Today we will look at why we think Webjet shares (ASX:WEB) are a good buy and some analysis on our WEB share price forecast.

Webjet Limited (ASX:WEB) is a digital travel services provider that acts as an intermediary in the B2B travel accommodation market.

It also operates an online travel agency and provides transportation services such as rental cars and motorhomes.

COVID-19 hit the travel industry particularly hard, bringing it to a virtual standstill.

At the current WEB share price, the market capitalization of Webjet shares is about A$1.8 billion, having lost roughly 55% of its value since the onset of the pandemic.

However, the company has a strong liquidity position, dominant market share, a very competitive cost structure and is likely to outperform once the industry recovers.

Table of Contents

- 1 About Webjet Shares (ASX:WEB)

- 2 Webjet (ASX:WEB) has a very well-rounded business model with significant strengths, particularly technology

- 3 COVID remains a threat to Webjet shares (ASX:WEB) but opportunities exist to augment revenue with technology

- 4 Webjet shares (ASX:WEB) responded to COVID with cost-reductions and raising liquidity but the return of overseas travel is crucial

- 5 WEB Share Price Valuation

- 6 Webjet shares (ASX:WEB) are a good candidate for a bet on the travel sector

Webjet Limited (ASX:WEB) operates in three business segments of the travel industry.

Its WebBeds B2B accommodation business is a major differentiator compared to other travel services companies.

WebBeds essentially operates as an intermediary between hotel/property owners and a variety of customer profiles (corporate/retail/wholesale travel agents, other online agencies, B2C travel apps, airlines, etc.).

Its client base includes major hotel chains and several independent hotels.

WebBeds made up 58.5% of Webjet revenues pre-COVID and is the main growth driver.

It is currently the second-largest player in this heavily fragmented but valuable market estimated at A$70 billion.

It currently has only a 4% market share and therefore has plenty of room to grow in the space.

Webjet OTA is the company’s Online Travel Agency business.

It also serves as a direct-to-consumer (D2C) channel for WebBeds.

The company has 50% of the domestic OTA flights market and 5% of the total domestic air bookings market.

This is an extremely competitive business, but Webjet (ASX:WEB) has dominated through its significant brand presence and low-cost structure.

The OTA made up 34.3% of Webjet revenue pre-COVID.

The Online Republic business offers travel services such as cars and motorhome rentals acting as an ancillary business to WebBeds and the OTA.

It rounds off the company’s presence in the travel market and enjoys economies of scale over competitors.

This is the smallest of the company’s three businesses and made up just 7% of revenues pre-COVID.

Webjet (ASX:WEB) has a very well-rounded business model with significant strengths, particularly technology

Webjet’s biggest strength is its well-rounded and broad business model.

Between WebBeds, Webjet OTA, and the Online Republic, the company covers accommodation, air travel, and ground travel.

This gives the company operating leverage and a very competitive cost structure.

The pandemic has accelerated the structural shift from offline to online giving the company an edge because of its technological prowess (more details later in this note).

The Webjet OTA managed to turn a profit in 1HFY21 due to its significant market share and variable cost structure.

In eight months during COVID, average industry bookings were just 13.7% of FY19, but Webjet managed 26.9% of FY19 volume (a 2x outperformance).

Further, the company’s variable cost structure gives it a very low break-even point of just 23% in the OTA business.

In the long-term, the unprecedented damage to the hotel industry from the pandemic could pivot as an opportunity for WebBeds.

Independent hotels/accommodation providers, which account for 80% of the global accommodation, are under tremendous pressure.

These providers have limited sales/marketing resources and scanty direct bookings.

For them, WebBeds is a valuable resource.

With just a 4% share, WebBeds, therefore, has a significant opportunity in a rather fragmented market.

Its acquisitions of JacTravel (UK-based Bedbank) and DOTW (Dubai-based B2B accommodation provider) in 2017 and 2018 respectively, helped WebBeds gain scale and a significant market presence.

These units should play a good role in the eventual revival of the travel industry.

