Today, we’ll have a look at why we like Rhipe (ASX RHP).

Rhipe is a company focused on the wholesale of subscription software licenses to various technology service provider resellers.

We first became interested in and recommending this stock to our clients in April, when the stock was trading at around $1.80.

Since then, the stock has rallied up to over $3 in July, before the RHP share price pulled back to 2.76, or over 50% return since April.

We think this stock continues to have good potential in the long term and this is why we like Rhipe.

Table of Contents

About Rhipe (ASX RHP)

In addition to the sale of wholesale subscription software licenses, Rhipe also provides value-added services for resellers in Asia Pacific area which contains marketing, consulting and 24/7 support as a service.

It assists service providers to transition towards cloud computing business models.

Rhipe provides services mainly in the Asia Pacific region and is expanding into South East Asia and South Korea market.

Rhipe has a tight cooperation relationship with Microsoft and has won the 2018 Microsoft Partner of the Year Winner Award, standing out from competitors in Australia.

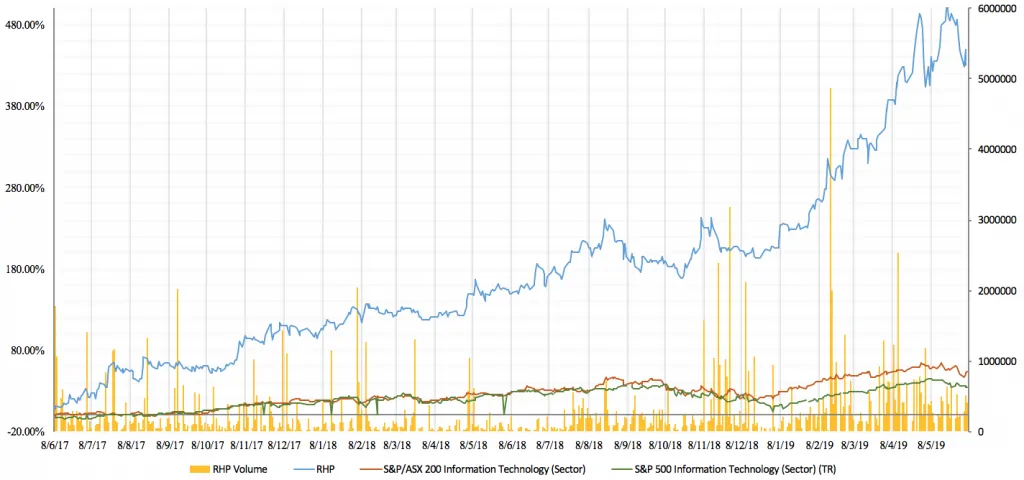

Since February 2019, Rhipe’s share price started to outperform S&P/ASX 200 Information Technology Sector Index and the S&P 500 Information Technology Sector Index and has continued to rally.

