Today we will look at why we think Freelancer shares (ASX:FLN) is a good way to leverage into the shift in work habits through our FLN share price forecast and analysis.

Freelancer Ltd (ASX:FLN) is an Australia-based online freelance portal with a worldwide reach.

The company, a pioneer of the gig economy has since morphed into the largest freelance portal by the number of users.

The company’s growth plateaued in the years leading up to the pandemic due to stiff competition from rivals such as Toptal, UpWork and Fiverr.

However, the pandemic was a shot in the arm for the company and revitalized its business due to the transition to online and remote work.

The company benefited from a massive rise in demand for popular gigs due to the acceleration of digitisation caused by the pandemic.

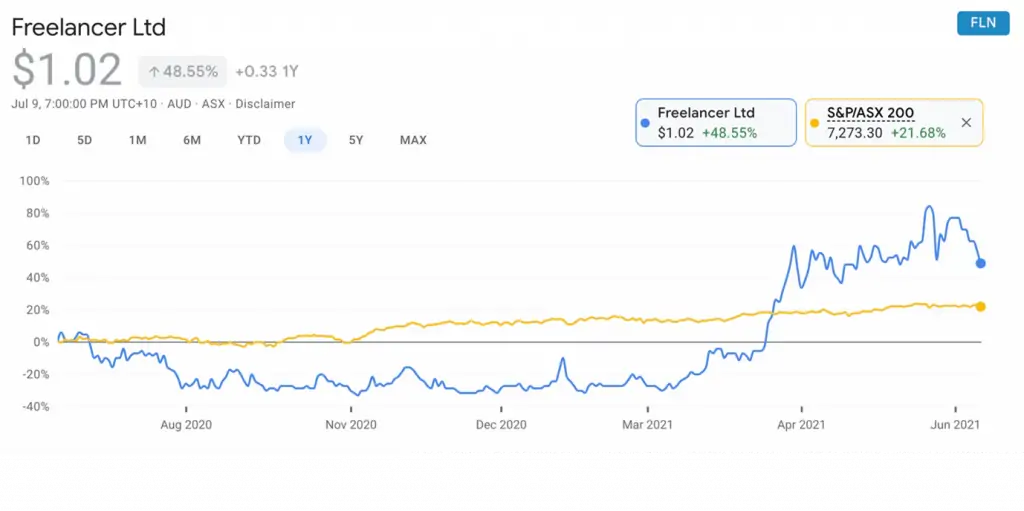

At the current FLN share price, Freelancer shares are up a solid 266% from its COVID low and has outperformed the ASX 200 index by 48% over the past year.

Table of Contents

- 1 About Freelancer Shares (ASX:FLN)

- 2 Very Strong Ancillary Businesses and Outlook

- 3 Overexposure to Weakening USD a Drag

- 4 The pandemic has created a golden outlook for the industry but competition is intense

