Today, we will look at why we like Bigtincan shares (ASX:BTH) and give you a rundown on our BTH share price forecast.

Bigtincan is a leader and innovator in the Software as a Service (SaaS) provider of sales enablement software with core operations in Sydney and sales headquarters in Boston.

The company’s software organises and delivers automation and productivity tools for employees, in other words, software that provides sales team with resources to close more deals.

This is a service that will have tremendous growth as the workforce shifts towards digital sales coaching, as opposed to physical classrooms, even after the COVID pandemic.

With the advent of working from home and the growth in digital and technology solutions, the shift from classroom to digital sales coaching will continue to grow now and into the future.

Some estimates forecast that up to 55% of sales training will be digital by 2021.

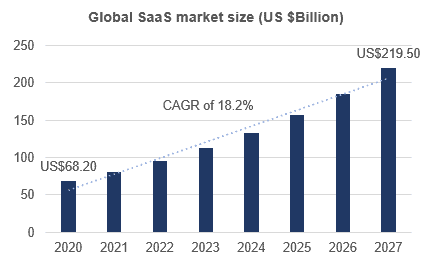

The global SaaS market is estimated to be US$68.2 billion in 2020, with a Compound Annual Growth Rate (CAGR) of 18.2% over the next 7 years.

In addition, Bigtincan has also leveraged its products towards the mobile sector, another industry with strong growth.

Bigtincan shares is well placed to leverage multiple high growth sectors and is a stock that we think has strong potential.

Table of Contents

Bigtincan is a leading provider of sales enablement software in the enterprise mobility market.

Since its inception in 2011 in Sydney (Australia), BTH has grown to be a global software solution provider with its core operations in Sydney and the global sales HQ in Boston.

Bigtincan Hub is BTH’s main product, which is a Sales Enablement Platform (main functions are shown on the graph) powered by a machine learning and AI system.

It facilitates sales mainly on mobile devices like phones, tablets, and laptops (also supports Microsoft Windows and Apple OS X) for enterprises by automatically organizing and delivering all the automation and productivity tools needed to employees in time.

Source: Aragon Research

BTH Share Price Historical Performance

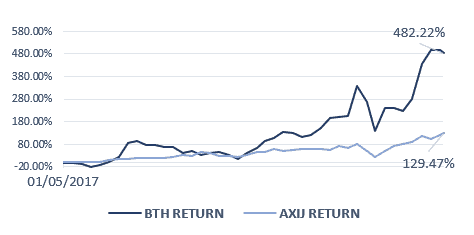

At the current BTH share price, Bigtincan shares outperformed the S&P/ASX 200 Info Tech (ASX:AXIJ) by over 350% since its commencement of trading on the ASX on 22 March 2017.

Bigtincan Shares (ASX:BTH) Business Strategies

Market-leading solutions

Bigtincan continues to position itself as a leading provider (identified as a leader by Aragon Research’s SEP competitive landscape) of enterprise mobility software in the global Enterprise Content Management (ECM) market.

Through a combination of organic development and strategic acquisitions (3 in FY2020 and 2 in FY2019), Bigtincan has continued to innovate its Sales Enablement Platforms (SEPs) platform.

Source: Aragon Research

Robust relationships with Channel Partners

Bigtincan highly values its relationships with channel partners who sell Bigtincan SaaS solutions to enterprise customers.

The company continues to invest in its channel by growing new partnerships in high-growth geographical areas (e.g. NTT DOCOMO, INC. in Japan) and deepening existing partnerships.

According to the 2020 annual report, BTH’s Channel partner network expands across 4 continents with 28 partners focused on offering solutions in key vertical markets.

Platform integration with third parties

Partnered with more than 100 popular software solutions, Bigtincan creates the most integrated sales enablement platform in the market.

Bigtincan aims to be a differentiator through technology integrations with third parties, and improve efficiency by seamlessly connecting customers to all the solutions they need.

Industry Trend

Overview

Bigtincan provides software solutions as a service (SaaS) to customers.

As shown in the Global Industry Analysts’ estimation, The global SaaS market size is estimated at US$68.2B in 2020 and is projected to more than triple in size over the next 7 years with a CAGR of 18.2%.

The growth drivers of SaaS include the Proliferation of mobile devices and increasing CAPEX on software.

