Today we will look at why we think Sequoia shares (ASX:SEQ) have good growth potential through our SEQ share price forecast.

Sequoia Financial Group (ASX:SEQ) is a financial services company based in Australia.

The company offers a host of financial and corporate services ranging from company establishment and pension services to asset management and brokerage.

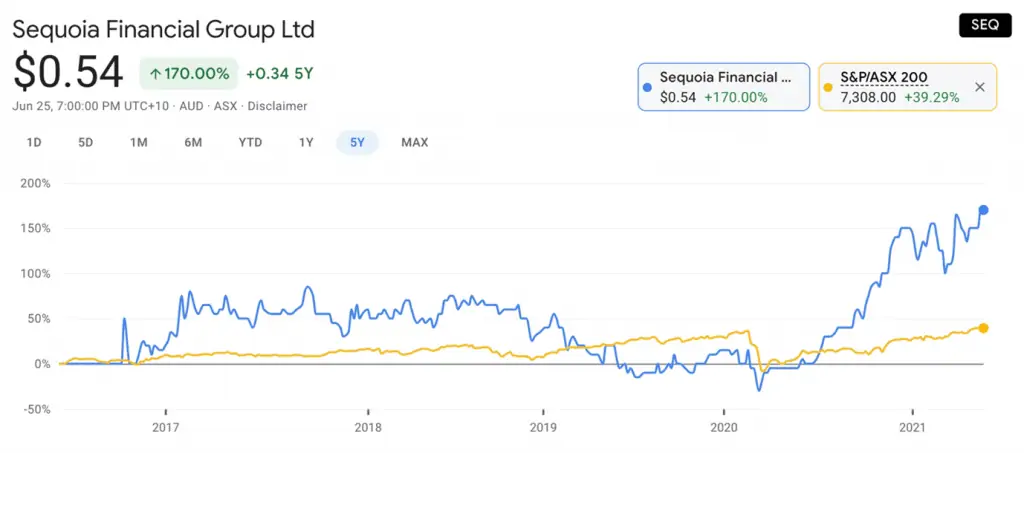

The stock has been in the news lately due to its sharp 280% rally commencing March last year.

The surge in its stock has been driven by successful acquisitions and increased stock market activity since the onset of COVID.

Technically, the SEQ share price appears to be revving up for a breakout from its essentially sideways move since December.

Table of Contents

- 1 About Sequoia Shares (ASX:SEQ)

- 2 Strong business model and secular tailwinds but a potential correction in stock markets could drag

- 3 The exit of banks from advisory presents an opportunity; however, automation and AI are a threat

- 4 Sequoia’s financials: Solid growth and robust projections

- 5 Sequoia’s (ASX:SEQ) comparative valuation

- 6 Sequoia (ASX:SEQ) is a small cap high growth company with positive earnings

Sequoia Financial Group (ASX:SEQ) is an integrated financial services company.

The company has a large product portfolio that consists of four main segments:

- Wealth

- Professional Services

- Equities

- Direct Investment

The company offers a host of financial services to corporate and retail customers.

Services include financial advisories, professional/admin services such as company formation and pensions management, wealth management, insurance, and stockbroking.

Strong business model and secular tailwinds but a potential correction in stock markets could drag

Sequoia operates an interesting business model that offers a vertically integrated product portfolio.

The main function of the company is to serve the financial advisory community by augmenting individual financial advisory and accounting practices.

The company now also has a presence in advisory and accounting through the acquisition of individual practices.

The acquisitions have integrated well and played a role in the company’s stellar performance over the past year.

The company has also expanded its footprint by selling third-party licenses (franchising) to individual practices.

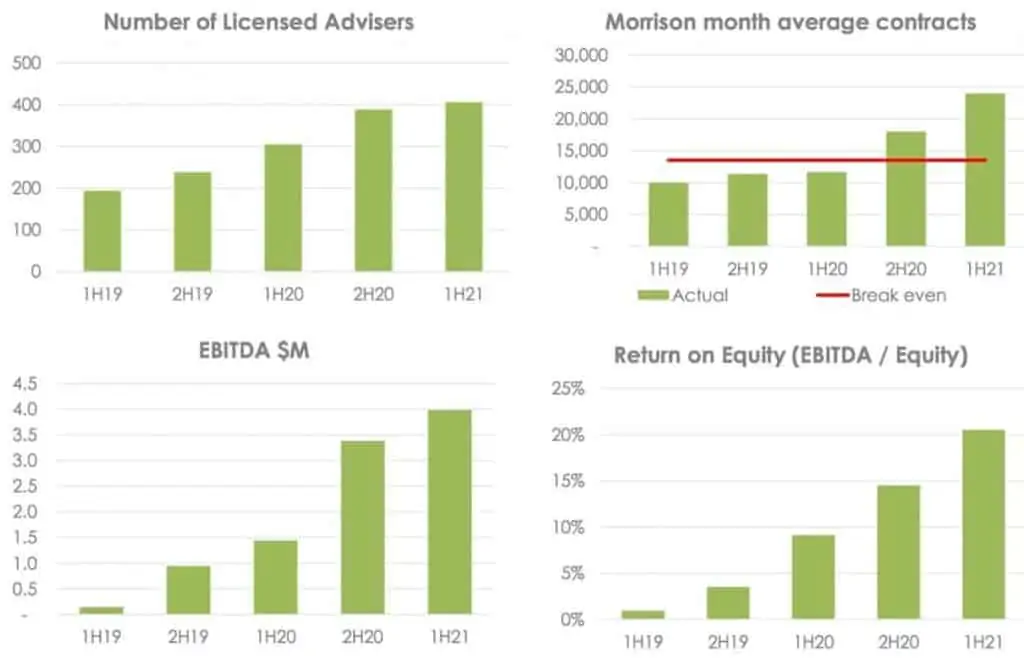

Source: 1HFY21 Report

Sequoia’s fortunes received a boost from the pandemic because people realized the importance of savings and prudent financial planning during crises.