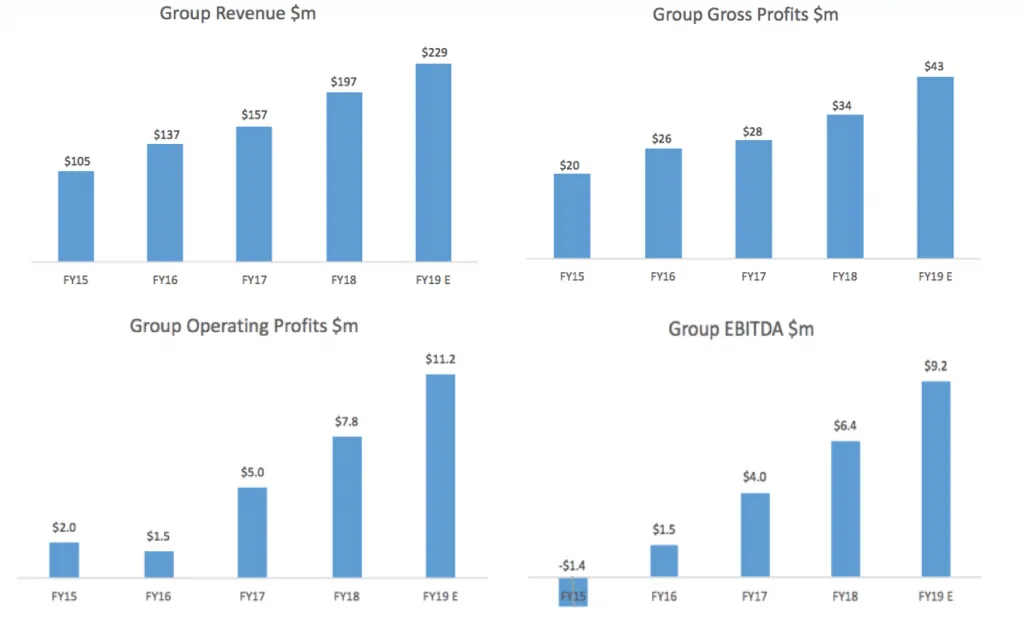

From 2015 to 2018, revenue and net profit keep grew strongly, with revenue growth doubling during this period.

Source: Yahoo Finance

| FY 2015 | FY 2016 | FY2017 | FY2018 | |

| 30/6/15 | 30/6/16 | 30/6/17 | 30/6/18 | |

| Revenue($000) | 104 | 137.1 | 157 | 196.6 |

| -Growth% | 46% | 32% | 15% | 25% |

| Gross Profit | 20.1 | 25.8 | 28.2 | 34.1 |

| -Margin% | 19.3% | 18.8% | 18.0% | 17.3% |

| EBITDA | (1.4) | 1.5 | 4 | 6.4 |

| -Margin% | (1.3%) | 1.1% | 2.5% | 3.3% |

| NPAT | (2.3) | (0.1) | 2.5 | 3.1 |

| -Margin% | (2.2%) | (0.1%) | 1.6% | 1.6% |

Source: RHP Appendix 4E and 2018 Annual Report to Shareholders

Strategic Overview

Rhipe, as a specialist of cloud software service distributor in Australia, has various vendors who are cloud-friendly, including Microsoft, KEMP, VMware, Citrix, Red Hat and so on. It provides cloud licensing, services and support to help partners deliver good services to end-user customers.

Cloud licensing, services and support

The company’s revenue primarily generates revenue from selling cloud licensing that is private, public or hybrid.

To be more specific, Rhipe offers Microsoft Cloud Solutions Provider (CSP) program which includes Microsoft’s public cloud offerings, such as Office365, Azure, Enterprise Mobility Suite (EMS) and Dynamics CRM Online, to its reseller channel on a monthly subscription pay-as-you-use basis.

It also provides Red Hat Certified Cloud and Service Provider (CCSP) program, which allows cloud, hosting, system integrator and managed service providers to host and resell certified Red Hat offerings on-demand via multi-tenant, dedicated and managed models.

Apart from cloud licensing, the company also receives revenue by providing value-added services and support to vendors and resellers worldwide respectively which contains marketing, consulting and 24/7 support as a service.

In the first half-year of 2019, licensing net revenue accounts for 80%($17.2M) of total net revenue($21.5M).

