Today, we’ll look at why we like Kalium Lakes (ASX KLL) and its strong upside potential.

Kalium Lakes manufactures sulphate of potash (SOP), a product used as fertilizer.

Australia consumes about 40,000 tonnes of SOP per year, yet, there are no companies in Australia producing SOP.

Once Kalium Lakes completes its Beyondie Potash Project in Western Australia early next year (2020), they will become the first in Australia to produce SOP.

In addition, KLL’s Beyondie project is the only company to have completed a Bankable Feasibility Study, which confirms the project is technically and financially robust.

This gives them a significant first-mover advantage.

This is why we think Kalium Lakes has strong upside potential.

Table of Contents

- 1 About Kalium Lakes Limited (ASX KLL)

- 2 KLL is developing a wholly-owned project for the manufacture of SOP

- 3 KLL has a 70% interest in the Carnegie Potash Joint Venture (CJV)

- 4 Population growth creating high demand

- 5 KLL moves ahead of the other domestic competitors

- 6 Advanced SOP production at low cost and high margin

- 7 Long life and stable production brings dividend potential

- 8 Experienced management team

- 9 Volatility in commodity prices a risk

- 10 Peer comparison

- 11 Great upside for Kalium Lakes

About Kalium Lakes Limited (ASX KLL)

Kalium Lakes Limited (ASX KLL) is an exploration and development company focused on developing the Beyondie Potash Project in Western Australia.

KLL manufactures sulphate of potash (SOP) for sale domestically and internationally.

KLL is developing a wholly-owned project for the manufacture of SOP

The project is expected to commence production at Beyondie at 82 Kilo-Tonnes Per Annum (ktpa) of SOP and after that ramp up to 164 ktpa for satisfying both domestic and international demand.

The company has completed a Bankable Feasibility Study (BFS) which confirmed that the Beyondie project is technically and financially robust, with production anticipated in 2020.

KLL has a 70% interest in the Carnegie Potash Joint Venture (CJV)

KLL is the manager of this joint venture with BCI Minerals (BCI, 30% interest).

This joint venture is KLL’s second brine SOP Project and focuses on securing additional tenements, which comprise 82,000ha of the ground position in Western Australia.

Both companies have completed Scoping Studies on their projects while KLL is about to commence a staged Pre-Feasibility Study.

Population growth creating high demand

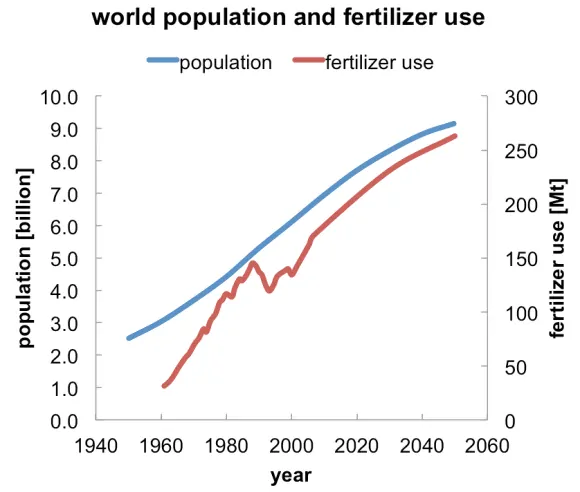

Population growth will create a high demand for the fertilizer and sulphate of potash. Research from Stanford University indicates that the world population is expected to grow by 2.4 billion in the following 30 years.

To fulfil the rapidly increasing food demand, the demand for fertilizer use will touch around 230mt per year in 2030.

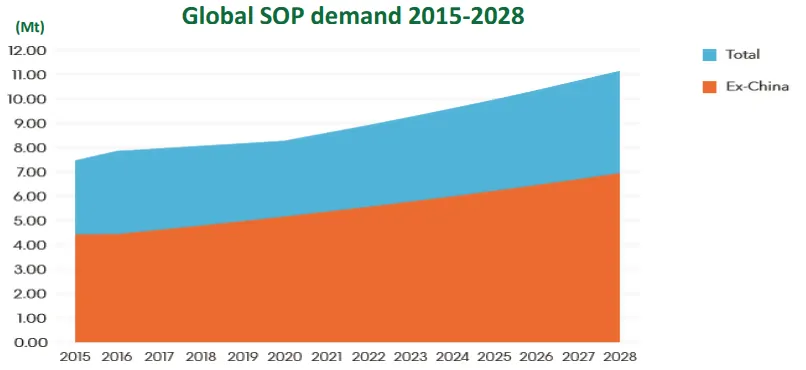

The global market for SOP as a fertilizer is 8mt per year, and the demand is increasing at 100 – 200kt annually. The total demand is estimated to rise to over 11mt by 2030.

