Today we’ll look at why Coles shares (ASX:COL) is a great addition long term buy and hold defensive stock for a portfolio. This COL share price forecast and analysis look at why Coles shares are undervalued compared to Woolworths (ASX:WOW).

Coles Group (ASX:COL) is an Australian retail chain operator.

The company has built a solid reputation for itself as a consistent dividend-paying and defensive stock.

Coles shares fared reasonably well throughout COVID.

Despite suffering a 1.7% drop in revenue and a 32% drop in profits in FY20 it remained profitable and honoured shareholders’ expectations of dividend payments.

The company has made good progress through FY21, but COVID concerns in Australia prevented that progress from being translated into significantly higher returns.

However, we believe the company is a good post-COVID dividend and defensive play.

At the current COL share price, Coles shares are down 5.5% YTD.

Table of Contents

- 1 About Coles Group (ASX:COL)

- 2 Coles (ASX:COL) is a Very Resilient Business

- 3 Sector Faces Secular Weakness

- 4 Technology To Drive Returns Moving Forward

- 5 COVID Will Continue to be a Threat Until Lockdowns are Resolved

- 6 The Company Remains an Excellent Defensive Stock

- 7 Coles (ASX:COL) Valuation

- 8 “People Gotta Eat (And Drink)” – Coles Is A Defensive Play With A Nice Dividend

About Coles Group (ASX:COL)

Coles Group (ASX:COL) is one of Australia’s largest retail chain operators.

After Woolworths, the company is the second-largest retailer by revenue in Australia.

Coles was spun off from Wesfarmers Inc. (ASX:WES), one of the ANZ region’s biggest industrial conglomerates, in 2018.

The company has a presence in supermarkets, online retail, loyalty, fuel retail, and liquor across 1500+ locations. It has:

- 27% market share in supermarkets

- 19% in liquor,

- 23% in convenience stores

In FY20, the company reported a revenue of A$37.7B and at the current COL share price, a market capitalization of A$23.3 billion.

Coles (ASX:COL) is a Very Resilient Business

Coles’ biggest strength is its resiliency.

The company’s diversified business model caters to the core needs of customers across various channels keeping it afloat through the worst of economic shocks.

The company’s performance through COVID is a testament to this quality.

In fact, we mentioned COL’s as one of the stocks at the beginning of the COVID pandemic, especially for those who needed dividends.

It reported a A$978 million net profit in FY20 and faced only a marginal decline in revenue.

The company’s omnichannel sales approach buoyed the company throughout COVID.

Coles was able to use its vast presence and a combination of physical and e-commerce infrastructure to cater to customers stuck at home or those wanting to avoid in-store shopping due to social distancing.

The pandemic gave the company’s online business a great tailwind. COVID buoyed the company’s revenue during lockdowns but also brought in a large number of new customers into its fold.

The company has also effectively used its vast reach to nurture Coles label brands.

These brands now make up 32% of the company’s offerings and are collectively worth $10 billion in annual sales.

In 1HFY21, the company showed a substantial recovery with overall revenue growth of 8% and NPAT growth of 12.5%.

The company reported 7.3% YoY growth in its flagship supermarkets business and a staggering 43.8% growth in online sales.

The liquor business did extremely well too with 15% YoY growth in revenue and 89% growth in online sales.

In difficult times, cash is king, and Coles’ cash flow is an impressive 92% of EBIT on average.

This allows the company to borrow cheaply when required, fund Capex easily and pay dividends consistently.

Source: Coles 2021 Investor Presentation

Sector Faces Secular Weakness

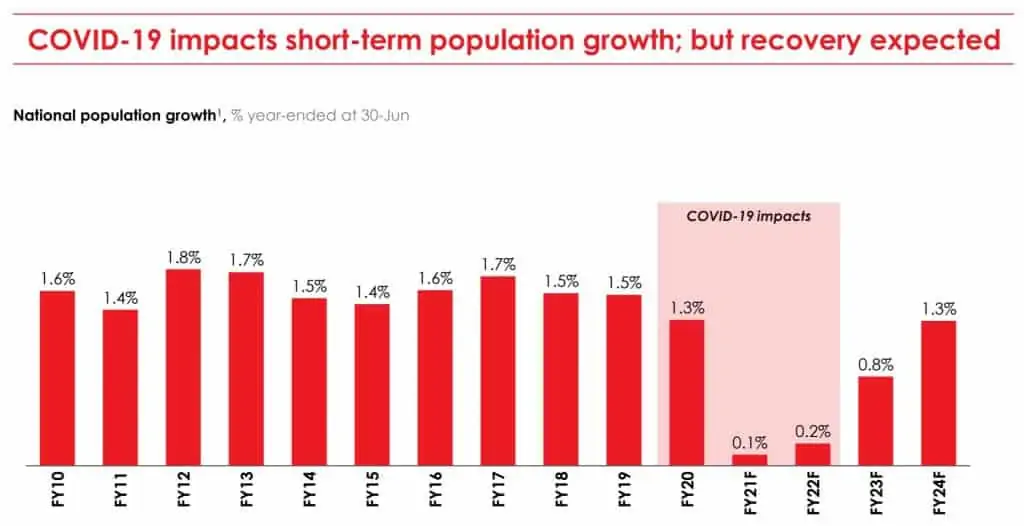

A secular weakness facing the entire supermarket industry is that COVID-19 has slowed down Australia’s population growth rate.

