Bapcor Limited (ASX BAP), previously known as Burson, is the leading provider of automotive aftermarket parts, accessories, automotive equipment and services in Australasia. Floated on ASX in 2014, Bapcor acquired a series of related automotive aftermarket companies from 2016 and it has been growing strongly ever since. The Bapcor share price started at AUD$2 in 2014 and more than tripled in less than three years, reaching AUD$7 per share, with Bapcor shares reaching a market cap of around AUD$2 Billion.

Through a combination of sustained organic growth and strategic acquisitions, it has transformed itself from a business primarily focused on the Trade segment of the automotive aftermarket into a group which now covers the full spectrum of the automotive aftermarket supply chain. It now has businesses in the Trade, Retail, Service and Specialist Wholesale segments, operating across Australia and New Zealand and more recently, South East Asia.

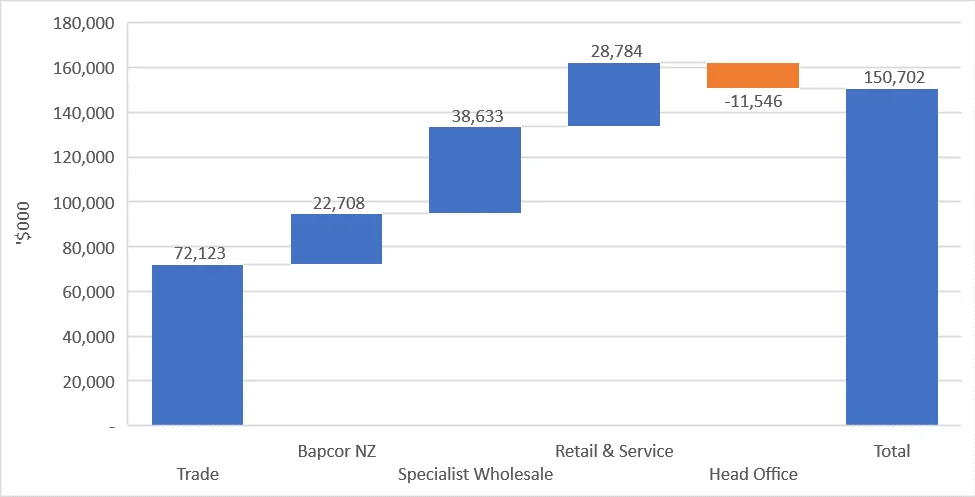

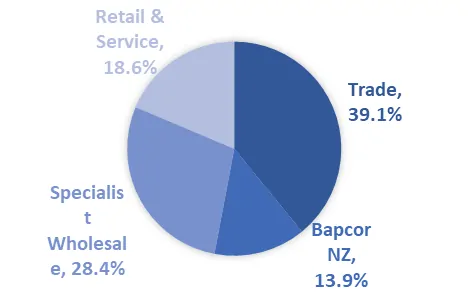

SALES BREAKDOWN (2018)

Key financials

Table of Contents

The five-year target of Bapcor’s core business segment is automotive aftermarket Trade (50%), Specialist Wholesale businesses (30%) and Retail & Service (20%).

Trade (50%): This segment refers to its business of distributing auto parts to independent and chain mechanic workshops. Bapcor offers a complete range of workshop equipment to fit-out.

Specialist Wholesale (30%): This segment supplies an extensive range of products principally imported from overseas to local premium brands. These local brands include AAD, Autolign, JAS Oceania Australia, JAS Oceania New Zealand, Baxters, Bearing Wholesalers, MTQ Engine Systems and many more.

Retail & Service (20%): Bapcor’s Retail & Service segment distributes parts and accessories from a variety of brands via a network of 385 company-owned and franchise stores. Distributed stores include 120 Autobarn, 85 Autopro, 85 Car Part, 70 Opposite Lock and 35 Sprint. Bapcor also owns about 160 service shops, including Midas, ABS and The Shock Shop.

Figure 3 – BAP – EBITDA BREAKDOWN (2018)

Growth Through Consolidations and M&A

The automotive car parts industry is very mature, highly competitive and fragmented. Consolidation and M&A are the current trends in the industry.

Bapcor shares is expected to achieve growth through the continuous improvement of its existing operations, store network expansion and strategic acquisitions. During 2015-2017 it acquired 10 companies and actively grew its franchise brands, becoming one of the most vertically integrated automotive aftermarket providers. Its distribution network of over 170 stores provides it with a competitive advantage over smaller competitors through greater breadth in inventory, higher service levels through shorter delivery lead times and the ability to offer competitive prices through greater buying power and rebates. This has fuelled an average 50% growth of revenue and a like-for-like sales growth of 4.6% for the past 3 years. Moreover, Bapcor has been selling off its ‘non-core’ businesses, including its footwear chain, resource centre and TBS Groups, while actively seeking to expand its brand store organically.