- 5 Freelancer (ASX:FLN) Financials Paint a Promising Picture

- 6 Freelancer Valuation

- 7 Gig Economy a Booming Sector in Post-Pandemic World

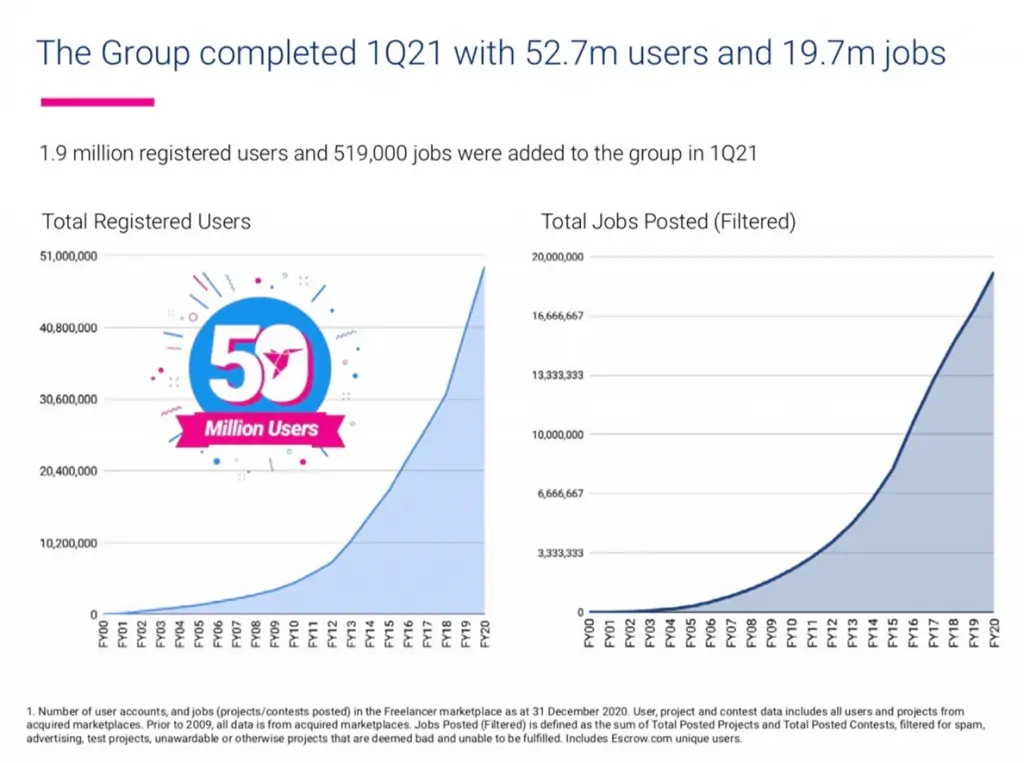

Freelancer (ASX:FLN) is the largest freelancer portal in the world with 51 million registered users covering about 2,000 skillsets.

With 20 million+ active projects, the company helps clients source cross-border talent efficiently and at cheaper rates while maintaining quality.

The platform is also used by SMEs and large multinationals to source high-caliber talent quickly for temporary and medium-length tasks.

Freelancer receives a commission from the billables of projects that originate on its platform.

The company has also built some ancillary businesses that integrate well with its core business and set it apart from other gig-only portals.

These ancillary businesses, which include Escrow.com, Freightlancer, and PhotoAnywhere, have also been driving the company’s growth.

Very Strong Ancillary Businesses and Outlook

One of Freelancer’s biggest strengths is Escrow.com.

Escrow.com is one of the world’s oldest digital escrow services with over $5B in processed payments.

It boasts an expansive client roster including Uber, eBay, GoDaddy, SpaceX, Twitter, Instagram, Google, Amazon, Shopify, and even Upwork, Freelancer’s chief rival.

The business gives the company a growing and stable earnings source that is not available to its rivals in the ultra-competitive freelance industry.

Because big-ticket items such as cars, jewelry, and homes are increasingly being sold online, escrow services have a bright future and Freelancer (ASX:FLN) enjoys a leadership position with Escrow.com.

