Today we will look at why we think Deterra Royalties shares (ASX:DRR) will develop into a well-priced, long-term, high yield dividend play with our DRR share price forecast.

Deterra Royalties (ASX:DRR), the largest ASX-listed resources-focused royalty company, is the result of a demerger in 2020 from Iluka Resources, Australia’s biggest mineral sands company.

The company earns mining royalties from its flagship Mining Area C (MAC), the site of BHP’s North Flank and new South Flank project.

Listed royalty companies such as Deterra provide investors with exposure to the value from a natural resources business, but without much of the exposure to some of the operating risks of their mining.

The demerger was fortuitously timed considering the recent rally in ore prices and the inauguration of BHP’s South Flank at the company’s flagship Mining Area C (MAC).

The latter will cause a sizeable jump in royalty flows to Deterra.

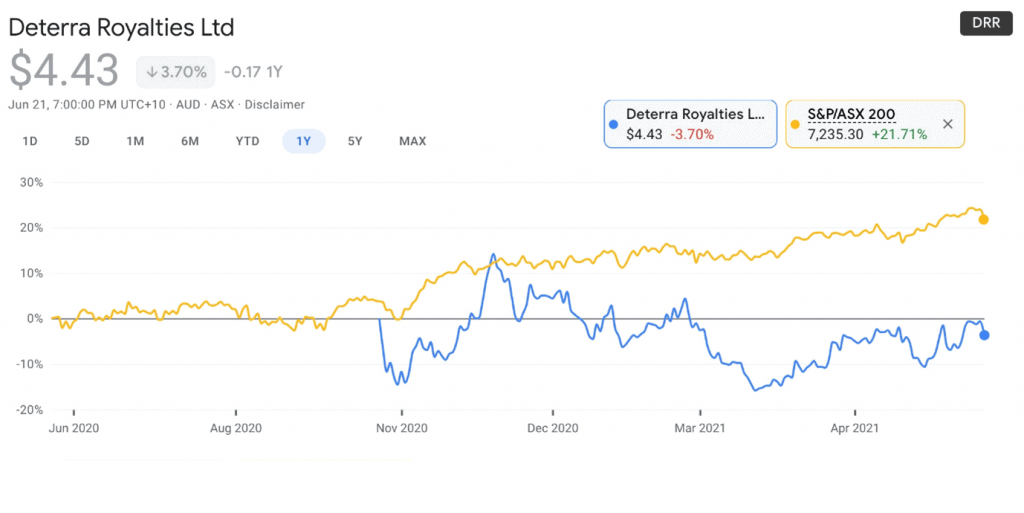

The DRR share price stock has consistently underperformed the ASX 200 index since listing.

Table of Contents

- 1 About Deterra Royalties (ASX:DRR)

- 2 Strong business model but long-term weakness in USD a cause for concern

- 3 Overexposed to MAC, iron ore, and BHP, but cheap debt and rising cash flows could be leveraged to tackle that

- 4 Robust outlook for financials with rising revenues and dividend yields in coming years

- 5 Deterra Royalties (ASX:DRR) Valuation comparison

- 6 Commodity price volatility will be a concern

- 7 Conclusion

About Deterra Royalties (ASX:DRR)

Deterra Royalties (ASX:DRR) is a mining royalty company that owns rights to mining sites, the most popular of which is Mining Area C (MAC), the site of BHP’s North Flank and new South Flank project.

The company is a dividend play due to the stable nature of its cashflows.

Deterra’s royalty agreements include a fixed revenue stream and a variable component based on production.

Strong business model but long-term weakness in USD a cause for concern

A typical mining royalty business model could be any of two types of arrangements:

- The royalty model – where the asset is leased out to a miner in exchange for a fixed stream of payments along with a variable component that moves with production;

- The streaming model – where the company buys a part of the production of an existing mine for an upfront cost and pays for the production at a pre-defined rate upon delivery.

Deterra’s business model is the royalty model.

The company’s royalty earnings are used to pay dividends or finance the acquisition of rights to new assets.

At this point, Deterra currently has a 100% NPAT payout ratio.

Due to its unique business model, the company is a standout with a 90% EBITDA margin.