Expansion to Asia

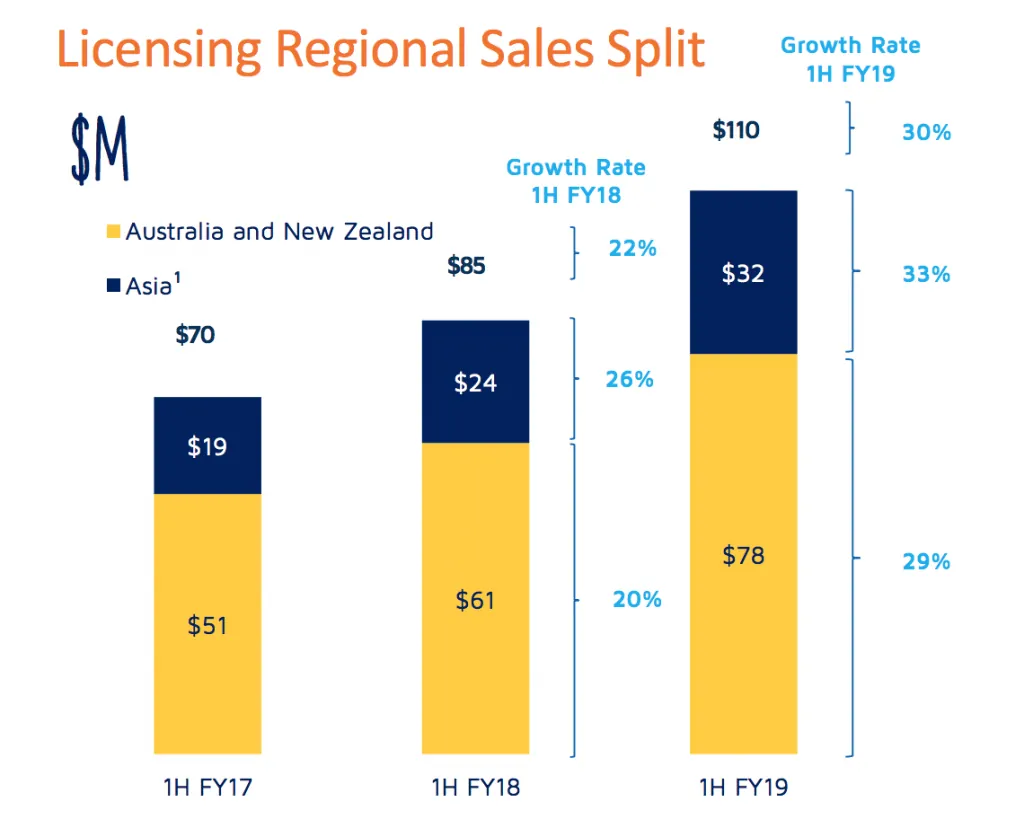

Rhipe is an Australian company who focused on the Pacific area initially and now is making an expansion to the Asian market. The graph below demonstrated the sales growth in the two main regions for the first half-year from 2017 to 2019.

The total licensing sales amount has increased yearly at a rising pace, which can be seen from the increased total growth rate from 22% to 30%.

In the first half of the past three years, the growth rates of the Asian market (26% and 33%) were both greater than that of the Pacific market (20% and 29%). In other words, the sales amount in the Asian region is taking a larger and larger proportion of total sales from 27% to 29% during the three-year period.

Source: RHP 1st Half FY19 Results Presentation

Innovative subscription sales model

Rhipe is using an innovative subscription sales model to deliver its services. It has invested an increasing amount of money in developing their intellectual property – Platform for Recurring Subscription Management(PRISM), which is used by resellers or service providers to buy, provision, and bill their end-use customers for monthly cloud software subscriptions.

This platform is digital based and helps manage the relationship between the companies and their customers. With the effort of incentivised and trained sales team, Rhipe’s sales model is not only able to generate recurring and compounding revenue, but also drive the demand for channel partners and help vendors optimise markets and profits.

Investment in Microsoft Dynamics Business Central

On 28 February 2019, Rhipe completed the acquisition of Dynamics Business IT Solutions Pty Ltd(‘DBITS’) which specialises in Microsoft Dynamics Business Central.

The acquisition aimed at improving the Dynamics consulting services and support provided to resellers as well as enhancing professionalism in Microsoft software offering. The investment is expected to generate $1m EBITDA for Rhipe in 2020.

Industry Analysis

Rhipe, which is a leading cloud service provider company, is highly exposed to software & services industry and information technology industry.

The use of cloud computing has become increasingly popular as both the growth in computing power and the reduction in storage cost encourage the production of data.