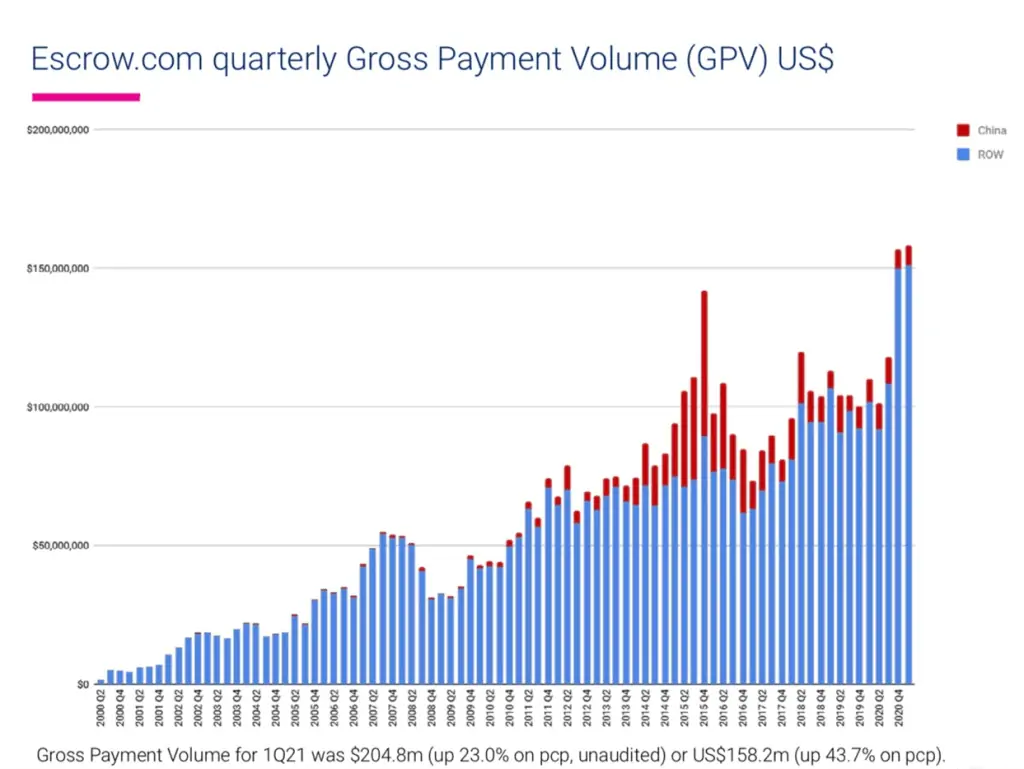

Escrow.com reported 43% YoY growth in Q1’21.

Source: Freelancer 1Q FY21 Report

The pandemic also spurred demand for logistics services as e-commerce replaced traditional sales channels due to lockdowns and border shutdowns.

This helped the company’s logistics portal Freightlancer, which connects freight operators such as truck operators and shipping companies to businesses that need to move products and raw materials.

Freightlancer integrates shipment tracking, digital contracts, and escrow services into a single product.

The company doesn’t report metrics for this segment separately.

Overexposure to Weakening USD a Drag

Currency exchange fluctuations are a source of concern for Freelancer shares.

It suffers an exchange risk overhang because 72% of its revenue is denominated in USD and only 4% in AUD.

Since mid-March 2020, the AUD has strengthened against the USD by nearly 30%.

Dollar weakness has an impact on the company’s reported earnings.

We can already see this playing out as Freelancer reported GPV (Gross Product Value) growth of 18% YoY in Q1’21 – however, that figure more than doubles to 39% without the effects of the AUD/USD conversion.

Moreover, due to large quantitative easing measures by the US Fed and inflation risks, the USD is expected to continue to depreciate over the medium-term, at least till the next rate hike which is expected in 2023.

The pandemic has created a golden outlook for the industry but competition is intense

Freelancer shares have benefited handsomely from the pandemic.

The COVID-induced structural shifts in work culture were a heaven-sent opportunity for the company and the entire freelance industry.

Businesses globally were forced to shift to work-from-home and online working modes.

The world was unprepared for the pandemic’s effects on work culture and the freelance industry thrived because the resulting environment was an excellent fit for its business model.

Businesses turned digital and were forced to build an online presence, virtually overnight.

As a result, demand exploded for popular freelance gigs like web design, app development, online marketing, content creation, graphic design, etc. that are location agnostic and cheaper to outsource to foreign talent.

This boosted hiring volumes on the Freelancer (ASX:FLN) portal.

The company also reported significant growth of 83% from enterprise clients including from blue-chip names like Uber, Amazon, Intel, and others.

According to a McKinsey report, the pandemic has accelerated the digitisation of businesses by 3 – 10 years.

This has significantly bettered the outlook for the freelance industry because a lot of the work in the tech sector can be executed remotely and major companies are now more open to hiring through the freelance route.

We can see the positive impact of the virus both on Freelancer’s financials and its peers.

The pandemic has allowed the company to fortify its position in this new, favorable environment as can be seen from the chart below.

Source: Freelancer 1Q FY21 Report

Notably, over the past few years, growth had slowed at the company’s core online freelancing business due to stiff competition from entities such as Fiverr and Upwork.

