Fortescue Metals (ASX: FMG) is one of Australia’s biggest miners and the world’s largest pure-play iron ore miner.

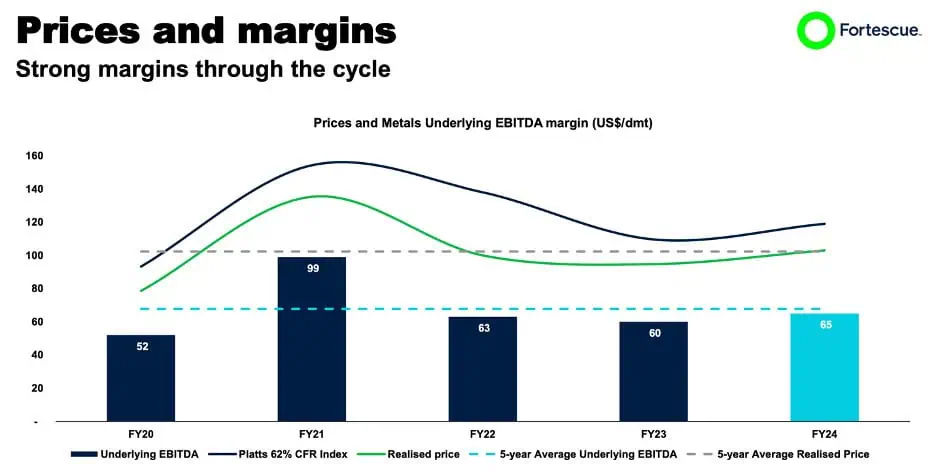

The company enjoys one of the sector’s most competitive cost structures, which drive cash flows and growth through metals cycles, as evidenced by massive earnings and cash flows.

While Fortescue shares have been an underperformer due to a slowdown in China over the past couple of years and a tough monetary policy environment worldwide, it is well poised for solid performance through the next upcycle with the addition of higher-purity magnetite ore to its world-class hematite operations.

Though the company’s efforts to make cost-competitive green iron mining contingent on massive engineering and operational challenges over the next five years, it has the financial might and operational experience to face the challenge head-on.

Fortescue also enjoys balance sheet strength and technological advantages to participate in the renewable energy megatrend across the world with the benefit of fiscal and policy incentives to drive investments.

Table of Contents

- 1 About Fortescue Metals Shares

- 2 World Class Operations and Indigenous Green Technologies Set The Company Apart

- 3 Single Product Portfolio and Macro Sensitivity Are A Weakness

- 4 Green Energy And Mining Decarbonization Are Huge Opportunities

- 5 Technological Challenges and the Pace Of Green Transition Are Threats

- 6 Fortescue Metals Group (ASX: FMG) Financials

- 7 Fortescue Metals Group: Valuation

- 8 Fortescue Metals Exceptional Dividend Yield

- 9 Conclusion – A Solid Asymmetric Investment Opportunity

Fortescue Metals (ASX: FMG) is an integrated mining company based in Western Australia established in 2003 exporting nearly 200 million tonnes of ore per annum.

FMG operates out of the West Australia Pilbara region where it operates three hubs – Western Hub, Iron Bridge (Joint Venture 69%), and Chichester Hub along with massive processing, rail, and port infrastructure. The company has vast exploration rights across Australia encompassing iron, copper, etc. and a upcoming mine in Gamon, Africa.

The company’s second division, Fortescue Energy, encompasses Fortescue Green Energy, Fortescue Zero, and Fortescue Capital. While Fortescue Green Energy and Zero house the company’s green energy assets in Australia and its engineering division, Fortescue Capital is an asset management firm that funds and accelerates the company’s green investments.

Fortescue’s headquarters are in East Perth, Australia, and the company’s market capitalization at the time of writing is A$61.9 billion.

Source: Fortescue FY24 Annual Report

World Class Operations and Indigenous Green Technologies Set The Company Apart

Fortescue Metals (ASX: FMG) vertical integration across mining, processing, haulage, and ports brings the company a big scale and a low operating cost, which is a key strength in a cyclical business as it builds resilience during downturns and massive operating leverage during booms.