WebBeds has effectively leveraged technology to gain a competitive advantage.

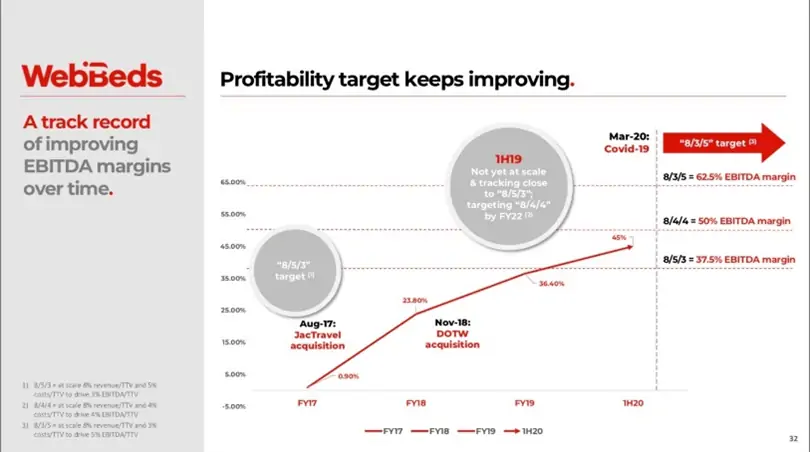

With the use of RezChain (the company’s proprietary smart contracts technology) and scale from acquisitions, the company was able to grow its EBITDA margin by 89% from FY18 to 1HFY20, after which COVID hit.

Source: WebBeds 2021 Strategy Presentation

The company is committed to achieving cost savings of 20% through efficiency improvements, according to investor presentations.

Furthermore, WebBed’s vast footprint of 14,000+ destinations and 365,000 hotels along with the Webjet OTA and the Online Republic businesses give it a large amount of data.

This translates into a competitive advantage by leveraging analytics to drive efficiency and savings over smaller competitors.

WebBeds generates one booking every eight seconds and over 4 million bookings a year, giving it insights into supply and demand data at a global level.

This also allows for more efficient pricing of rooms and better inventory management based on evolving travel trends and historical patterns.

The biggest threat facing the entire travel sector, and the company, is the extension of the disruption caused by COVID.

We are currently seeing a slowing of vaccination progress globally and a rise of second/third waves in various countries.

Australia too recently announced that it may keep borders closed until 2022.

Considering the company’s significant overall dependence on the domestic market, this represents a potential loss of revenue (an estimated 15% of total pre-COVID levels) from international travellers.

Although Webjet OTA derives most of its revenue and earnings from the ANZ region, both WebBeds and Online Republic have significant global exposure.

Before COVID, the APAC region was on track to become the largest segment of WebBeds in terms of booking volume and was a promising growth driver due to excellent tourist traffic from India, Japan, and China.

However, both India and Japan are going through significant second waves of COVID and it seems that they will be closed to travel for the better part of the year.

Singapore too recently announced a partial lockdown. Should this persist, it could hurt the company significantly.

As stated above, the company’s Rezchain technology has proved very successful in driving efficiency and cost savings.

The company recently expressed its interest in commercializing this technology for use in other sectors.

This is a promising opportunity for the company due to rising enterprise software adoption, potentially giving it an additional source of revenue that is completely uncorrelated to travel.

Source: WebBeds 2021 Strategy Presentation

Rezchain has potential applications in industries involving big supply chains, cross-border/multiple party settlements requiring automation, dispute resolution, etc.

The company also recently bought a 25% stake in LockTrip Holdings, a blockchain-based hotel marketplace, on the premise this can further drive cost-savings and efficiency while technologically future-proofing the business.

Like the entire travel industry, COVID had a major detrimental impact on the company’s finances.

The company had a rough six months ended Dec’20.

Though there were some signs of pent-up demand, travel conditions were, at best, somber.