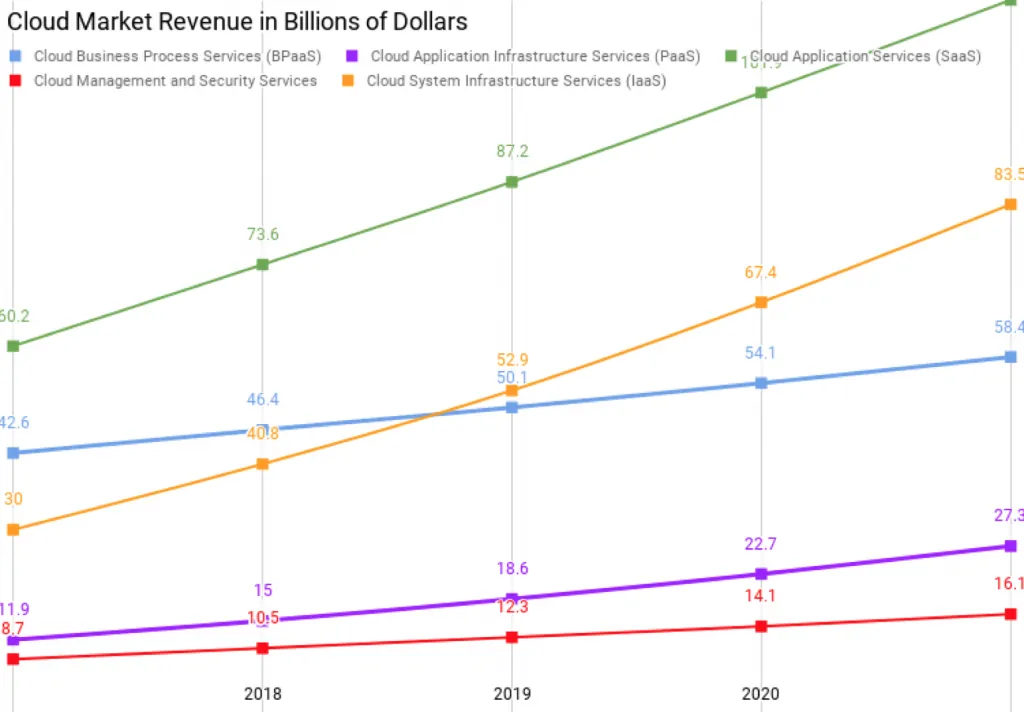

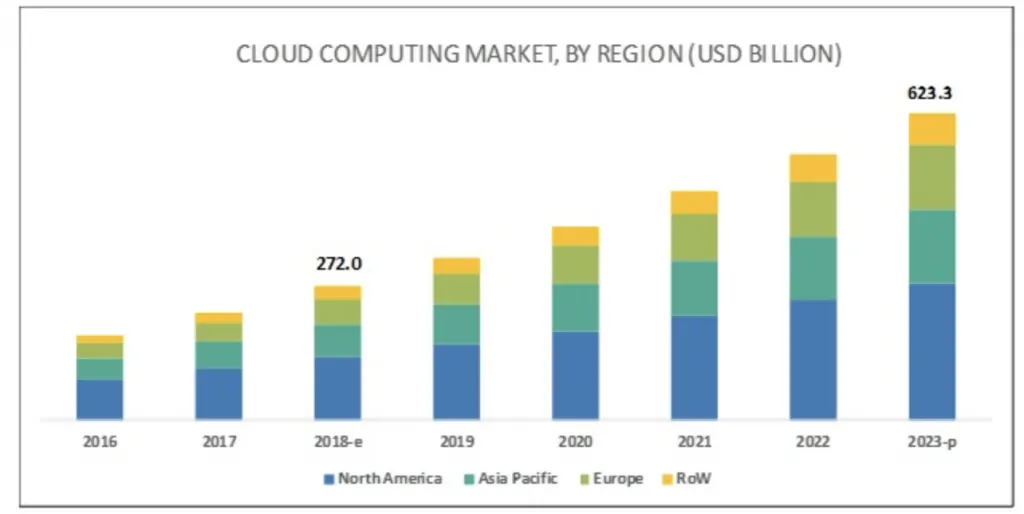

Organisations are moving their information technology workloads to the cloud so that they can access to the data, database, and applications easily. According to Gartner, the cloud market revenue is very likely to keep growing in the next several years as shown in the graph.

The cloud service provider software-as-a-service(SaaS) market is predicted to have the highest growth rate. The infrastructure-as-a-service(IaaS) market is expected to reach $83.5 billion by 2021.

Source: Amazon Web Services SSO authentication with Google GSuite

Distributors, also named indirect provides, are essential in the software and services industry.

Vendors do not intend to reach resellers directly since resellers are of different sizes and quality. Vendors would like a professional to manage those resellers and business relationships as well as provide tailored assistance to them.

As a distributor – the professional has to meet various requirements made by vendors. For example, as required, to have a direct partnership with Microsoft, which means to become a distributor, the company needs to firstly purchase $15k minimum annual support policy.

