Fletcher Building Limited (ASX FBU) is a New Zealand-based materials manufacturer and distributor. Considering decline in profitability and external risks involved in their international business, should you buy Fletcher Building shares?

Table of Contents

- 1 About Fletcher Building Limited (ASX FBU)

- 2 FBU’s Operating Earnings Have Declined In Recent Years

- 3 The External Risks For FBU Are Non-Negligible

- 4 A Decline In Profitability And Increase In Current Liabilities Could Cause Instability With FBU’s Stock Price

- 5 Expect A Decline In Fletcher Building Shares In The Short-Run

About Fletcher Building Limited (ASX FBU)

Fletcher Building Limited (ASX FBU) is the holding company for Fletcher Building Group and is a building materials manufacturer and distributor based in New Zealand. The company delivers building products, construction materials and services across Australasia, Asia, America, Europe, Middle East and South Pacific, operating through seven divisions including building products, concrete, construction, cranes, distribution, laminates & panels and steel.

FBU offers greater coverage than its direct competitor and with a focus on sustainability, FBU is committed to creating sustainable value for their shareholders by delivering the best quality products and services to their customers and meeting and exceeding the reasonable expectations of all their stakeholders.

FBU has approximately $5.25 billion in market capitalisation, which is comparable amongst rivals in the materials industry.

FBU’s Operating Earnings Have Declined In Recent Years

Building products are a core strength for FBU, and account for 49% and 61.9% of total revenue in 2016 and 2017 respectively.