Source: 2021 Investor Presentation

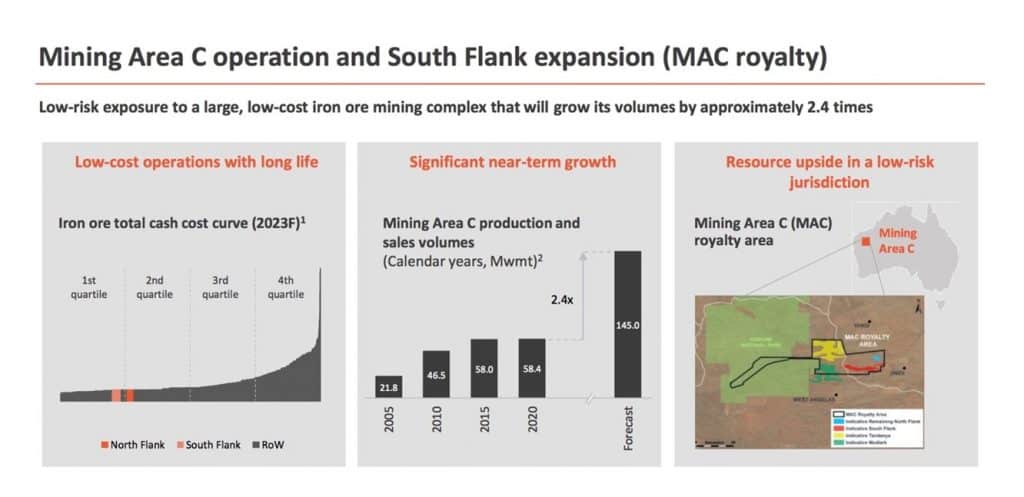

The company’s flagship asset is the Mining Area C in Western Australia which is leased out to BHP (ASX:BHP).

Having BHP as a counterparty is a big plus due to the company’s reputation and standing.

Under the agreement, Deterra is entitled to 1.232% of the revenue from MAC products and an additional A$1 million per tonne of increase in production.

BHP is expected to increase production by 2.4x to 145 Mtpa by 2023 after the South Flank operation is fully operational this year.

As Deterra shares have no exposure to the operating costs of the mine, the increased production will result in significant operating leverage from the higher royalties.

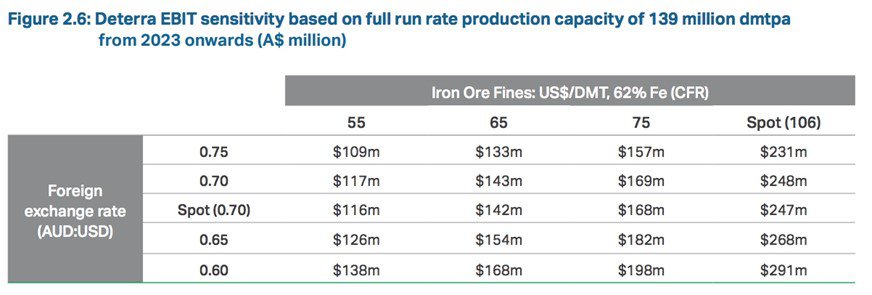

However, a concern for Deterra shares at this time is its exposure to currency exchange rates, particularly the USD.

As BHP’s revenue is denominated in USD and Deterra’s royalty is earned in AUD, the company is vulnerable to any changes in exchange rates.

Therefore, a strengthening of the AUD relative to the USD or weakening of the USD relative to the AUD will hurt the company’s financial performance.

Considering that quantitative easing due to COVID and inflation has led to worries of a long-term weakening of the USD, the bottom line of Deterra shares carry additional FX risk.

On the flip side, any moves by the Fed to tighten interest rates could bolster USD, and therefore, Deterra Royalties’ earnings in AUD.

Source – Iluka Demerger Booklet

Overexposed to MAC, iron ore, and BHP, but cheap debt and rising cash flows could be leveraged to tackle that

While the company has a solid outlook for Mining Area C and a quality lessor in BHP, other assets in the royalties portfolio have yet to bear any fruit.

Apart from MAC, Deterra shares has 4 other assets in its royalties portfolio namely:

- Yoongarillup and Yalyalup (Mineral Sands)

- Eneabba (Mineral Sands)

- Wonnerup (Mineral Sands)

- St Ives Gold (Minerals)

Of the four, only Wonnerup is currently operational but makes up only 1.1% of Deterra’s revenue and has a life till just 2027 compared to MAC’s 30-year life.

Meanwhile, Yoongarillup is to be decommissioned by the end of the June quarter, Eneabba is still in the exploration phase and St. Ives has no activity at the moment.

Yalyaup and Wonnerup are currently in the process of regulatory approvals for expansions.

At the moment, therefore, Deterra Royalties (ASX:DRR) is dependent on one flagship site (MAC), one resource (iron ore), and a single major counterparty (BHP). This is a concentration of risk till other assets bear fruit, or new ones are acquired.

On the other hand, Deterra shares would have to finance expansions or acquisitions by slashing dividends or taking on new debt.

Since the company currently has a 100% NPAT payout ratio and the stock is mainly considered a dividend play by the market (with MAC ramp up and related financial projections already priced in), either action will dilute its core attraction of being a capital-light dividend stock.