In August 2023, the company brought online its Iron Bridge mine, which was a key execution hurdle for the company. Iron Bridge is the company’s first magnetite mine, which represents higher quality ore and fetches higher prices than the hematite that makes up most of its production.

It is also a key pillar in the company’s Fortescue Blend strategy which will improve realizations in both regular operations and its green ore goal. Magnetite is key to the company’s Real Zero Emissions 2030 strategy as purer ore requires less energy to process and cost-effective scalable renewable energy is the limiting factor in decarbonization.

Source: Fortescue FY24 Annual Report

Fortescue’s indigenous decarbonization technology efforts are what truly sets the company apart from competitors as it not only brings it unique monetization and investment opportunities which we will expound on further below, but also puts the company first in line to capitalize on competitive advantages offered by the new technologies involved in mining.

For example, operating mine sites involves transporting millions of liters of diesel and tonnes of coal, which pose significant operating costs. However, mining sites offer tremendous acreage, and conversion to solar to power mine operations will offer big competitive advantages in terms of cost and make previously otherwise unviable mines monetizable.

Water to make hydrogen for storage and processing can be piped and also involves a one-time cost, same for electric grid infrastructure.

Source – Fortescue AGM Presentation 2024

Fortescue’s proprietary development of heavy mining equipment, electric and hydrogen powertrains, hydrogen fuel cells, and electrolyzers will give it the biggest advantages over the competition.

The company’s port infrastructure will also allow it to become a key player in hydrogen fuel exports should the market develop.

The Pilbara region is extremely rich in solar/wind intensity and the combination of storage in fuel cells can comfortably provide the energy requirements of operations as it owns land rights to more than 88GW of renewable energy potential with 3GW planned by 2030.

Source – Fortescue AGM Presentation 2024

Fortescue has commenced construction of a Green Metal test plant at its Chichester Hub which will use green hydrogen produced from the company’s solar farm to process ore at a capacity of 1500t in FY25.

This plant will be used to optimize efficiency and operations before scaling the technology across the company’s assets. At present massive overcapacity in the Chinese Solar market and planned tariffs in the US and EU might put the company in a strong bargaining position to build out renewables capacity while the company’s strong mining operations and cash flows can comfortably cover capital requirements.

Single Product Portfolio and Macro Sensitivity Are A Weakness

Fortescue Metals’ (ASX:FMG) major weakness is that it is a single-product company in a cyclical sector and that major consumer China is suffering from a prolonged economic crisis, with big consumption sectors like consumption and infrastructure suffering. While the government has vowed policy support to boost consumption, the election of Donald Trump might lead to significant tariffs and block Chinese economic recovery.

At the same time, governments and consumers in the developed world are suffering from high debt and cost of living crises, which may pose risks to demand ore if things deteriorate further due to persistent inflation. However, the company has weathered previous downturns with remarkable resilience.

Green Energy And Mining Decarbonization Are Huge Opportunities

Fortescue Metals’ (ASX: FMG) successful efforts in proprietary technology development in the space of zero-emission ore present huge opportunities for the company as a mining equipment technology company. Further, indigenous fuel cells and electrolyzers represent a much bigger opportunity for the company.

Fortescue’s joint development of fuel cell and battery-powered excavators and haul trucks with mining equipment giant Liebherr presents a huge market in the mining sector for the company.

Under the joint development, Fortescue is responsible for the development of the energy storage system (battery and/or fuel cell) and other electrical components such as fast chargers, stationary battery storage, and battery management systems. Quality of development is top notch as evidenced by its deal with the major Jaguar Land Rover for its battery management systems.

Combined with Fortescue’s leading mine development experience, this could present huge opportunities for the company. The company has already ordered an equivalent of two-thirds of its mining equipment fleet which will be delivered by 2030.

The order is valued at US$2.8 billion of which Fortescue Zero will generate US$1 billion, representing a revenue share of about 35% in electric haulers, excavators, and dozers.

Source – Fortescue AGM Presentation 2024

Secondly, the company is close to entering investment decision stages for its ammonia plant in Holmaneset, Norway with a 200ktpa capacity at the cost of $1 billion, and a $3.6 billion green hydrogen plant in Pécem Brazil.