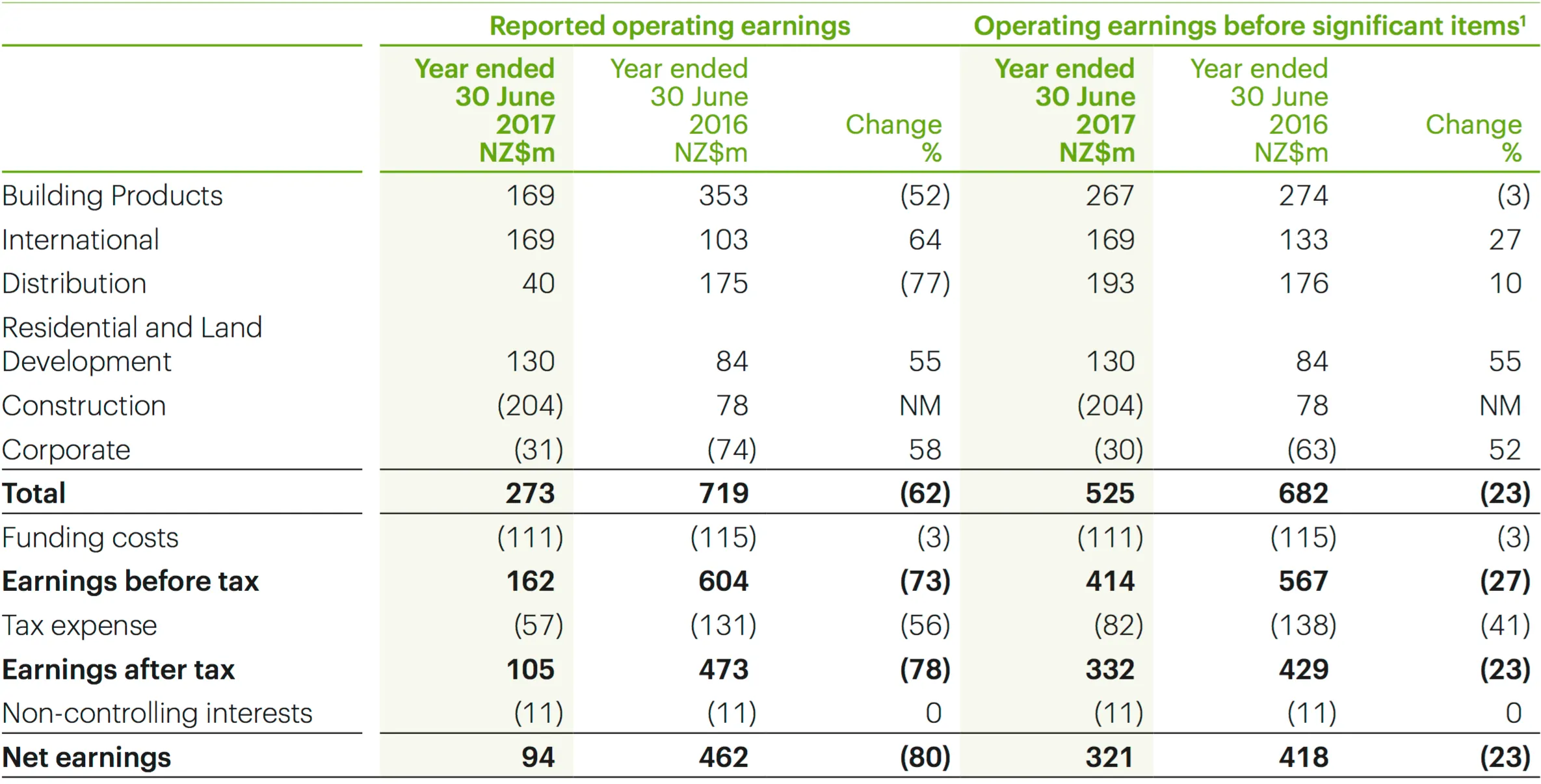

As the table below shows, the net earnings for the business in 2016 are significantly greater than the net earnings in 2017 while the funding costs are similar for these 2 years.

Construction, which is one of the main businesses for FBU, faced severe financial problems and in 2017 the earnings of construction were negative, which continues to be a big potential problem for FBU.

Integrating products, distribution and construction suffered heavy losses during the past two years as the international services and land development division become the core business for FBU.

Nonetheless, the growth cannot cover the loss, which contributes to the fact that operating earnings have declined over recent years.

SOURCE: FBU Annual Report 2017

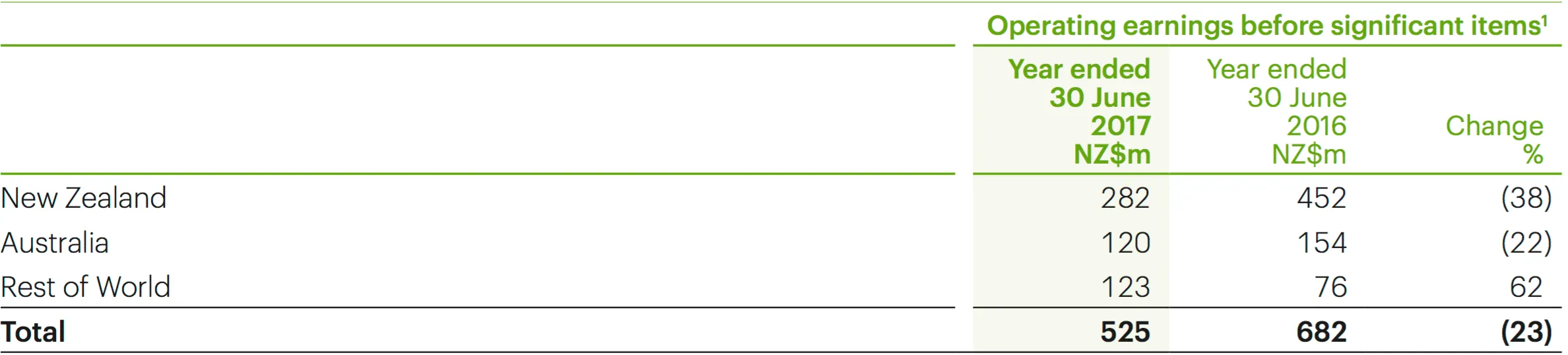

At an international level, the operating earnings of FBU have shrunk considerably in Australia and New Zealand, with only international business showing a positive trend.

SOURCE: FBU Annual Report 2017

The External Risks For FBU Are Non-Negligible

Currency translation risk is the main external risk for FBU due to an increasing number of international business opportunities on the horizon.

Should there be an unstable exchange rate, FBU’s policy is to hedge foreign currency translation risk by purchasing financial derivatives from corresponding countries. Due to this lack of operating funds, investment funds are often borrowed, which means FBU faces other financial risks due to the changed debt-asset ratio.

