Today, we will look at why we think AVZ Minerals is a good but highly speculative stock to buy.

AVZ Minerals Limited (ASX AVZ) is a mineral exploration company that acquires, develops, mines and produces lithium, tin, tantalum and other base metals.

AVZ Minerals shares floated at A$0.15 in 2007 and fluctuated between A$0.10 and A$0.20.

The stock then declining sharply to A$0.01 in FY12 and stayed at that level for more than four years.

In FY16, AVZ Minerals completed the acquisition of the Manono Project in Democratic Republic of Congo (DRC), the largest lithium deposit in the world.

The acquisition pushed the AVZ Minerals share price up more than 3000% to A$0.34 within two years.

Since then the share price has declined to around A$0.10.

At this point, AVZ Minerals is a play on the Manono project of which only 50% has been explored.

Manono was recently confirmed to be the world No.1 lithium deposit in scale and No. 2 in grade.

However, lots of risk and uncertainty exist in the short-to-medium term, as AVZ has not even begun commercial mining.

AVZ Minerals shares is a typical high risk and high reward stock.

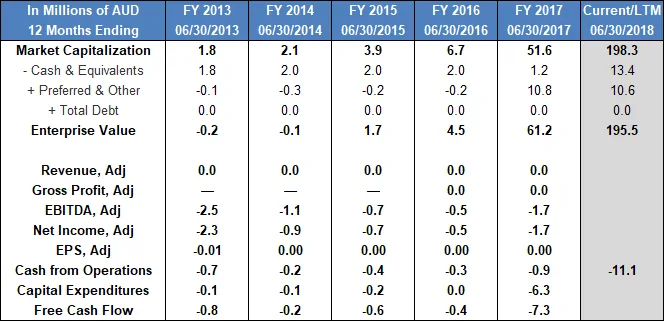

As illustrated in the table, AVZ is not profitable for five years as its activities were merely an initial investment in exploration.

Figure 1: Share price of AVZ

Figure 2: AVZ Financial Highlight

Table of Contents

- 1 AVZ Minerals Has Chinese Government Support

- 2 Adequate Funding from China

- 3 Lithium’s Booming Demand and Rising Price

- 4 Global Lithium Peer Comparison

- 5 Geological and Technical Risks Posed to Exploration

- 6 Lack of Expertise and High Cost of Production

- 7 Unpredictability in Commodity Price and Market Demand

- 8 The high Political Risk Might Hamper AVZ Mineral’s Potential

- 9 AVZ Minerals Shares Have Great Potential for High Risk

AVZ Minerals Has Chinese Government Support

Huayou Cobalt Group, China’s largest cobalt chemicals producer, owns 9.85% of AVZ.

The largest shareholder, Dathomir Mining Resource, controls 12.71% of AVZ.

In addition to equity ownership, China is a key player in arranging deals with the DRC government, including the transfer of the Manono license to AVZ.

Chinese influence in AVZ could be a cause for concern due to the opaqueness of the lithium market.

Lithium is a fast-growing market, but it is far from liquid or transparent. There are very few institutions that report the lithium price, and there is no futures market on lithium.

Furthermore, transactions mostly proceed in bulk volume between suppliers and EV manufacturers through long-term supply agreements.

Customer relationship plays a significant role in such an opaque and contract-based market.

The Chinese government could help AVZ secure its early success with its dominant position in the supply of lithium.

Adequate Funding from China

China controls AVZ along with many other lithium companies as the mineral is strategic to future Chinese growth.

It currently controls 50% of the global production of lithium and is seeking to control the supply of this strategically important resource.

Since China is the largest shareholder of AVZ and dedicated to lithium.

This means there will potentially be more funding from China to assist in the exploration and future development of mines.

AVZ primarily raised capital through issuing shares, and thus it bears almost no debt, with its debt ratio at 13.18% in FY18.

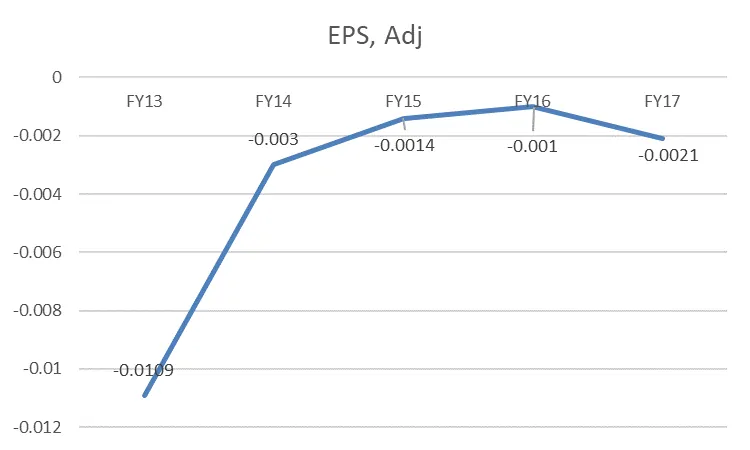

Moreover, AVZ is burning cash at a much slower rate, from A$-0.01 to -0.0021, as illustrated below.