Besides, Bigtincan belongs to the sales enablement market, a niche space that sees growing popularity among enterprises.

Source: Global Industry Analysts

The proliferation of mobile devices

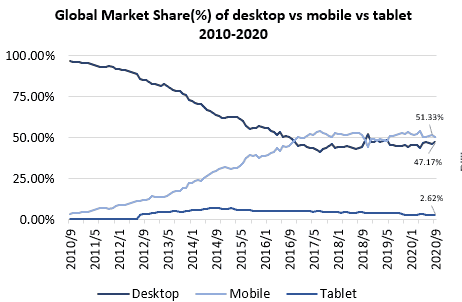

Source: Statcounter

Source: Statista

Bigtincan’s custom platform may benefit from the proliferation of mobile device and the shift in user behaviour.

Moreover, mobile devices have taken over a desktop to be No.1 in the global market share of mobile devices since 2016.

Bigtincan Hub is developed specifically for mobile devices to capture the popularity of mobile device as well as a shift in user behaviour towards the mobile device.

The growth of mobile devices and changing user behaviour is expected to support BTH’s high growth.

The growing popularity of sales enablement software

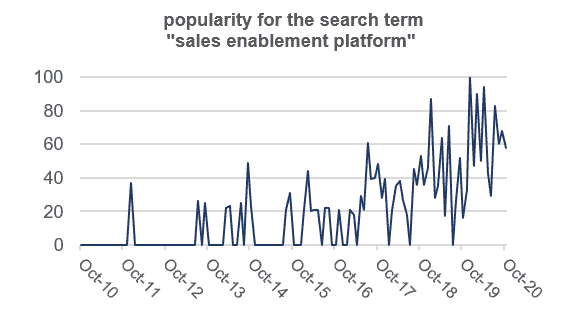

Aragon research states there is a 70% probability that 55% of enterprises will shift to digital sales coaching and learning instead of classroom-based sales training initiatives by 2021.

Sales enablement software might gain more opportunities to be adopted by enterprises.

Meanwhile, the search trend of “sales enablement platform” (Shown in the Chart from Google Trends) is increasing over the last 5 years which indicates the increasing popularity of sales enablement software.

Source: Google Trends

Key Advantages

Market-leading position

Source: Gartner

Source: Bigtincan

Bigtincan (ASX:BTH) aims to establish a differentiated position by integrating with other popular enterprise mobility software (e.g. Microsoft Office, Dropbox, etc.).

According to Gartner’s research on Sales Enablement Platforms, Bigtincan’s comprehensive platform has already achieved competitive advantages on the 8 most popular perspectives (Top use cases).

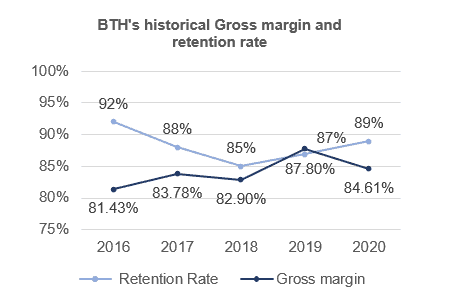

From a financial perspective, Bigtincan shares maintain a high gross margin growth and customer retention.

Bigtincan increased prices significantly over the last 5 years.

However, Bigtincan did not lose customers (retention rate achieves 4 years high) despite the increased price.

This is further evidence of customer “stickiness” brought by its market-leading position.

Strong revenue growth

Source: Fortune Business Insights

Source: Bigtincan

Enterprise Content Management (ECM) is one of the most profitable offerings in the SaaS market.

It is a high growth market that is anticipated to reach USD 43.16 Billion by 2026 with a CAGR of 13.81% (estimated by Fortune Business Insights).

Bigtincan (ASX:BTH) maintains a 30%+ growth rate during the last 4 years in this growing industry.

With an aggressive marketing strategy and M&A, the growth rate is still accelerating.

High-quality customers & partners

The company has more than 300 enterprise customers with internal complexity varying from small, regional entities to multinationals.

Its notable customers include AT&T, Guess, and ANZ, etc.

Its carrier partners include AT&T, Optus, and Singtel, while its technology partners include Apple, Blackberry, Citrix, and Samsung.