Within FBU’s corporate strategy the business will concentrate on developing its international business. Since 2017, the company’s operating earnings from international services has successfully increased, however, a slowdown in international markets could weigh on FBU’s revenue and growth plans. The company is unsure whether its operating revenue related to international business can be increased or decreased in the next few years.

A Decline In Profitability And Increase In Current Liabilities Could Cause Instability With FBU’s Stock Price

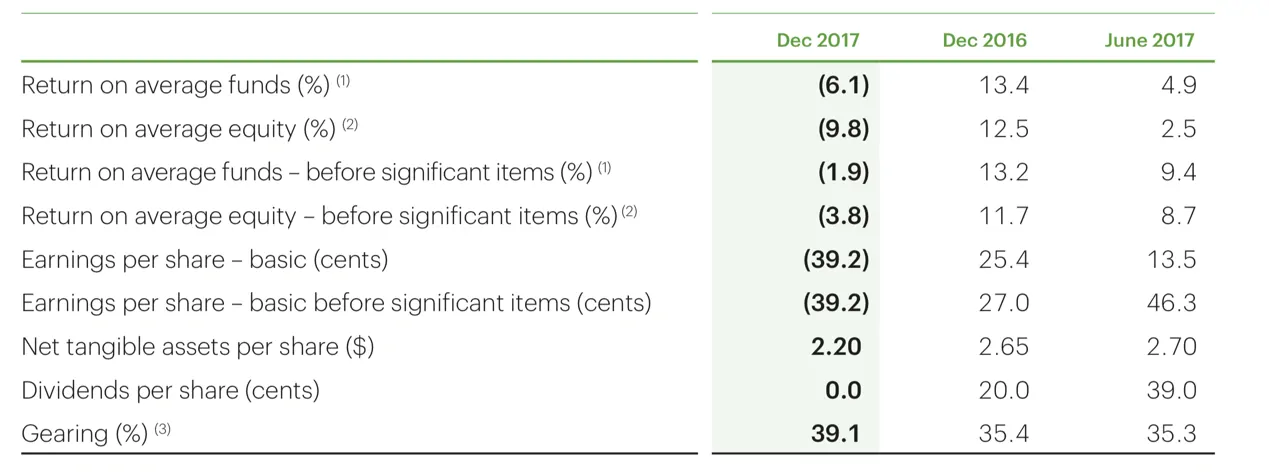

Fletcher Building shares have experienced a huge decline in terms of profitability over the last year, as shown in the table below. All ratios measuring the profitability have fallen approximately 20% on average and become negative, especially relating to ROI for shareholders which declined over 60%.

FBU has experienced huge losses on its primary business and did not pay dividends to its shareholders, which could negatively impact its stock price.

FBU’s debt gearing has climbed during the last three years, which means that risk will rise because the profit or loss from the change in market price per share will increase considerably.

SOURCE: FBU Annual 2018 Half Year Report

| Adelaide Brighton (ASX ABC) | Boral (ASX BLD) | Fletcher Building (ASX FBU) | |

| ROE | 14.2% | 6.5 | -9.8% |

| Profit Margin | 11.4% | 8.3% | 3.4% |

The table above indicates FBU’s price margin ratio and ROE compared to its two competitors, Boral Limited (ASX BLD) and Adelaide Brighton Limited (ASX ABC)

FBU has the lowest percentage in both profit margin ratio and ROE among its competitors, which suggests Fletcher Building shares is performing poorly amongst its peers.

SOURCE: FBU Annual 2018 Half-Year Report

In FBU’s case, the company has had to borrow a lot more money and has weakened their balance sheet by taking on more debt. Current liabilities have increased to NZ$3.904 billion in 2017, which is twice as much as the figure in 2016. The majority of the increase can be contributed to borrowing, of which the interest costs will eat into profits.

Overall, Fletcher Building shares have been performing poorly profitability-wise, especially on their ROI to shareholders and declining earnings. In its current state, Fletcher Building shares may not be a good stock to buy and we will need to see if there is a recovery in earnings in the next financial year.