At its current price at A$0.10, it is highly unlikely that AVZ will need to raise capital in the short term for exploration expenses.

This will be very beneficial to AVZ, as its early-phase Manono project is very capital-intensive.

However, a much lower cash-burning rate may also indicate that the progress of Manono Project may have slowed.

Figure 4: FY 13-17 AVZ Adjusted EPS

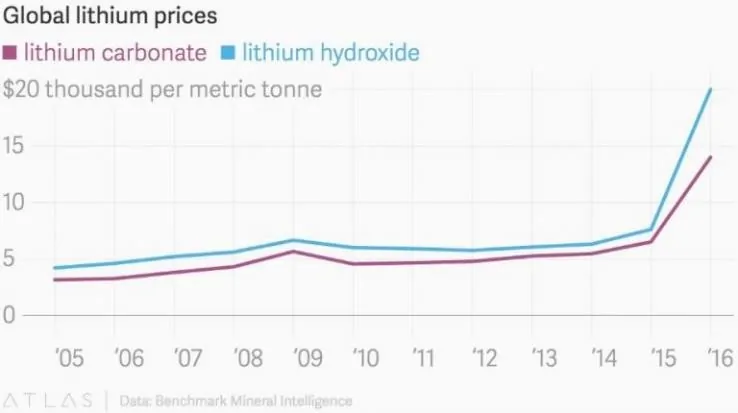

Lithium’s Booming Demand and Rising Price

The global demand for lithium is forecast to rise significantly over the next five years.

This is mainly due to the increasing demand for lithium-ion batteries used in electric cars. Additionally, lithium can be applied to mobile devices such as smartphones, tablet computers, and electric vehicles.

Electric car manufacturers prefer lithium batteries to nickel-metal hydride batteries because of their higher power output, greater durability and cost advantages.

Electric cars are expected to overtake traditional vehicles that are powered by gasoline and diesel.

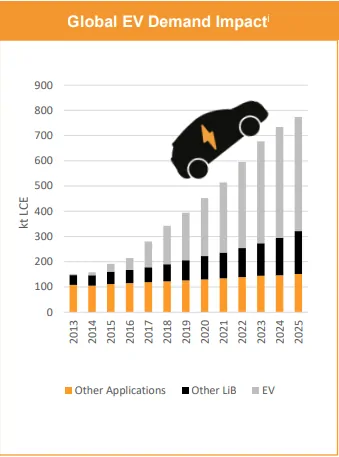

According to Wood Mackenzie, the energy consultancy firm, demand for lithium will rise due to the electric vehicle segment.

Demand is expected to rise from 233,000 tonnes of LCE (lithium carbonate equivalent, an industry measurement) to 330,000 tonnes in 2020 and 405,000 tonnes in 2022.

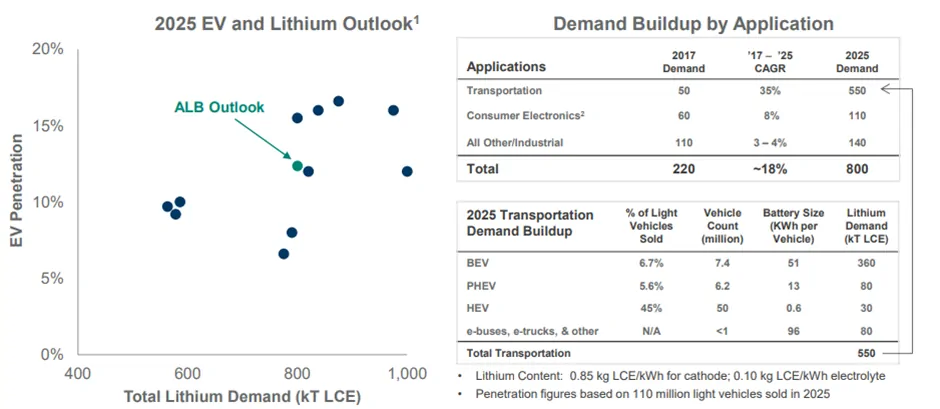

That represents a 42% increase over just two years and 74% over four years. A consensus EV and Lithium Outlook made by Morgan Stanley, UBS, Goldman Sachs and more predicted that an average CAGR of demand would be at 18%.

