Today we will look at why Magnis Energy Technologies shares (ASX:MNS) is a great way to get exposure to the EV boom in our MNS share price forecast.

Magnis Energy Technologies (ASX:MNS) is an Australian company involved in the development of cheap and nearly 100% recyclable batteries that address the global decarbonization megatrend.

Magnis Energy Technologies is developing its product through strategic partnerships to garner expertise in various segments of the battery value chain.

Its proprietary battery is claimed to outperform current technologies while being cheaper and environmentally friendlier.

The company also has great verticals, with an investment in a high-quality long-life mine.

At the current MNS share price, Magnis Energy Technologies shares have been a stellar performer this year and returned nearly 80% YTD, outperforming the ASX200 index by 32%.

Table of Contents

- 1 About Magnis Energy Technologies (ASX:MNS)

- 2 Great Product with Investments in Verticals

- 3 Success Contingent on Execution

- 4 Huge Market Opportunity But Disruption Risk Is High

- 5 Magnis Energy Technologies (ASX:MNS) Project Financials

- 6 Magnis’ Valuation Versus Peers

- 7 Magnis Energy Technologies (ASX:MNS) Batteries Could Be A Boon For The EV Boom

About Magnis Energy Technologies (ASX:MNS)

Magnis Energy Technologies (ASX:MNS) is an NSW-headquartered company proposing to manufacture high-performance lithium-ion batteries for increasingly popular EVs and to store energy at the grid level.

Magnis Energy Technologies operates under a strategic partnership structure where the company collaborates with companies that can play a direct role in its operations.

The company has three operating subsidiaries: iM3NY – which owns the New York Plant; iM3TSV – the owner of the Townsville Plant; and Magnis Resources – which owns the Tanzania Graphite Asset.

Magnis Energy Technologies has shares of 63.5% (directly and indirectly) in iM3NY, 33% in iM3TSV, and 100% of the Tanzania Graphite Asset.

At the current MSN share price, Magnis Energy Technologies shares have a market capitalization of about A$316 million.

Great Product with Investments in Verticals

Magnis’ biggest strengths are the high performance and lower costs of its battery.

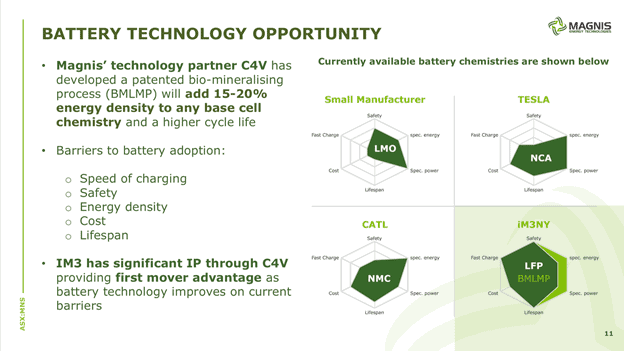

The battery, to be produced under a strategic partnership with C4V, a US-based designer and developer of batteries, offers an energy density that rivals state-of-the-art batteries but at a much lower cost.

That is due to the absence of exotic materials such as nickel or cobalt.

Furthermore, it has an extremely fast charge time of only 6 minutes for 85%.

The battery’s manufacturing process claims it can add 15%-20% energy density to any base chemistry.

The battery has patent protection in 35 countries and Magnis owns exclusive production rights.

Because of range anxiety and charge time concerns, EVs are currently attractive to only a small segment of the market such as climate-conscious buyers or customers wanting niche products.

These roadblocks to the widespread adoption of EVs remain despite EVs being significantly cheaper to run for two reasons:

- Electric motors are much more efficient than combustion engines

- Electricity costs significantly less than gasoline/diesel

However, the Magnis fast-charging battery solves both issues of charge time and range.

Magnis Energy Technologies, therefore, has immense scope for growth if it can bring this battery to market as promised. Further, by 2025, the company plans to shift production to a solid-state battery currently under development.

While the company’s claims may sound ambitious, it is to be noted that the inventor of the lithium-ion battery, Prof. Stan Whittingham, sits on its board.

This means the company has the skillset to pull it off.

The company plans to commence production at a rate of 1.8 GWh/year.

Meanwhile, Magnis’ ownership of its graphite mine in Tanzania gives it a cheap and consistent source of high-quality graphite, which is used to make battery anodes.

The combination of C4V’s patented high-performance anode technology and a cheap source of high-quality graphite will give the company a substantial competitive advantage.

The company’s graphite mine is located in an SEZ, thus giving it tax-free status for the next 10 years.

Success Contingent on Execution

Magnis Energy Technologies (ASX:MNS) prospects depend considerably on projects that are still under development.

This year, the company aims to start low-scale production at its New York plant and reach full capacity only by mid-2022 to early 2023.

It is still in process of raising adequate funding to build the plant.

The company recently spent about US$71 million to bring its 1.8GWh capacity online.

Given that the company wants to reach 32 GWh by 2030, it will have to find a way to fund these ambitions through a combination of earnings, debt, and equity.

Timely execution would then become of paramount concern. Therefore, equity dilution or excessive gearing are both potential concerns.

Any hiccups in project implementation could exacerbate these risks and could put pressure on the MNS share price.

Huge Market Opportunity But Disruption Risk Is High

Magnis Energy Technologies (ASX:MNS) has huge potential opportunities from increasing EV adoption and the global shift to renewable energy.

However, batteries are crucial to both trends.

As mentioned above, the cost of EV batteries is dropping apace with rising adoption, but range anxiety and charging time are still bottlenecks.

In the case of grid energy storage, battery performance and cost are both barriers to adoption.