Source: Stanford University

Source: Bloomberg

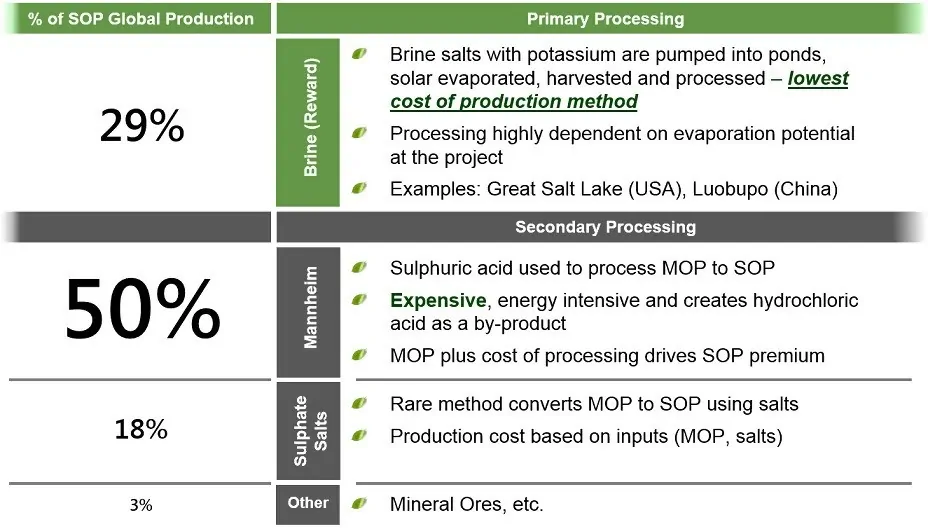

The two most common forms of Potash fertilizers in the market are Muriate of Potash (MOP) and Sulphate of Potash (SOP).

However, farmers must carefully monitor the levels of MOP fertilizer and can use it only for selected crops.

SOP is premium-quality potash, but it is not naturally occurring, and usually must be produced through chemical methods.

Because of the resource-intensive processes used to create it, SOP is priced higher than MOP.

Source: Kalium Lakes Investor Presentation

As for the global production of SOP, around 50% is produced using the Mannheim process, which is a capital-intensive and expensive approach.

Another 29% is manufactured through the brining process, which is the lowest cost production method and utilized by KLL.

Source: 2019 Reward Minerals Limited

Australia currently consumes 40,000 tonnes of SOP per year but does not produce a single tonne of it.

Although KLL’s Beyondie project is the most advanced in terms of construction progress, several junior miners have been progressing sulphate or potash projects in Western Australia.

Seven of them are now in the race to produce SOP.

KLL moves ahead of the other domestic competitors

KLL is the only company to have completed a definitive feasibility study (DFS), Bankable Feasibility Study (BFS), Front-End Engineering and Design (FEED) and pilot trials on its project.

KLL is expected to bring its Beyondie project into production early next year. KLL will, therefore, become the first SOP producer in Australia.

The company has already signed a 10-year binding off-take agreement with international potash producer and distributor K+S. This arrangement will likely earn revenue of $650M for KLL.

KLL is well-placed to meet its short-term financial commitments with its holdings of cash and other short-term assets.

Recently, it raised government-backed project finance of $176M, including $74M from Northern Australia Infrastructure Facility (NAIF), and $102M from a German bank KfW.

This funding will facilitate its construction of the second stage of the Beyondie project.