Global Lithium price

Global EV Demand Impact

Global Lithium Peer Comparison

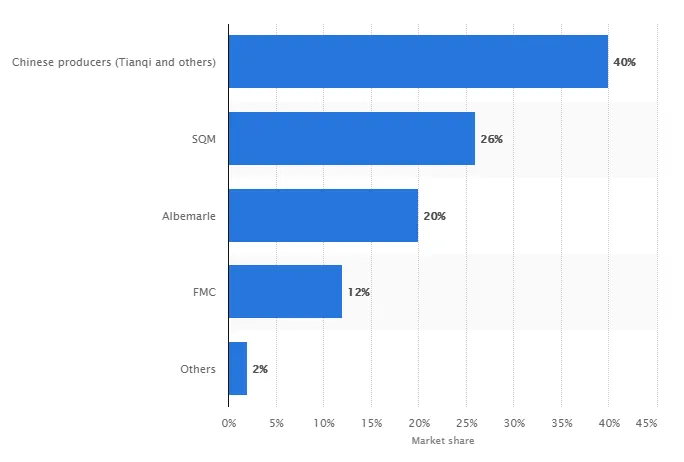

The biggest lithium producers in the world are Sociedad Química y Minera de Chile (Chile), Talison (Australia), Chemetall (Germany), and FMC (U.S.).

It is worth noting that many of the Chinese producers, including Tianqi, operate overseas or own considerable shares in mines in foreign countries.

Therefore, these Chinese companies control roughly 40% of global lithium production without directly producing them in China (See the first and the third graph below).

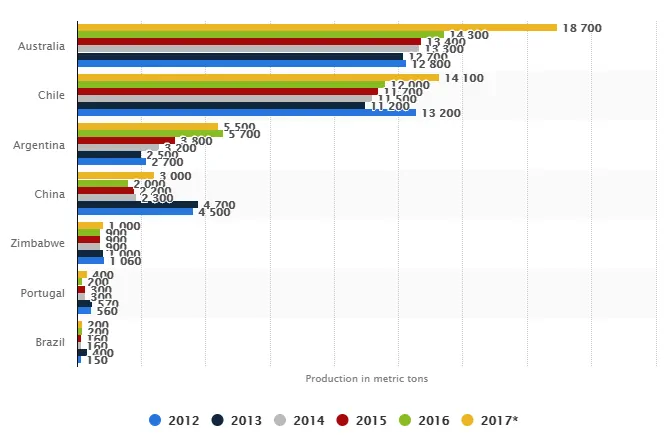

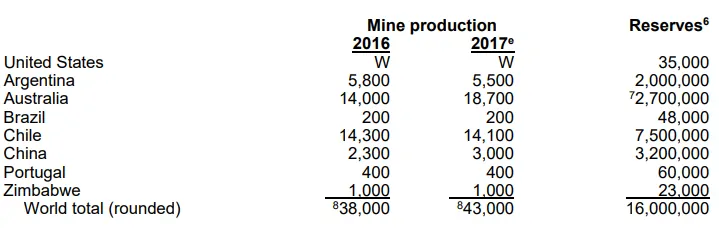

As seen in the second graph, Australia (44%, 18,700Mt), Chile (33%, 14,100Mt) and Argentina (13%, 5500Mt) are the three biggest lithium production countries in FY17.

Global market share of lithium producers in 2015

FY12-17 Major Lithium Mine Production Countries

FY16-17 Major Lithium Mine Production & Reserves Countries

These oligopolistic incumbents (Chinese Tianqi, SQM, FMC, etc.) supply 98% of output worldwide. Compared to these, AVZ has negative earnings each year and zero production.

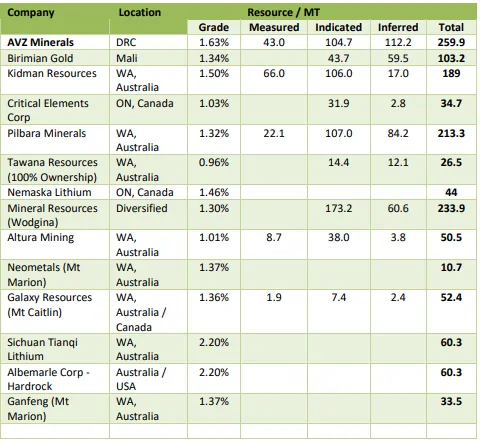

Most of the value of AVZ derives from its potential and only grade and tonnage of resource can be evaluated and compared to its competitors.