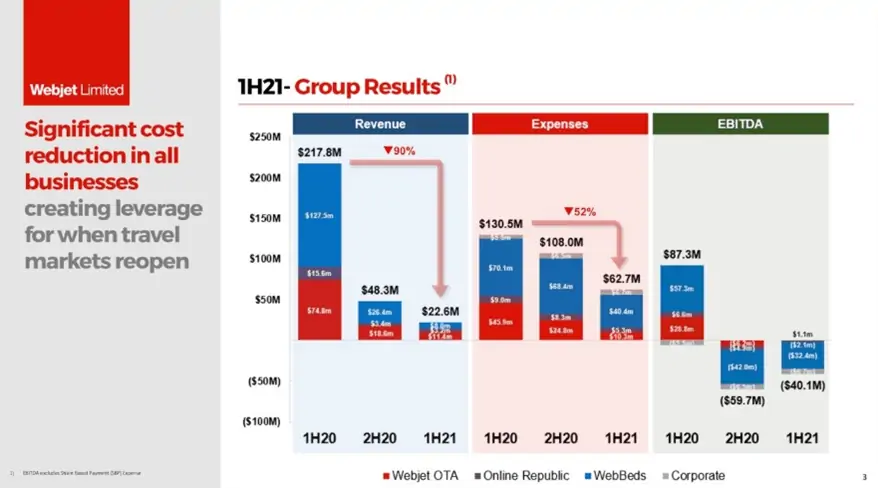

The Webjet OTA managed to turn a small profit of A$1.1 million, while WebBeds and the Online Republic posted losses of A$32.4 million and A$2.1 million.

At the group level, revenues were down 89.7% to A$22.6 million, resulting in a loss of $40.1 million.

However, the company was able to reduce the monthly cash-burn by 20% from A$6 million to A$4.8 million, thus putting it in an advantageous position for when the industry recovers.

Source: Webjet 1HFY21 Presentation

Webjet shares (ASX:WEB) also recently restructured its capital and debt by issuing A$250 million of convertible notes and converting early into equity the $100m convertible note issued in July last year.

The company has also agreed to pay down A$33.4 million of its term debt.

These changes have extended the period of debt, as well as reduced the interest cost.

Further, the company now has about A$452 million of liquidity with a A$100 million minimum liquidity requirement on its debt.

Therefore, assuming a cash burn of $4.8 million per month during 1HFY20, the Webjet shares has about 28 months of liquidity, even in a zero-income scenario.

Despite the dilution, this is a healthy financial position given the conditions in the travel sector.

We will compare Webjet shares (ASX:WEB) to Flight Center Travel Group and MakeMyTrip.com (NASDAQ:MMYT), an Indian online travel services company.

Since COVID has decimated profitability for the entire travel sector, we shall not consider P/E ratios.

We have also chosen an Indian travel services provider as India is currently going through a pretty severe second wave and could provide some context.

|

Metric |

WebJet | Flight Center Travel |

MakeMyTrip |

| Price/Book | 2.44 | 2.55 | 2.91 |

| Debt/Equity | 24.62% | 70.98% | 2.98% |

| Price/Sales | 6.5 | 1.7 | 4.77 |

As can be seen, Webjet Limited (ASX:WEB) is slightly cheaper than both its contemporaries in terms of Price/Book.

However, it is most expensive in terms of sales (COVID has had a severe impact on sales).

In terms of leverage, Webjet Limited (ASX:WEB) is positioned between Flight Center and MakemyTrip.

Surprisingly, the WEB share price has held up well since the crash in March 2020.

Even though the WEB share price is nowhere near its highs before the crash, it hasn’t deteriorated much from this level either.

In the event the travel sector recovers from the pandemic, the WEB share price is well-positioned to outperform its peers due to its well-rounded business model with a global footprint, substantial liquidity, a lean operating structure, and technological capabilities.

However, the timeline for this is hazy because new waves of COVID are emerging in several countries, putting a question mark on the extent and timeline of ultimate recovery.

Even though COVID could continue to drag on, frustrate and delay, the travel industry will not be closed forever and Webjet shares are currently a good risk to reward play leveraged to a COVID recovery.