There are three tenants when buying shares. Understanding the underlying fundamentals, macroeconomic forces and technical analysis for timing entries. We have covered off on the fundamental and macroeconomic parts through our research articles and top 5 best stocks to buy list. This article will cover how to buy shares using technical analysis to time your entries on the share market to buy income shares.

Table of Contents

Step 1 – Market Context

Context is the first of the three technical steps we take to picking an income share. Quite simply, shares tend to rotate around a price area, which is what people perceive as fair value.

Shares most of the time move in a pretty random manner. This is because investors and traders are buying and selling for their own reasons, none of which is easy to quantify.

However, they do tend to trade in a channel. Shares who consolidate in a channel rotate from overbought to oversold back to overbought. When purchasing shares, you don’t want to overpay – waiting for it to become oversold is paramount.

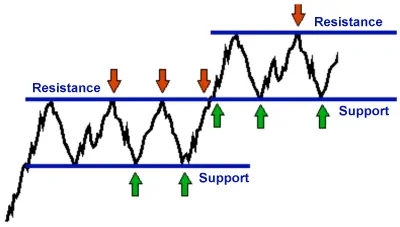

When shares trade at the top of a channel, this is called a resistance. The bottom of a channel is called the support.

Support and resistance areas are important because these are areas where the shares either has to mean revert or break out. These are areas that allow you to make a high probability entry if you have an edge.

Mean reversion happens when the shares fail to break below the support area (green arrows) and trades back to its resistance area (red arrows). Statistically, this happens about 70% of the time. However, since channels are generally quite small, the average win-to-loss ratio is generally about 1:2.5, meaning that without an edge to pick a direction, you would come out about breakeven.

Breakout happens when the stock manages to break out of its channel and trend higher. Statistically, this happens about 30% of the time. However, since breakouts can be quite strong, the average win-to loss-ratio can reach 3.5:1 depending on your exit criteria. This also means without an edge to pick a direction, you would come out about breakeven.

The aim of the game when trading income shares is to increase your mean reversion percentage to well over 70%, but keep or increase your winners to reduce your 1:2.5 win-to-loss ratio. If you are a long-term holder, then buying at the bottom of the range and holding would mean you have got in at a good price to reap outsized dividends.

Keep this in mind – buy low and sell high (or not sell at all). As an investor looking for income from the share market, we aren’t looking for a stock with momentum to break out. We want shares that just meander sideways so they have less risk of falling over, so we can generate an income by selling options around it and so we can take fat dividends from it.

Wesfarmers (ASX WES) would trade down to the $40 support level and predictably bounce back up to $45 and beyond.

Principle number 1: Take notice of stocks that are at the support point, looking to mean revert, because mean reversion has a very high percentage chance to win. Buy low and sell high (or not at all).

Step 2 – Volume Confirmation

Volume is everything in the stock market because investor sentiment and activity is what drives stock movement. Fundamental analysts will scoff at the idea of looking at charts, but in the end, if nobody is buying your shares, your shares won’t go anywhere. Since volume is a true indicator of how much interest there is in a stock, volume is everything.

If trade volume is normal or lower than average at a support point, this potentially means there is no interest from investors to sell shares at that level, indicating a higher percentage chance the shares will mean revert back to the centre of the channel.

This is because smart investors who are trading the channel, buy at the bottom of the range, and sell the top of the range. However, since fair value is in the middle of the channel, the sell volume available at those lower prices will be thin, since nobody wants to sell when the shares is perceived to be oversold.

Buyers at the bottom of the range will force the shares to trend back up to its mean very quickly on low volume as buyers come in to pick up a bargain.

However, If a high volume of investors sell at the BOTTOM of the range, it indicates they are expecting the shares to go lower. Shares that increase in volume as it falls, indicates a higher probability it will fall further.

This makes sense logically, as investors have no reason to sell shares when it’s oversold unless they feel that the stock will go lower.

If you buy shares that is falling heavily on high volume, you are doing what we call “catching a falling knife”. It works sometimes, but when it doesn’t, it’s not pretty as shares can fall away really quickly. Falls like this is usually due to fundamental or macroeconomic issues and these shares are best avoided.

Principle number 2: If there is normal to falling levels of volume at the bottom of the range at a support level, then investors are expecting a mean reversion. If volume is increasing at a support level, investors are expecting the stock to break further down.

Step 3 – Price Action Confirmation

Volume on its own doesn’t tell us much, except that there is interest in the stock because we don’t know if the professional traders are the buy or sell volume. Price action, however, can tell us what the supply and demand imbalance is and gives us clues as to what that volume and big traders are doing. If you are still using a line chart, now is the time to switch to candlestick charts. Here is a quick guide to the different candlesticks and how bullish or bearish they are:

If the price action is bullish at the bottom of the range in the support zone, it means investors are using the opportunity to buy shares. If the price action is bearish and there is high volume, it means investors are using the opportunity to sell shares. It is that simple.

Principle number 3: If the shares are trading at support, the more bullish the price action, the higher the probability the stock will successfully mean revert. The more bearish the price action and the higher the volume, the lower the probability it will mean revert.

What About Technical Indicators?

Indicators such as Moving Average, Bollinger Bands, Relative Strength Index (RSI), Stochastic Oscillator (STO) and Moving Average Convergence Divergence (MACD) are all just derivative indicators. They either derive from the share price (Moving Average, Bollinger Bands, MACD) or price action (RSI, STO) and does not add additional information. In fact, technical indicators such as this take away information by turning them into averages. These indicators are good as supplementary assistance to raw technical analysis (in fact, I use a moving average myself – just one though) but is useless and can be downright misleading used on their own or as a combination of indicators.

When trying to understand the markets, understanding supply and demand imbalance today is what’s important. This is why watching an uncluttered and raw chart will give you all the information you need. Unlike technical indicators which actually takes perfectly good data and removes information by averaging, by understanding context, volume and price action, you are accessing three completely independent data points that are up to date to the second.

Incidentally, this is why our Model Portfolios are named VPAC (Volume, Price Action & Context).

Key Takeaways

The 3 golden rules when using technical analysis is to always trade when the context is right and the trade is confirmed by volume and price action. Forget technical indicators. Buy low and sell high. If you want to become a consistent trader, using fundamental and macroeconomic analysis is not enough. Technical analysis and timing your entry on the stock market can mean the difference between a winning or losing trade.