AVZ’s Manano Project has 259.9Mt@1.63% compared to the second largest lithium producer Albermarle Corp’s 60.3Mt@2.20% in hard rock.

For a rough comparison, AVZ sits on approximately four times of Albermarle’s lithium hard rock resource. Albermarle’s net sales of lithium are at $1.17B with TTM Adj EBITDA $504M and TTM Adj EBITDA Margin 43%.

This indicates phenomenal potential growth in AVZ’s sales and profit once exploration is finished and production is scalable.

However, Albermarle was founded in 1887 while AVZ only started in 2007, so Albermarle has a much longer operation history and expertise in metal and chemicals.

Nevertheless, Albermarle did not enter the lithium market until 2016, and there are great opportunities for AVZ to catch up.

Figure 11: Peer comparison- Mine resource among main competitors

Geological and Technical Risks Posed to Exploration

AVZ is still in the early phase of investigation with only 50% of geological exploration completed.

The result of assays looks favourable and estimation of tonnages exceeded expectations. However, a potential risk exists as the assay is only an indication of grade and tonnages and may change when the result comes out.

Furthermore, there is no fast-tracking of the project, targeting annual average production or any accurate estimation of future cash flow.

Lack of Expertise and High Cost of Production

There are two primary means of extracting lithium.

- From brines in evaporated salt lakes known as salars;

- Hard rock mining, where the lithium is mined from granite pegmatite.

AVZ Minerals is the latter. Few hard rock projects have been put into production for the last two decades, and they are completed by the major lithium producers.

This means that there is a lack of skilled personnel in mineralogy/metallurgy and the engineering side of production in this industry.

AVZ Minerals is more prone to the shortage of talent due to its size and short operating history.

Moreover, AVZ has a higher cost of production when compared to salars miners.

First, hard mining must have significant capital costs for start-up and secondly the production cost is roughly twice what it is for the brine exploitation process.

Many of the big miners of lithium nowadays are brine miners, including SQM.

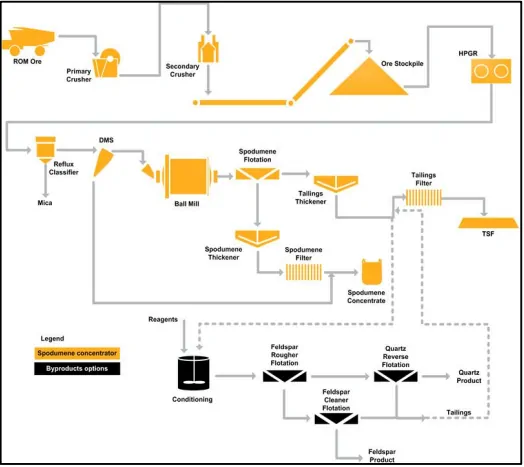

Compared to brine mining which can be as easy as scraping from rocks, hard-rock mining is more complicated, as illustrated in Simplified Concentrator Flowsheet.

Simplified Lithium Concentrator Flowsheet

Nevertheless, skyrocketing lithium price makes hard rock mining profitable despite its high production cost.

Three spodumene operations in Australia and two brine operations each in Argentina and Chile accounted for the majority of world lithium production.

High demand for lithium incentivizes technological advancement, and it is possible that the production cost of hard-mining can be further driven down soon.