The looming entry of Amazon into the Australian market may be the most apparent threat to Bapcor. However, in Bapcor more than 75% of profit contribution is from Trade and Wholesale segments which primarily supplies parts to mechanics and workshops. Additionally, online business sales comprise less than 2% of total revenue in Bapcor. Last but not the least, Bapcor has extensive knowledge of the technical areas while the US giant doesn’t provide technical expertise.

Key risks

Increased competition: The Australian automotive aftermarket parts distribution industry may face increased competition and further consolidation of the industry. Increased competition could hurt the financial performance of the company and industry returns. However, the fast-expanding network of Bapcor and its leading number of stores among its key competitors alleviates such risk.

Unfavourable vehicle trends: Demand for traditional automotive parts can be negatively affected by unfavourable vehicle trends. More recently, the emergence of an increased commitment from car manufacturers toward electric vehicles could have an adverse impact on the demand for automotive parts. According to Bapcor, only two per cent of Australasian car parts are from hybrid and electric cars. In the last quarter of FY17, sales of hybrid and electric vehicles accounted for only 1% of car sales. Even though this type of vehicles used in Australia and New Zealand is not growing massively, this can change dramatically as the world becomes more focused on the environment and global warming.

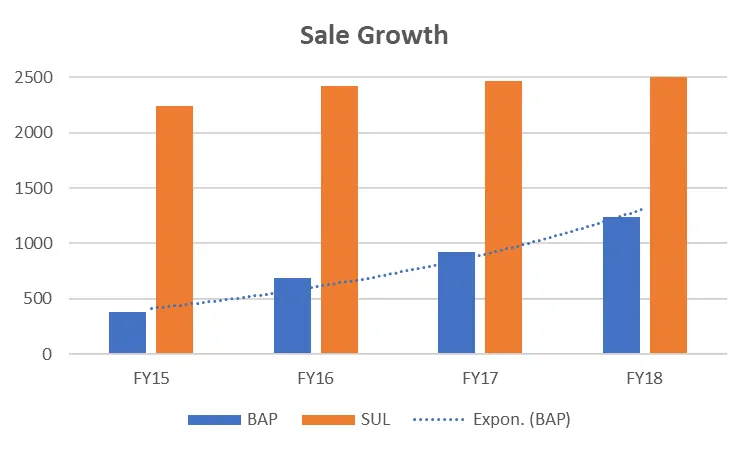

Outstanding Peers performance: Compared to its main competitors in Australia and New Zealand, Bapcor has expanded rapidly. As illustrated in Sales, Bapcor’s revenue increases at more than 50% YoY while Super Retail Group (ASX SUL) and Genuine Parts Company (NYSE GPC), though generating much higher revenue back then, only grew at 3% per annum. However, if their competitors pick up their game, they could pose a threat to Bapcore shares’ strong growth.

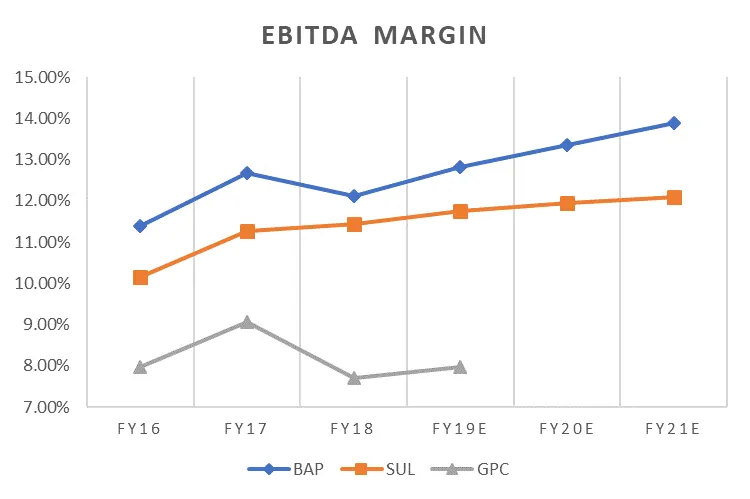

Bapcor shares EBITDA margin has been consistently higher than SUL and GPC, at about 12% and its margin has grown due to cost saving brought on from consolidation.