Secondly, it needs to have its own provisioning and billing platform. Thirdly, it has to deliver at least one managed services, IP service, and customer solution application. There are also additional performance requirements. If a company cannot meet the above requirements, it cannot become a direct partner of Microsoft.

This company has to purchase licensing from an indirect provider, which is the distributor.

Distributor companies like Rhipe providing the software and cloud service are unlikely to be replaced any time soon. There are a lot of companies providing the cloud service for Microsoft in Asian-Pacific Area, for example, the Dicker Data, Saasplaza and so on.

The reason for the existence of these companies is also because providing core technical skills is different from providing service support to different levels of customers. For Microsoft, cutting off companies like Rhipe is likely to cost more than working with a partner.

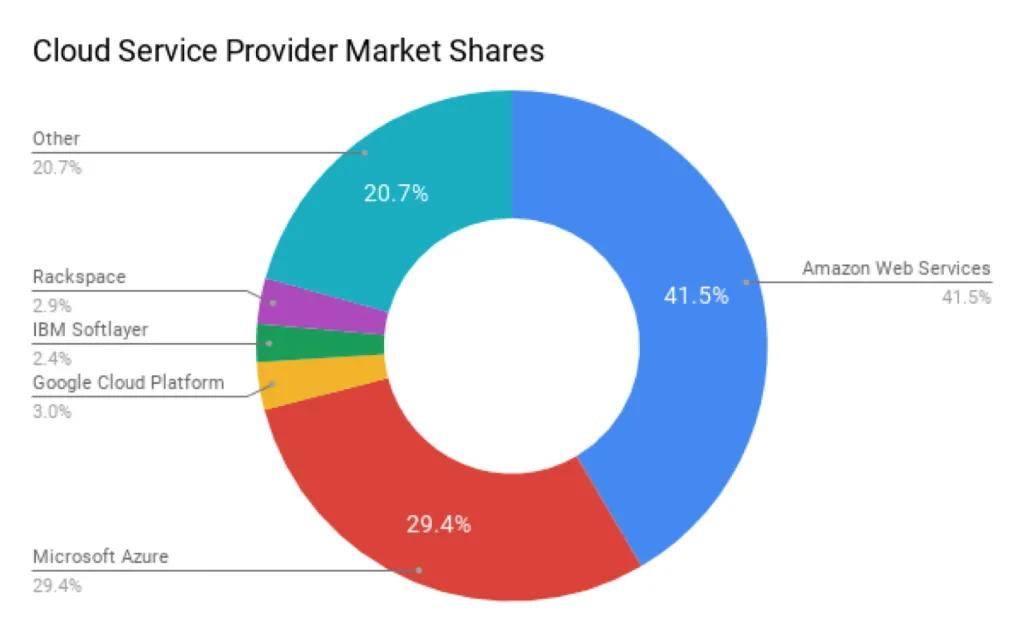

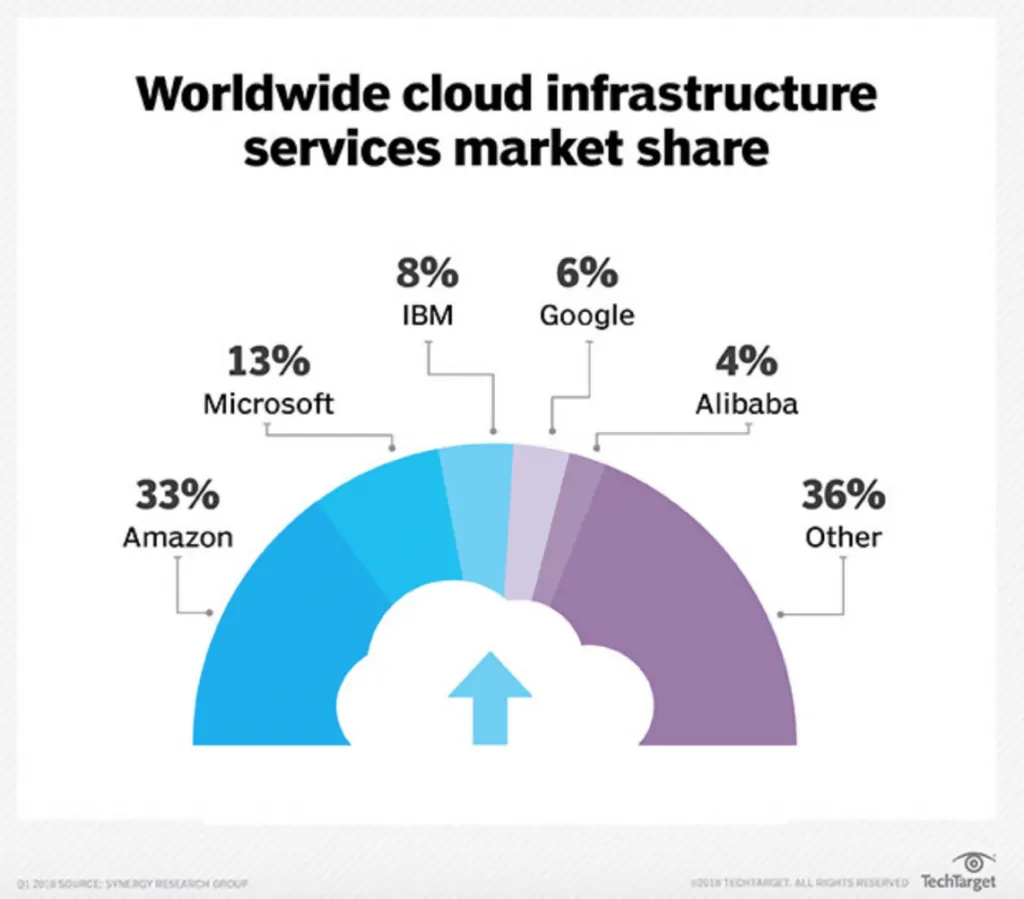

In the cloud computing market, as seen in the chart below, Amazon Web Services takes up nearly half of the market share, followed by Microsoft Azure and Other cloud service provider which occupies 29.4% and 20.7% respectively.

Amazon AWS provides more established cloud service than the other companies. However, its top rival Microsoft is catching up from behind and competing for the market-leading position. Rhipe, as the pioneer of Microsoft’s attack on AWS, is thus expected to continue to grow.

Source: Amazon Web Services SSO authentication with Google GSuite

Key Advantage and Risk

The concentration of revenue source

As mentioned above, Rhipe’s revenue comes from cloud licensing sales as well as value-added services and support.

Over 80% of its total revenue is generated from licensing sales. Rhipe has concentration risk as their business model is less diverse, which heavily relies on licensing subscription demand.