However, the current cheap debt environment presents an opportunity for the company to identify and pursue acquisition targets.

Deterra Royalties (ASX:DRR) is on the clock as debt is as cheap as it will get for the foreseeable future while the ramping up of operations at MAC will significantly improve its economic standing and financials for servicing new debt.

Robust outlook for financials with rising revenues and dividend yields in coming years

In 1H’FY21, Deterra shares reported revenue of A$53.9 million, EBITDA of A$47.8 million, and NPAT of A$33.3 million.

Of this, A$23.4 million was available to Deterra shareholders while the rest went to Iluka shareholders being related to the pre-spinoff period.

According to Goldman Sachs, the company is projected to generate revenues:

- FY21 – A$122 million

- FY22 – A$210 million

- FY23 – A$198 million

This represents growth of 32.6% and 72.6% over the next two years.

Further, EPS is projected to grow 33% and 81% in FY21 and FY22, respectively.

The company currently has a dividend yield of just 1.07%.

For FY21, the company is expected to have a dividend yield of 2.3% followed by 5.6% and 5.3% for FY22 and FY23, respectively, due to ramp up in production at MAC.

Deterra Royalties (ASX:DRR) Valuation comparison

For relative valuation, we compare Deterra Royalties to Labrador Iron Ore Royalty Corp (TSE:LIF), a Canada-based iron-ore royalty company, and Mesabi Trust (NYSE:MSB), a New York-based iron-ore mining royalty company.

| Metric | Deterra | Labrador Iron Ore | Mesabi Trust |

| Price/Book | 182.8 | 4.99 | 34.38 |

| Price/Earnings (2021E) | 30.67 | 11.01 | 15.13 |

| Dividend Yield | 2.3% (2021E) | 7.12% | 4.99% |

| EV/EBITDA | 28.41 | 12.48 | 12.99 |

Source – Yahoo Finance

As can be seen, Deterra shares at the current DRR share price is fairly expensive compared to its peers and have a significantly lower dividend yield.

However, Deterra Royalties is currently pricing in 2.4x higher mining volumes and subsequent royalties from Mining Area C.

Taking that into consideration, at the current DRR share price, Deterra shares will have a P/E of 12.5x with the forecasted dividend yield of 5.3% by FY23.

This would make Deterra shares more attractive than Mesabi Trust and not too far behind Labrador Iron Ore.

Additionally, as Deterra Royalties (ASX:DRR) start to rise over the next two years, we can expect its shares to catch more investor interest.

A stock with a 12.5x PE and a yield of more than 5% will become highly attractive in a low yield environment. Provided other factors stay the same, it is unlikely its PE and yield will stay at these attractive levels by FY23.

Considering the other two stocks will have additional FX risk considerations as they are not listed in Australia and despite the higher PE as of today, the DRR share price right now is looking fairly priced.

The main risk for DRR for the next two years will be the price of Iron Ore as production ramps up.

A route in the price of Iron Ore will severely dent future royalties received by the company.

However, this would be an industry-wide problem that should be considered separately but additionally to Deterra Royalties.

Commodity price volatility will be a concern

Investors should not ignore the volatility inherent in commodities.

Iron ore prices have been on a roll but could see another pullback as happened in May, though prices have since rebounded.

Global growth, and hence the demand for resources may be impacted by fresh waves of the virus that could damage the global economic fabric.

On a positive note, there is still a possibility we are amid a commodities supercycle that is unfolding.

Economies across the world would open up after a pandemic that ultimately wanes due to vaccinations and measures to control its spread.

A supercycle in commodities would be beneficial for Deterra Royalties, especially if it uses the current environment to acquire new opportunities for royalty business.

Additionally, resources stocks such as BHP and by association Deterra will be major beneficiaries of an inflationary economy if higher inflation does come to pass.

Conclusion

Deterra Royalties (ASX:DRR) is a capital-light mining royalty company with revenues expected to rise by 2.4x by FY23.

Even though Deterra shares as of the DRR share price today is expensive on a PE basis, the forecasted royalties will bring the forecasted PE of the company down to just 12.5x.

In addition, a forecasted yield of 5.3% by FY23 will be highly attractive and a very high-quality source of income.

The main risk with Deterra shares as with most mining companies is the price of its main commodity, in this case, Iron Ore.

However, with higher inflation expectations and a potentially new commodities supercycle on the horizon, the risks in our view are acceptable.

Even though a potential 12.5x PE is attractive, its current PE of 30x is still high.

Investors should consider waiting for a macroeconomic event and a temporary dip in the DRR share price before picking up the stock at a better discount.