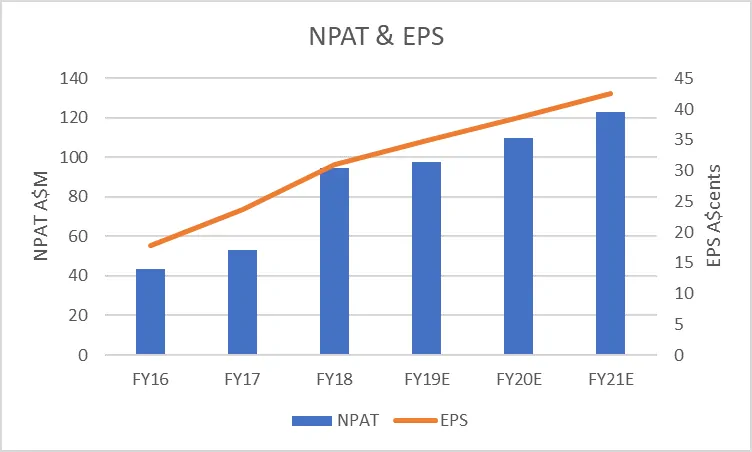

Additionally, Bapcor shares NPAT and EPS experienced exponential growth in FY16-18, from A$43.6 M and 17.8 cents to A$94.7 M and 30.9 cents. Conservative analysts project NPAT and EPS to grow 10% and 12.5% YoY for three years, to A$123M and 42.5 cents, respectively.

Bapcor shares PER was consistently higher than SUL and GPC and is still projected to be higher than them in three years, showing the market’s confidence in its business model and future performance. However, Bapcor shares PER is decreasing rapidly, from 31x to 19.8x FY16-18. This drop is due to the comparatively lower growth potential compared to a few years ago. As ASX average PER hovering around 20, falling P/E makes Bapcor much more attractive to buy. However, a falling P/E could also indicate that the market feels the strong growth Bapcor shares had in the past will slow as they grow larger.

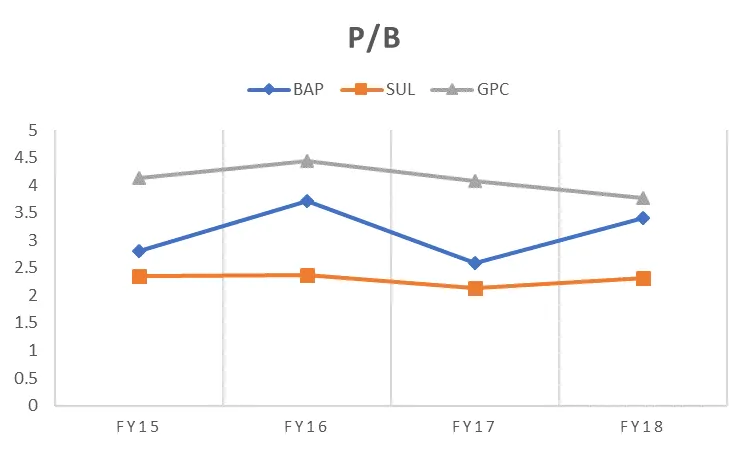

Its P/B also sits comfortably between SUL and GPC, fluctuating between 2.8 to 3.7, indicating a reasonable market value.

Prospect

The Outlook for growth looks favourable: BAP’s FY18 result was sound, achieving 31.6% growth in NPAT, which includes the benefit of acquisitions. All business segments reported sales growth and profit growth in FY18. Its targeted store numbers for the core Burson Trade segment has increased 15% to 230 stores, up from 200 stores previously. Management also indicated plans to increase its Service Centres to 500 stores, up from the current 128 stores it supplies; the company’s financial position has strengthened with net/debt to EBITDA back under 2x. The company indicated it is heading towards “mid-sized” acquisitions.

Financial position: BAP finished the period with net debt of $289.5m, down on the $390m reported in FY17. The company’s net debt to EBITDA declined to 1.9x, down from 3.3x reported last year. It is worth noting the company’s dividend payout ratio declined slightly in FY18 to 50%, which reflects its growth profile over the short to medium term.

Returns have been diluted: Bapcor’s investment activity and acquisitions have temporarily diluted the returns of the group. Returns have been diluted by higher working capital requirements, an increase in fixed assets and a slower asset turn. This trend should reverse in coming years through higher sales, leveraging its existing asset base and cost reduction opportunities.

Strong growth well above its peers and good financial management

Bapcor shares has gone from strength to strength and have found a way to grow strongly whilst keeping debt under control. In a mature and possibly declining industry, as electric vehicles become more popular, Bapcor shares has found a way to gain double-digit growth whilst their competitors remain stagnant. Considering the size of the market and its stagnant competitors, if Bapcor shares can keep up their growth, there is still plenty of upside and much more of the market pie for them to take in the medium to long-term.