Magnis’ battery offers a solution to both. Its performance solves to a large extent the problem of range with low charge times, while its nickel and cobalt-free design make it 10%-15% cheaper.

Further, to drive costs down further, the company has designed a semi-automated production line.

Over time the company plans to use AI and ML to almost completely automate its production. This would reduce expenses considerably, increasing margins and give the MNS share price much more potential upside.

EVs are projected to make up more than 50% of new vehicle sales by the end of this decade and 80% by 2050.

Battery demand in terms of capacity is therefore expected to grow ten-fold by the end of this decade to US$90 billion annually by 2025.

On the other hand, the stationary/grid energy market is expected to make up 18% of the battery market or US$23 billion.

Given the size of the opportunity in batteries, multiple companies and groups are attempting to build a scalable solution.

Any technological innovation that outperforms Magnis’ offering, or one that leads to cheaper batteries could derail the company’s ambitions.

However, such attempts have been on for a while and have borne no fruit – as of now, lithium-ion batteries are still the front-runners for both EV and grid storage solutions.

Magnis Energy Technologies (ASX:MNS) Project Financials

Since the company is on the verge of commencing commercial production, there are no operating financials available as of now.

However, the company successfully commenced trial production at its New York plant in June.

The company has not shared specific details about the company’s per kW cost of production at either site or specifics about the total Capex in New York.

The company has expressed interest in a listing of the New York subsidiary by Q4 this year.

In Townsville, the company expects a total outlay of about US$3 billion across three stages over the next few years.

The planned capacity for Townsville is about 18 GWh.

The company expects revenues of US$3.5 billion at full capacity in Townsville, but the timeline to full capacity is not known.

In Tanzania, the company is the sole owner of an extremely high-quality graphite asset.

The quality of output from this mine is very rare outside of China which is the most graphite-rich nation in the world and the largest producer of the mineral.

Magnis Energy Technologies (ASX:MNS) customers, therefore, have a valuable option to diversify their graphite supply chain. The mine has reserves of 240ktpa and a life of 15 years.

The mine’s high-quality graphite is sold for about US$1,750 – US$2,000/ton at present, compared to US$750-US$1,000, for traditional graphite.

The mine will require an outlay of US$270 million and is tax-free for the next 10 years. The company plans to finalize funding by Q1 2022.

Magnis Energy Technologies has raised US$49 million so far this year through equity placement.

The money will be utilized towards the US$71 million Capex plan on its New York plant, assist with the unit’s US listing, developing the Tanzanian resource, and maintain liquidity.

Part of the money raised this year came from New York fund manager and venture capitalist Lind Partners, a firm advised by John Hancock, son of Gina Rinehart, Australia’s richest person.

Hancock is known for his spectacular $4 million bet on lithium player Vulcan Energy (ASX:VUL) that turned into $65 million.

Rinehart piled into Vulcan after knowing of her son’s investment – will she follow suit with Magnis? If so, we could see a very strong lift in the MNS share price and interest in Magnis Energy Technologies shares.

The company has off-take agreements from the US Department of Energy and others totalling US$729 million.

The company has cash on hand of A$73 million (US$53 million).

Magnis’ Valuation Versus Peers

Magnis Energy Technologies (ASX:MNS) is a unique company and no other companies in the space have the same operating structure or asset base.

However, Magnis Energy Technologies shares can be approximately valued based on comparables of its asset base.

CATL, one of the largest battery manufacturers in the world, whose main product is also lithium-ion batteries, is valued at US$200 billion, or about US$5B per annual GWh.

Based on that, Magnis’ manufacturing business should be valued at about US$4.5B for 1.8 GWh after applying a discount factor of 50% for all contingencies involved.

Since Magnis Energy Technology has exclusive rights to the commercialization of C4V’s battery and owns a 9.65% stake in the company, it also owns a part of the very attractive intellectual property.

QuantumScape is a Bill Gates-backed battery company that is in the process of bringing its solid-state battery to commercialization.

The performance of both offerings is very similar, and while the companies have not shared details about per kWh pricing, both state that their batteries are comparable or slightly cheaper than current lithium-ion batteries.

Based on QuantumScape’s current market cap of US$8.53 billion, Magnis’ stake should be worth about US$810 million.

Last but not the least, Magnis Resources can be compared to companies that are involved in high-performance battery component manufacturing and development.

Sila Resources is a California-based startup that is in the process of bringing its silicon anode technology to market.

The company was recently valued at US$3.3 billion in a funding round by BMW, Daimler, and CATL.

Discounting 75% for contingencies and Magnis’ partial ownership of intellectual property with exclusive rights, we get a value of about US$825 million for the graphite mine.

This brings the total potential, sum-of-parts, future value of the company to about US$6 billion, a far cry from the company’s current valuation of roughly A$300 million (US$217 million).

However, investors should take into account that there is a high probability of substantial dilution involved due to implementation and that there are a lot of contingencies involved.

Magnis Energy Technologies (ASX:MNS) Batteries Could Be A Boon For The EV Boom

Magnis Energy Technologies offers an opportunity to get in on the ground floor of the massive technological opportunity from decarbonization and the switch to electric mobility supported by high technology batteries.

The company’s patent-protected battery has excellent potential to ride the foreseeable boom in demand for high energy-density, quick charging and low-cost batteries for use in both mobility and grid applications.

However, investors should consider Magnis Energy Technologies as a long-term investment that could face technological innovations, project implementation, and equity dilution risks.

However, the company has shopped out some of these risks by entering into strategic partnerships.

At the current MNS share price, Mangis Technology shares is a small-cap, higher-risk play with great potential upside leveraged to the EV boom.