Fiverr has successfully operated a different model whereby all freelancers’ profiles are available to a client to choose from for a particular service.

Because commoditised products such as web design, graphic design, app development, voice-over, etc. are a major portion of the gig economy, clients can choose freely by reviewing all available freelancers, their portfolios, and fixed prices without having to wait for bids.

On the other hand, UpWork has been growing faster reportedly due to better technical systems and user experience, particularly on mobile devices.

However, Freelancer has been working to solve these issues by investing heavily over the past four years to overhaul its technical systems and build a native mobile app.

The efforts have already started bearing fruit as the company reported 110% YoY growth in mobile-generated fees during 1QFY21.

Nevertheless, Freelancer must fend off intense industry competition on an ongoing basis.

Freelancer (ASX:FLN) Financials Paint a Promising Picture

After the company completed its technology investments, it just about broke even in FY20.

Total Revenue was A$58.8 million with gross profit of A$49 million (Gross Margin 83.33%) and Net Loss After Tax was A$0.4 million.

However, in 2HFY20, the company came into the black on the group level with both Escrow.com and Freelancer.com turning a profit, thus positioning it for profitability ahead.

In 1QFY21 too the company reported very promising results.

Both metrics of Gross Marketplace Volume of A$33.6 million (up 5.1% YoY)/US$25.9 million (up 23.6% YoY) and Gross Payment Volume of A$249.7 million (up 18.8% YoY)/US$192.9 million (up 39% YoY) reached all-time highs.

The company also reported a record cash flow of A$15.6 million (up 12.4% YoY)/US$12 million (up 32.1% YoY).

Total hours tracked jumped 23%, registered users went up 105% and website hits surged 120% YoY.

In 1QFY21, Escrow.com turned profitable for the first time with A$2.4 million/US$1.9 million net operating cash flow.

Gross Payment Volume for the quarter was a record US$158.2 million (up 43.7% YoY)/A$204.8 million (up 23% YoY).

The business reported 83.4% growth in Enterprise revenue with a 2.3x increase in average spending.

Moving forward, the company is poised to benefit from higher operating leverage from the rapidly growing market for freelance work and escrow services.

Freelancer Valuation

We will compare Freelancer shares to UpWork and Fiverr.

Both companies are Freelancer’s main rivals in the gig industry.

While Fiverr operates on a micro job business model, UpWork is more traditional and better comparable to Freelancer in terms of user experience and business model.

| Metric | Freelancer | UpWork | Fiverr |

| Price/Book (MRQ) | 15.94 | 23.84 | 25.29 |

| Price/Sales | 7.86 | 18.05 | 38.59 |

| Net Operating Cash Flow/Revenue | 13.04 | 3.09 | 7.73 |

As can be seen, at the current FLN share price, Freelancer shares are substantially cheaper than UpWork and Fiverr in terms of price multiples.

The company also generates far more free cash flow as a percentage of revenue compared to its peers.

Gig Economy a Booming Sector in Post-Pandemic World

The pandemic has laid bare the potential of the gig economy, with almost every on-premise job being under threat of reinvention for remote fulfilment.

According to the Mckinsey Global Institute, 160 million jobs, or about 11% of the projected 1.46 billion services jobs worldwide, could, in theory, be carried out remotely, barring any constraints in supply.

That does open up the horizons, further, for hiring portals such as Freelancer.

Though the FLN share price struggled to match its peers because of slower growth in its core business in the years leading up to the pandemic, its situation is very different now.

Efforts to strengthen competitiveness over the years through a technical overhaul have meshed well with the dramatic turn in the industry’s fortunes.

These moves are now paying off in spades.

Further, Freelancer (ASX:FLN) has built a strong and rapidly growing ancillary business in Escrow.com.

The company’s financials are a testament to its improving condition and leverage to a changing working environment.

At the current FLN share price, compared to its competitors and growth potential, Freelancer shares represent a cheap entry into an industry basking under a favorable, paradigm change that is perhaps irreversible.