At the same time, the company will bring online over the next two years its Queensland and Arizona green hydrogen plants with 8ktpa and 11ktpa hydrogen capacities. Having indigenous technology will give the company cost, integration, and expertise in setting up downstream projects.

A key advantage of being in this policy tailwind sector is financial incentives and market potential as the Norway plant has been approved for a 200 million euro grant from the EU, California’s plan to phase out diesel trucks, and China’s plans to mandate 10% of steel production to ammonia from coal.

Technological Challenges and the Pace Of Green Transition Are Threats

A major threat to Fortescue Metals shares (ASX: FMG) is the possibility that its green ambitions may fail to materialize due to technological challenges or cost challenges. Fortescue’s bet on zero emissions by 2030 is heavily contingent on its R&D fructifying and delivering economically viable efficiency and costs.

An additional threat is a change in government policies which could impact the long-term prospects of projects. For example, Donald Trump’s denial of climate change and plans to remove EV credits.

Fortescue Metals Group (ASX: FMG) Financials

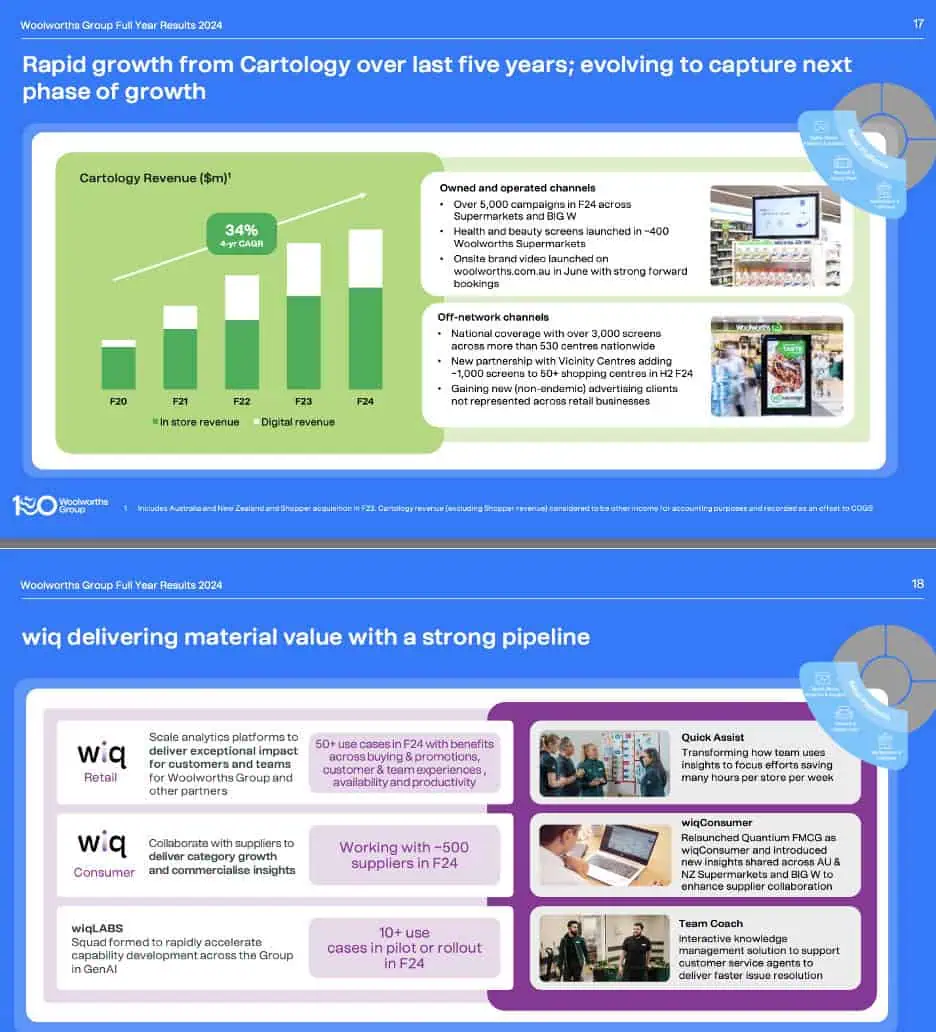

In FY24, Fortescue Metals (ASX: FMG) posted reasonable growth after a tepid FY23 with revenue up nearly 8% to US$18.2 billion, EBITDA up 7.4% to US$10.7 billion, and NPAT up 2.2% to US$5.6 billion.