The systemic changes due to COVID (such as habitual saving) are, therefore, a long-term tailwind for the company and the sector.

Furthermore, the pandemic forced the RBA to implement rate cuts that lowered bank deposit rates.

An increasing number of clients are now turning to advisors to protect and grow their wealth in the face of lower interest incomes and a decline in purchasing power due to potential inflationary pressures.

The stock market rally post the pandemic has also worked wonders for the company’s wealth management and equity markets divisions.

These businesses have been the biggest drivers of the company’s change of fortunes as witnessed in its 1H21 numbers.

However, there is also the risk of a correction which could dampen investor sentiment.

The bulk of the interest in personal investing in equities was driven by the global bull market over the last 15 months.

Given that markets are currently at record-high valuations, potential ‘tapers’ by the Fed and rising inflation could put pressure on the strong growth show by the company.

The exit of banks from advisory presents an opportunity; however, automation and AI are a threat

Over the past few years, four of Australia’s major banks have pulled out of the advisory and planning business citing low margins and high regulation costs.

After banks exited, a lot of their advisors set up their own practices.

However, the financial advisory industry is quite fragmented and most of the practices do not have the resources to offer an extensive range of services.

As a result, individual advisories find it difficult to compete with larger financial institutions, even though the market for financial advice has changed for the better due to COVID, interest rate cuts, and booming equities.

A significant growth opportunity is therefore available to Sequoia shares because it could step into the vacuum.

Already, the company’s number of franchises has nearly doubled over the past two years.

Its large product portfolio gives independent advisors and franchisees a platform to provide clients an extensive range of services without incurring the cost and effort of setting up for these on their own.

However, the rise of artificial intelligence-powered robo-advisors from large financial institutions poses a threat to the company.

While a part of the financial advice business involves providing unique solutions to clients, many solutions in wealth and asset management, which make up the bulk of Sequoia’s business, are being automated.

Robo-advisors are highly complex software programs and large institutions have a natural advantage in their development.

They are also far more scalable, efficient, and in some cases, generate superior returns.

Sequoia’s financials: Solid growth and robust projections

In the first half of the year (1HFY21), the company reported revenue of A$52.4 million (up 27.6% YoY), EBITDA of A$4 million (up 176% YoY), and NPAT of A$1.7 million. Return on Equity (ROE) jumped 25%.

The financial advisory business saw 33% growth YoY due to economies of scale manifested from previous acquisitions.

However, the equities market division was the star of the show with a 400% increase in contract turnover and a 560% YoY increase in client holdings.

The company’s number of licensed advisors grew 36% YoY and wealth under management grew in the range of 25%-30%.

Source: 1HFY21 Report

Additionally, the company carries no debt and approximately $15 million of shareholder cash allowing the company to continue to make acquisitions without little dilution to current shareholders.

In light of the strong financial performance, the company has twice raised its revenue guidance for the year following the realization of better than expected margins in the Professional Services, Wealth, and Equity divisions from the integration of its recent acquisitions.

For FY21, the company projects revenue of A$110 million-A$120 million (up to 30%-42% YoY) and EBITDA of approximately A$11 million (up 129% YoY).

The company expects to distribute about a million dollars in dividends at the end of the financial year.

Over the next five years, the company aims to top A$400 million in annual revenue and generate A$32 million in yearly EBITDA.

Sequoia’s (ASX:SEQ) comparative valuation

We compare Sequoia Financial Group to Clearview Wealth (ASX:CVW) and IOOF Holdings (ASX:IFL), both Australian peers.

Clearview provides wealth management, insurance, and financial advisory services while IOOF Holdings provides financial advisory, investments management, and administration services.

| Metric | Sequoia Financial | Clearview Wealth | IOOF Holdings |

| Price/Earnings | 20.36 | 24.31 | 23.79 |

| Return on Equity | 9.9% | 2.84% | 3.8% |

| Net Profit Margin | 3.48% | 3.28% | 6.2% |

As can be seen, at the current SEQ share price, Sequoia shares are cheaper than both Clearview Wealth and IOOF Holdings, enjoys a higher ROE, and is midway in terms of profit margins.

However, IOOF Holdings is a significantly larger company and may not have the same growth trajectory.

Sequoia (ASX:SEQ) is a small cap high growth company with positive earnings

We believe Sequoia shares are well-placed to benefit from both sectoral and secular tailwinds.

Its business model is highly scalable through franchising, while its product portfolio gives it the vertical integration required to service a variety of clients – from individuals to companies.

At the current SEQ share price, Sequoia has a lower PE and 2-3x higher ROE than its peers with a strong balance sheet primed for more acquisitions and a small market capitalisation to boot.

This means that this is a relatively cheap, high growth stock with positive earnings that institutions have likely overlooked – something that doesn’t come across our desk often.