Source: Bigtincan

Besides, Bigtincan’s channel partners helped the company to achieve expansion more effectively.

Bigtincan shares’ revenue grows at a higher rate than sales and marketing expenses.

The ratio of marketing expense to total operating expense also shows a decreasing trend.

These ratios indicate BTH is receiving benefits from its investment in building channel partner relationships.

Reliance on a Single Product

Source: Bigtincan

Source: Bigtincan

While Bigtincan’s business model and product offering sets have expanded, it still heavily relies on a single product—Bigtincan Hub.

The company’s future success depends on continuing R&D of the Bigtincan Hub.

If this product loses competitive advantage within the market, the company will suffer from sales decline, customer loss, and the inability of market expansion.

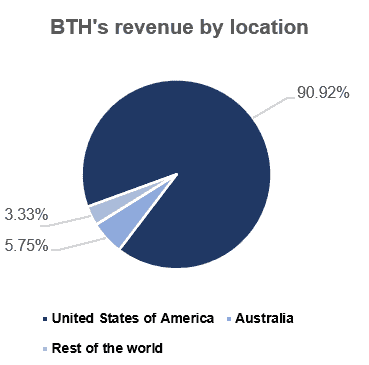

Additionally, since over 90% of sales revenue comes from the USA, failure to develop geographical diversification or significant fluctuation on the USD/AUD exchange rate may cause serious impacts on Bigtincan shares’ performance in the future.

Competitive industry

Bigtincan (ASX:BTH) operates in an increasingly competitive industry with a high growth rate in the next decade.

The high growing industry will attract new participants with innovative products and competitive prices.

To face the intensive competition, Bigtincan spent huge capital resources on product development (shown in the chart).

The increasing R&D expense and competition may bring further pressure on the company’s profitability (the company is loss-making now).

Bigtincan Shares financial performance

Bigtincan’s (ASX:BTH) operating revenue growth continues to maintain a positive trend and achieved a 55.95% growth rate from A$19.9m to A$31m in 2020.

The high growth rate mainly results from new customers, expanding platform and M&A. EBITDA in FY2020 increased significantly because of the business combination.

Adjusted EBITDA (adjustments for foreign currency and one-off items) in FY2020 is -A$6.735M.

Operating expenses grew by 70% to A$39.9M for the year primarily as a result of investment in customer support, data science, network infrastructure, and engineering resources.

Overall, Bigtincan continues to support its sales growth by investing in marketing, M&A, and product development.

Peer Analysis

Source: Morningstar

Peers selection

Bigtincan shares’ competitors include Seismic, Brainshark and Highspot, etc. (they all are private).

Therefore, constituent stocks in the Software & Services (GICS Industry Group) with similar revenue growth compared to Bigtincan shares are selected to be peers.

Overperformed in gross margin

Bigtincan shares (ASX:BTH) have the 2nd highest gross margin (85.00%) compared to its peers who have similar revenue growth.

Its gross margin also far higher than the industry average (69.30%).

As mentioned in the advantage part, its competitive advantage in the market will continue to support its high gross margin.

Low EV/Rev & P/B ratio

EV/Rev is used to evaluate Bigtincan’s market value because Bigtincan and some of its peers are still loss-making (EBITDA is still negative).

At the current BTH share price, Bigtincan shares are trading slightly below the average level (industry average: 15.59x EV/Rev).

Taking Bigtincan’s high gross margin and revenue growth rate into consideration, its 14.47x EV/Rev is relatively lower than its peers.

Additionally, at the current BTH share price, Bigtincan shares have the lowest P/B ratio among peers, which could indicate the stock is currently undervalued.

Conclusion

Bigtincan (ASX:BTH) is an innovative market leader leveraged to multiple high growth sectors.

In the short term, Bigtincan is expected to maintain its high growth supported by its competitive advantages and strong partner relationships.

Compared to its peers, at the current BTH share price, Bigtincan shares trades relatively cheap with a high growth rate.

However, reliance on a single product and intense market competition will be risks that the company has to navigate.

If Bigtincan stops its aggressive marketing campaign and M&A, the growth rate may flatten, however, their sales and marketing strategies have been topnotch so far.

Even though there are risks, the company has a strong product leveraged to multiple high growth sectors and we believe the BTH share price has very strong upside potential.