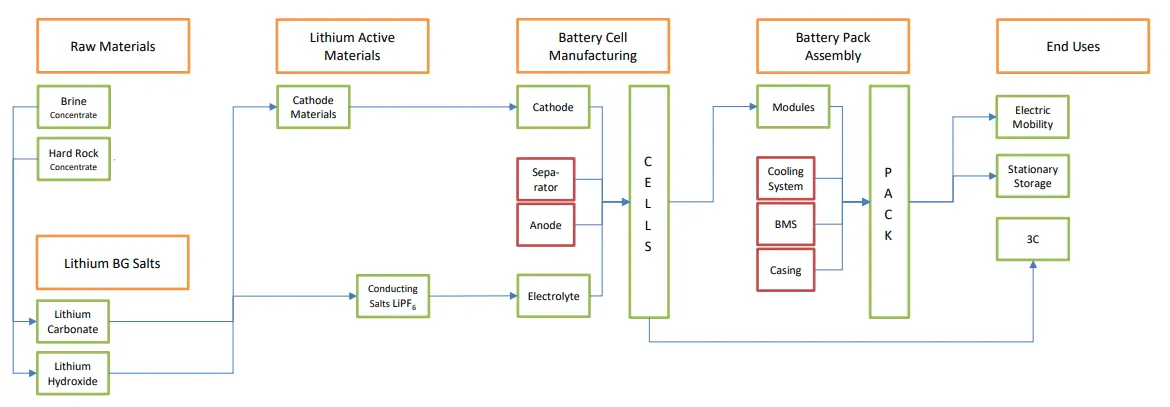

Lithium Battery Value Chain

Unpredictability in Commodity Price and Market Demand

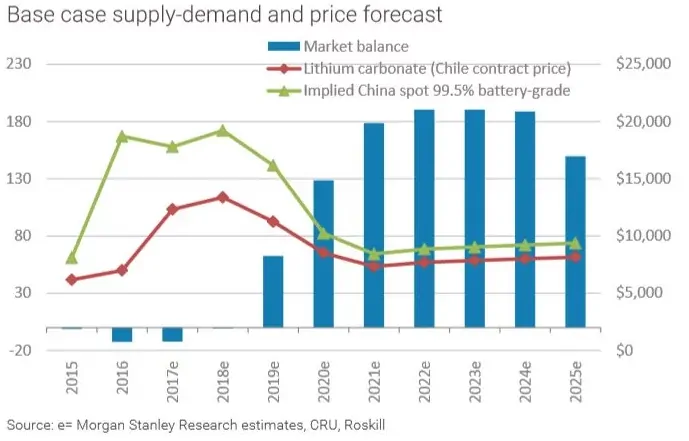

The chart below shows the joint estimation of Roskill, BMO Capital Markets, Citi Investment Research, Deutsche Bank, Goldman Sachs, Instine, Nomura, Morgan Stanley, UBS, Oppenheimer, SQM, and FMC.

It showed that lithium demand ranges from less than 600 kT LCE to more than 1000 kT LCE and EV penetration varies between 8% to 16% in FY25, which all see almost 100% variance.

Global Forecast of EV and Lithium. Includes estimates from Roskill, BMO Capital Markets, Citi Investment Research, Deutsche Bank, Goldman Sachs, Instine, Nomura, Morgan Stanley, UBS, Oppenheimer, SQM, and FMC. Estimates are same data points that were presented in March 2018 investor presentation. Includes 20 kT LCE in grid storage (ESS) volume.

Morgan Stanley’s report is among the most pessimistic, predicting that lithium will see a glut in production and a massive fall of 45% in price by FY21.

Moreover, the uncertainty market leader Tesla and other EV manufacturers and the fluctuation in lithium price make the demand for lithium extremely hard to predict, as reflected in the divergence of the estimate. This poses an enormous risk to AVZ’s future potential profit.

Morgan Stanley’s Estimate of Lithium Demand

Figure 16: Volatile Lithium Price FY17-18

The high Political Risk Might Hamper AVZ Mineral’s Potential

The DRC is characterized as a non-democracy, as the state has a Freedom House Score in 2016 of 5.5 out of 7.

This grade refers to military-backed dictatorship, authoritarian states, elitist oligarchies, and absolute monarchies.

DRC also ranks 135 out of 150 in corruption control, 200 out of 214 in the rule of law and 141 out of 150 in political instability and the threat of violence or terrorism in FY17, according to World Bank Worldwide Governance Indicators.

The drinking water access rate is 26%, and electricity is only 6%, showing a severe lack of robust infrastructure and reliable electricity supply.

Despite all these challenges, the DRC’s mining sector is expected to see exponential growth due to foreign investments from mining companies.

This is due to untapped mineral reserves and perceived low mining cost. This is expected to result in the further development of the transport network as well as infrastructure, including electricity and water supply.

However, there has been a fall in the infrastructure construction rate in DRC over the last thirty years due to internal conflicts.

Vast geography and low population and foreign investment may not alleviate the problem.

AVZ Minerals shares have great potential as well as high risk.

It has the biggest lithium mine (Manono Project) on earth and close relation to the Chinese government.

Although AVZ has not started commercial mining, the lithium market is booming. Almost all lithium miners saw exponential growth, and AVZ should catch up once it finishes its exploration phase.

However, the lack of expertise in lithium mining industry and high costs involved in hard-rock mining may undermine AVZ’s future profitability.

Furthermore, AVZ does not have any financial company guidance, or indicator of future lithium output and volatility in lithium price and divergence in estimation makes future profit unpredictable.

Nevertheless, an increasing number of lithium-ion battery used in mobile devices and EV’s will eventually reduce the fluctuation and uncertainty in lithium.

In addition, AVZ Minerals shares have strategic Chinese backing. This means that some of the geopolitical risks and funding can be better navigated since sovereign interests have much more firepower and influence than regular investors.