customers not fulfilled by banks.

“As brokers understand, the cheapest rate isn’t always the ‘right’ solution for every customer.

Brokers play an integral role in recommending an option that helps their client succeed,” said Pepper Money CEO Mario Rehayem in this context.

Earlier this week, Pepper Money completed a $1.25 billion (upsized from $650 million) residential mortgage-backed security transaction, its sixth for 2022.

Rehayem stated the “very strong demand” for this deal and its capability to upsize the raising were a “testament to the strength and resilience of Pepper Money’s funding programme”, despite recent market volatility.

On a more macro note, as global central banks get increasingly hawkish in a bid to reign in inflation, the risk of global recession and high rates is increasingly becoming probable, also known as stagflation.

The current economic scenario could therefore turn a gloomy business outlook over the short to medium term and may affect demand for Pepper Money’s offerings.

The company conceded last month that the Reserve Bank’s interest rate increases since May had led to a significant decline in demand for housing loans.

On the flip side, the treasurer of Pepper Money, Anthony Moir said at an event in July that funding pressures were likely going to normalise quickly – “so 2023 should be a period of normality, rather than what we’re seeing today, which is a little bit of a period of craziness.”

Strong Financials With Steady Growth and Solid Liquidity

In 1H’22, Pepper Money shares (ASX:PPM) reported a Net Interest Income of A$192.5 million (up 9.2% YoY), interest revenues came in at A$376.5 million while interest expenses were A$184 million.

Total operating income including fees, securitization gains, service fees, etc. was A$198.4 million (up 12% YoY).

EBITDA and NPAT for the period were A$119.4 million and A$73.1 million, both up 10.6% YoY.

The company originated a record A$5.6 billion in 1H’22, reported Non-Performing Assets of just 0.18%, a net interest margin (NIM) of 2.29%, and a Cost-to-Income Ratio of 44.2%.

The company has about A$19.03 billion in borrowings/liabilities (up 29.8% YoY) against loan assets of A$18.38 billion (up 28.2% YoY).

Total funding capacity stands at A$11 billion, of which A$2.5 billion was raised via direct debt issuance.

Total AUM as of 1H’22 was A$19.4 billion, of which about 73% is in mortgages and the rest is in asset financing.

Cash on hand stands at A$1.265 billion, and dividend for the first half was 5.4 cents, representing an annual yield of about 6.7% at the current PPM share price.

In sum, Pepper Money shares’ (ASX:PPM) financials show decent growth in interest income and loan originations achieved in a challenging macro environment without compromising on lending quality.

On cash, the company is well juiced, and as well, offers a lucrative dividend yield.

Valuation: A Growth Value Hybrid

We will compare Pepper Money (ASX:PPM) to Resimac (ASX:RMC) and Liberty Financial Group (ASX:LFG), both of which are leading non-bank lenders in Australia.

A comparison could also be made to some BNPL’s who are getting into asset financing such as cars; however, they are far more expensive and are trading at high valuations with no record of profitability.

| Metric | Pepper Money | Resimac (ASX:RMC) | Liberty Financial (ASX:LFG) |

|---|---|---|---|

| Price/Earnings (TTM) | 4.52 | 4.99 | 6.99 |

| Price/Book (MRQ) | 0.88 | 1.35 | 1.22 |

| Price/Sales | 1.51 | 1.94 | 3.29 |

| Net Interest Margin | 2.29% | 1.91% | 3.08% |

As can be seen, at the current PPM share price, Pepper Money shares are cheaper than both peers on all price ratios and earns a NIM that lies in between.

On a general note, however, although the company has slightly expensive but formidable competition, the space as a whole is still a far better value proposition when juxtaposed against other pockets of finance such as BNPL.

Furthermore, the three companies are profitable and pay attractive dividends.

Pepper Money has used technology, its two-decade presence in Australia’s finance market, and targeted, big-ticket products to drive above-average growth in its financing businesses, all the while keeping a solid cap on loan losses.

Its performance in recent years, amidst turmoil events such as the pandemic, runaway inflation, and rising rates is creditable.

The company securitises its loan receivables with consummate ease, reflecting the wholesale debt market’s acceptance of its loan origination and credit assessment procedures.

Housing loans offtake may be on the back foot – as of now – but is likely to rebound given the country’s penchant for owning property.

At the current PPM share price, Pepper Money shares are looking quite attractive.