Today we will look at why we like PushPay (ASX PPH).

PushPay is an Auckland headquartered company that provides integrated ChMS (Church Management Services) and donor management services to the faith and not-for-profit sectors worldwide.

The company’s biggest market is in North America where it has 98% of its clients.

The spread of COVID-19 across the world has played right into the hands of PushPay.

As customer-facing and religious organizations put a hold on in-person gatherings, they are utilizing the company’s digital services to engage with their communities digitally and provide a platform for digital giving.

At the end of last year, the company acquired Church Community Builder, a SaaS platform for the faith sector, to offer a more vertically integrated suite of services.

The company has since declared a 42% jump in customers and a 32% jump in overall revenue, both on a YoY basis.

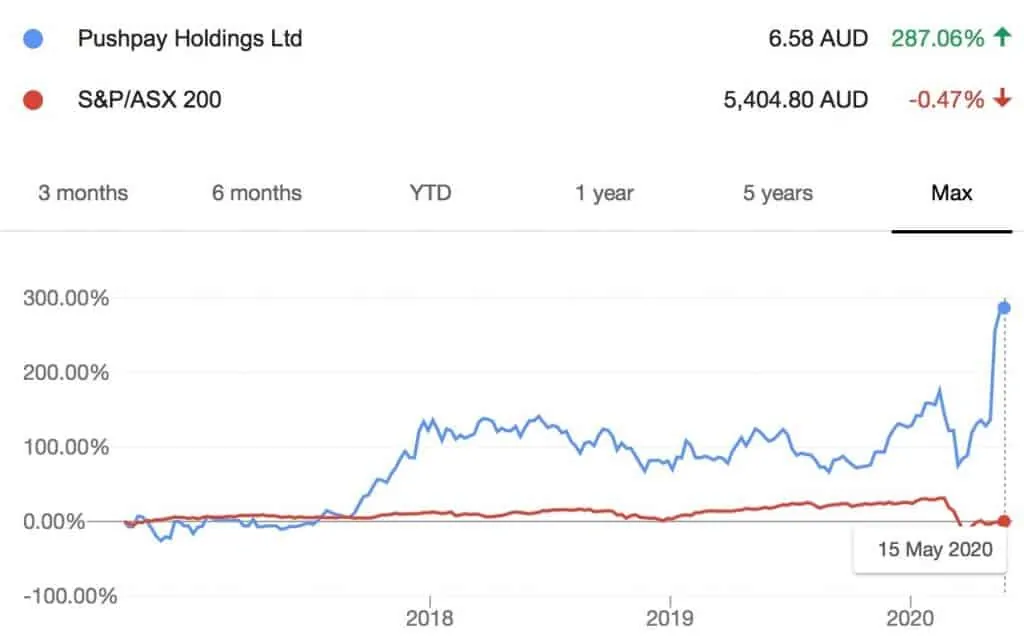

After a brief period of underperformance for a year, after its IPO, the company has significantly outperformed the ASX200 since mid-2017.

Source – Google Finance

Table of Contents

About Pushpay (ASX PPH)

PushPay is mainly a donor and financial management platform for the faith and not-for-profit sectors.

After acquiring Church Community Builder, the company now offers a suite of community engagement and management services comprising of fundraising, administrative services, digital communications, and individual member profiling.

The company reported a profit-before-tax increase of 15.6x and an operating revenue increase of 9.5x in 2020.

The company is trading at an all-time high of $6.65 and a market capitalization of $1.91B.

Pushpay Benefits From The Explosion In “Online” Due To Covid-19

PushPay is essentially a SaaS (Software-as-a-Service) platform where customers pay a subscription fee for their web and mobile-based platforms.

The company also charges a volume-based fee for all transactions processed.

PushPay has a gross profit margin of 65% (up 5% YoY) and an average revenue per customer of $1,317.

Due to lockdowns and mass social distancing in the US, the company saw explosive growth in revenue from increased live streaming of meetings and digital donations.

The company reported a 33% increase in operating revenue, a 39% increase in transaction volume, and a 46% jump in LTV (Lifetime-Value) of its customer base for FY20.

Since the virus has likely caused a permanent change in the way people work and conduct their lives, the company’s digital advantage is likely to prevail for the foreseeable future.

The company also incurs R&D cost in NZD and generates the bulk of its revenue in USD, as the NZD has been weakening against the USD, this is another competitive advantage for the company.

Although the company reported an increase in all its revenue and cash-flow metrics, its timeline for recovery of customer acquisition costs is up 60% YoY. Also, only 27.7% of the company’s revenue came from subscriptions, the remaining 72.3% came from transaction processing fees.