If the demand for cloud computing is impacted negatively by new technology, Rhipe could see pressure on its revenue line. Moreover, Rhipe’s business is 100% cloud-focused. It does not sell any other technology products such as computer hardware.

Rhipe only collaborates with the vendors who are able to provide cloud product because it aims at helping organisations increase revenue and reduce costs by implementing digital transformation. Rhipe may also be influenced by vendors’ relative policies and condition of the business.

The threat of competitors

Microsoft, one of Rhipe’s largest vendors, has more than five partners in the Pacific area. In Australia and New Zealand, Microsoft has Dicker Data and Ingram Micro as cloud licensing distributors other than Rhipe and their size are both larger than Rhipe.

Additionally, Ingram Micro also provide cloud services in different countries in Asia such as Indonesia, which may threaten Rhipe’s market shares in Asia and the Pacific in the future.

In terms of Dicker Data, it is not only offering IT services but also various hardware equipment. Another risk is that Dicker Data has 78 vendors but there are only 13 vendors for Rhipe. Therefore, strong competitors could be a potential threat to Rhipe.

Reputation and expertise of vendors

Rhipe has various vendors, including public cloud providers Microsoft and IBM as well as private cloud providers like Citrix which has a partnership with Microsoft Azure.

Those cloud computing companies are of good reputation and have established market shares. From the graph below, Microsoft and IBM ranked second and third, accounting for 13% and 8% of market shares respectively.

Rhipe’s recent increase in revenue is primarily related to the cooperation with Microsoft. Its Microsoft CSP O365 seats have increased 100% in the first half of the year 2019 compared within the year 2018.

The growth rate of Microsoft Azure ARR sales has reached 180% from Dec 2017 to Dec 2018. Thus, the steady growth of the business relationship with those vendors will be a positive to Rhipe’s development.