Source: Fortescue FY24 Annual Report

Net profit growth was very marginal because of a US$400 million increase in depreciation due to accumulated capex on Iron Bridge, which was commissioned in August 2023.

At the cash flow level, things look better. Free cash flow improved 18.3% YoY to US$5.1B, as capex declined 9.5% YoY to US$2.87B, and Cash from Operations improved 6.5% YoY to US$7.9B.

The company has guided US$3.7B-US$4.3B of capex in FY25, with about a 10% increase in sustaining capex and 57% growth in Fortescue Green Energy investments.

ROE is a very strong 30% despite a modest leverage of 22% and gross debt to EBITDA of just 0.5x. ROEs have shown expansion to the 40%-60% range during upcycles, which should improve further due to the inclusion of higher realization magnetite ore from Iron Bridge.

Mining Performance through to Q1’FY25 is as follows –

Note: The dip in ore shipped is due to a combination of factors such as weather vents and some wage pressures, management expects moderation through the year.

Fortescue Metals Group: Valuation

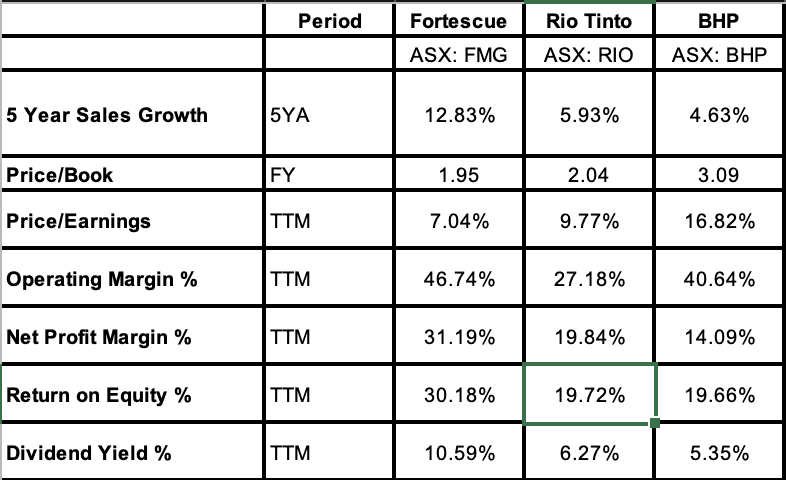

A comparison of Fortescue Metals shares (ASX: FMG) with arch-rivals Rio Tinto and BHP is tabulated below.

Time of writing – 13/12/24

Source – Investing.com

FMG is superior across various valuation and growth metrics. However, it must be noted that while Rio Tinto and BHP are primarily iron ore miners, they have multiple products in their portfolio.

Fortescue Metals Exceptional Dividend Yield

Fortescue Metals Group (ASX: FMG) stands out for its exceptional dividend yield, making it a compelling option for income-focused investors. The company’s ability to generate strong free cash flows, even through iron ore price cycles, has allowed it to maintain a high payout ratio and an exceptionally high yield.

In FY24, Fortescue declared total dividends of A$1.97 per share, representing a yield of 10.59%. This places the company among the highest-yielding stocks in the sector, almost doubling BHP and RIO.

While dividend forecasts may moderate due to potential fluctuations in iron ore prices and macroeconomic conditions, Fortescue’s continued focus on efficiency and growth ambitions in green energy solidifies its position as a standout and innovative player in this sector.

Conclusion – A Solid Asymmetric Investment Opportunity

Fortescue Metals (ASX: FMG) is extremely well placed to enjoy solid growth over the next upcycle in iron ore as it has developed and brought online a high-quality hematite asset in Iron Bridge to complement its solid magnetite operations.

The company’s visionary dive into green mining and renewable energy production brings opportunities that are a cherry on top of their world-class mining operations.

Overall, at current prices, Fortescue is cushioned by a very cheap valuation, cycle-resilient cost structure, hefty dividend yield, strong balance sheet, and big upside.