Since the coronavirus is taking a severe toll on the global economy, a possible recession could lead to a significant reduction in charitable donations, and hence lower revenues for the company on transaction fees.

Pushpay’s Acquisition Of Church Community Builder Was Brilliantly Timed

In December of 2019, PushPay completed its acquisition of Church Community Builder.

The goal of this acquisition was to be able to offer a more complete and versatile product.

PushPay went from simply being a digital donor service to a complete Church Management platform that tracks member involvement, attendance, contributions, and enabling digital congregation.

The spread of the coronavirus has allowed the Pushpay-Church Community Builder combination to show customers and prospective customers its true value in a manner that would not have been possible without a pandemic.

The coronavirus could spur a huge shift to the digital congregation and digital giving as a vaccine remains at least a year away. This presents an opportunity for the company to significantly grow its customer base.

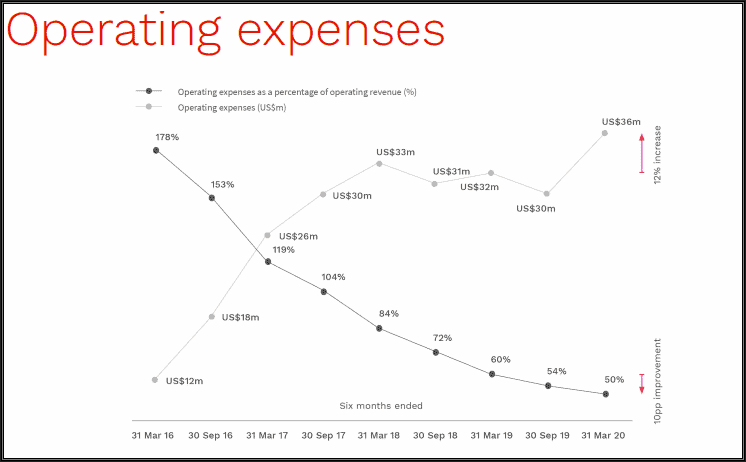

In 2020, the company was able to grow its revenue by 33% whilst operating expenses grew only 5%.

Given that the company is targeting a 50% market share in the medium/large church segment and $1 billion in revenue, then its high operating leverage could generate significantly higher profitability for the company.

Source – PushPay Annual Report

The company has massive room to grow, as the total giving to churches in 2019 was nearly $130 billion, of which PushPay only processed $5 billion.

additionally, the company has recently entered into the not-for-profit and education sectors, which broadens the addressable market.

Pushpay’s Financials

PushPay operates in a very niche segment, hence, there are very few direct competitors to the company and only one that is a listed company.

We will compare PushPay to Blackbaud Inc. (NASDAQ BLKB), a NASDAQ listed company that provides SaaS to the social good community.

PushPay trades at a P/E of 78.25, nearly half of Blackbaud’s P/E of 140.18

On the Price-to-Book metric, PushPay is significantly more expensive at a P/B of 21.66, more than triple when compared to Blackbaud’s P/B of 6.4.

On profitability metrics, PushPay outperforms Blackbaud by a decent margin.

We are using gross-profit-margin instead of net-profit-margin as the companies operate in different jurisdictions, and hence are taxed at different rates.

PushPay has a gross-profit-margin of 65%, compared to Blackbaud’s 52.9%.

Return on Equity for PushPay is 30.22%, while Blackbaud is less than a fifth of that at just 5.2%.

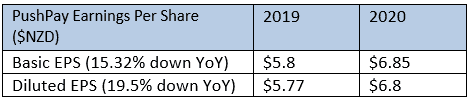

Although the company’s EPS metrics are down YoY, it is important to note that the company reported an operating loss in 2019 of $2.1 million, and the net-profit last year was in-fact due to the realization of a one-time deferred tax asset.

However, in 2020, the net profit of $16 million was purely from operations.

In 2020, the company reported an EBITDAF (Earnings before interest, tax, depreciation, amortization, and foreign currency) gain of 15x, inclusive of acquisition costs of Church Community Builder.

The company has projected a 100% jump in EBITDAF for FY21, from this year’s $25.1 million to the range of $48 million to $52 million next year.

(Data sources – Bloomberg for PushPay, Yahoo Finance for Blackbaud)

Pushpay’s Fundamentals Look Attractive Despite The Run-Up In Price

The fundamentals of PushPay are very strong, with a likely continuing shift towards the digital congregation, participation in religious gatherings, and charitable donations.

Meanwhile, costs are on a leash.

Though the stock has had a sharp runup, any correction in the stock price should present an opportunity.