Source: Top IaaS Providers slowly warm up to multi-cloud.

Operate business online

Rhipe delivers all products and services to customers through the Internet. Their online platform is used to manage the subscription of licensing, which is the main source of the company’s revenue.

Technology support can also be contacted easily via their website. Rhipe runs its business totally online because it is 100% focused on providing cloud services.

Thus, Rhipe does not need a physical warehouse to store its products, which saves a large number of costs compared to other competing companies such as Dicker Data.

Cloud service demand increasing in Asia and the Pacific area

From the graph below, cloud service demand is expected to increase fast in the future, especially in Asia-pacific and North America areas.

Major vendors in the cloud computing market include

- AWS (US),

- Microsoft (US),

- Google (US),

- Alibaba (China),

- SAP (Germany),

- IBM (US),

- Oracle (US),

- VMware (US),

- Rackspace (US),

- Salesforce (US),

- Adobe (US),

- Verizon (US),

- CenturyLink (US),

- Fujitsu (Japan) and

- NTT Communication (Japan).

Recently, cloud services are being rapidly adopted by SMEs, due to the flexibility and ease of use.

The cloud computing market in the Asia-Pacific area is now larger than in Europe, but less than in North America. However, the Asia-Pacific area has huge growth potential.

The public cloud service has gained enormous traction in the Asia-Pacific area, as enterprises seek to enhance their digital initiatives. In the near future, cloud computing will become more and more important in business operation.

Cloud service usage will possibly keep increasing beyond the forecasting period above. Therefore, Rhipe’s expansion to the Asia-Pacific market is regarded as a big advantage.

Source: Cloud Computing Market by Service Model (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), Deployment Model (Public, Private, and Hybrid), Organization Size, Workload, Vertical, and Region – Global Forecast to 2023

Financial Performance & Peer Review

All qualitative financial information indicates a growing trend. As can be seen in the graph below, its revenue has increased from $105m to $197m since 2015, and it is expected to grow more than 118% by 2019.

The gross profits and operating profits also went up by 70% and 290% respectively during this period. Its EBITDA rises by $2.6m average per year since 2015.

The data for FY2019 is calculated based on the assumption that the growth rates for the second half-year of 2019 will be the same as those for the first half-year of 2019.

Source: RHP 1st Half FY19 Results Presentation

High Revenue, EBITDA & Net Income

Rhipe’s growth rate for total revenue is 25.4%, for EBITDA is 59% and for net income is 21% respectively in 2018.

Rhipe’s total revenue, EBITDA and net income all performed better than the peer averages last year.

The total revenue growth percentage is 11% more than the second-place company-Dicker Data. And for the EBITDA, it is 45.1% higher than Dicker Data.

| Company name | LTM Total Revenue, 1Yr Growth % | LTM EBITDA, 1Yr Growth % | LTM Net Income, 1Yr Growth % |

| Dicker Data LTD (ASX: DDR) | 14.4% | 13.9% | 20.5% |

| Data #3 Limited (ASX: DTL) | 7.6% | -9.3% | -8.4% |

| Mean | 15.8 | 21.2% | 11.03% |

| Media | 14.4% | 13.9% | 20.5% |

| Rhipe Limited (ASX: RHP) | 25.4% | 59% | 21%

|

Source: Dicker Data Financial Year 2018 (FY2018), Data#3 Annual Report 2018 & RHP Appendix 4E and 2018 Annual Report to Shareholders

Rhipe is a High Growth Market Leader in Cloud Services

Rhipe (ASX RHP) is a global company that sells cloud licensing and offers relative support for various vendors such as Microsoft and VMware.

Rhipe’s aim is to become an expert in cloud licensing distribution by expanding across South East Asia and acquiring software companies in order to provide professional consulting services to customers.

The cloud market is growing and Microsoft is the second-biggest cloud service provider in the market. Rhipe is awarded as 2018 Microsoft Country Partner of the Year for Australia and is getting more cloud seats from Microsoft.

Rhipe will benefit from the market and the business relationship with major vendors, but it is facing the risks of concentration of revenue source and strong competition.

We can see stable revenue growth and accelerating profit growth compared with Dicker Data and Data #3.

We think that Rhipe (ASX RHP) is on the right track and that there is a lot of potential upside for the RHP share price.