Following the pandemic, the Australian Bureau of Statistics has extended all population forecasts by 6 years.

At present reckoning, population growth is expected to return to pre-pandemic levels by 2024, at best.

Significantly, population growth has contributed to a third of the industry’s growth historically.

Furthermore, Coles shares (ASX:COL) reported lower supermarket sales in Q3FY21 on a YoY basis for the first time in 50 quarters as panic spending due to the pandemic declined.

While COVID has made a comeback, investors may nevertheless have to worry about slow growth or stagnation over the medium term.

However, the company is making extensive efforts to mitigate slow growth with cost savings which are discussed below.

Source: Coles 2021 Investor Presentation

Technology To Drive Returns Moving Forward

Coles Group (ASX:COL) is making significant efforts to change its strategy by using technology to drive efficiency and cut costs.

Under the company’s “Smart Selling Program”, the company aims to gradually shift towards smaller and more efficient stores that can cater to customers at their location more effectively.

The company is already using data to forecast stocking at its stores up to 4 months in advance.

Coles’ efforts are paying off because stock movement is up 35% under the program, thus leading to a higher product shelf life.

Source: Coles 2021 Investor Presentation

Coles has agreed with Witron to build automated warehouses in NSW and Queensland.

The Smart Selling Program will help the company revamp its supply chain and make its omnichannel model even stronger.

The company has stated that customers who shop across multiple channels generate nearly twice as much revenue as single-channel ones.

Technology will also help cut costs.

The company is on track to deliver A$1 billion in annual savings by 2023 and A$550 million in FY21.

Coles have planned a capital expenditure of A$1.1 billion in FY21 and A$1.4 billion in FY22 to fund this program.

COVID Will Continue to be a Threat Until Lockdowns are Resolved

COVID has hurt the industry’s growth prospects, but the company is using its financial muscle to convert that into an opportunity to cut costs, boost efficiency, and drive returns.

A major threat facing the company is the uncertainty from the pandemic.

The resurgence of COVID in Australia, coupled with the so-far sluggish progress on vaccination, could hurt the economy due to lockdowns and supply chain disruptions.

With cases increasing across the country and Brisbane and Sydney in lockdown, progress made by Coles over the past 12 months could nullify.

The company expects to face A$10 million a month in COVID costs and has stated that it expects supermarket sales and EBIT to be lower compared to the first half of the year.

In Q3FY21, the company reported lower sales due to the national lockdown and generally lower footfalls at its physical locations.

On a group basis, the company reported revenue of A$8.75B, down 5.1% YoY.

The main drag on sales in Q3 was the supermarket business that reported revenues of A$7.724 billion, down 6.1% YoY, due to the national lockdown.

However, liquor and convenience stores reported YoY sales growth of 2.6% and 7.4% respectively.

Preliminary retail sales for June fell by a larger-than-expected 1.8% (MoM) versus analysts’ expectations of a fall of only 0.5%.

Significantly, food retailing was the only industry to gain in June, up 1.5% with states entering lockdown during the month driving the increase.

With lockdowns persisting, third-quarter growth is under a cloud.

However, Australia is making progress towards vaccinations and have a plan in place to have lockdowns be a thing of the past. The recovery could see a lot of these issues dissipate even though COVID related costs will likely remain for a while.

The Company Remains an Excellent Defensive Stock

That being said, Coles shares are undeniably an excellent defensive dividend stock.

The stock currently has a dividend yield of 3.46%.

Given that interest rates are near all-time lows, dividend stocks backed by resilient businesses are a wise place to invest in at the moment.

Morgan Stanley has a target of A$19 on the stock, 8.6% above the current value.

Coles (ASX:COL) Valuation

We compare Coles shares (ASX:COL) to its chief rival Woolworth Group (ASX:WOW) and Kroger Co., a major American retailer.

| Metric | Coles Group | Woolworth Group | Kroger Co. |

| Price/Earning Ratio | 22.24 | 34.6 | 21.23 |

| Return on Equity (TTM) | 39.4% | 15.34% | 16.12% |

| Return on Assets (TTM) | 5.71% | 5.32% | 3.17% |

| Dividend Yield | 3.46% | 2.61% | 2.06% |

As can be seen, at the current COL share price, Coles shares are far cheaper than its chief rival Woolworths, and more or less the same as Kroger, in terms of earnings multiple.

The company also outperforms both its peers on ROE and ROA, which gauge shareholder value and efficiency.

To top it off, Coles also offers a higher dividend yield.

At the current COL share price, Coles shares are much more attractive than Woolworths shares as a defensive dividend payer.

“People Gotta Eat (And Drink)” – Coles Is A Defensive Play With A Nice Dividend

Coles shares are a solid defensive stock with a decent dividend payout.

While there are stocks with higher dividend yields, few of them can match the payout consistency of Coles and the resilience of its “essential”-tagged business.

The next time we hit another crisis, and we will at some point, companies like Coles will be a bedrock in dividend payments as other companies cut to save cash.

The company has also succeeded in adding a lucrative online business to its brick-and-mortar model.

It has the financial wherewithal to develop technology to make both digital and physical businesses work together harmoniously.

The company is therefore well-positioned to address the developing consumer needs in Australia, said to be one of the most attractive foods and drink markets globally.

At the current COL share price, Coles shares are also available at a much better valuation compared to its main peer Woolworths across all metrics.