Advanced SOP production at low cost and high margin

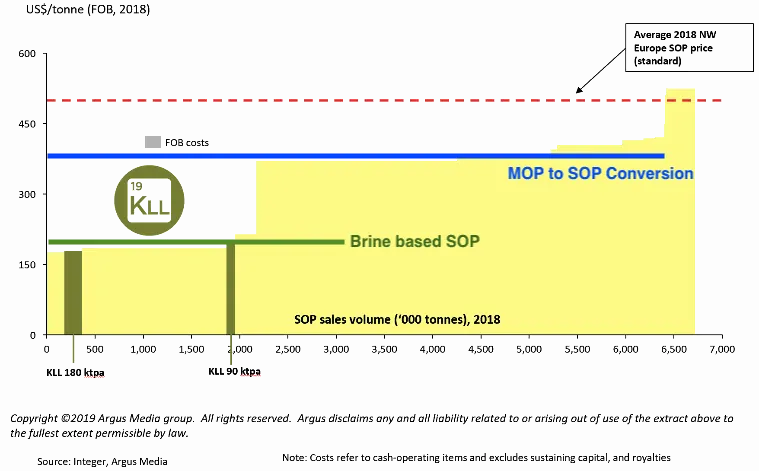

The average SOP price in 2018 was around US$500/t FOB, whereas KLL’s cost of production is estimated to be only US$200.

The profit margin may, therefore, be significantly higher than most other SOP producers.

Source: Integer, Argus Media

Long life and stable production brings dividend potential

The Beyondie project is assumed to have an operating life of 30 years.

Its advanced and lower-cost production process and the high demand for SOP in the global market will enable KLL to generate around $50M of EBITDA on completion of production of Stage I and about $125M from Stage II.

As a company with an advanced, low-cost SOP process and high EBITDA forecast, KLL could potentially start paying out dividends quite soon after Beyondie comes online next year.

Experienced management team

KLL’s management has a successful track record in project implementation.

Before the Beyondie project, they commissioned projects in Western Australia (Iron Valley – Iron Ore Holdings), South Australia (Prominent Hill – Oz Minerals), and Indonesia (Gosowong – Newcrest).

Volatility in commodity prices a risk

Commodity price volatility is a significant risk for KLL, which is still a start-up company and has limited ability to withstand substantial price fluctuations. Adverse price changes may affect its expected cash flows.

Also, as mentioned, several companies are preparing to enter this industry in the Australian domestic market, and it may become highly competitive in the future.

Peer comparison

KLL will enjoy a significant first-mover advantage in the coming year, and there is a high probability that it could capture the entire domestic market.

Only Danikali and Crystal have neared the Front-End Engineering and Design (FEED) stage, but they suffer from a lack of low-cost debt financing.

Additionally, KLL’s initial cost estimates are in AACE class 2, which indicates their accuracy.

The company will likely have the lowest All-In-Sustaining-Cost (AISC).

| PROJECT | Kalium Lakes | Agrimin | Reward | Salt Lake | Australian Potash | Danikali | Crystal Peak |

| Production (Ktpa) | 90 | 426 | 408 | 200 | 150 | 472 | 338 |

| Study Status | FEED | PFS | PFS | Scope | Scope | FEED | BFS |

| AACE Class | 2 | 4 | 4 | – | – | 5 | 3 |

| Capital Intensity A$/tpa capacity | 1967 | 1280 | 1106 | 980 | 1166 | 914 | 1744 |

| Adjustd CAPEX | 177 | 545 | 451 | 49 | 175 | 431 | 589 |

| AISC A$/t FOB | 284 | 341 | 353 | 387 | 368 | 396 | 377 |

Source: Company Release

Great upside for Kalium Lakes

In 2019, Kalium Lakes became the only company to complete DFS, BFS, and FEED pilot trials of its project.

The progress on its Beyondie project enabled the company to raise $176M of low-cost and government-backed long-term debt financing, providing KLL with a strong capital base for further expansion.

Its brine-based process allows KLL to produce SOP at a low cost of US$200/t and therefore, a high-profit margin.

However, risks include volatility in commodity/product prices and potential competition from other companies in the SOP race.

Additionally, project implementation risks remain until the commencement of production, though these will likely diminish as the project nears completion dates.

If everything goes to plan, Kalium Lakes will be the first SOP producer in Australia, with very high-profit margins feeding into an impressive EBITDA.